October Health Winners: Uscom, Respiri lead sluggish sector, but ‘time in the market, not timing, is key’

“Time in the market, not timing, is key. Picture via Getty Images

- ASX healthcare stocks underperform but optimism grows

- Uscom, Respiri and Hitiq report mixed results

- Artrya and Nyrada make key clinical advances

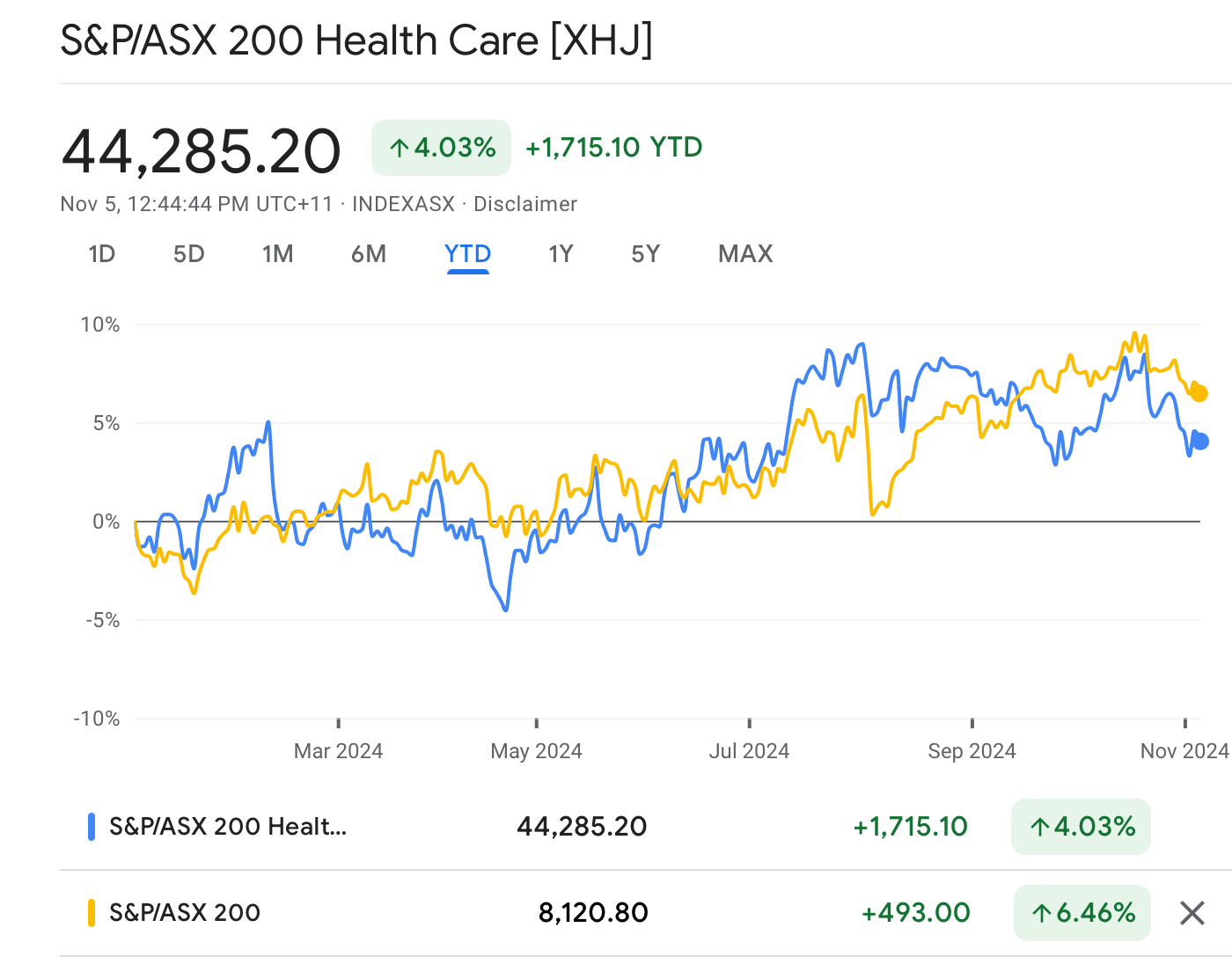

The S&P/ASX 200 Health Care [XHJ] index made a 0.9% gain in October.

