September Health Winners: EZZ and Althea lead upbeat sector sparked by Fed rate cut

The health sector could see more recovery as the Fed cuts rates. Pic via Getty Images

- Healthcare stocks are doing relatively well globally in 2024

- The sector could see more recovery as Fed cuts rates

- How ASX biotechs performed in the month of September

The S&P 500 Health Care Index, a key world benchmark for healthcare stocks, has risen about 11% this year. In comparison, the overall S&P 500 index has seen a return of 21%.

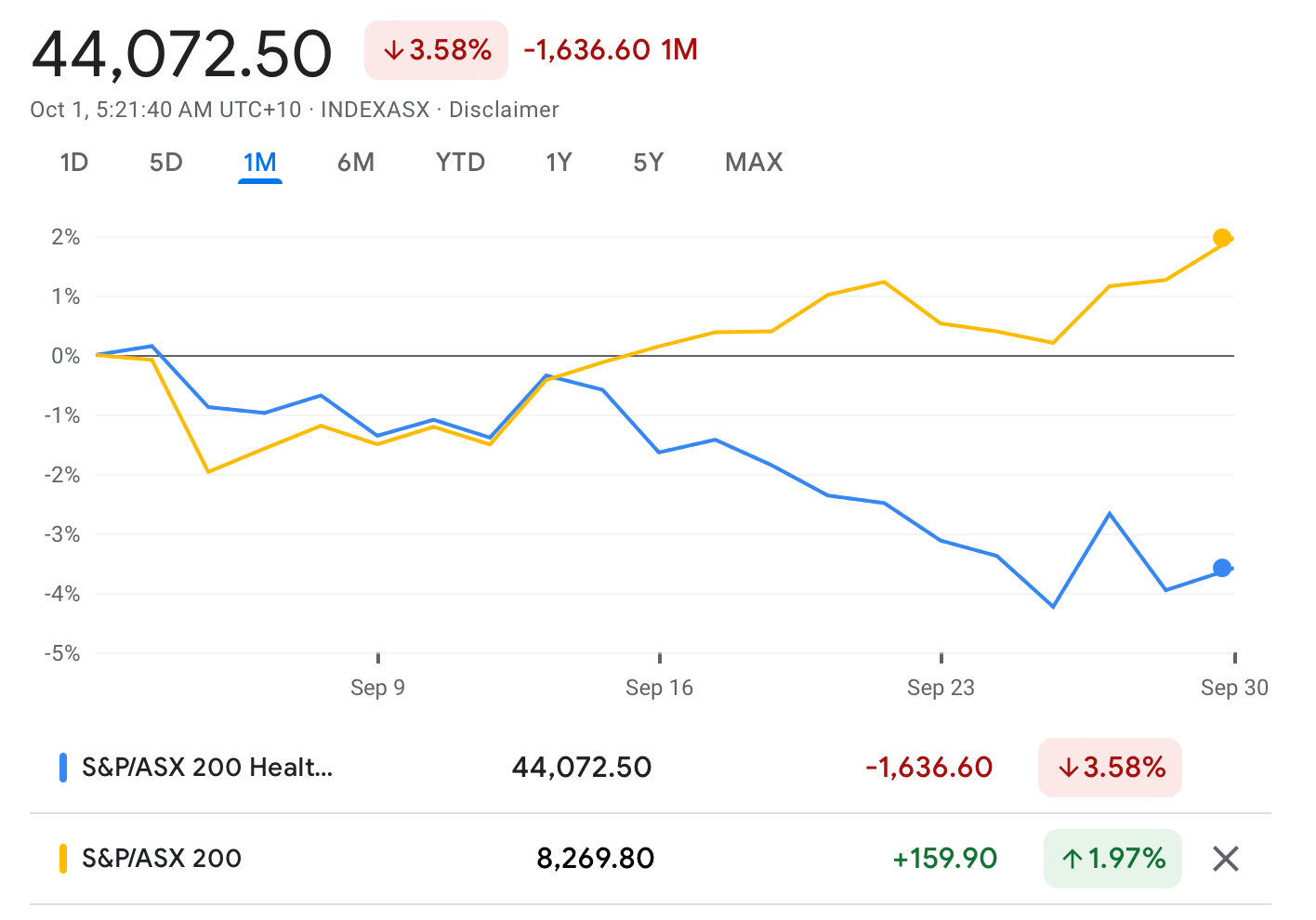

In Australia, the returns have been a bit more muted.

