Cast your eyes over these 15 weird and wonderful biotech stocks we found on the ASX

Pic: Francesco Carta fotografo / Moment via Getty Images

- Avita Medical makes spray on skin for burns and soft tissue injuries

- HITIQ’s concussion tech is popular for athletes and sports teams

- PainChek’s smartphone app can tell if babies or older Aussies are in pain

There’s a plethora of biotech stocks on the ASX, so we’ve done the hard work of wading through them for you.

A plethora.

And seeing as you liked our weird and wonderful tech stock picks recently, here are all the bizarre, cool, and interesting biotech ones that caught our eye.

In need of soft tissue regeneration? Aroa has you covered.

It’s proprietary extracellular matrix (ECM) biomaterial is manufactured from the ovine (sheep) forestomach tissue, sourced exclusively from New Zealand pasture-raised animals, and basically provides a scaffold for tissue regeneration.

ECM also contains residual vascular channels,(7) that facilitate the rapid establishment of a dense capillary network by supporting migrating endothelial cells to establish new vasculature and a robust blood supply to help build new tissue.

The $231m market cap company had a cash balance of NZ$56 million as at 31 March 2022.

Last month $4.6m market cap company Analytica announced its PeriCoach pelvic floor exercise system had received patents grants in Europe and India.

The PeriCoach is an e-health treatment system for women who suffer stress urinary incontinence, which affects 1 in 3 women worldwide and is mostly caused by trauma to the pelvic floor muscles during pregnancy, childbirth and menopause.

The system comprises a device, web portal and smartphone app. The device evaluates activity in pelvic floor muscles and the information is transmitted to a smartphone app and can be loaded to PeriCloud where physicians can monitor patient progress remotely.

In Europe, the patent was validated in Switzerland, France, Great Britain, Italy, Sweden, Turkey and Germany and the invention has already been granted a patent in Australia and Japan.

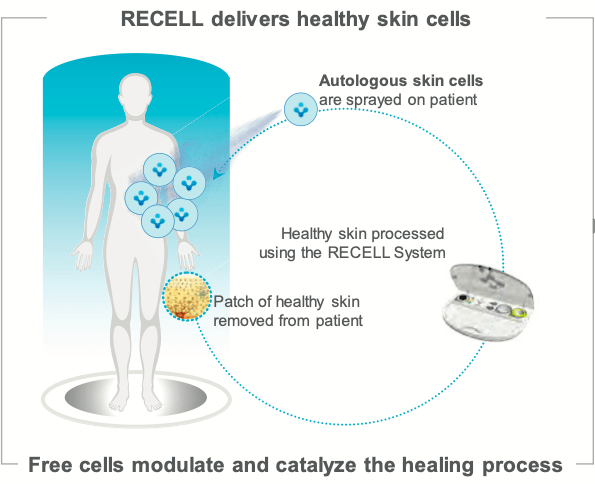

The spray-on skin developer was once synonymous with burns surgeon and Australian of the Year Fiona Woods.

Now, the $165m market cap company sells approved burns products in the US and is eyeing Food & Drug Administration assent for the bigger markets of vitiligo and soft tissue injuries.

In March, Avita was awarded a purchasing contract from Premier Inc to supply the RECELL system to hospitals across the US.

The RECELL system is a device that enables healthcare professionals to produce a suspension of Spray-On Skin Cells using a small sample of the patient’s own skin for the treatment of acute thermal burns.

This new agreement enables Avita access to Premier’s alliance of approximately 4,400 US hospitals and 225,000 healthcare providers.

Last month the CBD player announced it had acquired Sofpironium Bromide gel to treat excessive underarm sweating (known as primary axillary hyperhidrosis) from Brickell Biotech (Nasdaq:BBI).

Botanix still needs to go through the approval process for the gel, which could take about a year.

The US FDA has also granted Botanix new Qualified Infectious Disease Product (QIDP) designation for its investigational cannabidiol antibacterial product, BTX 1801 which applies to the use of BTX 1801 to potentially reduce the risk of staphylococcus aureus bloodstream infections.

The company has a market cap of $60m and had $16.4 million at the end of the March quarter.

The COVID-19 pandemic hit hearing solutions giant Cochlear hard since the start of 2020 through postponement or stopping of elective surgeries which included installing its implants.

