Genetic Technologies edges closer to sale amid shareholder revolt

Pic: Godji10 / iStock / Getty Images Plus via Getty Images

Cancer risk assessor Genetic Technologies is in discussions with several possible suitors following an ongoing strategic review announced in August.

Several interested parties had “expressed significant interest in the company and its assets” and had presented to board members in late November, the biotech told investors on Tuesday.

“Multiple parties” had proceeded to due diligence, the company said.

However, those discussions could be derailed by an ongoing shareholder revolt, the company warned.

Earlier this month, a group of shareholders holding a 5.5 per cent interest lodged a proposal to shaft three of the existing board members, Dr Malcolm Brandon, Mr Grahame Leonard and Mr Eutillio Buccililli.

The move comes after the company shifted away from its lead breast cancer testing product and appointed financial advisors Roth Capital to explore “strategic alternatives” — not ruling out a reverse takeover or sale of the company.

In their first public response to the claims, Genetic Technologies (ASX:GTG) told shareholders any results from a review would be contingent on who was in the top jobs.

“There can be no assurance as to whether or not any transaction arising out of the Roth strategic review will take place, the structure of any such potential transaction, or the ultimate timing,” they said.

“In part this may depend upon the results of the shareholder meeting to be convened to consider the change in the company’s board composition.”

The rebelling shareholders want to see their representatives Mr Samuel Lee, Mr Peter Rubenstein and Mr Jerzy Muchnicki in the directors roles instead.

It has been rocky for GTG since their lead product BREVA Gen Plus hit snags in the market earlier this year.

The company lowered the price for its non-hereditary breast cancer test and made it available direct-to-consumers online but found the time taken to administer the test made it inefficient in a clinical setting.

‘Carefully consider all alternatives’

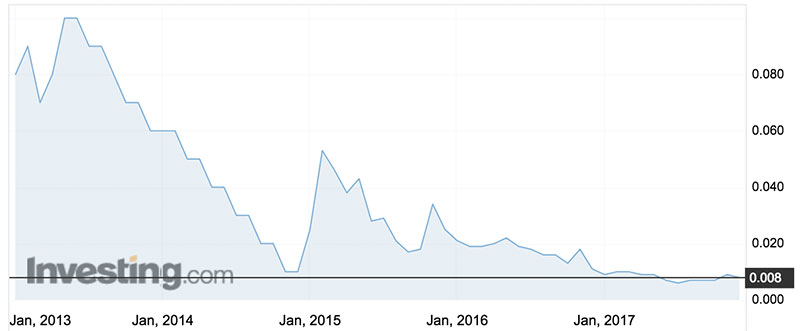

The shares have traded under 1c over the past month, dropping to lows of 0.6c around the time the review was announced.

But the board says it remains committed to its investors.

“The company remains in active discussions with multiple parties regarding a potential transaction(s) as those short-listed interested parties now continue their due diligence. The Board remains committed to the strategic review and will carefully consider all alternatives and make a decision that reflects the best interest of all shareholders,” they said.

Genetic banked $179,000 in sales for the September quarter — but burned about $2.1 million, leaving $8.7 million in the kitty.

The company expected to spend about $1.4 million this quarter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.