The ASX 200 Health Care [XHJ] is up by 3.5% this year, versus the 8% return for the broad-based ASX 200 index.

And here’s how the XHJ index has performed versus the ASX200 in September:

Fed rate cut to spur the sector

Healthcare stocks have had a mixed year but they started picking up steam in July and August.

The market has effectively broadened out, and strong performance is no longer just limited to the tech-heavy stocks that previously led the way.

However, performance within the ASX pharmaceutical sector this year varies greatly.

While many stocks are showing more consistent revenue and improved profit margins, such as ResMed (ASX:RMD) and CSL (ASX:CSL), some segments such as pathology are struggling with low patient numbers.

Generally speaking, though, the sector has faced cost challenges due to high interest rates, which hinder funding for research and trials.

But there’s now potential for a positive shift after the Federal Reserve’s recent 50 basis points cut.

As we know, biotech stocks perform better in a low-rate environment, and we’re beginning to see signs of that recovery.

BlackRock bullish on health stocks

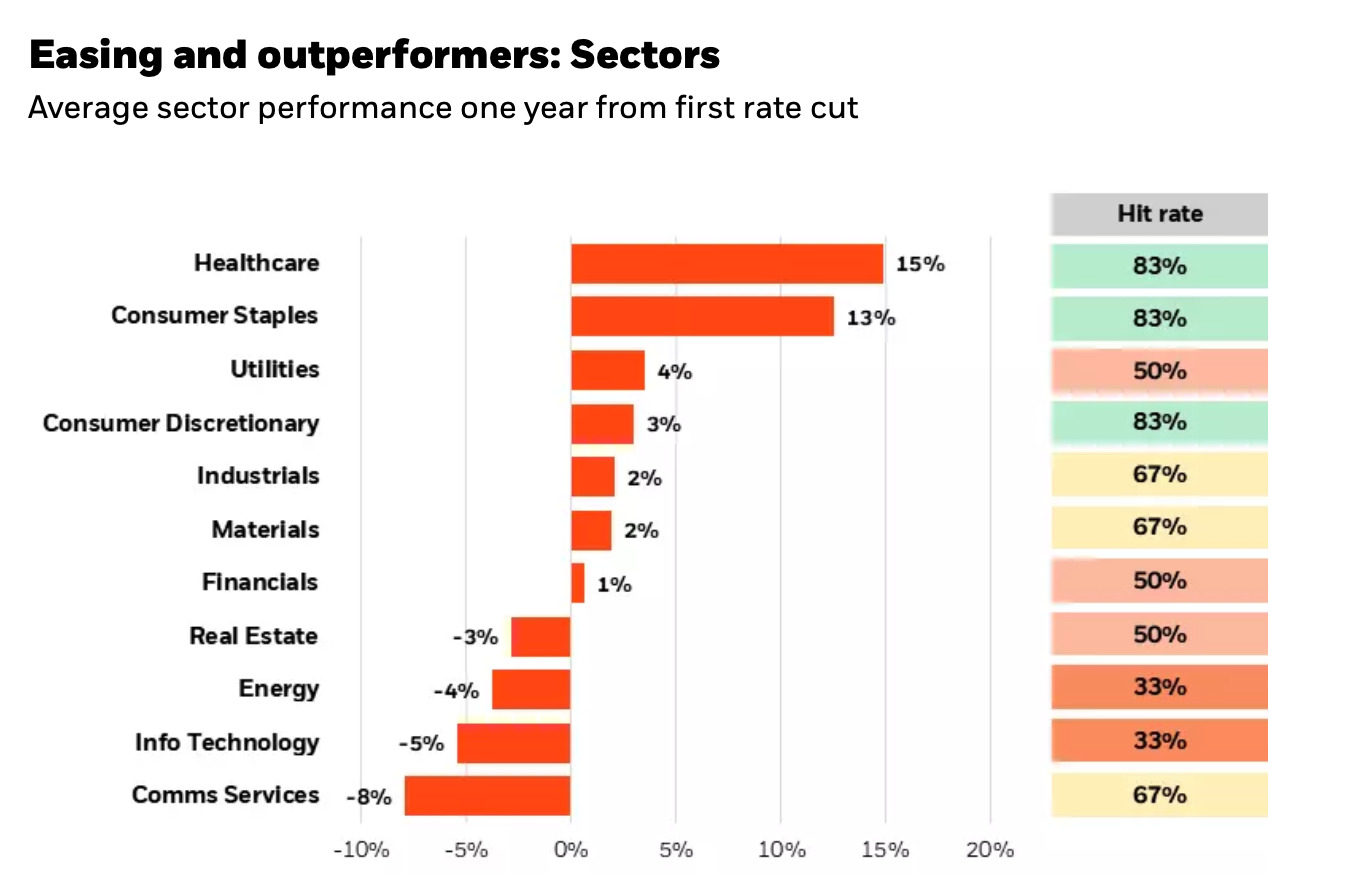

According to a recent note from BlackRock, the Healthcare sector has historically emerged as the top performer in the year following the first Fed rate cut of a cycle, as shown in the chart below.

“No surprise, cyclicals become more interesting as the cycle evolves and the economy approaches recovery mode,” said BlackRock.

BlackRock’s analysis of data since 1979 shows that healthcare has consistently performed well over the long term.

Although each market cycle is unique, BlackRock believes in the healthcare sector’s potential due to strong trends like ageing populations and increasing health needs.

“Our analysis of stock dispersion within sectors over the past 20 years shows that healthcare was among three sectors (discretionary and tech being the others) that exhibited above-average difference between the best- and worst-performing stocks.

“This suggests potential for attractive stock picking in a sector that typically performs well in the environment we are entering,” wrote BlackRock.