But as elective surgery gets back into full swing, so is the company.

Cochlear said sales revenue for the half-year ending December 2021 was up 10% to $815m.

Last month, the company announced plans to acquire hearing implant business Oticon Medical from Denmark-based Demant for A$170m.

The acquisition is expected to add A$75-80m in annual revenue, although the business is currently running at a loss, and could increase Cochlear’s patient base by ~75k hearing implant recipients.

The company had $506 million at the end of the December 2021 quarter and has a market cap of $12.5b.

ARX, ALT, AVH, BOT and COH share prices today:

HITIQ (ASX:HIQ)

This company has developed concussion assessment tech that’s in high demand on the sports field.

Just this week New Zealand Rugby extended its deal with the company to use the tech which provides an efficient baseline testing and a digital record of any suspected concussion incident, as well as standardising rehabilitation protocols, ensuring consistency and a safe return to play.

Additionally, the platform contains an education portal to inform parents and caregivers about the signs and symptoms of concussion.

The new deal is a subscription agreement for the next 12 months.

While HITIQ doesn’t consider it to be material revenue-wise, it represents the largest rugby union-driven program of its kind and sets a blueprint for a global rollout across other competitions.

The $5m market cap company had cash reserves of A$2,752m as at 31 March 2022.

This company’s intelligent imaging and machine learning software to automate the imaging, analysis and interpretation of culture plates following incubation.

And last month LBT executed a binding sale agreement for an Automated Plate Assessment System (APAS) Independence with urine analysis module worth ~$200k to Albany Medical Centre in New York.

The sale follows a successful evaluation-to-buy by a laboratory which is part of Albany Medical Centre health system, a not-for-profit with 1520 hospital beds across four hospitals in northeastern New York.

Reproductive biotech company Memphasys says it’s progressing the commercialisation of its Felix system for sperm separation.

The $20m market cap company says that IVF Clinic key opinion leader (KOL) sites that have been conducting in-vitro assessments of the Felix System over the last 12 months have now completed those assessments.

Initial results showed that while both the Felix System and DGC (the most globally common sperm preparation method for IVF procedures) were able to select sperm of high quality from the raw semen samples, the overall quality from the Felix System was superior to DGC in a vast majority of cases.

And although the yield of sperm from the Felix System was less than the yield from DGC, there were sufficient sperm prepared by the Felix System for IVF processes.

Notably, the Felix System processed semen samples in six minutes whilst DGC required at least 30 minutes, which could be an advantage especially in a busy IVF clinic.

Memphasys is now preparing for a pre-submission meeting with the US FDA.

The company had a 31 March 2022 cash balance of $5.6 million

MEDICAL DEVELOPMENTS (ASX:MVP)

A pioneer in first-line pain relief, Medical Developments, has had great success in revitalising an old drug, the analgesic penthrox, which it sells in multiple countries.

The drug is best known as the Green Whistle, an analgesic used by paramedics and ambulances to administer emergency pain relief – you’ve probably seen athletes clutching one while being stretchered off the field.

A notable gap in the company’s global coverage is the US, but the FDA has now lifted a clinical ‘hold’ order on a planned Phase III trial for first-line relief.

The latest FDA move means that MVP can immediately begin preparing for its Phase III US clinical trial, a critical step towards bringing Penthrox closer to licensure in the US market.

The two-year trial will be conducted on a targeted trauma and associated pain patient group, with recruitment expected to commence in late 2022.

The company has a market cap of $114m and had $28.3m at the half-year ending 31 December 2021.

This company makes mini X-ray tech, which is also used in airport security – but more recently has been deployed to the front lines in Ukraine.

In the March quarter, MX1 secured $0.8 million of Micro-X Rover sales into the Ukraine to provide additional medical imaging capability for Ukrainian soldiers and civilians injured in the war.

The orders were funded by a US-based charity for use in temporary medical facilities following attacks on Ukrainian health infrastructure.

The company is also working on its ‘Argus’ IED X-ray camera product, “with a number of customers already expressing strong interest in conducting Argus trials, including the United States Federal Bureau of Investigation, military EOD organisations and some of the larger state police bomb squads,” the company said.