For the year, the Index trails the broad ASX 200 Index by a full two percentage points.

Despite some investor anxiety, there is cautious optimism for the remainder of 2024, especially following the recent US Federal Reserve interest rate cut of 0.50% – which may reinvigorate interest in healthcare stocks that have been underperforming amid macroeconomic uncertainties.

In 2024, healthcare companies have raised $1.2 billion in capital, already surpassing the total raised for all of 2023, indicating a robust investment environment despite patchy share price performance.

One standout stock, Clarity Pharmaceuticals (ASX:CU6), has seen significant success, with shares up approximately 230% year-to-date.

Looking ahead, experts believe the Fed’s interest rate cut may lead to increased investments in biotech companies, suggesting potential upside for the sector heading into 2025.

But regardless of what experts say, investors need to stay focused on their long-term goals and avoid reacting to every headline. Constantly shifting your portfolio based on short-term news can lead to unnecessary losses.

Instead, stick to the basics: define your investment goal, consider your time horizon, keep costs low, and avoid overtrading in volatile markets.

A well-diversified portfolio, with a mix of growth and defensive assets, remains the best strategy for weathering market ups and downs and achieving stable returns over time.

“Time in the market, not timing the market, is key. Reviewing your portfolio and deciding not to make changes is still a decision,” said Saxo Markets’ Jessica Amir.

