Gold-silver explorer Prospech ready to IPO and hunt multi-million ounce monsters in Slovakia

Pic: d3sign / Moment via Getty Images

In 2007, ASX-listed Bolnisi Gold was taken over by major US silver producer Coeur d’Alene Mines for $1.3 billon.

It was a deal that made Bolnisi one of the great success stories of the junior end of the ASX market.

Key members of the old Bolnisi team are now out to repeat that success with Slovakia-focused gold and silver explorer Prospech.

Prospech has just closed its oversubscribed $5m initial public offering (IPO) a week ahead of schedule. Listing on the ASX is now provisionally set for 1 December, with a market cap at issue price of $17.7 million.

It won’t be the first ASX-listed explorer to set foot in the former communist country of Slovakia.

Metalstech (ASX:MTC) has been one of the small cap success stories of the year, up 1600 per cent since it signed an option agreement to acquire the 1.1-million-ounce Sturec gold project in November 2019.

Prospech – which has already been exploring its main project here for six years — will be hoping to emulate Metaltech’s early success.

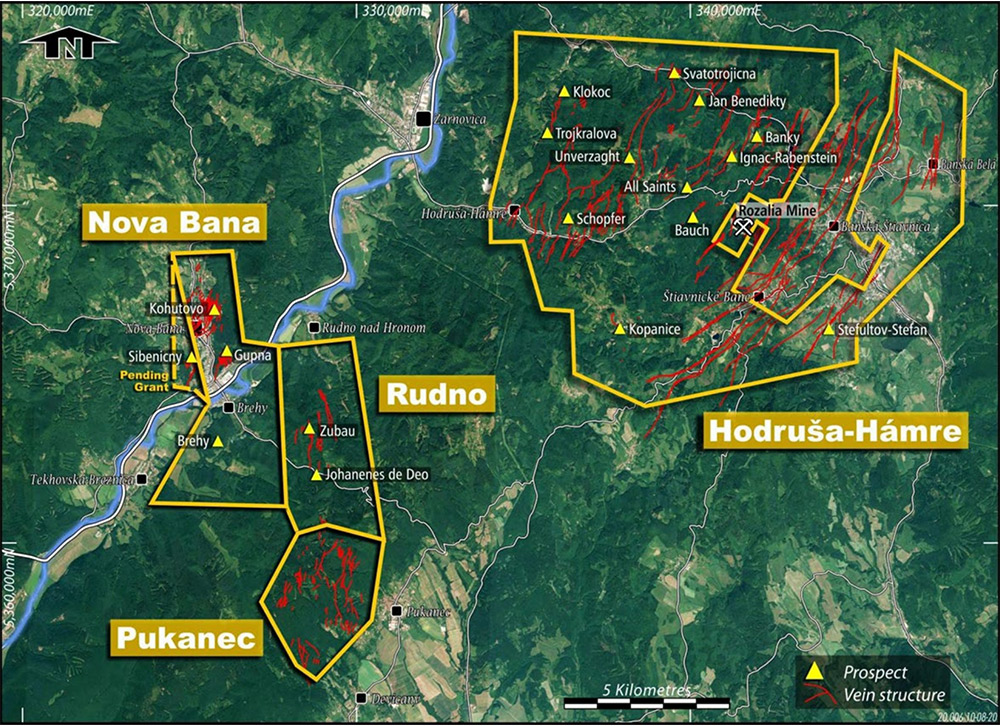

Its main game is the Hodrusa-Hamre project.

Hodrusa-Hamre has produced ~2.4 million ounces of gold and 120 million ounces of silver, as well as 70,000 tonnes of zinc, 55,000 tonnes of lead and 8,000 tonnes of copper over the last 1000 or so years.

But the company reckons Hodrusa-Hamre is far from mined out.

With 120 known mineralised epithermal veins — some reaching up to 6km in length — there are numerous high grade gold targets for the company to tackle:

Cash raised from the IPO will fund an ongoing drilling program testing a mix of brownfields (explored or mined) targets under and along strike of historical high-grade workings at Schopfer, Bauch and Ignac, and the company’s recent greenfields (untouched or unexplored) surface-visible gold discoveries at Nova Bana and Pukanec.

At Bauch and Ignac, Prospech will test targets on the so-called ‘Low Angle Normal Fault (LANF)’, a geological feature that hosts the neighbouring high grade Rozalia mine, which has been in production since the 90s.

Most (~90 per cent) of the mineralised LANF plane is on Prospech’s licences.

“The LANF host target is the real potential game-changer at Hodrusa-Hamre,” Prospech managing director Jason Beckton says.

“It was originally identified in 2006 but was overlooked at the time.

“Based on evidence from other similar large international epithermal gold deposits which have similar LANF or detachment fault structures which control and host large high grade deposits, we’ve looked at it closely and we think it is the host feature that controls the high-grade mineralisation.

“It’s exciting to be in a position to contribute to the longevity of the local mining industry, while exploring on projects that are in our view prospective to host multi-million ounce deposits.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.