How ASX biotechs performed in the month of September

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | MARKET CAP |

|---|---|---|---|---|

| CAN | Cann Group Ltd | 0.095 | 157% | $28,119,989 |

| EZZ | EZZ Life Science | 4.53 | 133% | $179,469,728 |

| AGH | Althea Group | 0.039 | 105% | $14,997,300 |

| PEB | Pacific Edge | 0.14 | 71% | $109,608,656 |

| 4DX | 4D Medical | 0.675 | 57% | $258,634,633 |

| ECS | ECS Botanics Holding | 0.019 | 46% | $23,193,892 |

| ANR | Anatara Ls Ltd | 0.07 | 46% | $13,502,561 |

| OPT | Opthea Limited | 0.775 | 42% | $960,253,801 |

| ACL | Australian Clinical Labs | 3.67 | 40% | $720,547,434 |

| HGV | Hygrovest Limited | 0.054 | 35% | $10,936,151 |

| OSL | Oncosil Medical | 0.014 | 33% | $56,760,358 |

| PYC | PYC Therapeutics | 0.17 | 31% | $839,895,014 |

| PER | Percheron | 0.105 | 28% | $90,154,497 |

| ATX | Amplia Therapeutics | 0.16 | 28% | $42,593,738 |

| REG | Regis Healthcare Ltd | 6.19 | 27% | $1,873,770,957 |

| NYR | Nyrada Inc | 0.065 | 25% | $12,572,400 |

| VFX | Visionflex Group Ltd | 0.005 | 25% | $14,589,123 |

| RSH | Respiri Limited | 0.036 | 24% | $47,536,450 |

| MSB | Mesoblast Limited | 1.17 | 23% | $1,284,507,128 |

| SNT | Syntara Limited | 0.043 | 23% | $53,547,963 |

| PME | Pro Medicus Limited | 178.25 | 21% | $18,186,985,597 |

| ARX | Aroa Biosurgery | 0.565 | 20% | $189,695,141 |

| CU6 | Clarity Pharma | 8.38 | 20% | $2,734,101,134 |

| VTI | Vision Tech Inc | 0.125 | 19% | $6,879,558 |

| CAJ | Capitol Health | 0.365 | 18% | $394,437,574 |

| TRU | Truscreen | 0.02 | 18% | $11,051,822 |

| UCM | Uscom Limited | 0.014 | 17% | $3,506,678 |

| ILA | Island Pharma | 0.08 | 16% | $10,531,775 |

| AHC | Austco Healthcare | 0.255 | 16% | $89,194,911 |

| SIG | Sigma Health Ltd | 1.44 | 16% | $2,374,365,226 |

| OCC | Orthocell Limited | 0.425 | 15% | $89,070,148 |

| TRJ | Trajan Group Holding | 1.285 | 15% | $189,564,062 |

| IDX | Integral Diagnostics | 2.97 | 14% | $699,546,371 |

| BOT | Botanix Pharma Ltd | 0.405 | 14% | $689,334,359 |

| IRX | Inhalerx Limited | 0.033 | 14% | $6,262,310 |

| CSX | Cleanspace Holdings | 0.5 | 12% | $40,331,196 |

| GLH | Global Health Ltd | 0.14 | 12% | $8,126,935 |

| RAC | Race Oncology Ltd | 1.785 | 12% | $302,505,990 |

| NAN | Nanosonics Limited | 3.69 | 11% | $1,130,181,973 |

| CDX | Cardiex Limited | 0.059 | 11% | $17,356,300 |

| RHT | Resonance Health | 0.06 | 11% | $26,366,683 |

| IBX | Imagion Biosys Ltd | 0.04 | 11% | $891,164 |

| AVH | Avita Medical | 3.02 | 11% | $213,378,781 |

