Canadian cannabis giants Aphria and Tilray closer to merger; ASX cannabis stock Bod snares new CFO

Candian cannabis plays Aphria and Tilray are set to merge, as ASX cannabis stock Bod Australia gets new CFO. Picture: Getty Images

The performance of the Horizons Marijuana Life Sciences Index ETF (HMMJ) continued to dip this week, falling to just 10.77 by close of trading Friday, although another upswing is forecast in the coming months as a flurry of mergers and acquisitions is expected to hit the US cannabis sector.

The most notable of these is the upcoming merger between Canadian cannabis giants Aphria (TSE:APHA) and Tilray (NASDAQ:TLRY), which moved a step closer last week after the latter company made a significant revision to its corporate bylaws.

Tilray will now only require one-third of its voting shareholders to approve the deal, instead of needing the majority, which is expected to significantly boost the merger’s chances of going through.

“Together, we expect the Combined Company to have a strong financial profile, low‐cost production, leading brands, distribution network and unique partnerships, positioning us to deliver sustainable value for all stakeholders,” Aphria chairman and CEO Irwin D. Simon said.

“We continue to maintain our financial flexibility through the strength of our balance sheet and access to capital. As a combined company, we expect to continue to pursue M&A in the U.S. across the branded consumer products industry that are accretive and can parlay into complementary cannabis products when we are able to do so.”

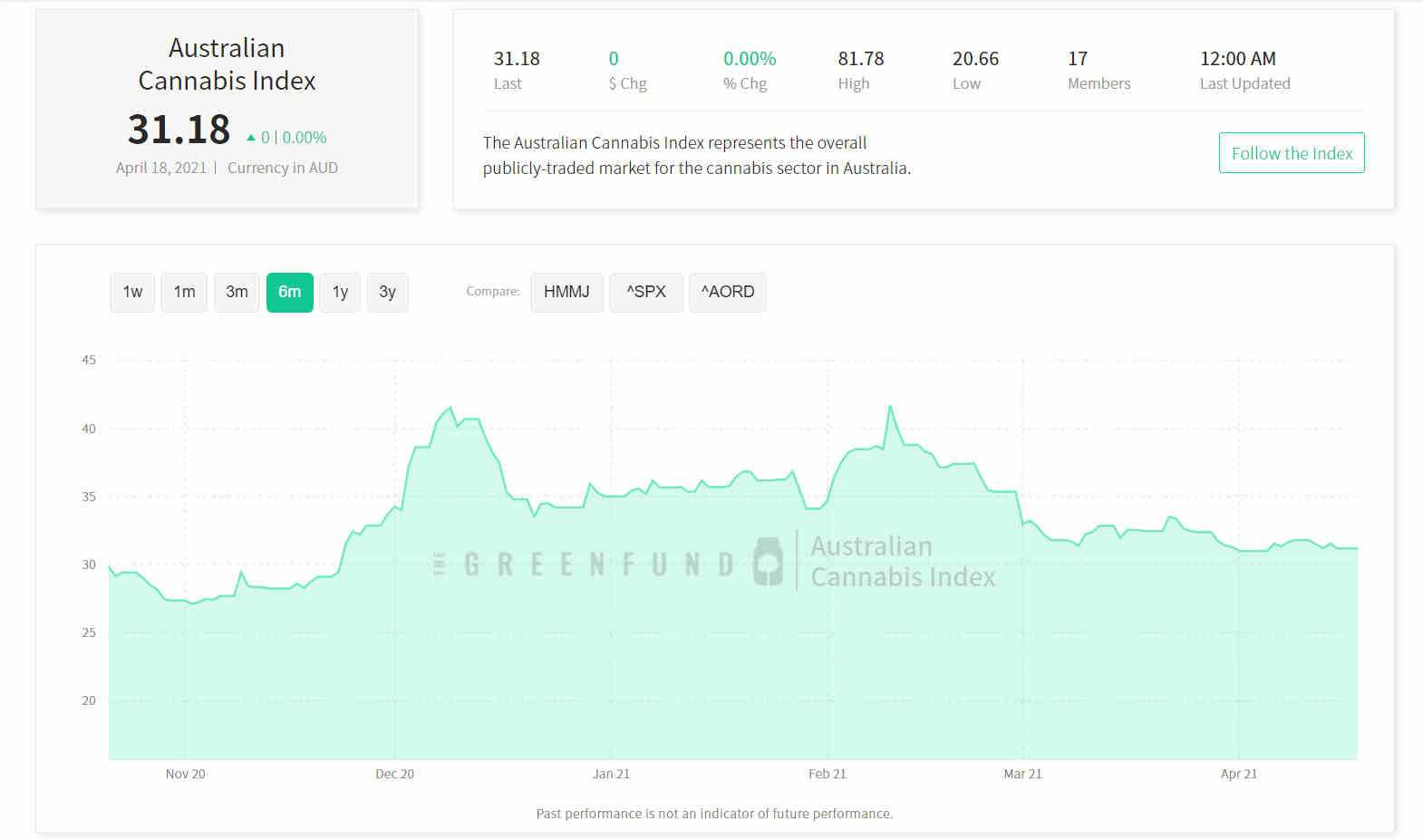

Meanwhile, the Australian Cannabis Index fell to -10.56% on the six-month performance chart, while Australia’s All Ordinaries reached a 14.73% gain and the S&P 500 closed out the week up by 20.14%.

The Australian cannabis-centric healthcare company, Bod Australia (ASX:BOD), saw its share price reach 52c this week, after appointing senior accounting and financial management executive Alan Dworkin as its Chief Financial Officer (CFO).

This generated considerable excitement, as Dworkin previously served as the CFO of FIT Bioceuticals — formerly an unlisted public nutraceuticals company — before overseeing its eventual acquisition by the Australian health supplement juggernaut Blackmores Limited (ASX:BKL).

According to the CEO of Bod Australia, Jo Patterson, the company is highly confident that Dworkin’s “extensive experience in the pharmaceutical, R&D and nutraceutical sectors will be imperative in Bod’s next phase of growth”.

“Alan’s defined skillset in accounting and financial management will allow Bod to continue to grow its revenue profile, reduce operating expenses and streamline operational processes, which will further assist Bod in its development,” Patterson said.

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.