You might be interested in

IPO Watch

IPO Wrap: 2024 outlook for IPOs, and which stocks could list on ASX before year-end

IPO Watch

IPO Wrap: Two new ASX IPOs and Arm's Nasdaq listing, and suddenly... everyone's talking about IPOs again

IPO Watch

IPO Watch

While you were wrapping pressies, a santa-like fresh-listee snuck their way into 2022 by listing just before Christmas, so lets start there and see how they’re tracking.

Listed: 23 December

IPO: $5m at $0.20

The one lonely IPO before Christmas was SOCO Corporation, an Australian based IT consultancy, specialising in the delivery of cloud solutions, business applications and integration projects – with a particular focus on Microsoft solutions.

The company’s key target markets include federal government, local and state government, along with large corporates.

And SOC is up 55% on its listing price, trading at $0.31 per share today.

Listing: 9 January

IPO: $30m at $1.35

The Company’s flagship project is the Goschen Project which has a substantial rare earth deposit of 413,107 tonnes of total rare earth oxide (TREO), with an accompanying mineral sands resource, located in the premier mineral sands province in North-West Victoria, Australia.

Goschen has a current Proved and Probable Ore Reserve of 198.7Mt.

And the scalability of the project is underpinned by a Mineral Resource inventory of 629Mt, comprising measured, indicated, and inferred resources with further resource expansion potential, the company says.

Listing: 10 January

IPO: $5.5m at $0.20

On listing, the company will acquire the Werner Lake Cobalt Project in north-western Ontario, within the Kenora Mining District.

Initial plans include reviewing the existing exploration and geological data, drill targets not previously drilled and establish new drill targets at the Project.

New drill targets will then be established using electromagnetic techniques to consider targets outside of the existing orebody, after which an RC and/or diamond drilling program will be conducted.

Listing: 12 January

IPO: $20m at $4

This company develops and sells AI-based traffic enforcement solutions, including the world’s first illegal mobile phone use enforcement camera program, deployed in New South Wales.

ACE’s patent pending technology also includes a windshield penetrating imaging system and high-performance artificial intelligence to detect illegal mobile phone use – which has been demonstrated in partnership with Tasmanian Police.

Listing: 13 January

IPO: $8m at $0.20

We’ve all heard of the Lithium Triangle, the famous salars in Argentina and Chile where brines deliver around 40% of the world’s lithium materials.

Patagonia is coming to market with a slew of projects covering 23km2 across the Salta and Jujuy Provinces of Argentina, in close proximity to established producers and developers like Ganfeng, Allkem (ASX:AKE), Lake Resources (ASX:LKE), Power Minerals (ASX:PNN) and Lithium Energy (ASX:LEL).

The company plans to undertake follow-up exploration on the sites, with funds raised to pay vendor costs, provide working capital and IPO expenses, and cover around $1.725m of exploration expenditure including drilling at Tomas III.

Listing: 13 January

IPO: $20m at $0.50

This company is focused on gold hydrogen, which is hydrogen that occurs naturally, generated by geological processes, and offers significant cost and emissions advantages relative to other means of hydrogen production.

Gold Hydrogen holds one granted Petroleum Exploration Licence in South Australia (PEL 687) that covers approximately 7,820 km2 on the Yorke Peninsula and Kangaroo Island in South Australia.

On PEL 687, the company is planning to confirm historic occurrences of natural hydrogen of up to 89% purity, at its flagship Ramsay Project.

They also have seven other tenements in application before the South Australian Government, across a further approximately 67,512 km2.

That’s the largest tenure position over naturally occurring hydrogen prospective acreage in Australia.

Listing: 16 January

IPO: $7m at $0.20

The specialist metals suppliers are one of the UK’s largest independent stockists of aerospace high-grade metals supplying materials to many industry sectors across the UK, mainland Europe and globally.

In addition to cutting and supplying from their extensive stock of titanium, stainless steels, nickel alloys, alloy steels and aluminium, the company have the necessary relationships to enable us to source more exotic ‘hard to find’ metals and the equipment and skills to process them on site – plus there’s no minimum order quantities required.

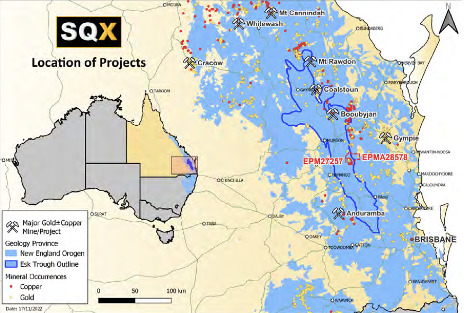

SOUTH-EAST QUEENSLAND EXPLORATION (ASX:SQX)

Listing: 3 February

IPO: $5m at $0.20

SQX’s current focus is on copper and gold mineralisation at its Ollenburgs and Scrub Paddock Prospects, in the underexplored Esk Basin in southeast Queensland and situated near major regional infrastructure and population centres.

Scrub Paddock has been identified as a potential gold-copper porphyry, and features more than 20 mine workings and an area of comparable scale to Cadia/Ridgeway.

The company intends to drill high priority targets immediately upon listing, with the aim of defining an economic mineral resource.

TIGER TASMAN MINERALS (ASX:T1G)

Listing: 24 February

IPO: $8m at $0.20

Tiger Tasman Minerals has projects in WA and QLD focused on copper, lithium, nickel, manganese, silver, gold, base metals and industrial minerals (DMM) essential to the global clean energy transition, decarbonisation and a more sustainable future.

The projects are in proven and prospective jurisdictions including Paterson Province, Fraser Range, Earaheedy Basin, Ashburton and the Townsville region.

They are the Iron Skarn silver-copper-lead-zinc project (QLD), the Copper Canyon copper-gold project (WA), the Fraser Range lithium-nickel-copper project (WA), the Mt Minnie manganese project (WA), and the Crater copper-zinc-lead-silver-gold project (WA).