IPO Watch: Gold’s allure brings IPO fever back to ASX

Golden Dragon is the latest ASX gold IPO ready to fly. Pic: Getty Images

- IPOs are back on the ASX, led by gold explorers aiming to take advantage of prices beyond $5500/oz

- Golden Dragon Mining is one of the next to head to the market, chasing $5m through Sanlam to explore for gold in Cue

- Brings new player to 35Moz Murchison gold field

After a barren couple of years, IPO activity is finally reawakening on the ASX.

And it’s the dream of finding a major gold deposit on ground overlooked by majors that has investors willing to part with their cash in the hopes of getting in on the ground floor at a potential multi-bagger.

Recent history has shown the growth potential of even modest gold miners in the current market, with prices topping $5500 Aussie an ounce.

Explorers just starting out want to revive the market’s optimism that another Northern Star Resources (ASX:NST) or Evolution Mining (ASX:EVN) could emerge from the new gold boom.

The latest to try its hand is Golden Dragon Mining, which is expected to lodge a prospectus this week.

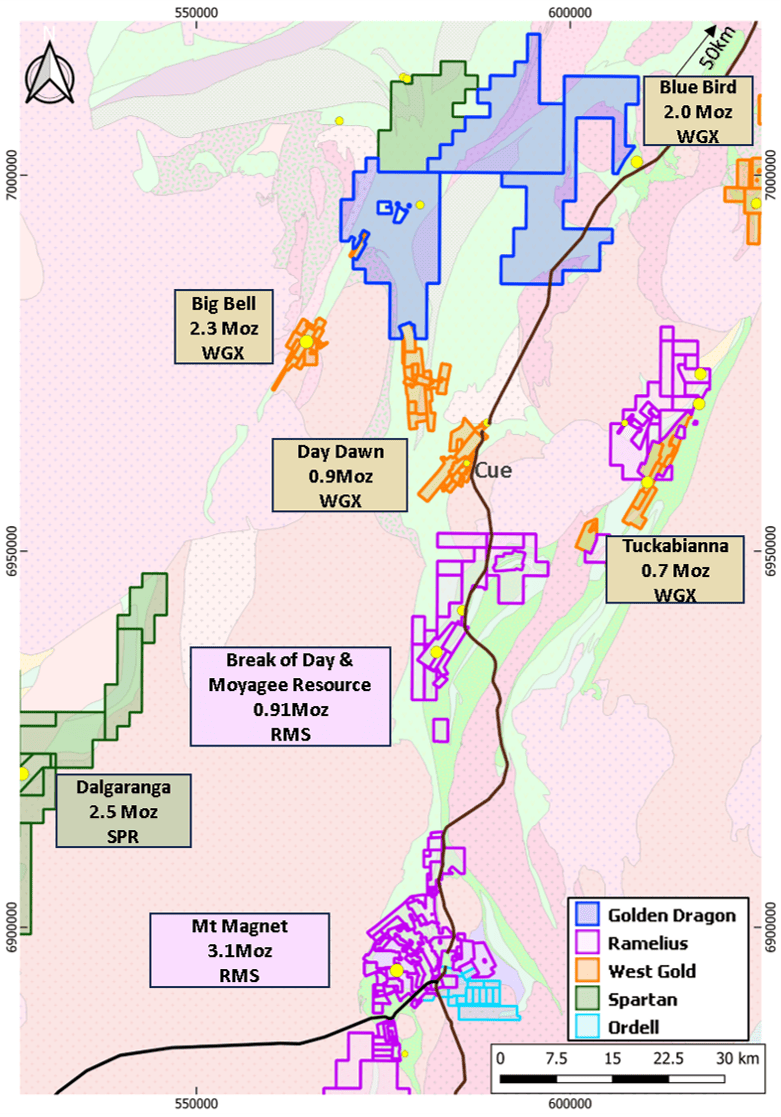

Its prized possession is the Cue gold project in WA, a 600km2 package just 15km from the 5Moz Big Bell deposit in the heart of the Murchison gold field, historic production of 35Moz.

Some of the ground was at one point subject to a JV between Musgrave Minerals and the ASX’s second biggest gold producer Evolution Mining (ASX:EVN), which spent $3m on exploration on tenements now under Golden Dragon’s control before Ramelius Resources’ (ASX:RMS) takeover of the junior. Other ground was drilled by Victory Metals (ASX:VTM) before its move into rare earths.

That happened in a far different gold environment. Golden Dragon, led by geo Simon Buswell-Smith as MD and WA gold veteran Rhod Grivas as chair, sees the potential to make a major gold discovery which has alluded explorers who have held the ground for decades.

“The sentiment has definitely changed and the money’s coming in to the junior sector for sure,” he said.

“I think the belief is there that juniors can do it again and it’s the juniors that usually do find in the big deposits as well.”

IPO drought broken

Much was made of a resources IPO drought through the start of 2025.

In the peak of the market, in 2021, there were 105 mining IPOs. That fell to 64 in 2022, 25 in 2023 and 15 in 2024, according to numbers compiled by Lion Selection Group’s Hedley Widdup.

That was broken by Robex Resources Inc’s (ASX:RXR) $120m raising to dual list the TSX-listed West African developer and miner on the ASX, and $50m for the dual listing of London exchange hosted Telfer gold mine owner Greatland Resources (ASX:GGP).

Those were followed by the spinoff of Ballard Mining (ASX:BM1) from Delta Lithium (ASX:DLI), bauxite proponent VBX (ASX:VBX), gold and copper hopeful LinQ Minerals (ASX:LNQ) and a smattering of other gold juniors.

Upcoming listings on the ASX notice board now show a healthy pipeline. AIM listed Ariana Resouces is due to dual-list today after a $15m raising, planning to add to its Mediterranean copper-gold mines with the Dokwe development in Zimbabwe, with fellow gold hopefuls PC Gold, Green and Gold Minerals and Golden Globe Resources all in the pipeline.

