Rebel investors eye Genetic Technologies for blockchain conversion

Bankrupt businessman Joe Gutnick, a member of the European Parliament, and two directors of a blockchain darling are trying to take over a breast cancer testing company.

The group of seven investors is after troubled Genetic Technologies’ (ASX:GTG) ASX and Nasdaq listings in order to launch it as a blockchain-based medical data management.

Stockhead asked Europe parliamentarian Antanas Guoga, who also goes by the name Tony G, why they chose Genetic Technologies when there are a number of listed shells in Australia looking for a blockchain acquisition.

He listed the Nasdaq securities and the company’s research capabilities as key assets that are suitable for “being converted to blockchain assets”.

An additional reason is convenience: Blockchain Global founder Samuel Lee is one of the coup leaders, and Genetic Technologies director Paul Kasian sits on his board.

We can do it better

In December, six of the group told the Board they wanted it gone.

They want to replace chairman Dr Malcolm Brandon, Grahame Leonard and CEO Eutillio Buccilli with DigitalX (ASX:DCC) directors Samuel Lee and Peter Rubenstein, and Jerzy Muchnicki.

They said the business was performing badly, the Nasdaq listing was a problem (Genetic Technologies only re-complied with minimum listing rules this month) and management lacked vision and cost too much.

Or as Mr Guoga says, “this company is well suited [to becoming a medical data business] because whatever they have been pursuing hasn’t been working”.

Genetic Technologies responded by saying it had cut costs significantly and was in “active discussions” to sell the company — but likely not at a price the coup leaders want to pay.

The board did not wish to comment for this article but said in a statement in December that the six investors plus Mr Lee started buying up stock in October and owned 5.5 per cent of the company.

That stake would have cost collectively about $1 million. The company’s market cap is $38 million.

Mr Guoga says he started buying in December and now owns about 30 million shares.

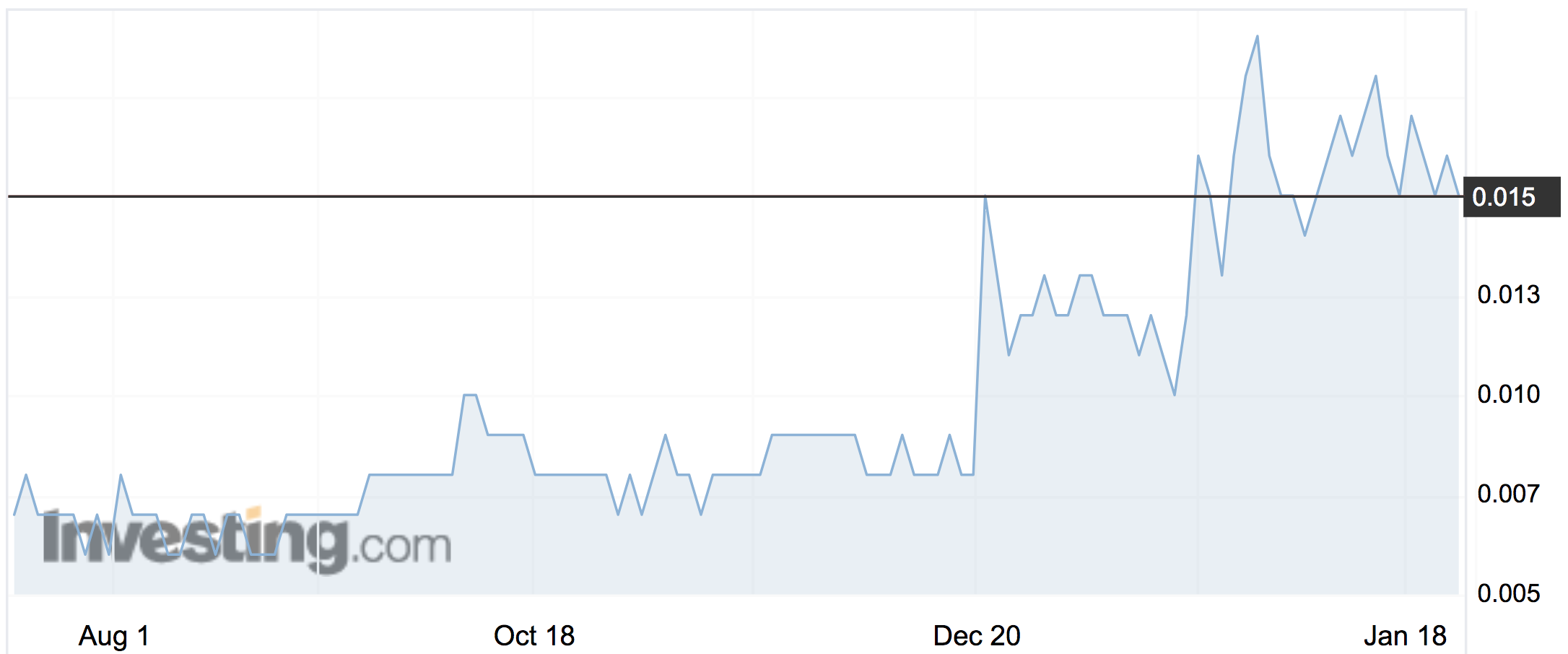

Genetic Technologies’ stock has almost doubled since mid December to 1.5c on Friday night.

The names behind the coup

Leading the boardroom putsch are Mr Rubenstein, who owns shares via Irwin Biotech Nominees, and Mr Lee.

They joined the board of blockchain consultant DigitalX in September after Mr Lee’s Blockchain Global bought 40 per cent of the business.

Mr Rubenstein became chair of DigitalX in November.

Neither responded to requests for comment.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

DigitalX CEO Leigh Travers told Stockhead that “as of this moment” they don’t have anything to do with Genetic Technologies.

Mr Lee tried to list Blockchain Global in 2015 and 2016 before being told to give up by the securities regulator — after eight prospectuses — in November 2016.

They are being supported by Mr Guoga — a Melbournite and current member of the European Parliament for Lithuania, as well as being an advisor to DigitalX clients blockchain bank Bankera and CoinPoker, and the founder of an eponymous gambling agency TonyBet — and the CEO of TonyBet Ugnius Simelionis.

Former ining magnate Joseph “Diamond Joe” Gutnick — who last year faced a Federal court grilling over his bankrupt estate — is in the mix via his company Security and Equity Resources.

Mr Gutnick, a former chairman of troubled gold miner Blackham Resources, declared himself bankrupt in 2016 owing $275 million after an Indian business deal went south.

Mr Gutnick did not respond to requests for comment.

An entity called SH Rayburn is one of the six and controlled by Howard Rabinowitz. He has done business with Mr Gutnick before, trying and failing to wrest control of Merlin Diamonds (ASX:MED) from the Gutnick family in 2016.

The last entity calling for the overthrow is MJGD Nominees. It has invested alongside Mr Rubenstein’s Irwin Biotech for many years in companies like Benitec Biopharma (ASX:BLT) and Paradigm (ASX:PAR), and which lists George Muchnicki as a director.

Mr Guoga says they have “overwhelming” shareholder support for their plan to turn Genetic Technologies into a data management business.

This will be seen at the meeting on January 31, when shareholders convene to decide whether to support the existing board’s direction or a new — albeit still theoretical — vision.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.