Stemcell gets China deal over the line but cannabis could still go up in smoke

Stemcell United has got its China deal, but the cannabis part is still a long way off becoming a reality.

Stemcell (ASX:SCU) has a cooperation agreement with hemp hopeful Yunnan Hua Fang Industrial Hemp Co (HFIH).

HFIH isn’t in the hemp business yet but is planning to apply for an industrial licence in China to grow the plant.

It’s unclear when HFIH plans to make its application or how long it will take.

What the deal will do, once Stemcell makes a down payment of RMB2 million ($400,000), is give it access to HFIH’s import export licence.

Stemcell plans to piggy-back off that licence to distribute their traditional Chinese medicine dendrobium (orchid) products, which include bottled dendrobium-infused bird nests.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

They also say they want to manufacture in China, but that plan too is a long way off as it’s still in the initial planning stage.

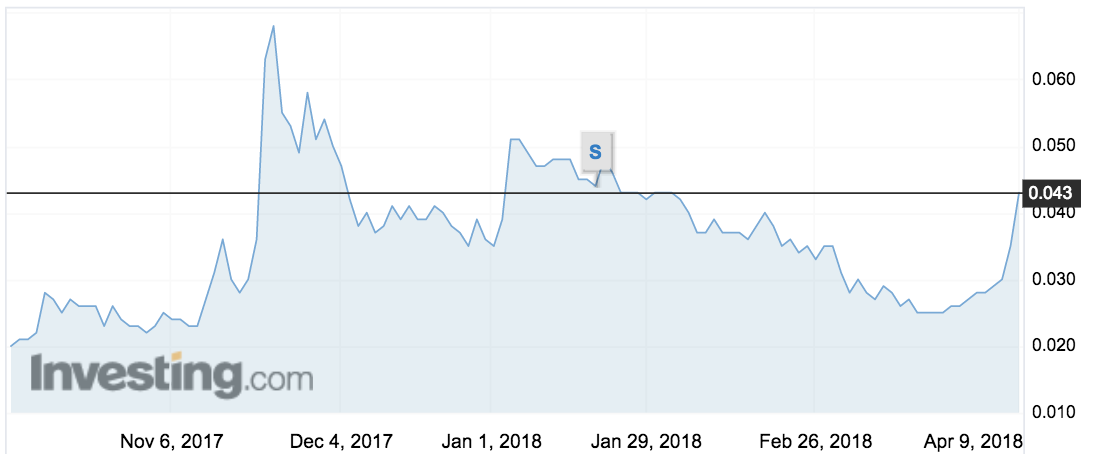

The Australian-listed company saw its shares jump 23 per cent on Monday morning to 4.3c.

Cannabis depends on the Chinese regulators

The biotech said last month it’s “extending the company’s stem cell technology to cannabis plant stem cells extraction to produce Traditional Chinese Medicine beauty products”.

But that depends on its new Chinese partner getting a hemp licence, and giving them access to cannabis material for product development.

Stemcell does not currently have another cannabis option, as an agreement in May last year to work with iCAN Israel Cannabis has lapsed.

Stemcell United first said it was getting into the marijuana market in March 2017.

In China, while medical cannabis is illegal, the provinces Yunnan and Heilongjiang allow industrial hemp and cannabidiol (CBD) extract production.

Cannabis is the generic name for the plant; hemp is a low-THC and low-resin Cannabis Sativa plant often grown as an agricultural fibre crop, while what is more commonly known as marijuana is a high CBD, high-THC and high-resin plant.

If HFIH do get a licence, Stemcell has the right to invest RMB3.8 million ($760,000) to buy 51 per cent of the Chinese partner.

Stemcell gets a board seat for its $400,000, and if it buys in later it will have the “majority of board seats”.

It also has to pay 2 million shares to a corporate advisor named Xie Mu Ci, the equivalent of $70,000.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.