This cannabis ETF is still enjoying the wallstreetbets treatment

Health & Biotech

Health & Biotech

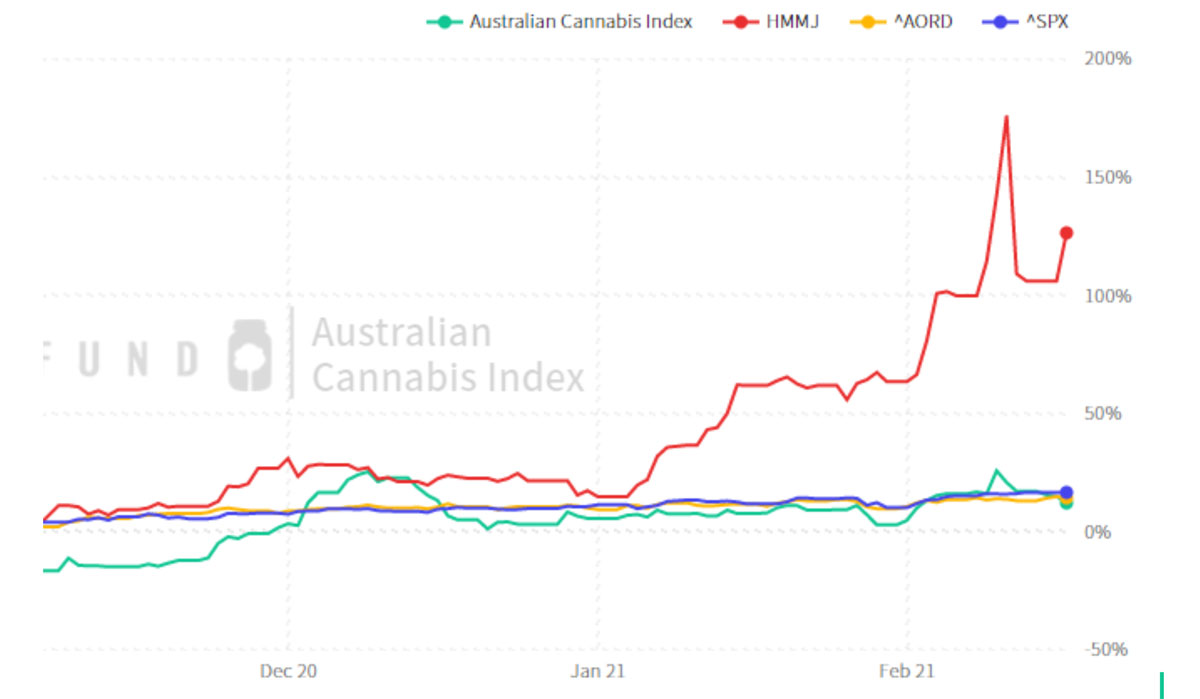

Last week, the North American cannabis industry experienced stratospheric growth, much like that felt recently by GameStop and AMC, all of which were largely spurred on by the reddit forum r/wallstreetbets.

The ‘Horizons Marijuana Life Sciences Index ETF’ (HMMJ) spiked over 140% compared with the month prior, driven primarily by a wave of investment in big-name cannabis companies such as Tilray (NASDAQ:TLRY), Canopy Growth (NYSE:CGC), and Aurora Cannabis (TSE:ACB).

Contrastingly, the S&P500, Australia’s All Ordinaries, and the Australian Cannabis Index remained relatively flat over the same period.

The rally in stock prices for the HMMJ is believed to have been the result of wallstreetbets, who moved onto the cannabis industry after targeting heavily-shorted entertainment companies.

After the reddit hype died down, the HMMJ precipitously declined 50% in price just days after its spike, though the industry has since enjoyed a small recovery, remaining 134% up over the past six months.

As we discussed last week, the retained gains by the HMMJ suggest that there’s more enthusiasm toward the industry than just from those attempting to make some quick profits, which is likely the result of Joe Biden’s election and the Democrats gaining control of the senate.

The Australian Cannabis Index, by comparison, has stayed largely in tandem with the S&P500 and the AORD, albeit with more fluctuations.

The best performer in the Australian cannabis industry over the past month has been the biotech MGC Pharma (ASX:MXC), whose stock price more than doubled from $0.03 per share to $0.069 in a little over a week.

The jump in MGC’s share price came amid news that the company would be the first cannabis company to be listed on the London Stock Exchange, which boasts a market cap of £39 billion ($69.75 billion).

“The LSE listing is a hugely significant moment for MGC Pharma, our admission to the LSE follows the successful capital raising of £6.5m which will be used to immediately commence the priority clinical research trials of our leading products, expand our distribution network into key sales markets, as well as advance the construction of our manufacturing facilities in Malta,” said Roby Zomer, the chief executive and managing director of MGC.

MGC also recently began a new clinical study into using its proprietary nano-delivery platform to treat glioblastoma, an aggressive form of brain cancer.

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

Louis O’Neill is a writer based in Sydney with a focus on social and political issues. Having interviewed local politicians and entrepreneurs, he now focuses on cannabis culture, legislation and reform for The Green Fund.