IPO Watch: Cooper Metals eyes a strong copper market in Mt Isa exploration play

Pic: John W Banagan / Stone via Getty Images

Geologist Ian Warland has had a long and varied career since cutting his teeth in copper and gold mines in Queensland three decades ago.

His success as an explorer is underlined by the Explorer of the Year gong he took out in 2006 in the team that made the Jacinth Ambrosia discovery for Iluka Resources (ASX:ILU) in South Australia, the world’s largest zircon mine.

His experiences have taught him major discoveries can be made even in regions and areas thought to be well explored.

It is a lesson he is taking with him into new IPO Cooper Metals (ASX:CPM), which listed on the ASX today with a swag of copper and gold assets in Queensland and WA.

“What I guess I’ve taken from all of that is firstly, you can still find deposits in areas that you think have been well explored,” he said.

“So, for instance, with the Iluka example, three major companies had been through that area before Iluka had and done a fair bit of drilling.

“Then we came along with a new model and a new idea and made major discoveries there. So that really taught me don’t write areas off just because you’ve had some major companies that have been through there before.”

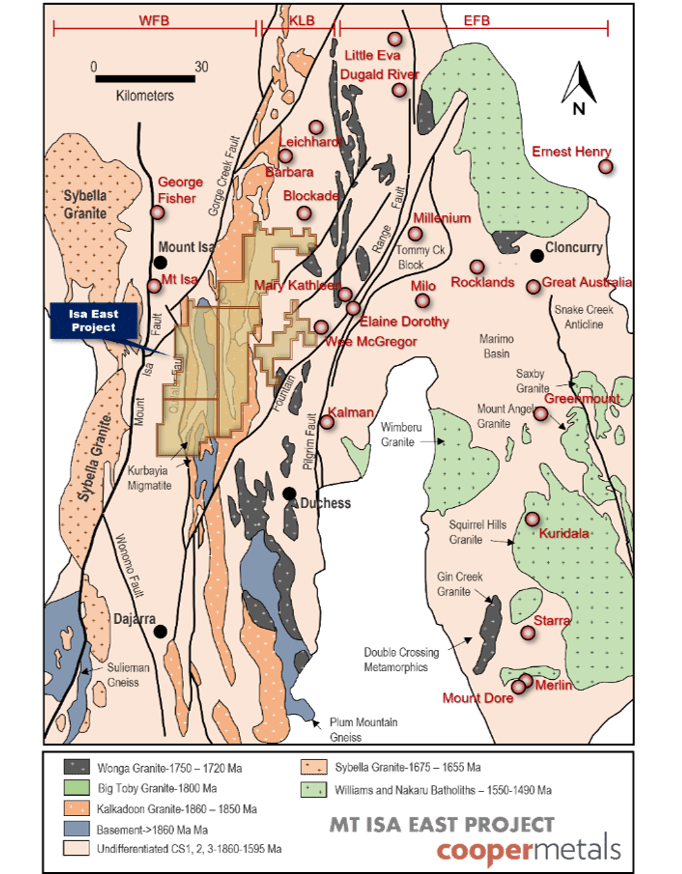

Indeed, that is the case with Cooper’s flagship Mt Isa East project in Queensland, located in the heart of one of Australia’s richest and longest running copper-gold domains.

Fresh eyes, techniques to back Mt Isa copper search

Cooper’s top billing asset is an 85% stake in the 1300km2 Mt Isa East project, located around 30km south-east of the famous copper mining town in north-west Queensland.

The ground, spread across five tenements, has been looked over by a host of companies including Rio forebear CRA Exploration, Glencore’s Mount Isa Mines and Chinalco, but Warland said there is plenty of potential for iron sulphide copper-gold discoveries.

He argues the discovery of Ernest Henry under deep cover by Glencore around 30 years ago changed the style and nature of the deposit copper-gold explorers were searching for in the Mt Isa region.