| CYP | Cynata Therapeutics | 0.215 | 10% | $37,942,017 |

| CYC | Cyclopharm Limited | 1.52 | 10% | $163,371,170 |

| MX1 | Micro-X Limited | 0.067 | 10% | $40,712,263 |

| SHG | Singular Health | 0.09 | 10% | $19,021,856 |

| PGC | Paragon Care Limited | 0.445 | 9% | $728,334,371 |

| CMB | Cambium Bio Limited | 0.39 | 8% | $4,593,437 |

| IMR | Imricor Med Sys | 0.56 | 8% | $154,000,187 |

| ANN | Ansell Limited | 31.81 | 7% | $4,624,964,853 |

| UBI | Universal Biosensors | 0.15 | 7% | $41,729,441 |

| HLS | Healius | 1.725 | 7% | $1,267,101,811 |

| SOM | SomnoMed Limited | 0.4 | 7% | $86,443,301 |

| LBT | LBT Innovations | 0.016 | 7% | $24,486,813 |

| EOF | Ecofibre Limited | 0.032 | 7% | $11,745,091 |

| PNV | Polynovo Limited | 2.61 | 6% | $1,823,426,312 |

| AFP | Aft Pharmaceuticals | 3.03 | 6% | $317,744,768 |

| PAA | Pharmaust Limited | 0.195 | 5% | $99,716,009 |

| SPL | Starpharma Holdings | 0.1 | 5% | $41,319,399 |

| DOC | Doctor Care Anywhere | 0.0715 | 5% | $26,031,599 |

| IXC | Invex Ther | 0.075 | 4% | $5,636,539 |

| RMD | ResMed Inc. | 34.97 | 4% | $22,281,976,712 |

| RCE | Recce Pharmaceutical | 0.535 | 4% | $122,891,957 |

| TLX | Telix Pharmaceutical | 20.73 | 4% | $6,840,802,295 |

| IPD | Impedimed Limited | 0.056 | 4% | $117,339,447 |

| VIT | Vitura Health Ltd | 0.076 | 3% | $42,038,787 |

| BMT | Beamtree Holdings | 0.315 | 3% | $95,482,444 |

| RHY | Rhythm Biosciences | 0.064 | 3% | $17,401,773 |

| NOX | Noxopharm Limited | 0.105 | 2% | $29,223,795 |

| SNZ | Summerset Grp Hldgs | 10.66 | 2% | $2,371,194,964 |

| CUV | Clinuvel Pharmaceut. | 14.02 | 2% | $716,112,254 |

| MVF | Monash IVF Group Ltd | 1.225 | 2% | $475,354,505 |

| RGT | Argent Biopharma Ltd | 0.35 | 1% | $17,183,989 |

| PSQ | Pacific Smiles Grp | 1.805 | 1% | $293,630,766 |

| SDI | SDI Limited | 0.93 | 1% | $110,544,943 |

| VLS | Vita Life Sciences.. | 2.23 | 0% | $125,770,345 |

| EBO | Ebos Group Ltd | 33.11 | 0% | $6,424,123,530 |

| AMT | Allegra Medical | 0.029 | 0% | $3,468,720 |

| BDX | Bcaldiagnostics | 0.125 | 0% | $46,626,356 |

| BP8 | Bph Global Ltd | 0.003 | 0% | $1,189,924 |

| IVX | Invion Ltd | 0.003 | 0% | $20,299,775 |

| PAB | Patrys Limited | 0.006 | 0% | $12,344,684 |

| CTE | Cryosite Limited | 0.8 | 0% | $39,047,650 |

| MEM | Memphasys Ltd | 0.009 | 0% | $13,007,233 |

| TD1 | Tali Digital Limited | 0.001 | 0% | $3,295,156 |

| OIL | Optiscan Imaging | 0.195 | 0% | $158,714,753 |

| ME1 | Melodiol Glb Health | 0.001 | 0% | $1,125,828 |

| MDC | Medlab Clinical Ltd | 6.6 | 0% | $15,071,113 |

| IMC | Immuron Limited | 0.105 | 0% | $23,939,826 |

