Here are the Top 10 crucial trials coming up for ASX biotechs in 2022

Top 10 crucial clinical trials for ASX biotechs in 2022. Picture Getty Image

- What are the risks of investing in biotechs?

- How to value a biotech

- Top 10 crucial trials coming up for ASX biotechs in 2022

Risks of investing in biotechs

Historical data shows that biotech is one the best sectors to put your money in over the long term.

Since 2007, the S&P Biotech Index is up by 500%, beating the benchmark S&P 500 return of 150%.

And over the years, the sector has been one that routinely delivers single day 50 per cent or 100 per cent gains.

But while investing in biotech stocks can lead to these quick gains, it also comes with great risks as it could easily go the other direction.

Take ASX-listed Hexima (ASX:HXL), a biotech that was developing a drug from plant defensins to treat fungal nail infections.

The company pretty much lost its entire value in one day (June 24), after announcing that its Phase 2 preliminary results were inconclusive.

The final nail in the coffin then came on July 11, when Hexima announced that results observed in Phase 2 were nothing like its prior Phase 1 study, driving its share price down close to zero.

Hexima share price chart:

But for every Hexima out there, there’s also a Neuren Pharma (ASX:NEU).

Neuren is one of the biggest biotech stories on the ASX in the past 12 months.

On December 8, the neurological diseases specialist announced that it was close to launching the world’s first drug for Rett syndrome to the market.

The company’s partner Acadia Pharma had just reported positive top-line results from the Phase 3 Lavender study of trofinetide, Neuren’s lead asset.

The news sent Neuren’s share price up by over 90% that day, demonstrating exactly the kind of binary event that could happen with biotech stocks, especially around results announcement dates.

Neuren share price chart:

The main reason for these share price spikes is that most large clinical studies are typically blinded, meaning that results will not be known until the end of the study.

This means there could be a bunch of important information revealed all at once in a single announcement.

In general, the further along a drug is in its clinical trial journey, the bigger the potential for a spike in the underlying share price. Neuren’s 90% bump for example, happened at the end of its Phase 3 trial.

Neuren’s CEO, Jon Pilcher, told Stockhead that in order to squeeze more value, most biotechs would normally take their studies through to Phase 2 completion, before roping in a bigger pharmaceutical partner for Phase 3 like Neuren did with Acadia.

“Acadia executed the Phase 3 trial, and they took the funding for that trial completely away from us,” Pilcher said.

“Obviously if you have the ability and funding to complete Phase 3 yourself, then there would be a bigger uplift in value for the company,” he added.

Valuing a biotech stock

Like any other stocks, biotechs are valued based on the expectations of future revenues.

The problem with valuing a clinical stage biotech stock or any startup company for that matter, is that there is no historical data to make predictions from.

So instead of financial information, most biotech investors rely mostly on the science and clinical trials announcements.

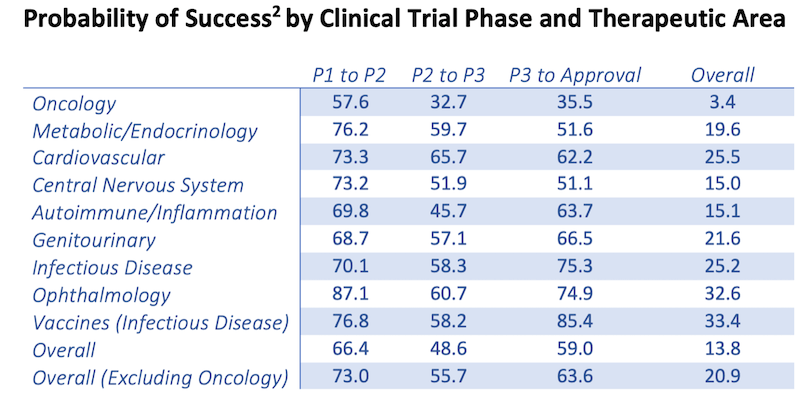

Another way biotechs are being valued is by placing a probability of success (or failure) on the drug.

