Kava player The Calmer Co eyes growth after $2.9m funding

The Calmer Co is well funded for growth after a capital raise. Pic: Getty Images .

- The Calmer Co raises ~$2.9 million to fund growth

- East Coast Research rerates the company, following strong ecommerce sales

- ecommerce sales increased to $555k in June up from $496 in May

Special Report: The Calmer Co International says it’s well funded for growth after closing an oversubscribed renounceable rights issue, which has raised $2 million, and undertaking a follow-on placement of $880k.

The capital raise comes as East Coast Research rerates The Calmer Co (ASX: CCO) based on what it terms “impressive recent monthly sales growth results, across several months”.

CCO is dedicated to enhancing health and wellness through natural ingredients that foster calmness, aid relaxation, and promote better sleep including kava drinks.

East Coast has rerated CCO to a fair value of $0.017, representing a 112% upside from the price of ~$0.008 and up from its earlier initiating coverage midpoint of $0.015.

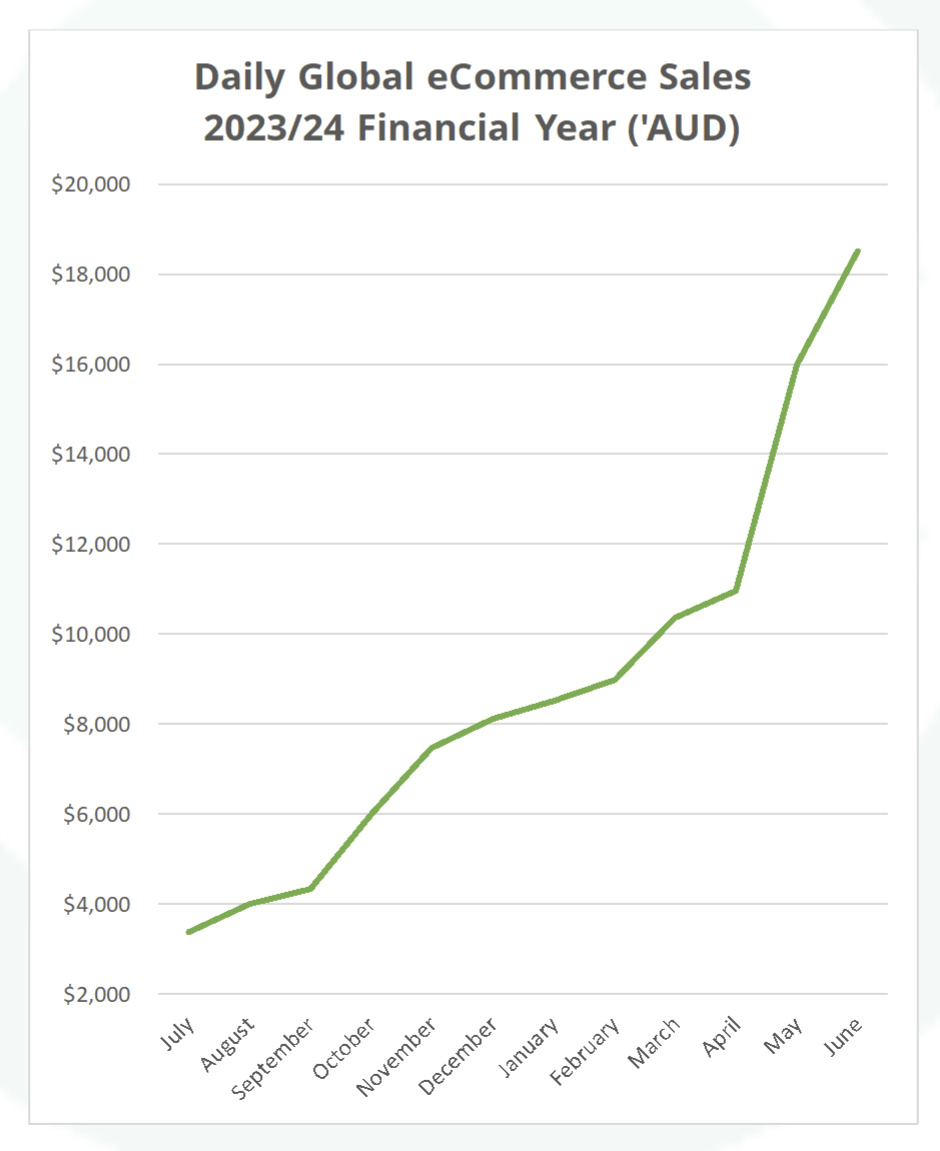

CCO has reported ecommerce sales increased to $555k in June up from $496 in May and are now surpassing $18,500 per day.