Golden Dragon is intriguing since it is pre-resource and will test the market’s appetite for early stage gold exploration.

Sanlam is leading the raising, chasing $5m at 20c a pop, with much of it already spoken for before a roadshow began in Perth on Monday.

Mighty Murchison

Its selling point is the quality and scale of its holding in the Murchison, a district which has become one of the rising stars of the WA gold scene as the commodity doubled in price over the past three years.

Cue, Meekatharra and Mt Magnet have emerged as the citadels of ASX 300 gold miners Westgold Resources (ASX:WGX), Catalyst Metals (ASX:CYL) and Ramelius, bringing extraordinary competitive tension to the district.

Spartan Resources (ASX:SPR) high-grade Never Never discovery at Dalgaranga, which led to a ~$2.5bn merger with RMS, thrust a glaring spotlight on other explorers nearby.

Smaller players have also drawn the eye, from Odyssey Gold’s (ASX:ODY) 407,000oz Tuckanarra project, to Caprice Resources’ (ASX:CRS) high-grade Island discovery, New Murchison Gold’s (ASX:NMG) recently opened Crown Prince gold mine and Great Boulder Resources’ (ASX:GBR) +500,000oz Side Well deposit.

Golden Dragon’s management hopes to put their finger on a multi-million ounce discovery akin to Never Never or Big Bell, but the proliferation of mills in the area means even a modest 100,000oz deposit could generate exceptional cash flow.

“I‘ve spent over 30 years in the gold game, mostly in WA, and I’ve watched the cycles of exploration and discovery,” Grivas, whose history of discoveries include work on the East Kundana and Frog’s Leg mines now producing big ounces for Evolution, said.

“One of the challenges always is getting a decent landholding in an area close to existing discoveries. The best place to always look is in the right address.

“That doesn’t mean you can’t make greenfields discoveries outside that.

“But particularly for a junior, there’s always that body of information that … you basically build on that information.

“With the gold price changes that suddenly opens your eyes to opportunities in data that people saw no opportunities before because they couldn’t make a go of it.”

Who’s on board?

The Golden Dragon IPO includes a tantalising link to Mark Creasy, the billionaire prospector known for having a hand in some of WA’s largest mineral discoveries.

He is connected with prospector Bruce Legendre, who picked up the mining leases central to Golden Dragon’s key Cue project in a ballot.

Grivas has connections with Creasy too, as a director at London-listed South African gold explorer Lexington Gold, where the prospector is a major shareholder.

More ground was consolidated from Adam Brand, the country singer who has tried his hand at mining and prospecting as a second career.

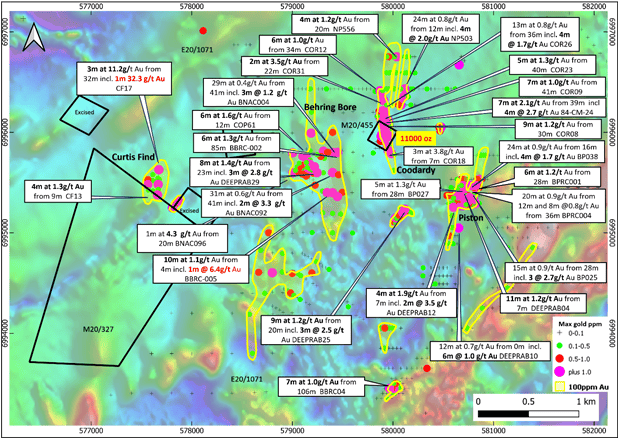

Drilling highlights across the project include 12m at 5.4g/t from 16m at Behring/Coodardy, 8m at 5.77g/t from 144m, 3m at 11.2g/t from 32m at Behring/Curtis Find and 5m at 5g/t from 60m.

Despite these hints of high-grade mineralisation, little drilling has been completed at depth.

RC drilling is planned to target a resource and extend known mineralisation at Coodardy lode, with deeper RC drilling planned at Curtis Find and Piston and an extensive aircore program to come at Behring Bore.

IP/resistivity geophysics, deep drilling and aircore infill drilling is also planned at the Stockyard East prospect, where drilling in 2010 intersected a shallow high grade zone of 8m at 5.8g/t which remains untested from 2010.

Further RC drilling is planned along strike from historic drilling at Big Bell North, targeting a repeat 16km along strike to the north of the famous Westgold mine.

The company’s board has been rounded out with founder and non-executive director Francesco Cannavo, a non-executive director also of Western Mines Group (ASX:WMG) and Golden Mile Resources (ASX:G88), and Sam Zheng, a Sydney-based asset manager who has led early stage investments in ASX gold and battery metals stocks including WA success story Black Cat Syndicate (ASX:BC8).

Golden Dragon has additional projects at Narndee-Fenceline, where it is looking for base metals and PGE targets in the Windimurra complex of central WA, and Stella Range, a potential gold and nickel project near the Tropicana gold mine.

But the lion’s share of IPO funds will go to Cue, with the WA and gold focus of the company planned long before the decision to take it public.

“It’s the best place in the world to explore for gold,” Grivas said. “If you discover something here you can do relatively cost effective exploration.

“You’ve got all the services and all the geologists, everything you need, and if you discover something, this is the state that it’s going to get developed because it’s pro-mining and it’s got all the knowledge base you need.”

“It’s not like we’ve been waiting for the market to turn,” Buswell-Smith added.

“We’ve been bullish on gold for quite a while, and we think it’s going to continue to go up as long as Trump’s in.”

At Stockhead, we tell it like it is. While Victory Metals, LinQ Minerals, Ballard Mining and Delta Lithium are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.