Drugs that are already in Phase 3 have more probability of succes than those in Phase 1 and Phase 2 for obvious reasons.

According to the American Council of Science and Health, the overall probability that a drug could successfully go from Phase 1 all the way to the market is a very low 13.8 per cent.

For oncology drugs, the odds are even smaller with only 3.4% of those drugs making it past Phase 3.

For most biotechs, clinical trial readouts are what really move the share price needle.

They determine how successful a drug will be as a product. If the primary endpoints of a trial have been met, that’s a good sign that it could progress further to the next phase.

If the drug works better than what’s out there (standard of care), it will likely to be approved by the FDA, prescribed by physicians, and ultimately reimbursed by insurance companies.

And finally, if the drug is designed to meet high unmet needs, it’s a strong indication that it could do well in the market.

Top 10 crucial trials coming up for ASX biotechs in 2022

| Code | Name | Phase | Indication | Timeline |

|---|---|---|---|---|

| IXC | Invex Therapeutics | Phase 3 trial in presendin | Idiopathic intracranial hypertension or IIH | First readout expected 1H23 |

| DXB | Dimerix | Phase 3 trial in DMX-200 | Focal segmental glomerulosclerosis (FSGS) | First interim analysis expected 1H23 |

| OPT | Opthea | Two Phase 3 trials in OPT-302 | Wet age-related macular degeneration | Patient recruitment is expected in mid 2023 |

| AVH | Avita Medical | Two Phase 3 trials for RECELL device. | Stable vitiligo and soft tissue reconstruction | Top-line results and FDA submission expected in 2H22 |

| MVP | Medical Developments | Two Phase 3 trials for penthrox | Trauma and associated pain | End of 2024 |

| NEU | Neuren | Four Phase 2 trials of NNZ-2591 | Angelman Syndrome, Phelan-McDermid Syndrome , Pitt-Hopkins Syndrome,and Prader-Willi Syndrome. | Around 1H23 and 2H23 |

| PXS | Pharmaxis | Phase 2a PXS-5505 trial | Rare bone cancer myelofibrosis | End of CY 2022 |

| BNO | Bionomics | Two Phase 2 BNC210 trials | Social Anxiety Disorder (SAD) and Post Traumatic Stress Disorder (PTSD) | End of year 2022 for SAD, and 1H23 for PTSD |

| PAA | PharmAust | Two Phase 2 monepantel trials | Lymphoma cancer in canines, and leukaemia and other cancers in humans | Phase 2 trial expected to begin Q4CY22. |

| BIT | Biotron | Two Phase 2 BIT225 trials | HIV-1 | Preliminary results late 2022. |

Current Phase 3 trials

Invex Therapeutics (ASX:IVX)

Phase 3 trial in presendin

Indication: Idiopathic intracranial hypertension or IIH

Timeline: First readout expected 1H23

Invex has received a Human Research Ethics Committee (HREC) approval and Clinical Trial Notification (CTN) scheme clearance by the TGA to commence the IIH EVOLVE Phase 3 clinical trial of presendin in Australia.

The IIH EVOLVE Phase III study is a placebo-controlled, double-blind trial that will randomise 240 patients with newly diagnosed IIH to determine the efficacy and safety of Presendin versus placebo.

Patients suffering from IIH or Idiopathic Intracranial Hypertension often suffer from severely raised intracranial pressure, which causes disabling daily headaches and can compress the optic nerve.

The usual age of onset is 20-30 years of age, and it is most common in women who are obese.

Results are expected at the end of the 24 weeks period after enrolment is completed, around the first half of 2023.

Dimerix (ASX:DXB)

Phase 3 trial in DMX-200

Indication: Focal segmental glomerulosclerosis (FSGS) – a rare kidney disease

Timeline: First interim analysis expected 1H23, with possibility for accelerated marketing approval.