| OSX | Osteopore Limited | 0.042 | 0% | $4,853,148 |

| EPN | Epsilon Healthcare | 0.024 | 0% | $7,208,496 |

| ALA | Arovella Therapeutic | 0.155 | 0% | $168,294,916 |

| FCG | Freedomcaregrouphold | 0.135 | 0% | $3,224,328 |

| AHX | Apiam Animal Health | 0.42 | 0% | $81,647,601 |

| AHI | Advanced Health | 0.092 | 0% | $22,733,170 |

| FPH | Fisher & Paykel H. | 32.11 | -1% | $19,236,220,291 |

| COV | Cleo Diagnostics | 0.38 | -1% | $32,232,000 |

| ZLD | Zelira Therapeutics | 0.75 | -3% | $8,510,366 |

| ZLD | Zelira Therapeutics | 0.75 | -3% | $8,510,366 |

| MAP | Microbalifesciences | 0.185 | -3% | $78,374,096 |

| CGS | Cogstate Ltd | 1.035 | -3% | $182,087,613 |

| EMD | Emyria Limited | 0.032 | -3% | $13,707,850 |

| LGP | Little Green Pharma | 0.09 | -3% | $27,460,215 |

| FRE | Firebrickpharma | 0.058 | -3% | $11,740,004 |

| EMV | Emvision Medical | 2.03 | -3% | $175,308,897 |

| SHL | Sonic Healthcare | 27.23 | -4% | $12,821,982,039 |

| LDX | Lumos Diagnostics | 0.037 | -4% | $20,830,474 |

| NEU | Neuren Pharmaceut. | 15.14 | -4% | $1,951,745,373 |

| IME | Imexhs Limited | 0.48 | -4% | $21,897,632 |

| IDT | IDT Australia Ltd | 0.115 | -4% | $49,431,815 |

| AT1 | Atomo Diagnostics | 0.021 | -5% | $12,144,844 |

| PTX | Prescient Ltd | 0.041 | -5% | $31,407,472 |

| LTP | Ltr Pharma Limited | 1.665 | -5% | $146,685,057 |

| HXL | Hexima | 0.017 | -6% | $2,839,674 |

| VBS | Vectus Biosystems | 0.08 | -6% | $4,256,842 |

| M7T | Mach7 Tech Limited | 0.555 | -6% | $132,682,576 |

| COH | Cochlear Limited | 282.09 | -6% | $18,431,054,886 |

| MVP | Medical Developments | 0.44 | -6% | $48,443,079 |

| TRP | Tissue Repair | 0.355 | -7% | $21,767,343 |

| OCA | Oceania Healthc Ltd | 0.695 | -7% | $503,340,566 |

| CSL | CSL Limited | 286.28 | -7% | $138,047,290,826 |

| AGN | Argenica | 0.715 | -8% | $97,350,562 |

| MYX | Mayne Pharma Ltd | 4.59 | -9% | $391,341,725 |

| CMP | Compumedics Limited | 0.3 | -9% | $54,212,177 |

| IMU | Imugene Limited | 0.049 | -9% | $356,988,011 |

| GTG | Genetic Technologies | 0.039 | -9% | $5,671,273 |

| RHC | Ramsay Health Care | 41.62 | -9% | $9,569,210,905 |

| NC6 | Nanollose Limited | 0.019 | -10% | $3,268,121 |

| IIQ | Inoviq Ltd | 0.5 | -11% | $55,205,717 |

| GSS | Genetic Signatures | 0.665 | -11% | $153,138,709 |

| MDR | Medadvisor Limited | 0.425 | -11% | $226,036,131 |

| NXS | Next Science Limited | 0.19 | -12% | $58,432,047 |

| IMM | Immutep Ltd | 0.325 | -12% | $493,888,179 |

| CHM | Chimeric Therapeutic | 0.014 | -13% | $12,672,098 |