He pointed to the success other companies like Hammer Metals (ASX:HMX) and Minotaur Exploration (ASX:MEP) have had exploring for smaller iron sulphide copper gold targets.

“The discovery of Ernest Henry under cover, which is iron oxide copper gold deposit, started this massive focus on magnetic targets looking for iron oxide, copper-gold, in the Mt Isa Inlier,” Warland said.

“And people moved away from the sort of terrains that are outcropping and moved to these undercover giants, because they thought they’d have more success there drilling magnetic highs.

“We’re really following in sort of Minotaur’s footsteps, and looking at more iron sulphide copper gold, which often has a strong footprint in electromagnetic surveys. And there really has been very little EM surveying done in our area.”

Warland said Cooper would be seeking for both large and small copper-gold deposits at Mt Isa.

The company’s $4.8 million raising, which gives it a market cap on listing of $8 million, has come at a time when copper is trading near all time highs with expectations of major supply shortages in the years to come.

Warland doesn’t see demand for copper going away, opening up the potential that higher prices will provide a lower entry point into the market.

“When we looked into detail of what had been done (at Mt Isa East), the last lot of drilling was in the mid-1990s and there hasn’t been a lot of drilling on that area, but there are a lot of copper gold occurrences that have been mined periodically over the last 100 years,” he said.

“So there’s quite a lot of smoke. And I think, in the past, companies have sort of written them off as being small and not being economic, not big enough.

“But to be honest there just hasn’t been the work done to systematically determine that.

“In fact there was the Barbara deposit (owned by Soul Patts copper subsidiary Round Oak Minerals), not far from our tenements, which is 5Mt at about 1.5% copper and that was toll-treated through Glencore.

“So now you’re finding that you can find smaller deposits, toll treat them and you’ve got a very of economic development pathway.”

