IPO Watch: The biggest resources listing of 2022 so far is not a miner – say hello to Chrysos

Picture: Getty Images

- Mining tech firm Chrysos Corporation is expecting to list this month after a ~$180 million IPO and shareholder selldown

- It is bringing the CSIRO’s X-Ray sample analysis PhotonAssay technology to market

- PhotonAssay promises to reduce carbon emissions and hazardous waste generated from the centuries-old fire assay process

The biggest resources IPO of 2022 is not a gold miner or a lithium stonk.

It’s a mining technology stock that hopes to blaze a trail for the brave modern technology needed to bring the famously conservative sector into the 21st century and green energy transition.

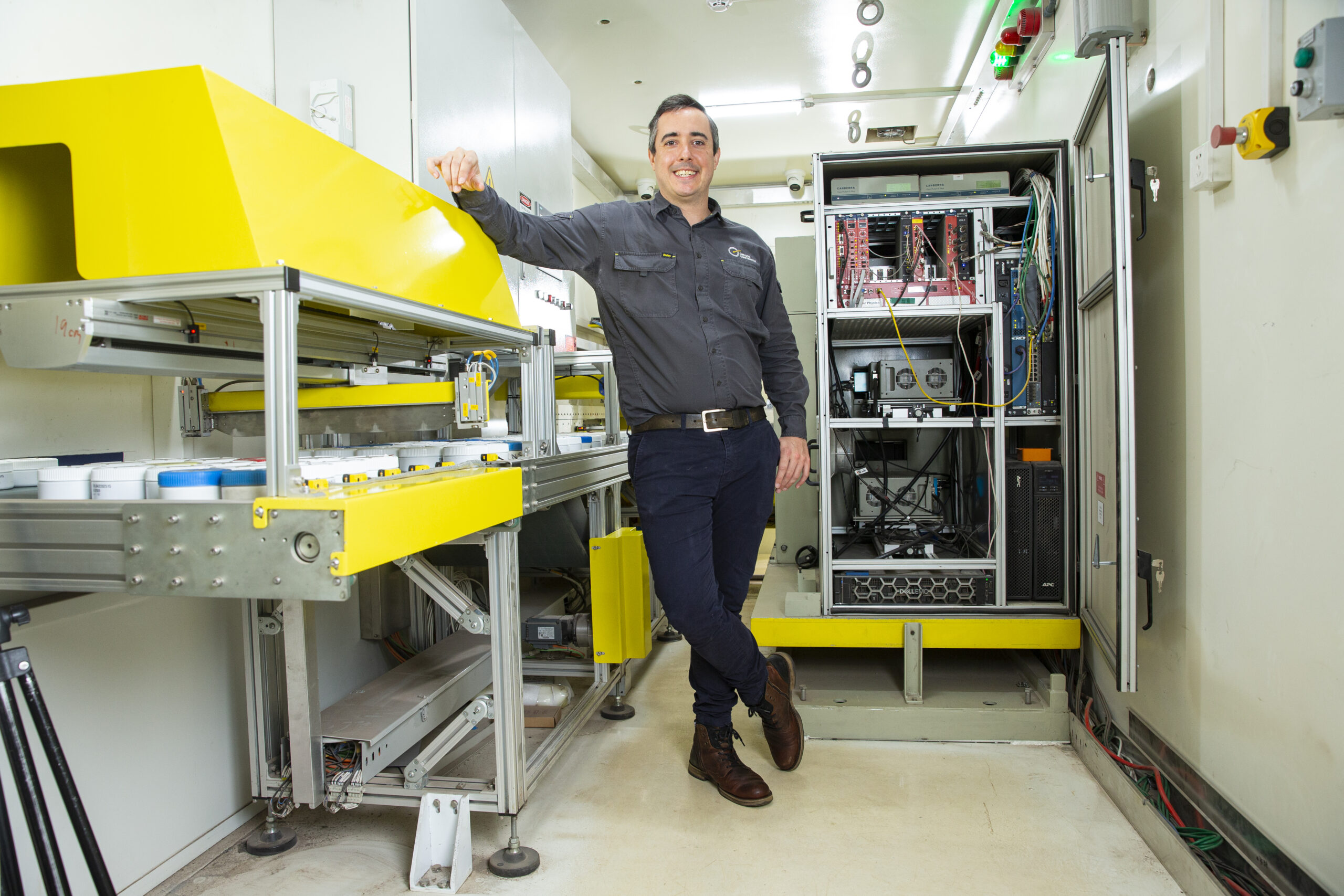

Born out of technology developed by the CSIRO in a commercialisation partnership with RFC Ambrian, Chrysos Corporation (ASX:C79) has emerged as a timely disrupter in the lab analysis field.

It boasts the rights to a technique developed by the chief Australian science agency called PhotonAssay.

The method, which has gained traction with major gold miners and drew famous Aussie mining services firm Ausdrill as an early investor five years ago, bombards drilling samples with X-rays to assess gold and other metal grades.

Quicker, cleaner, safer and non-destructive, Chrysos’ pitch is that its PhotonAssay method will displace fire assay, a method of mineral analysis used for 500 years.

It seems a matter of divine providence that the man tasked with bringing Chrysos to market is a nickel hydrometallurgist by the name of Dirk Treasure, who says he sees PhotonAssay displacing fire assay in all but a handful of specialist applications over time.