| HMD | Heramed Limited | 0.021 | -13% | $11,398,497 |

| AVR | Anteris Technologies | 12.2 | -13% | $264,036,302 |

| CVB | Curvebeam Ai Limited | 0.155 | -14% | $48,862,612 |

| NTI | Neurotech Intl | 0.06 | -14% | $61,042,693 |

| DXB | Dimerix Ltd | 0.375 | -15% | $214,457,051 |

| ACR | Acrux Limited | 0.056 | -15% | $16,861,578 |

| DVL | Dorsavi Ltd | 0.01 | -17% | $6,697,759 |

| ONE | Oneview Healthcare | 0.33 | -18% | $216,566,138 |

| RAD | Radiopharm | 0.028 | -18% | $65,188,823 |

| AYA | Artryalimited | 0.26 | -19% | $20,463,038 |

| EYE | Nova EYE Medical Ltd | 0.1825 | -19% | $41,230,938 |

| ALC | Alcidion Group Ltd | 0.062 | -19% | $84,606,020 |

| CTQ | Careteq Limited | 0.012 | -20% | $2,845,425 |

| NSB | Neuroscientific | 0.035 | -20% | $4,916,566 |

| TRI | Trivarx Ltd | 0.019 | -21% | $9,140,774 |

| PCK | Painchek Ltd | 0.03 | -21% | $49,074,875 |

| PIQ | Proteomics Int Lab | 0.68 | -22% | $91,701,903 |

| 1AI | Algorae Pharma | 0.007 | -22% | $11,811,763 |

| EBR | EBR Systems | 0.87 | -22% | $320,359,433 |

| 1AD | Adalta Limited | 0.017 | -23% | $10,305,494 |

| PAR | Paradigm Bio. | 0.195 | -24% | $66,545,476 |

| ENL | Enlitic Inc. | 0.07 | -24% | $5,116,573 |

| CBL | Control Bionics | 0.068 | -24% | $14,022,214 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | $21,281,344 |

| ADR | Adherium Ltd | 0.012 | -29% | $9,102,960 |

| HIQ | Hitiq Limited | 0.012 | -29% | $4,222,140 |

| BIT | Biotron Limited | 0.019 | -30% | $17,143,876 |

| ICR | Intelicare Holdings | 0.014 | -30% | $7,292,822 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | $6,338,594 |

| ACW | Actinogen Medical | 0.024 | -43% | $70,680,034 |

Cann’s share price surged from $0.045 on September 26 to $0.073 on September 30, prompting the ASX to inquire about the reasons behind the rally.

In response, Cann stated that it was not aware of any undisclosed information that could explain the trading activity.

However, the company pointed to several factors that might have contributed to the price rise.

An investor presentation on September 19, delivered by CEO Jenni Pilcher at a conference, received positive feedback and was highlighted in various articles discussing the company’s potential for a turnaround.

Also, Cann said it launched an advertising campaign for the sale and lease-back of its Mildura facility, which garnered positive media attention and suggested a potential sale price of over $80 million.

The company is also contemplating a Rights Issue to raise further capital, although specific details are still under evaluation.

