Fertility play Virtus Health continues its strong form with profits doubling

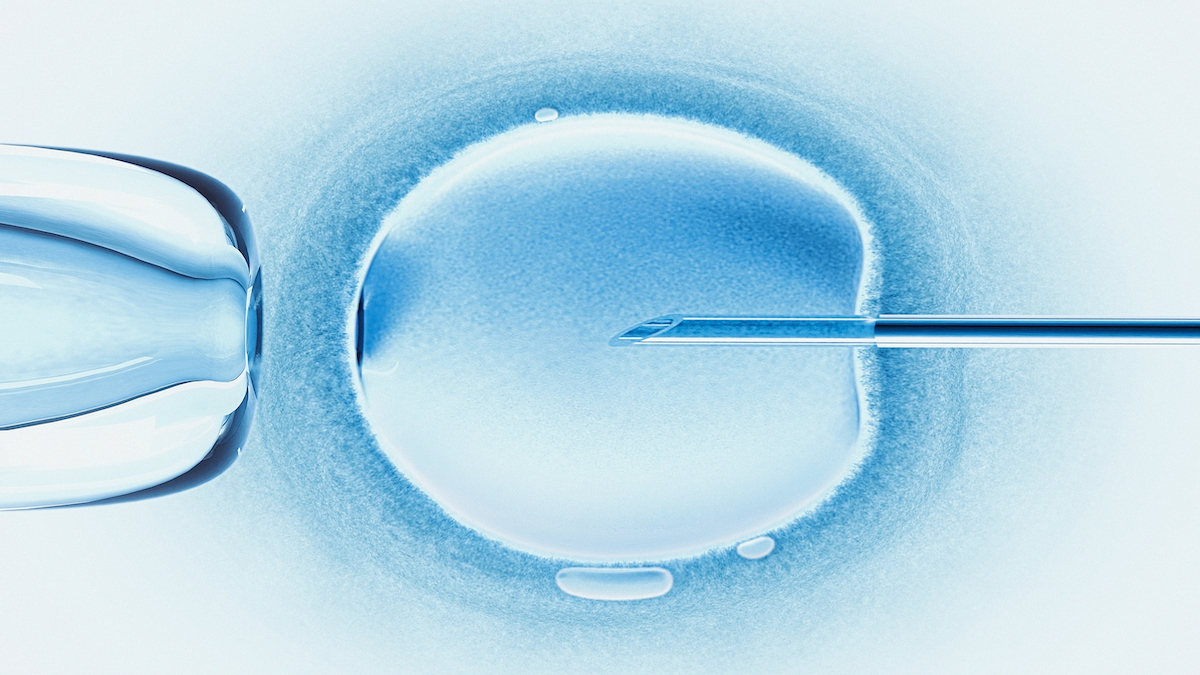

Virtus Health shows solid profit in Australian recovery - Getty Images

Fertility play Virtus Health (ASX:VRT) has continued its impressive run going into the new year – doubling its net profit after tax (NPAT) in the H2 FY20 compared to the first half.

The Virtus share price is trading at $6.25 in early morning, up by 1.13%.

Virtus Health share price today:

First, the key metrics..

The NPAT of $29.9 million for the H2 comes on the back of a $169.6 million in revenue, which increased from $142.1 million in H1.

The company has managed to pay down debts – with a leverage ratio of 1.7x at 31 December 2020, compared to 2.1x for the full year FY20.

Virtus will pay an interim dividend of 12cps fully franked for H1 FY21.

Australian recovery

The solid results were mostly underpinned by its Australian segment. H2 revenue grew by 21.3% to $136.8 million compared to the first half, and makes up 80% of its total revenue.

Virtus said the Jobkeeper Program has helped to keep its earnings grow by an extra 19% in the second half.

Virtus CEO, Kate Munnings, believes both its IVF and genetics testing services will continue to show resilience and growth in the future.

“Our ARS (assisted reproductive services) activity in H1 demonstrates resilience of IVF as a non-discretionary service. Our reproductive genetics service is also one of our growth opportunities as more people look to genetic testing for disease avoidance and diagnosis of fertility issues,” Munnings said.

Outlook for Virtus Health

As part of its ambitious growth strategy program announced in August 2020, Virtus said it will continue to focus on its One Lab strategy in order to improve IVF pregnancy rates, which has increased by 15% in the last three years.

The company is also looking to expand its international footprint in the fertility ecosystem, and has recently signed a collaboration agreement with a global genomics provider, CooperSurgical.

Virtus anticipates a normalisation of growth rates in the second-half of 2021 from the severe disruptions of COVID-19. However, the company expects its European segment to lag behind, due to continuing lockdowns in UK and Ireland.

According to healthcare and life science expert Scott Power of Morgan Financial, fertility companies like Monash IVF (ASX:MVF) and Virtus Health have good tailwinds as Medicare figures show Australian women are opting for more IVF cycles now that the lockdowns have eased.

“They certainly look very interesting as far as where their share price is sitting,” Power said.

The MVF share price is currently trading at 76.5c, down 0.25% for the year. Meanwhile, VRT is up 19% on a year-to-date basis.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.