Sales via ecommerce grew at an average of 17% month on month over the full year FY24 with an aggregate annual growth of more than 540% across the year.

Source: CCO

“These increases in sales have been sequential over the last 12 months, hence, they are not isolated and are made sustainable because of CCO’s clever integrated strategies across sales and marketing, distribution, partnerships, and product development,” East Coast says in its latest report commissioned by the company.

East Coast says that currently, more than 60% of e-commerce sales are made via CCO’s Australian Shopify platform.

“However, given CCO’s social media-based marketing campaigns, tie-up with Walmart, and growing interest in kava, going forward, it’s expected that US Shopify sales will be the main source of sales growth,” East Coast says.

“The sources for growth extend to other areas, such as retail, and arise also due to product development innovations.

“For example, CCO’s strategy of attracting new customers via its Taki Mai 50ml kava shot offered only at Coles outlets is a strategically astute move.”

Taki Mai 50ml kava shots started selling in Coles in March 2024, marking CCO’s entry into the ready-to-drink category.

‘Mindful drinking’: market size grows for kava

East Coast says the market size for kava continues to grow as more data emerges supporting its growing use as a healthier alternative to alcohol.

CCO says Millennials and Gen Z are driving mindful drinking and what has become known as the ‘NoLo’ movement (no and low alcohol), increasing demand for alternatives to alcoholic beverages, according to various studies.

The company says emergence of new sobriety-themed months like FebFast, Dry July, and Sober October along with the ‘NoLo’ movement is transforming the beverage industry.

East Coast says as a result CCO’s addressable market is significant and growing and the company is taking advantage of the opportunity including the capital raise to substantially increase its Fiji processing facility.

“CCO is tapping into the right channels and making the right R&D, capex, and working capital investments to ensure that its growth momentum continues,” East Coast says.

Capital raise to fund processing facility upgrade

Directors have agreed to subscribe for $255,150 in the follow-on placement, subject to shareholder approval at a general meeting.

Following completion of the follow-on placement, the total amount raised will be $2.9m.

Between the renounceable rights issue and follow-on placement CCO will issue a total of 724,999,970 new fully paid ordinary shares and 362,499,985 new options exercisable at $0.006, with an expiry date of June 30, 2026 and quoted under the ASX code CCOOA.

Mahe Capital Pty Ltd has acted as the lead manager for the capital raise with the new securities expected to be issued on July 2, 2024, in accordance with the rights issue timetable.

CCO managing director Anthony Noble says the funding will be used to upgrade its central processing facility in Navua in Fiji to around three times its current size as it works to increase production capacity and also reach break-even.

“This fundraising will importantly allow us to upgrade our facility in Navua to increase production capacity to over 20MT of green kava processing per week which will contribute to both scaling and margin improvement,” he says.

“The company continues to be committed to rigorous cost control and remaining focused on the highest margin, most scalable channels as we drive towards our breakeven target and then further.”

Investment in product development

Complementing its successful sales, marketing and distribution strategy, East Coast says CCO continues to invest in product development initiatives that will lead to more customers experiencing its products and their benefits for the first time and then becoming regular customers.

“As one example, CCO is currently expending resources into R&D with the aim of launching flavoured kava shots in the USA in late 2024, which will help increase CCO’s appeal to a higher number of potential customers,” East Coast says.

Noble says CCO has new products nearing launch in coming months, which will support further revenue growth and increase the lifetime value of its more than 30,000 customers.

“These will include fruit flavours add ons in Australia, flavoured kava shots in the USA and our Fiji Rugby cobranded Coconut Kava product lines,” he says.

This article was developed in collaboration with The Calmer Co International, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.