Cann said these activities likely contributed to the increased trading volume and share price.

Now read: Medical pot play Cann Group sees an earnings turnaround through the haze

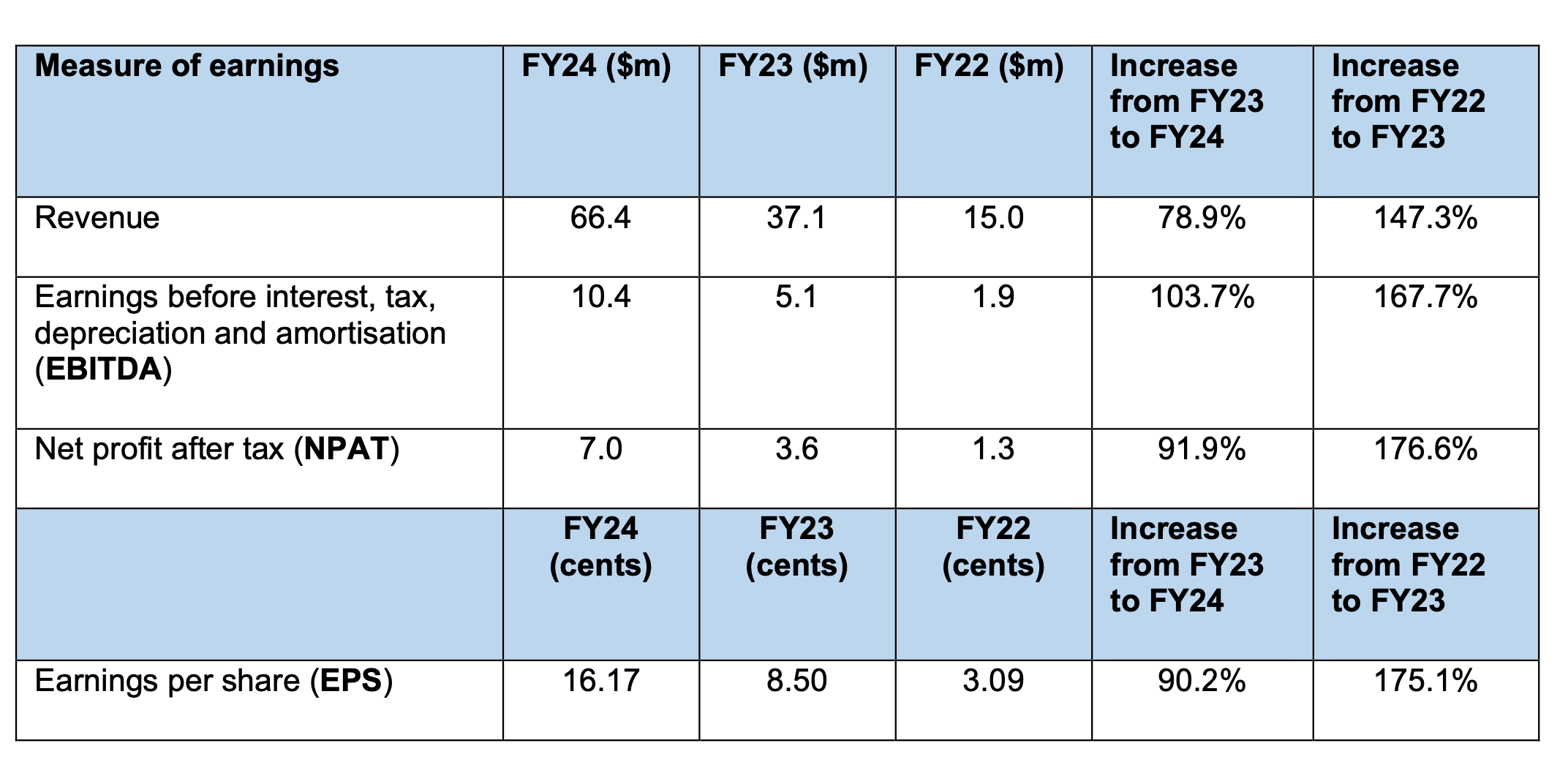

EZZ also received an inquiry from the ASX regarding its recent share price movements and whether its earnings for the year ended June 30 differed from market expectations.