In May Dimerix completed a significant milestone in its ACTION3 Phase 3 pivotal clinical trial of DMX-200 following the recruitment of the first patient.

The trials will be performed across 75 sites in 12 different countries globally, with ethics and regulatory submissions already made in all 12 countries, including an open IND (investigational new drug) in the US.

The potential commercial opportunity for Dimerix in this space is quite material, given over US$55 billion is estimated to have been spent on end stage renal failure in the US healthcare system alone in 2021.

Dimerix has received Orphan Drug Designation for DMX-200 in both the US and Europe, as well as the equivalent Innovative Licensing and Access Pathway (ILAP) designation in the UK, for the treatment of FSGS.

Opthea (ASX:OPT)

Two Phase 3 trials in OPT-302

Indication: Wet age-related macular degeneration (Wet AMD)

Timeline: Completion of patient recruitment is expected in mid 2023, with top-line data to be reported after all patients complete a 52-week treatment period.

Eye disease specialist Opthea is currently conducting two concurrent Phase 3 clinical trials with OPT-302, which are actively recruiting patients for the treatment of wet AMD.

Patient recruitment began the first half of 2021, and over 200 clinical trial sites are expected to participate with around 990 patients per trial.

The Phase 3 trials, referred to as ShORe and COAST, are double-masked trials which will assess the efficacy and safety of 2.0mg OPT-302 in combination with anti-VEGF-A therapy, compared to standard of care anti-VEGF-A alone.

The primary endpoint of both trials will be the mean change in visual acuity from baseline at week 52. Patients will continue to be dosed until week 96 to further assess long-term safety at week 100.

AVITA (ASX:AVH)

Two Phase 3 trials for RECELL device.

Indications: Stable vitiligo and soft tissue reconstruction

Timeline: Top-line results and FDA submission expected in 2H22, with commercial launch expected in 2H23.

The spray-on skin developer was once synonymous with burns surgeon and Australian of the Year Fiona Woods.

Now, the $165m market cap company sells approved burns products in the US and is eyeing FDA assent for the bigger markets of vitiligo and soft tissue injuries.

In March, Avita was awarded a purchasing contract from Premier Inc to supply the RECELL system to hospitals across the US.

The RECELL system is a device that enables healthcare professionals to produce a suspension of Spray-On Skin Cells using a small sample of the patient’s own skin for the treatment of acute thermal burns.

This new agreement enables Avita access to Premier’s alliance of approximately 4,400 US hospitals and 225,000 healthcare providers.

MEDICAL DEVELOPMENTS (ASX:MVP)

Two Phase 3 trials for penthrox.

Indications: Trauma and associated pain

Timeline: End of 2024

A pioneer in first-line pain relief, Medical Developments has had great success in revitalising an old drug, the analgaesic penthrox, which it sells in multiple countries.

The drug is best known as the Green Whistle, an analgaesic used by paramedics and ambulances to administer emergency pain relief – you’ve probably seen athletes clutching one while being stretchered off the field.

A notable gap in the company’s global coverage is the US, but the FDA has just lifted a clinical ‘hold’ order on a planned Phase III trial for first-line relief.

The latest FDA move means that MVP can immediately begin preparing for its Phase III US clinical trial, a critical step towards bringing penthrox closer to licensure in the US market.

The two-year trial will be conducted on a targeted trauma and associated pain patient group, with recruitment expected to commence in late 2022.

Current Phase 2 trials

Neuren (ASX:NEU)

Four Phase 2 trials of NNZ-2591 in serious neurological disorders that emerge in early childhood with no approved medicines.

Indications: Angelman Syndrome, Phelan-McDermid Syndrome, Pitt-Hopkins Syndrome, and Prader-Willi Syndrome.

Timelines: Results are expected around 1H23 and 2H23

These diseases are caused by different genetic mutations, but all affect the patients’ ability to walk, talk, sleep, eat and even breathe.