How ASX biotechs performed in October

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | MARKET CAP |

|---|---|---|---|---|

| UCM | Uscom Limited | 0.041 | 193 | $10,019,080 |

| RSH | Respiri Limited | 0.078 | 117 | $104,568,483 |

| HIQ | Hitiq Limited | 0.026 | 117 | $8,444,279 |

| AYA | Artryalimited | 0.53 | 104 | $40,164,536 |

| NYR | Nyrada Inc. | 0.12 | 85 | $22,776,087 |

| RHY | Rhythm Biosciences | 0.1 | 56 | $24,859,675 |

| EOF | Ecofibre Limited | 0.049 | 53 | $18,564,821 |

| ILA | Island Pharma | 0.12 | 50 | $19,482,175 |

| LGP | Little Green Pharma | 0.135 | 50 | $40,887,854 |

| OCC | Orthocell Limited | 0.62 | 46 | $130,787,613 |

| VIT | Vitura Health Ltd | 0.105 | 38 | $60,466,748 |

| SIG | Sigma Health Ltd | 1.96 | 36 | $3,141,342,310 |

| IBX | Imagion Biosys Ltd | 0.054 | 35 | $2,213,628 |

| BP8 | Bph Global Ltd | 0.004 | 33 | $1,586,566 |

| CDX | Cardiex Limited | 0.079 | 32 | $23,828,140 |

| AHX | Apiam Animal Health | 0.53 | 26 | $97,649,156 |

| NOX | Noxopharm Limited | 0.13 | 24 | $37,990,934 |

| IXC | Invex Ther | 0.09 | 20 | $6,763,846 |

| EBR | EBR Systems | 1.04 | 20 | $383,885,365 |

| ALA | Arovella Therapeutic | 0.18 | 16 | $200,686,213 |

| CTE | Cryosite Limited | 0.92 | 15 | $44,904,798 |

| MSB | Mesoblast Limited | 1.32 | 13 | $1,535,699,633 |

| IMR | Imricor Med Sys | 0.625 | 12 | $186,421,279 |

| BIT | Biotron Limited | 0.021 | 11 | $18,948,494 |

| AGH | Althea Group | 0.043 | 10 | $16,213,298 |

| AGN | Argenica | 0.785 | 10 | $94,788,705 |

| PME | Pro Medicus Limited | 194.83 | 9 | $20,640,619,370 |

| ARX | Aroa Biosurgery | 0.615 | 9 | $206,940,154 |

| PYC | PYC Therapeutics | 0.185 | 9 | $816,564,597 |

| IDT | IDT Australia Ltd | 0.125 | 9 | $54,804,838 |

| ADR | Adherium Ltd | 0.013 | 8 | $10,620,119 |

| OPT | Opthea Limited | 0.835 | 8 | $1,034,119,478 |

| PAR | Paradigm Bio. | 0.21 | 8 | $69,989,344 |

| CYP | Cynata Therapeutics | 0.23 | 7 | $42,458,924 |

| DXB | Dimerix Ltd | 0.4 | 7 | $225,719,577 |

| PIQ | Proteomics Int Lab | 0.725 | 7 | $93,011,930 |

| SDI | SDI Limited | 0.985 | 6 | $117,676,875 |

| 1AD | Adalta Limited | 0.018 | 6 | $10,911,700 |

| PSQ | Pacific Smiles Grp | 1.91 | 6 | $305,599,411 |

| MVP | Medical Developments | 0.465 | 6 | $52,386,121 |

| AVH | Avita Medical | 3.19 | 6 | $217,130,883 |

| RMD | ResMed Inc. | 36.92 | 6 | $22,886,970,682 |

| SNZ | Summerset Grp Hldgs | 11.25 | 6 | $2,664,286,020 |

| IDX | Integral Diagnostics | 3.13 | 5 | $725,282,191 |

| NC6 | Nanollose Limited | 0.02 | 5 | $2,924,108 |

| CMB | Cambium Bio Limited | 0.41 | 5 | $4,951,367 |

| REG | Regis Healthcare Ltd | 6.49 | 5 | $1,961,133,269 |

| AT1 | Atomo Diagnostics | 0.022 | 5 | $14,062,451 |

| HMD | Heramed Limited | 0.022 | 5 | $18,113,933 |

| GLH | Global Health Ltd | 0.145 | 4 | $8,417,183 |

| PCK | Painchek Ltd | 0.031 | 3 | $50,755,096 |

| CAJ | Capitol Health | 0.375 | 3 | $405,149,401 |

| NUZ | Neurizon Therapeutic | 0.2 | 3 | $97,326,911 |

| FPH | Fisher & Paykel H. | 32.81 | 2 | $19,160,423,210 |

| CMP | Compumedics Limited | 0.305 | 2 | $53,293,326 |

| CUV | Clinuvel Pharmaceut. | 14.2 | 1 | $720,873,792 |

| VBS | Vectus Biosystems | 0.081 | 1 | $4,260,265 |

| TLX | Telix Pharmaceutical | 20.93 | 1 | $7,061,818,833 |

| GSS | Genetic Signatures | 0.67 | 1 | $140,660,740 |

| COH | Cochlear Limited | 283.22 | 0 | $18,598,633,743 |

| EBO | Ebos Group Ltd | 33.2 | 0 | $6,560,553,061 |

