Tailoring medicine to our DNA could save our health system billions – let’s get personal

Experts say we could save $2.4 billion a year if we studied people's genetic makeup before administering treatment.

It seems like a logical idea — tailoring medical practices, treatments and care to the specific individual rather than applying an accepted broad brush strategy that does not take into account a patient’s unique circumstances and genetic makeup.

That’s the idea behind personalised medicine, a theory that has been around since Hippocrates. But while his Hippocratic Oath remains in use today, personalised medicine is scarce.

Fundamentally, it is about mapping a person’s DNA and then analysing it before treatment, with the DNA outlining whether a treatment will be effective before it is administered.

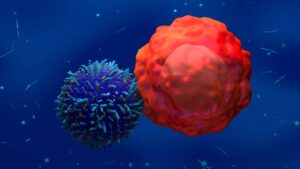

A number of small cap ASX companies are beginning to embrace it — mostly in the cancer field — but it’s only a handful, as Australia is yet to adopt the practice widely.

That’s led to calls for Australia to embrace pharmacogenetic testing (PGx) to save billions “wasted each year through unsafe and ineffective drug prescriptions”.

“Most people expect that when they get a prescription filled from a pharmacy, it will be effective and have minimal side effects,” Dr Vijay Suppiah, a UniSA scientist, says. “Unfortunately that only happens in up to 60 per cent of cases.

“People don’t realise their genetic makeup plays a large role in whether a specific drug will work or not or even have adverse side effects.”

Australian investment into PGx testing trails world leaders US and Europe. Deloitte has suggested PGx testing would deliver economic benefits to Australia in the order of $12 billion over 15 years if adopted nationally.

“If community pharmacists had access to their clients’ PGx test results in their database, they could tell straight away if a particular drug or dose is going to work optimally for that client based on that individual’s genetic makeup,” Dr Suppiah says.

Personalised medicine in the small cap market

And while we’ll have to wait and see whether increased calls for personalised medicine garner widespread support in Australia, small cap ASX biotechs are getting on the gravy train.

Veteran Morgans senior health analyst Scott Power says the concept is not new.

“It’s the way things are heading,” he tells Stockhead. “Personalised medicine is all about really trying to target the drug or treatment to fit the person and fit the condition they have.

He points to Kazia Therapeutics (ASX:KZA) as an example. It is attempting to treat glioblastoma, a form of brain cancer.

Temozolomide is the drug most often used to treat glioblastoma, but only 35 per cent of patients respond to it. It is developing GDC-0084 for the 65 per cent of patients who will not respond to existing treatment.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“It makes sense because not only is it much more appropriate for the patient because you’re not giving drugs to patients that have a minimal chance of working,” Mr Power says.

Factor Therapeutics “the right approach”

Mr Power says one of the biggest trends developing in the field of personalised medicine is more sophisticated and better targeted clinical trials.

In biotech land, there are two types of companies. Those who will announce they are moving into every hot new indication in order to drive excitement, share price value and investment — but often don’t follow through on actual regulated trials or quietly admit down the track that their drug failed miserably.

And then there are those who target extremely specific and niche indications, often quite rare diseases with small populations — not as exciting, but as Mr Power explains, it’s a more conservative strategy that can pay off in the long run.

“It makes economic sense, because if you can target the drug you have a much higher chance of getting it to market,” he says. “Factor Therapeutics was a good example.”

Factor Therapeutics (ASX:FTT) made headlines last year when it plummeted 97 per cent when its flagship clinical trial failed.

The company was testing its VF001 drug in patients with severe, slow-healing, hard-to-treat leg ulcers in Phase II trials. Data from Phase I had shown that the drug was safe and tolerable, leading to the Phase II trials — but the results came back comprehensively negative, showing that VF001 made no difference compared with standard care.

“It didn’t work, but what they tried to do was the right approach,” says Mr Power. “They identified the target that the data had told them had the highest chance of succeeding. It was a small population base and had it worked it would have made it easier to take the drug to market.

“Designing trials that give you the best chance for a good outcome is the way forward. I think we will start to see better-designed, more sophisticated trials, with better analysis work being done beforehand, targeting and personalising their treatment.

Personalised cancer vaccines and other small cap personalised medicines

Invitrocue (ASX:IVQ) owns 3D-based diagnostic technology that helps clinicians work out the best drugs to administer more quickly.

Singapore-based Invitrocue’s flagship product is Onco-PDO, as in oncology patient-derived organoid. It uses 3D cultures to grow a patient’s own cancer cells on scaffolds and then test them in view of the best medicine to use.

Stem cell biotech Regeneus (ASX:RGS) is testing its cancer therapy RGSH4K, which is a vaccine manufactured from a patient’s own cancer cells.

Such vaccines are called autologous vaccines, and offer patients more specific, personalised treatment with the right mix of tumour associated antigens (TAAs) for the body to recognise and attack.

Back in April last year, Prescient Therapeutics (ASX:PTX) treated 28 women who had a kind of breast cancer that has little or no HER2 (human epidermal growth factor receptor 2) protein with its PTX-200 drug. They claim it cured two women completely.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.