Yamarna gold and Gooroo copper-gold also to be tested

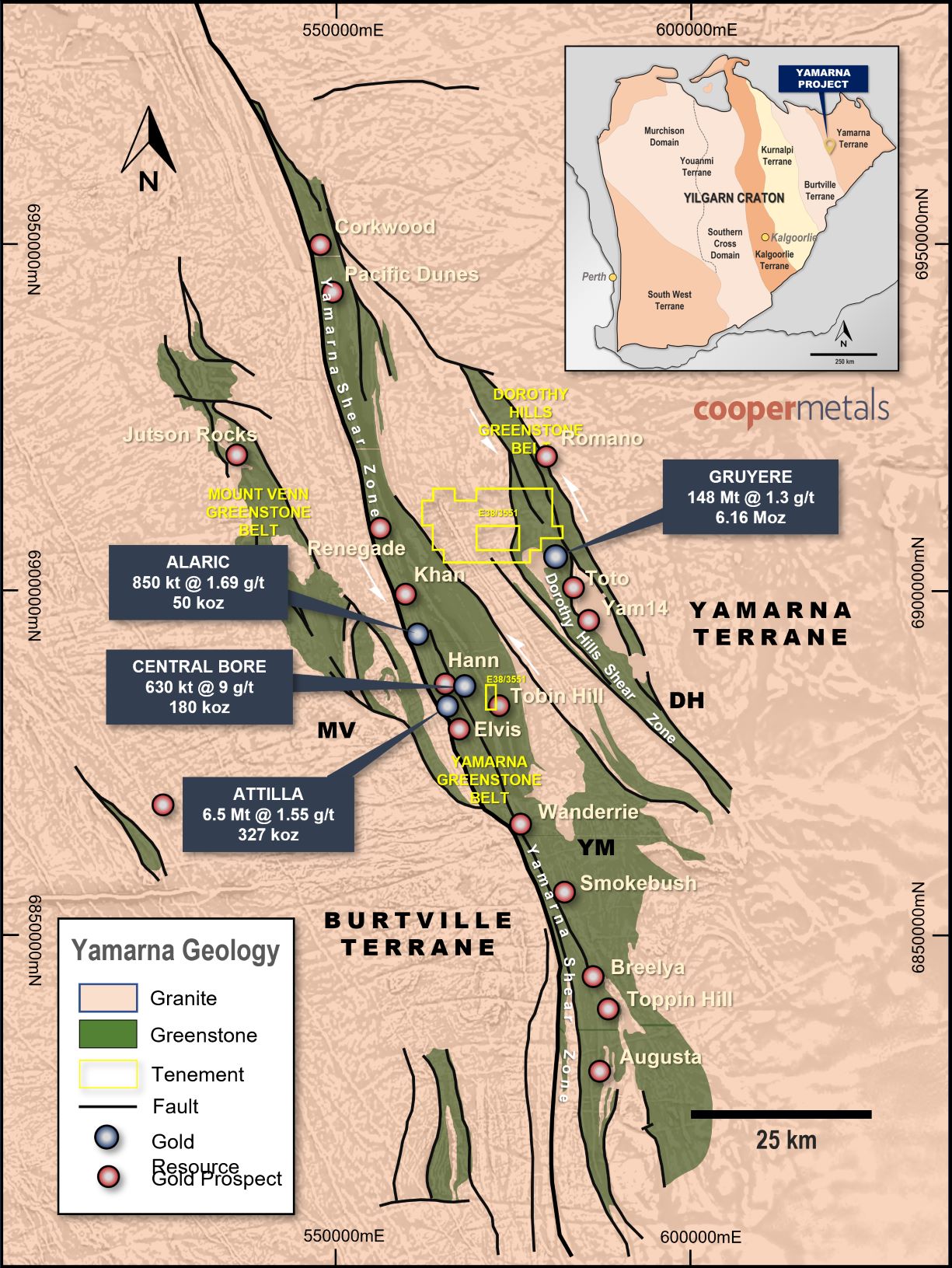

Cooper Metals has also secured 100% ownership of the Yamarna gold project and Gooroo gold and copper project in Western Australia.

Gooroo is near the historic mining town of Yalgoo and is located just 20km from Silver Lake Resources’ (ASX:SLR) Deflector mine.

Incredibly, it covers a 26km greenstone belt only added to WA’s geological maps in 2020. The Yamarna project meanwhile is situated just 2km from the top-tier 6Moz Gruyere deposit currently being mined at a rate of over 300,000ozpa by Gold Road Resources (ASX:GOR) and South African mining giant Gold Fields.

A major structure called the Dorothy Hill shear zone runs through the tenement, which Cooper will be looking to access once agreements are completed with traditional owners.

“The Dorothy Hill shear zone basically continues along strike from the Gruyere deposit and through our tenement and it’s had very little exploration that we can see in the historical data today,” Warland said.

“So it’s an obvious area to go looking, I can’t explain to you why gold road don’t have the tenure.

“We’re just happy that we’ve got it and we want to get on the ground as quickly as we can.”

Back at Mt Isa, Warland said electromagnetic surveys and modern exploration techniques would be a key part of the company’s exploration strategy.

“They’re much more powerful these days, they can see deeper, they can see through conductive cover more easily, so there’s a huge technological advantage 25 years later, using the new equipment,” he said.

“So the strategy is to apply modern exploration technologies to areas of known, proven mineralisation, we know these areas have mineralisation. They’re proven, they’re close to infrastructure, they don’t need to be standalone deposits.

“If we can find something with 50,000t of copper metal or 150,000t, then they don’t need to be standalone that can go through a toll treatment.

“It’d be great to find a tier one world class deposit, but we’d be happy happy with the sort of mid size things as well. And there’s never been a better time to do exploration for copper and gold with prices currently near all time highs.”

How did Cooper finish today?

It may not have been in Kuniko or Evolution territory.

But Cooper was up 12.5% to a price of 22.5c at 3.45pm AEDT, a handy lift on its 20c per share offer price.

It is the latest Queensland copper play to list on the ASX this month following the successful $30 million listing of miner and cathode producer Austral Resources (ASX:AR1).

Cooper Metals share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.