MoneyTalks: In 2016 these guys bet on ESG and mining tech. It is now at the heart of their business

Experts

Experts

Around five years ago resources-focused corporate advisors RFC Ambrian took a punt on a little-known technology developed by the CSIRO.

It was called PhotonAssay, a process that uses X-rays to stimulate and assess the proportion of gold particles in rock samples.

What Australia’s chief science body believed was that the technology could become a disrupter in the billion dollar minerals analysis business.

RFC agreed and got to work sourcing investors, providing a management team and getting the business up and running.

It is a bet that is about to pay off handsomely for RFC, early investors and the CSIRO.

That firm, Chrysos Corporation, this year raised $50 million in its latest funding round and is heading towards an IPO next year, where it is estimated it could have a value of $500 million.

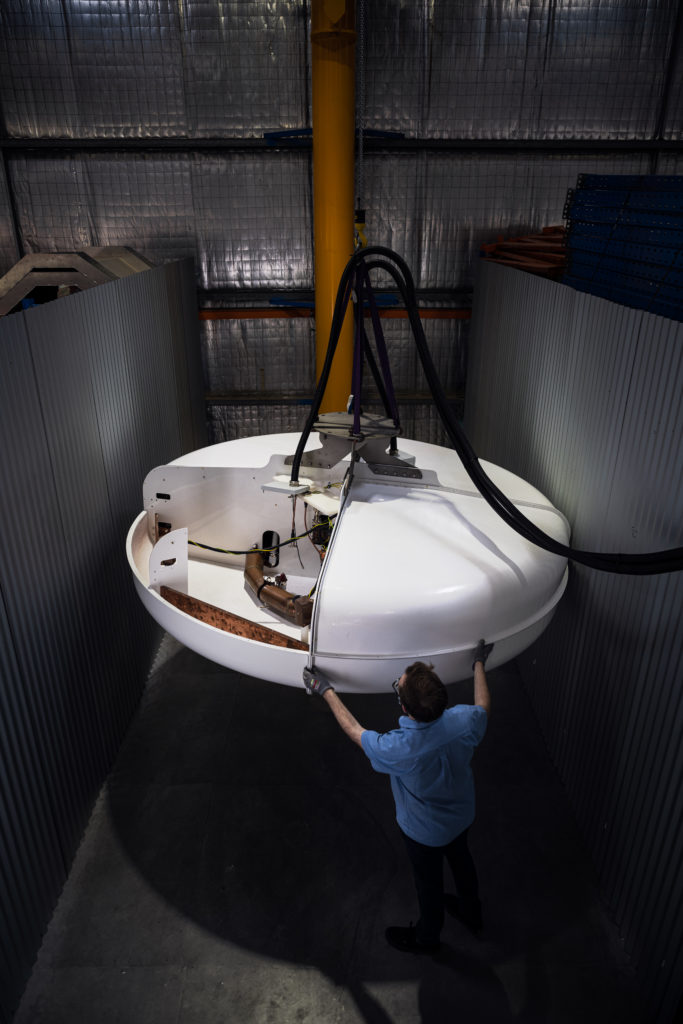

RFC has since piloted the commercial spin-out of the CSIRO’s partner technology NextOre, a magnetic resonance imaging machine that sorts waste rock from copper rich ores which appears to be on a similar trajectory to Chrysos.

Once a traditional mining focused corporate advisory firm, early stage investment opportunities in groundbreaking mining and industrial technology now make up around half of the RFC business.

It is now launching its $75 million basic industries venture fund, expected to close by the end of this year, focused on making early stage “impact” investments to commercialise the next wave of technologies like Chrysos and NextOre.

“Essentially after Chrysos and NextOre, we’d had a lot of techs come through and knock on our door,” RFC associate director and VC fund chief investment officer Chris Vinson told Stockhead

“And what we realised is there’s quite a big gap in the market. Most VC firms, essentially all VC firms, and most people in general, are really just not focused on this area and there are several reasons.

“One is it can be technically challenging, so having a blend of the engineering and the technical skills across our firm is really useful in evaluating these technologies, and figuring out where the value levers lie, and what you might actually get out of them.

“What’s the downstream effect of that? Will that actually be valuable to somebody, that’s not always a straightforward analysis.

“The other one is, these are very different than a software company, or an IT company, that can begin as one or two guys on computers, they can be developing a product and could turn into a big business if it’s scalable.

“In these instances, where you develop these industrial technologies, especially industrial technologies for heavy industries, they tend to be big pieces of equipment. So there’s a capital need in not only the development, but in building the first unit to be deployed.”

Vinson said one of the key themes of the technologies in which RFC is invested is how they reduce the environmental footprint of mining and the businesses that operate around it.

That, he says, is where the “impact” comes in.

“All these investments that we’ve done, including Chrysos and NextOre, and the third one that we’re working on is a conveyor company called CMA, they all make a substantial difference to the environmental footprint and/or to the safety in the industry in one way or another,” he said.