In response, EZZ stated that it did not believe its earnings results were materially different from what the market anticipated.

The company highlighted that it had not issued any earnings guidance for FY24, nor was it covered by sell-side analysts during that period.

EZZ provided a comparison of its FY24 earnings with those from FY23, showing significant increases across various measures, including revenue and net profit:

The company also noted that it had kept the market informed about its performance and growth prospects throughout the year, with announcements regarding product launches, US market expansion, and strategic partnerships, which likely contributed to positive market sentiment.

EZZ essentially attributed the trading activity following its earnings announcements to positive developments and increased confidence in its growth trajectory.

Read more about EZZ here: ASX health stocks capitalise on growing Southeast Asian market

Althea said that its wholly-owned subsidiary, Peak USA, has made significant progress in its operations by establishing an emulsion manufacturing lab in Florida, which is a major step forward for its presence in the US market.

Initial production has already begun as part of a joint venture with Flora Growth Corporation, with plans to launch a range of cannabis-infused beverages soon.

The product lineup will feature Melo seltzers in Wild Berries, Grapefruit, and Strawberry flavours, each containing 5mg of THC, alongside Cloud Cola sodas in Vintage Cola, Root Beer, and Orange Creamsicle flavours, each with 10mg of THC.

As the joint venture prepares for launch, Peak is actively negotiating with liquor distributors across key US states, expecting to secure agreements shortly.

Online sales are set to begin immediately, with efforts underway to gain placement in physical retail locations.

This new venture aims to tap into the burgeoning US cannabis beverages market, which is valued at nearly a billion dollars in 2024 and projected to grow significantly in the coming years.

The cancer diagnostics company based in Dunedin, New Zealand, is currently engaging with the American Urological Association (AUA) regarding a new draft guideline for evaluating microhematuria.

This consultation process is taking place under strict confidentiality rules and began on 15 September. The AUA guidelines are important as they can influence medical reimbursement policies and affect how individual urologists practice.

Meanwhile, PEB announced that its chairman, Chris Gallaher ,will delay his planned retirement, originally set for the end of this year, to provide stability amid ongoing uncertainties regarding Medicare coverage for the company’s Cxbladder tests.

The Board has requested this extension to ensure a smooth transition to a new Chair, with Gallaher indicating that the recruitment process for his successor will ramp up following the finalisation of the Local Coverage Determination by Novitas.

Pacific Edge’s Cxbladder tests are currently facing uncertainties regarding Medicare coverage in the US, particularly related to the Local Coverage Determination (LCD) from Novitas, the contractor responsible for its US lab.

Novitas has been granted an extension to finalise or withdraw the draft LCD on genetic testing for oncology, which has delayed decisions on coverage for these tests.

Novitas confirmed this extension in late July, indicating that final decisions on the draft could take longer than anticipated.

The Cxbladder tests are non-invasive urine tests developed by Pacific Edge to help diagnose bladder cancer.

4DMedical recently signed a significant distribution agreement with Philips, marking an important step for its products in the US market.

This agreement has granted Philips exclusive distribution rights for 4D Medical’s suite of respiratory imaging products to US government customers, while providing non-exclusive rights for other commercial customers.

The five-year deal aims to utilise Philips’ extensive existing partnerships with key government entities such as the Veterans Affairs (VA) and the Department of Defense (DoD).

The deal expands the 4DMedical and Imbio product portfolios within Philips’ catalogue, allowing Philips to offer these advanced imaging technologies to its US clientele.

To maintain exclusive rights for government customers, Philips must meet specific sales targets throughout the agreement’s duration.

4DX says the partnership presents considerable opportunities, particularly within the VA, as both companies aim to support lung screening initiatives mandated by the PACT Act, which provides healthcare eligibility to millions of veterans affected by deployment-related respiratory issues.

Given that veterans experience chronic lung diseases at significantly higher rates than the general population, 4DMedical’s technology is well positioned to provide essential insights for physicians treating these patients.

Read more on the stock here: 4DMedical could take off with big US opportunities and deal with Philips

At Stockhead we tell it like it is. While EZZ Life Science and Althea Group are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.