The $55 market cap company had a cash balance of $16.1 million as at 31 March 2022.

HIQ, LBT, MEM, MVP and MX1 share prices today:

This $70m healthcare software company offers a cloud-based care experience platform where it provides patients with a digital tablet at their bedside that uses real time information intended to make a patient’s stay easier.

In May they signed a deal with BJC Health System to provide its platform to 2,441 additional beds, taking the total number of beds under contract with BCJ to 14,283.

Under this agreement, BJC will also be migrating to Oneview’s CXP Cloud Enterprise platform, and moving all existing deployments to Android hardware.

“The pandemic has raised the importance of bedside technology for enabling self-service, keeping patients, families and clinicians connected, and supporting hybrid care models,” said CEO of Oneview, James Fitter.

“BJC Health System has a clear and innovative vision for how technology can support inpatient care into the future with the ‘Connected Patient Room’, he added.

This $61m market cap company has had some recent success with nerve reconstruction, reporting earlier this month that the final data read-out of all patients in its nerve reconstruction trial has shown encouraging results.

The regenerative medicine company said results demonstrated early recovery of muscle function in paralysed upper limbs, with continued improvement seen at the 12-month and 24-month checkpoints.

Follow-up data at 12 months showed that 76% (25 of 33) of nerve reconstructions resulted in functional recovery of muscles controlled by the reconstructed nerve.

And data at 24-month post treatment showed that 85% (23 of 27) of nerve reconstructions resulted in functional recovery of target muscles closest to the reconstruction site.

Orthocell held a cash balance of A$11.2m at the end of the March quarter.

This company applies an algorithmic solution to pain assessment – a common problem in nursing homes when a resident with dementia is unable to verbalise discomfort.

Using a smartphone snap of the person’s face, PainChek derives a reliable pain score that helps with care delivery, such as better administration of meds.

The company has a presence in 1500 facilities, covering 126,000 beds and is looking to expand into the UK and US markets.

PainChek is also rolling out an application for Children who have not yet learnt to speak, and achieved UK, CE & TGA clearance for the infant version in Q2 CY21.

US market entry as a Clinical Decision Support tool was submitted in Q2 2022.

The company has a market cap of $37m and $4.7m cash at the end of the March quarter.

The smartphone-based respiratory diagnostic maker plunged by almost 30% this week after announcing its cough app might need a bit of fine tuning.

An independent study released yesterday revealed that ResApp’s COVID-19 cough algorithm achieved a sensitivity of only 84% and a specificity of 58%, significantly lower than the results of ResApp’s own pilot study.

They’re also significantly lower than the thresholds specified under the acquisition terms with Pfizer, which set a minimum sensitivity of 86% and a minimum specificity of 71%.

As a result, Pfizer’s acquisition price will now be reduced from 20.7c to 14.6c per ResApp share in cash, representing an equity value of $127 million.

On Tuesday, the RAP share price had jumped by 50% after Pfizer increased its offer to 20.7c, valuing the company at $180m.

ResApp’s proprietary machine learning technology could identify coughs from audio recorded using the smartphone’s in-built microphone.

The company says the technology will provide a ‘rule-out screening test’ for COVID-19 at scale globally, which could eventually phase out PCR tests.

The $107m market cap company had $1.7m in cash at the end of the March quarter.

VOLPARA HEALTH TECHNOLOGIES (ASX:VHT)

The $110m market cap Auckland-based company has developed Volpara Density, an algorithm-based tool to measure breast density and identify women at risk of breast cancer for more frequent examinations.

The company was booted from the S&P/ASX All Technology Index earlier this month, and just this week announced a collaboration with software giant Microsoft to expand breast cancer screening programs’ ability to make cardiovascular assessments from routine mammograms.

The two parties will collaborate to accelerate the production of a product that detects and quantifies breast arterial calcifications (BACs) which represents medial calcification of the mammary arteries and have been shown to be associated with cardiovascular disease outcomes.

For women, the BACs product will add a new dimension to their regular breast screenings, providing important information about their cardiovascular health.

Volpara says the collaboration marks the company’s entrance into a new area of care which is part of a US$146 billion cardiovascular disease market.

At the end of the March quarter the company had NZ$18.2M cash on hand.

ONE, OCC, PCK, RAP and VHT share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.