“Chrysos is replacing the fire assay process, which eliminates quite a bit of toxic waste that comes out of fire assay, as well as removes the risk of lead poisoning to operators because the lead and the gold is mixed together in fire assay. Chrysos is non-destructive, chemistry free, and the machine takes the reading, so there’s really no harm or potential harm to the operators.”

NextOre uses technology akin to an MRI machine to sense copper grades. It is considered more accurate than conventional ore-sorting machines, which only scan for visual cues regarded as proxies for metal grades.

“NextOre is probably the most impactful one, because the sensing and sorting not only has a huge economic benefit to the operation, but it also has a huge environmental benefit.

“What you’re doing is digging up a bunch of rocks, and you’re guessing and you’re saying that on average, all this rock we dug up is 0.3% copper.

“But what’s really more likely, is that some of it is 0.6%, some of it is 0.1%, and some of it is probably zero; there can be a lot of variability in there.

“Every tonne of rock that you send through the mill uses 500 or 600kg of water, and a heap of energy in grinding and processing and flotation. So every tonne that you can take out that was not worth processing, it actually lowers the environmental impact of producing copper significantly.”

On top of that Chrysos and NextOre have proven commercially successful.

While he declines to put a dollar value on the investments, Vinson says they are worth many times the initial outlay.

They are of material value to the equity portfolio of the CSIRO, which is set for a major payday to fund further research when it sells down its stake in the upcoming Chrysos IPO.

Now what started as a side project has become an increasingly important component of RFC’s business model.

Vinson says the impact fund, structured as an early stage venture capital limited partnership fund, will enable it to provide a dedicated resource to progress a number of investments derived from the CSIRO, universities, start-ups and private tech developers.

“The business planning process, the negotiations, the fundraising, fundraising actually takes quite a bit of time as well. And that’s a big effort. Preparing materials for every subsequent fundraise round, going out and talking to the market, negotiating, doing contracts, doing diligence, it’s a big use of time,” he said.

“So one thing that would cut down on that and give us more time to spend back on the business is having a dedicated pool of investment capital that we can draw from.

“So that leads us to launching this $75 million Impact Fund structured as an ESVCLP. There are a couple of other investors in the space that are targeting METS or that are targeting early stage and even say industrial technologies. But I don’t think we’ll have any true competitor in the space.

“When I think about skill sets and experience and track record, there’s just not that many people with the ability or the desire to fund these types of things.”

Vinson said RFC has a large amount of expertise internally in fields like engineering and geology it could leverage to support investments made through the fund, which he said would be complemented by the capital raising and financial acumen within its traditional corporate advisory business.

“This has been a side project within a corporate advisory firm and we want to turn it into a proper business that has its own focus, and truthfully, I think the two businesses will be highly complementary,” Vinson said.

“The knowledge and experience and insight into technologies and the market will be really useful from an advisory perspective.

“And the market experience, discussion with other industry players, as well as the technical knowledge residing within the corporate advisory business will be extremely useful to the investment side of the business.”

Vinson says it is hard to quantify exactly how much value the ESVCLP brings to RFC Ambrian compared to its corporate advisory work because its value is based on the underlying investment.

“I think 50/50 is a good approximation for the relative size of the two businesses, they’ll be close,” he said.

“The corporate advisory business will have steady work generating fees on a regular basis, whereas the investment business will largely depend on performance of underlying investments, and that will take some time to realise.

“If you’ve performed well, you may earn some sort of performance fees or some profit sharing toward the end of it.”

ESVCLPs have other benefits as well. They are extremely tax effective, Vinson said, thanks to rules introduced by the Federal Government in 2016 to encourage venture capital investments in Australia.

“So if you’re an outside party, one of our investors in the fund, you’ll get a 10% tax offset when the money goes in,” Vinson said.

“And then on the back end, when the fund is successful and creates investment returns, those returns are going out to the limited partners capital gains tax-free. So it’s extremely tax efficient, very attractive for investors.”

There are no guarantees that a venture capital investment will work out, but RFC and the CSIRO’s partnerships have been winners so far.

That is not measured in commercial terms only, with Vinson noting Chrysos and NextOre had leveraged access to capital and human resources through RFC to develop their ESG-focused technologies further.

“We want to build sustainable businesses, because the whole point in doing these things, it’s not just so that we can make a dollar,” Vinson said. “Of course, we want to make some money for our efforts and be compensated.

“But the whole point in doing this and setting the business up for success and making it sustainable and making it generate its own profit is so that those research activities can go into the business.

“Chrysos started with the one scientist, they now employ half a dozen nuclear PhDs, which is a significant portion of all the nuclear PhDs in Australia.

“They used CSIRO as contract research for the last several years while the company has built its own capabilities in-house, all that time creating a source of external consulting work for CSIRO.

“And so what these commercialisation partnerships do is give the technology a life of its own, take them off the CSIRO’s or any research institution’s balance sheet, so that they’re not only funding the research internally, it actually turns it into a revenue stream for them.

“Once the company grows and becomes self-sustaining, and it can continue to develop and not only push the initial technology out, but continue to improve upon it and widen the scope, such as with new applications or by creating complementary products.”