| CSL | CSL Limited | 286.95 | 0 | $139,190,018,313 |

| AMT | Allegra Medical | 0.029 | 0 | $3,468,720 |

| ONE | Oneview Healthcare | 0.33 | 0 | $223,333,830 |

| HGV | Hygrovest Limited | 0.054 | 0 | $11,356,773 |

| AVE | Avecho Biotech Ltd | 0.002 | 0 | $6,338,594 |

| AHC | Austco Healthcare | 0.255 | 0 | $91,015,216 |

| TD1 | Tali Digital Limited | 0.001 | 0 | $4,942,733 |

| PTX | Prescient Ltd | 0.041 | 0 | $36,239,391 |

| ME1 | Melodiol Glb Health | 0.001 | 0 | $1,125,828 |

| MDC | Medlab Clinical Ltd | 6.6 | 0 | $15,071,113 |

| ACW | Actinogen Medical | 0.024 | 0 | $73,625,036 |

| VFX | Visionflex Group Ltd | 0.005 | 0 | $14,589,123 |

| ATH | Alterity Therap Ltd | 0.003 | 0 | $21,281,344 |

| GTG | Genetic Technologies | 0.039 | 0 | $5,671,273 |

| OSX | Osteopore Limited | 0.041 | 0 | $4,737,597 |

| EPN | Epsilon Healthcare | 0.024 | 0 | $7,208,496 |

| DVL | Dorsavi Ltd | 0.01 | 0 | $8,037,311 |

| NSB | Neuroscientific | 0.035 | 0 | $5,494,985 |

| 1AI | Algorae Pharma | 0.007 | 0 | $10,124,368 |

| SHG | Singular Health | 0.09 | 0 | $18,401,578 |

| CTQ | Careteq Limited | 0.012 | 0 | $3,319,662 |

| AHI | Advanced Health | 0.092 | 0 | $25,355,783 |

| ACL | Au Clinical Labs | 3.63 | -1 | $725,956,333 |

| SHL | Sonic Healthcare | 26.93 | -1 | $13,066,988,066 |

| FRE | Firebrickpharma | 0.057 | -2 | $11,976,185 |

| IPD | Impedimed Limited | 0.055 | -2 | $109,247,072 |

| TRJ | Trajan Group Holding | 1.26 | -2 | $191,847,967 |

| ANN | Ansell Limited | 31.02 | -2 | $4,432,318,794 |

| COV | Cleo Diagnostics | 0.37 | -3 | $30,192,000 |

| LDX | Lumos Diagnostics | 0.036 | -3 | $25,355,841 |

| CSX | Cleanspace Holdings | 0.485 | -3 | $37,676,906 |

| EMD | Emyria Limited | 0.031 | -3 | $12,461,682 |

| EMV | Emvision Medical | 1.96 | -3 | $171,033,070 |

| RHC | Ramsay Health Care | 40.17 | -3 | $9,389,615,512 |

| DOC | Doctor Care Anywhere | 0.069 | -3 | $26,031,599 |

| VLS | Vita Life Sciences.. | 2.15 | -4 | $118,438,442 |

| FCG | Freedomcaregrouphold | 0.13 | -4 | $3,104,908 |

| VTI | Vision Tech Inc | 0.12 | -4 | $6,604,376 |

| MAP | Microbalifesciences | 0.1775 | -4 | $80,613,356 |

| HLS | Healius | 1.655 | -4 | $1,198,119,191 |

| MVF | Monash IVF Group Ltd | 1.175 | -4 | $469,509,982 |

| CGS | Cogstate Ltd | 0.98 | -4 | $172,644,894 |

| SNT | Syntara Limited | 0.041 | -5 | $56,298,810 |

| AFP | Aft Pharmaceuticals | 2.88 | -5 | $302,014,829 |

| TRU | Truscreen | 0.019 | -5 | $9,946,640 |

| NTI | Neurotech Intl | 0.057 | -5 | $53,800,340 |

| ACR | Acrux Limited | 0.053 | -5 | $15,407,993 |

| PGC | Paragon Care Limited | 0.42 | -6 | $736,610,898 |

| MX1 | Micro-X Limited | 0.063 | -6 | $39,549,056 |

| SPL | Starpharma Holdings | 0.094 | -6 | $37,211,526 |

| LBT | LBT Innovations | 0.015 | -6 | $26,360,071 |

| IME | Imexhs Limited | 0.45 | -6 | $20,529,030 |

| MYX | Mayne Pharma Ltd | 4.3 | -6 | $365,819,438 |

| ZLD | Zelira Therapeutics | 0.7 | -7 | $7,659,330 |

| ZLD | Zelira Therapeutics | 0.7 | -7 | $7,659,330 |

| PEB | Pacific Edge | 0.13 | -7 | $105,549,077 |

| CYC | Cyclopharm Limited | 1.405 | -8 | $167,260,959 |

| OCA | Oceania Healthc Ltd | 0.64 | -8 | $459,886,704 |

| IIQ | Inoviq Ltd | 0.46 | -8 | $51,859,916 |

| EYE | Nova EYE Medical Ltd | 0.17 | -8 | $40,085,634 |

| CBL | Control Bionics | 0.062 | -9 | $15,101,060 |

| TRI | Trivarx Ltd | 0.017 | -11 | $7,312,619 |