Currently there are 8 PhotonAssay units in operation, with 33 contracted to be delivered out to 2024. Treasure says the market extends well beyond that.

“We would fully anticipate displacing fire assay in practically all of its uses,” he told Stockhead.

“There are some obscure areas where we wouldn’t end up displacing fire assay, it does have a lower detection limit than we do, but realistically we’re coming down to 10 parts per billion, 0.01 grams per tonne.

“You’re at significantly sub-economic mining grades at that point.

“We estimate the market at about 610 units for PhotonAssay and have every expectation that we could take practically complete market share.”

An ESG friendly solution?

Chrysos has returned 2 million gold samples since its first commercial unit was rolled out in 2018.

Starting as a quick turnaround option for non-JORC resource activities like grade and process control, it has since gained acceptance as an assay method for resources and reserves compiled under both Australia’s JORC Code and Canada’s N43-101 standard.

It dovetails well with the emerging obsession among the investment community with the environmental, social and governance credentials of mining companies and their suppliers.

Treasure says each sample moved from fire assay to PhotonAssay will displace 450g of CO2 production and 300g of hazardous lead waste.

PhotonAssay units are also being installed onsite at major gold mines. If those mines have the capacity to run their electricity-reliant operations of solar and wind, that doubles to 900g of CO2.

“We’re not proving new value proposition to the industry,” Treasure says.

“We’re substituting something they already do, which is a non-discretionary spend for the industry.

“We’re replacing a technology that is labour intensive, bad for the environment, slow, uses a lot of consumables, et cetera, et cetera.

“For every single sample that we substitute fire assay, we reduce carbon dioxide emissions and we reduce hazardous waste production. For us, that ESG benefit of the technologies is a direct benefit of that substitution.

“When you look then at the size of the target market and our penetration at the moment, we’re doing a small amount of removal of CO2 and hazardous waste compared to what we will do once we start to dominate the market.

“Every single new unit that we deploy, pulls out tons and tons of carbon dioxide that would otherwise be produced through fire assay.”

&nsbp;

Future facing tech

Chrysos is seeking to raise $65 million from new investors in its IPO at $6.50 a share, with existing shareholders including the CSIRO also selling $118.5m of stock.

Existing shareholders will retain 78.7% of the company.

It will list with a projected market cap of $637 million, and stands to be one of the government-funded science organisation’s best commercial investments.

“For the CSIRO we want to make sure that this becomes the thing that they make the most money off out of any investment,” Treasure said.

“I think it’s wifi that’s their biggest investment so far. So if we can make them more money than wifi, then that’s the goal.”

Treasure said the value proposition for Chrysos is that it is taking something already done in the industry and improving it.

On top of that it has set itself up as a supplier to major labs like ALS (ASX:ALQ) – which purchased the former Ausdrill Perenti Global’s (ASX:PRN) Minanalytical business last year, SGS and Intertek – rather than a competitor.

Treasure says he sees Chrysos not as an analysis company but a mining technology firm.

“The thing that has made it easier for us is that mines cannot operate without analysis,” he said.

“You can’t build a reserve, you can’t mine something out, you can’t process it. You can’t produce a product without knowing your gold grade at every point of the process.

“So for us we’ve probably had an easier run at it than some of the other technologies but there’s a lot of very, very interesting technologies in the pipeline out there that are in the process of proving out their value proposition.

“And for Chrysos as we go forward we’ll be looking at those companies equally as much as I would say that the mining industry will be.”

It’s busy out there

The mining industry is operating at an incredible pace these days, with exploration expenditure hitting near record levels amid a boom in commodity prices.

Labs have been unable to cope with the influx of work, a situation compounded by labour shortages and supply chain issues due to Covid, with assay turnaround times blowing out to months in some cases.

Chrysos’ listing comes at a time when lab analysis firms are soaring on the back of the boom, with ALS’ shares up almost 25% over the past 12 months. Driven by its geoscience division, ALS increased its NPAT guidance for FY22 by 6.3% to $260-265m back in March.

Treasure says Chrysos’ technology will not cure the backlog, which is being seen at the lab door.

But it can deliver benefits to miners with the heft to co-locate a machine in a lab onsite.

Unlike X-Ray Fluorescence, a handheld X-ray technology used to assess base metal grades on exploration sites, PhotonAssay can assess gold grades (not just proxies) to a high degree of accuracy.

“It’s an amazing time when it comes to backlog in the industry and it must be very difficult for those miners because, as much as XRF can give you sort of base metal grades and or elements that may be indicative of gold in the sample, it can’t give you a quantitative analysis of gold,” Treasure said.

“What we’ll do is we’ll grow capacity and alleviate the backlog via that, but having the unit in the lab doesn’t give you that instantaneous turnaround.

“Having it on site does, so the more miners that are adopting these and taking these directly to site means that they have complete control over their turnaround times.

“I would say I actually don’t know exactly what the turnaround time at the moment for PhotonAssay is in WA but I’d say it’s still two to three weeks.”

More to come?

Chrysos is the first company to list publicly incubated by RFC Ambrian, a natural resources corporate advisory firm which has shifted into mining-focused venture capital investment in recent years.

Its listing comes as RFC looks to close a $75 million VC fund designed to find and back other technologies that help modernise and improve the ESG metrics of the industry.

Chrysos is currently scheduled to list on May 6.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.