Even though they’re different, they’re very similar and Neuren believes that NNZ-2591 has the capability to treat all of them.

Neuren CEO, Jon Pilcher, believes these four indications could provide a much bigger opportunity than the Rett Syndrome drug, which has just completed its Phase 3 trial.

“Next year will be a massive year for us,” said Pilcher.

Pharmaxis (ASX:PXS)

Phase 2a PXS-5505 trial

Indications: Rare bone cancer myelofibrosis

Timeline: Meaningful data by end of CY 2022

Pharmaxis’ lead drug candidate PXS-5505 is an orally taken drug that inhibits the lysyl oxidase family of enzymes.

In pre‐clinical models of myelofibrosis, PXS‐5505 reversed the bone marrow fibrosis that drives morbidity in myelofibrosis, and reduced many of the abnormalities associated with this disease.

It has already received IND approval and Orphan Drug Designation from the FDA.

The Phase 2a study is on track for meaningful data by end of CY 2022, with the number of open recruiting sites now increasing to 16 with four US sites due to come on stream.

Bionomics (ASX:BNO)

Two Phase 2 BNC210 trials

Indications: Social Anxiety Disorder (SAD) and Post Traumatic Stress Disorder (PTSD)

Timelines: Top-line data expected by end of year 2022 for SAD, and 1H23 for PTSD

Clinical studies have shown that BNC210 has several properties which may be useful to treat PTSD, SAD and anxiety disorders.

The drug has demonstrated a well-tolerated safety profile which indicates a potential advantage over currently available medications for the treatment including antidepressants and benzodiazepines.

The drug has also received a US FDA Fast Track designation for both clinical indications.

Anxiety disorders are a significant burden for communities and approximately 18 million adults suffer from Social Anxiety Disorder in the US alone.

PTSD meanwhile, affects up to 8% of adults in their lifetime, with no newly approved treatment seen on the market in almost two decades.

PharmAust (ASX:PAA)

Two Phase 2 monepantel trials

Indication: Lymphoma cancer in canines, and leukaemia, glioblastoma, esophageal, gastrointestinal, ovarian & pancreatic cancers in humans

Timeline: Phase 2 trial expected to begin Q4CY22.

In the Phase 2a and Phase 2b canine studies, PharmAust’s lead drug monepantel (MPL) demonstrated effective anti-cancer activity.

PharmAust is currently testing four different doses and will be carried out over a 28-day period at sites in Melbourne, Sydney, Perth, Brisbane, Auckland and Texas, and will require greater than 18 clinical benefits in 46 dogs to meet the targeted endpoint.

In the human trials, a preliminary study demonstrated that PharmAust’s lead drug monepantel can kill the HTLV-1 virus and inhibit its protein production.

What this means is that MPL has the ability to interfere with the complex HTLV-1 lifecycle, killing the virus more effectively than that of a control non-transformed cell line.

PharmAust believes these results warrant further investigation to better understand the mechanism and ability of MPL in slowing down disease progression.

The company has previously said that MPL could be studied for other indications, including glioblastoma, esophageal, gastrointestinal, ovarian and pancreatic cancers.

Biotron (ASX:BIT)

Two Phase 2 BIT225 trials

Indication: HIV-1

Timeline: Expected trial conclusion 2H22, with preliminary results late 2022.

Previously, BIT225 has been tested in newly infected, antiretroviral treatment-naïve people commencing treatment for the first time.

But in the Phase 2 trial, BIT225 will be tested in people who have an HIV-1 infection and have been taking approved anti-HIV-1 treatment for an extended period.

The BIT225-011 trial will be conducted in Sydney, while the other BIT225-010 has also commenced at two sites in Thailand.

The trials are expected to conclude in mid-2022 and data will be made available during the second half of 2022.

At Stockhead we tell it like it is. While PharmAust and Dimerix are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.