| IRX | Inhalerx Limited | 0.0295 | -11 | $6,335,450 |

| MEM | Memphasys Ltd | 0.008 | -11 | $10,116,737 |

| RGT | Argent Biopharma Ltd | 0.31 | -11 | $16,824,403 |

| ENL | Enlitic Inc. | 0.062 | -11 | $34,005,110 |

| AVR | Anteris Technologies | 10.75 | -12 | $229,578,402 |

| BDX | Bcaldiagnostics | 0.11 | -12 | $43,039,713 |

| RCE | Recce Pharmaceutical | 0.47 | -12 | $110,139,018 |

| IMU | Imugene Limited | 0.043 | -12 | $349,600,600 |

| IMM | Immutep Ltd | 0.285 | -12 | $414,551,836 |

| BOT | Botanix Pharma Ltd | 0.355 | -12 | $636,111,151 |

| ALC | Alcidion Group Ltd | 0.054 | -13 | $69,833,540 |

| NAN | Nanosonics Limited | 3.2 | -13 | $976,844,648 |

| RAD | Radiopharm | 0.024 | -14 | $52,151,058 |

| ATX | Amplia Therapeutics | 0.135 | -16 | $37,097,772 |

| ECS | ECS Botanics Holding | 0.016 | -16 | $20,616,793 |

| OIL | Optiscan Imaging | 0.165 | -18 | $137,831,232 |

| TRP | Tissue Repair | 0.29 | -18 | $17,837,129 |

| NEU | Neuren Pharmaceut. | 12.35 | -18 | $1,569,576,501 |

| CU6 | Clarity Pharma | 6.83 | -18 | $2,193,448,535 |

| RHT | Resonance Health | 0.048 | -19 | $23,238,432 |

| M7T | Mach7 Tech Limited | 0.455 | -19 | $121,826,729 |

| RAC | Race Oncology Ltd | 1.44 | -19 | $255,709,085 |

| UBI | Universal Biosensors | 0.12 | -20 | $37,258,429 |

| ICR | Intelicare Holdings | 0.012 | -20 | $5,348,070 |

| ANR | Anatara Ls Ltd | 0.056 | -20 | $10,802,049 |

| PNV | Polynovo Limited | 2.06 | -21 | $1,422,956,962 |

| 4DX | 4Dmedical Limited | 0.53 | -21 | $209,370,893 |

| EZZ | EZZ Life Science | 3.5 | -23 | $155,481,200 |

| PER | Percheron | 0.081 | -23 | $83,978,914 |

| HXL | Hexima | 0.013 | -24 | $2,171,515 |

| NXS | Next Science Limited | 0.145 | -24 | $40,902,433 |

| LTP | Ltr Pharma Limited | 1.26 | -24 | $108,106,039 |

| SOM | SomnoMed Limited | 0.32 | -26 | $73,476,806 |

| IMC | Immuron Limited | 0.077 | -27 | $17,644,198 |

| BMT | Beamtree Holdings | 0.23 | -27 | $69,538,960 |

| IVX | Invion Ltd | 0.002 | -33 | $20,449,775 |

| PAB | Patrys Limited | 0.004 | -33 | $8,229,789 |

| CHM | Chimeric Therapeutic | 0.009 | -36 | $8,776,267 |

| CVB | Curvebeam Ai Limited | 0.094 | -39 | $28,810,419 |

| OSL | Oncosil Medical | 0.008 | -43 | $34,056,721 |

| MDR | Medadvisor Limited | 0.235 | -45 | $192,957,673 |

| CAN | Cann Group Ltd | 0.04 | -55 | $19,215,326 |

For the quarter, Uscom reported cash on hand of $1.39 million, marking a 14% increase from the pcp.

In terms of revenue, receipts from customers decreased by 6% to $0.59 million, and a 61% drop from $1.54 million in the previous quarter.

Uscom, however, managed to reduce its overall expenditure; staff costs fell by 37% to $0.54 million from $0.85 million in the pp, while advertising and marketing expenses slightly decreased to $0.29 million.

Executive Chairman Professor Rob Phillips noted that the dip in customer receipts was expected due to the company’s strategic focus on expanding distribution and increasing sales in the second half of the year.

He also said the first quarter is historically the quietest, with many markets, including Europe and China, on holiday, while the second quarter is anticipated to be one of the busiest, driven by pent-up demand.

Uscom continues to lead in the development and marketing of innovative medical devices, including the USCOM 1A, Uscom BP+, and Uscom SpiroSonic technologies, all aimed at addressing cardiovascular and pulmonary diseases.

