ASX Health Stocks: US FDA approval could expand EBR Systems’ addressable market by $400m

EBR Systems gets go ahead from the US FDA. Picture Getty

- US FDA approves EBR’s wireless pacemakers

- Singular Health and Osteopore to pursue US FDA and TGA approvals

- Virtus Heath to be acquired and de-listed

The ASX 200 Health Index (XHJ) is trading higher by 1.5% at the time of writing, compared to the broader index which is up by 0.90%.

US FDA approves EBR’s wireless pacemakers

The US FDA has agreed for EBR Systems (ASX:EBR) to include leadless (wireless) pacemakers as a co-implant in the pivotal SOLVE-CRT IDE clinical trial.

Pairing leadless pacemakers with the WiSE CRT System is expected to deliver better cardiac resynchronisation therapy (CRT) for eligible patients.

If approved for final labelling, the opportunity to pair leadless pacemakers could potentially expand EBR’s addressable market by US$400m in 2024.

Leadless pacemakers represent a fast-growing market in cardiac rhythm management, and this update makes WiSE the only device that can potentially support the upgrade of patients currently implanted with a leadless right ventricle pacemaker.

The SOLVE-CRT trial remains on track to complete enrolment for interim analysis by H1 2022.

EBR Systems share price today:

Singular Health and Osteopore to pursue US FDA and TGA approvals

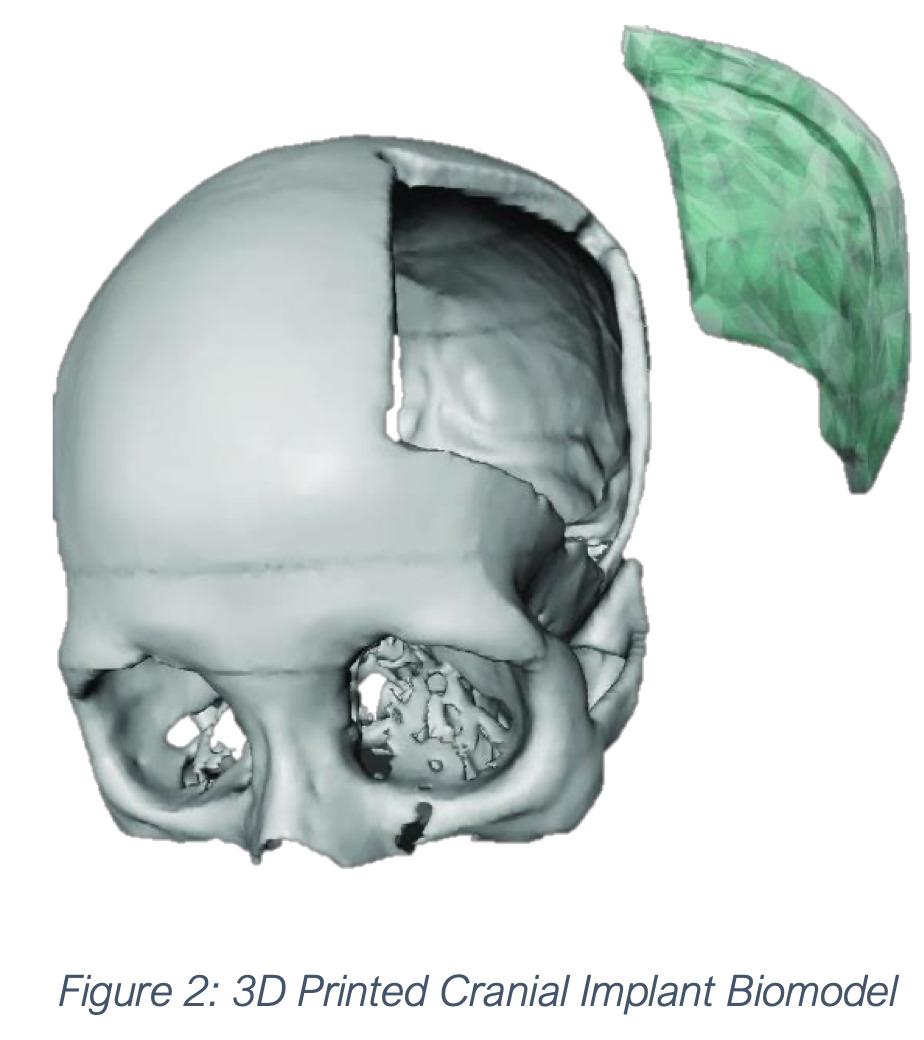

Singular Health (ASX:SHG) says it has completed the Cranial Implant Design project with with Australia’s science agency, CSIRO, announced in October last year.

Singular Health’s research team has been working closely with the CSIRO to use a publicly available dataset of craniotomy CT scans.

These data were used to train a Convolutional Neural Network (CNN) AI model to generate a cranial implant, which has surpassed all previous models with an accuracy of greater than 91% and an inference time of less than four minutes.

The SHG team has also configured it to use standard DICOM inputs to work across both Windows and MacOS hardware, and generate the cranial implant design into the company’s 3Dicom Surgical software.

The focus now turns to the collaboration with ASX-listed Osteopore (ASX:OSX) to validate the model, and seek US FDA and Australia TGA certification.

The aim is for the cranial implant to be deployed for use with Osteopore’s cutting-edge bio-resorbable material.

Khoon Seng Goh, CEO of Osteopore, said: “Having reviewed Singular Health’s new AI-driven cranial implant design tool and the 3Dicom Surgical, Osteopore is excited to begin this collaboration and to work towards a commercial outcome for the two companies.”

Dadong Wang, Principal Research Scientist of CSIRO said the development could lead to 3D printing of cranial implants.

“We understand a patient specific cranial implant is important for cranioplasty,” Wang said.

“The AI- based custom modelling of skulls can facilitate the design and 3D printing of such patient specific cranial implants, and is a great example to show how AI can augment surgical decision-making,” he added.

Singular Health and Osteopore share prices today:

Virtus Heath to be acquired and de-listed

Virtus Health (ASX:VRT) has finally entered into a binding deal with CapVest to acquire 100% of Virtus at an improved price of $8.25 cash per share.

The Virtus Board may now determine and pay a fully franked special dividend, based on the H1 FY22 Results at 31 December 2021, less the $0.12 per share dividend declared by Virtus on 22 February.

Virtus had earlier received a competing offer from BGH Capital of $7.65 a share, but rejected that offer.

Virtus Health share price today:

At Stockhead we tell it like it is. While Singular Health and Osteopore are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.