During the quarter, Respiri reported a record enrolment of 2,435 patients in its programs, representing a 71% increase from the previous quarter.

Revenue also surged, reaching $409,000, a 93% increase compared to the June quarter, with cash receipts of $242,000.

The company demonstrated substantial clinical impact, achieving a 56% reduction in re-hospitalisations and a 47% decrease in emergency room visits through its remote care programs.

Respiri added three new clients in the quarter, bringing the total to 29, which is expected to generate more than $2.6 million in annual recurring revenues once patient onboarding is complete.

With approximately 8,000 identified patients awaiting enrolment, the company said it is well-positioned for continued growth.

Respiri closed the quarter with $1.2 million in cash and reported operating cash outflows of $2.42 million, a rise attributed to increased staffing to support its expanding remote monitoring services.

Following the quarter, the company raised an additional $1.6 million from strategic placements, further bolstering its financial position as it aims for profitability.

HITIQ has had a transformative quarter marked by several significant developments.

The company secured additional funding of $400k through an extension of its R&D Tax Incentive Loan Facility, along with a convertible loan, reinforcing its financial position.

There was a pivotal change in leadership, with the appointment of Earl Eddings as executive chairman, bringing new direction to the company following the transition of co-founder and former CEO, Mike Vegar.

The leadership shift is expected to foster growth and strategic focus moving forward, complemented by the hiring of a new CFO, Andrew Hart.

HITIQ made big progress in its intellectual property portfolio, receiving approval for its second US patent related to its Nexus technology.

This patent, which covers the design feature for instrumented mouthguards, promises to improve fitting for a variety of mouthguard shapes and sizes.

The company relocated to a new facility in South Melbourne during the quarter, increasing its manufacturing capability from approximately 5,000 units annually to an anticipated 25,000 to 30,000 units. This move is expected to generate substantial annual cost savings.

Financially, HITIQ reported cash reserves of $156,000 as of September 30, alongside the extension of its loan facility, which now totals over $1.39 million repayable upon receipt of expected R&D tax incentives.

The extension of the convertible note facility to $4.6 million further positions HITIQ for ongoing development and growth in the burgeoning market for instrumented mouthguard technology.

In Q1 FY25, Artrya achieved several key milestones as it advanced toward full commercialisation.

The company submitted its 510(k) regulatory application to the US FDA for its Salix Coronary Anatomy product, a major step in gaining clearance to enter the US market.

This submission followed a year-long process of rigorous development and feedback from the FDA, including two Q-Submission meetings that validated Artrya’s approach.

In addition to the FDA application, Artrya successfully integrated Salix into the Tanner Health System and is in the final stages of integration with Northeast Georgia Health System.

These integrations are crucial for ensuring smooth data flow between Salix and hospital systems, with the potential to expand to 15 hospitals and numerous clinics across the US after FDA clearance.

Artrya is also focused on its Australian market, where it plans to upgrade Salix to a Class II TGA-approved product, based on positive feedback from clinicians.

The company received its first revenue in during the quarter, processing 546 CCTA scans at The Cardiac Centre NSW, marking an important step in its commercial rollout.

On the financial front, the company reported a net cash outflow of $4.33 million for the quarter, though it ended the period with $6.5 million in cash.

Looking ahead, Artrya is preparing for additional FDA applications in the new year, while continuing to expand its operations both in the US and Australia.

The company said it was committed to maintaining cost discipline as it moves closer to full commercialisation in 2025.

In Q1 FY25, Nyrada made significant progress with its lead drug candidate, NYR-BI03.

The company completed successful Good Laboratory Practice (GLP) safety studies, confirming the drug’s favourable safety profile and paving the way for a Phase I clinical trial, scheduled to begin later this year.

Preclinical studies also showed that NYR-BI03 provided an impressive 86% cardioprotective effect following myocardial ischemia-reperfusion injury, positioning it as a potential breakthrough treatment for heart and brain damage caused by blood-flow restoration.

Nyrada also launched a collaborative study with the Walter Reed Army Institute of Research to assess NYR-BI03’s neuroprotective effects in traumatic brain injury.

Financially, Nyrada ended the quarter with $2.98 million in cash, with an $1.38 million R&D tax rebate expected by mid-2025.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.