Weed Week: Cannabis boom a ‘matter of when, not if’; and NSW to allow residents to grow pot

Expert says global cannabis boom is a matter of if, not when. Picture Getty

- Expert says global cannabis boom is a matter of if, not when

- Catalyst will be US DEA’s pending decision to move cannabis from Schedule 1 to Schedule 3

- NSW residents could grow six marijuana plants and carry 50g of weed under proposed law

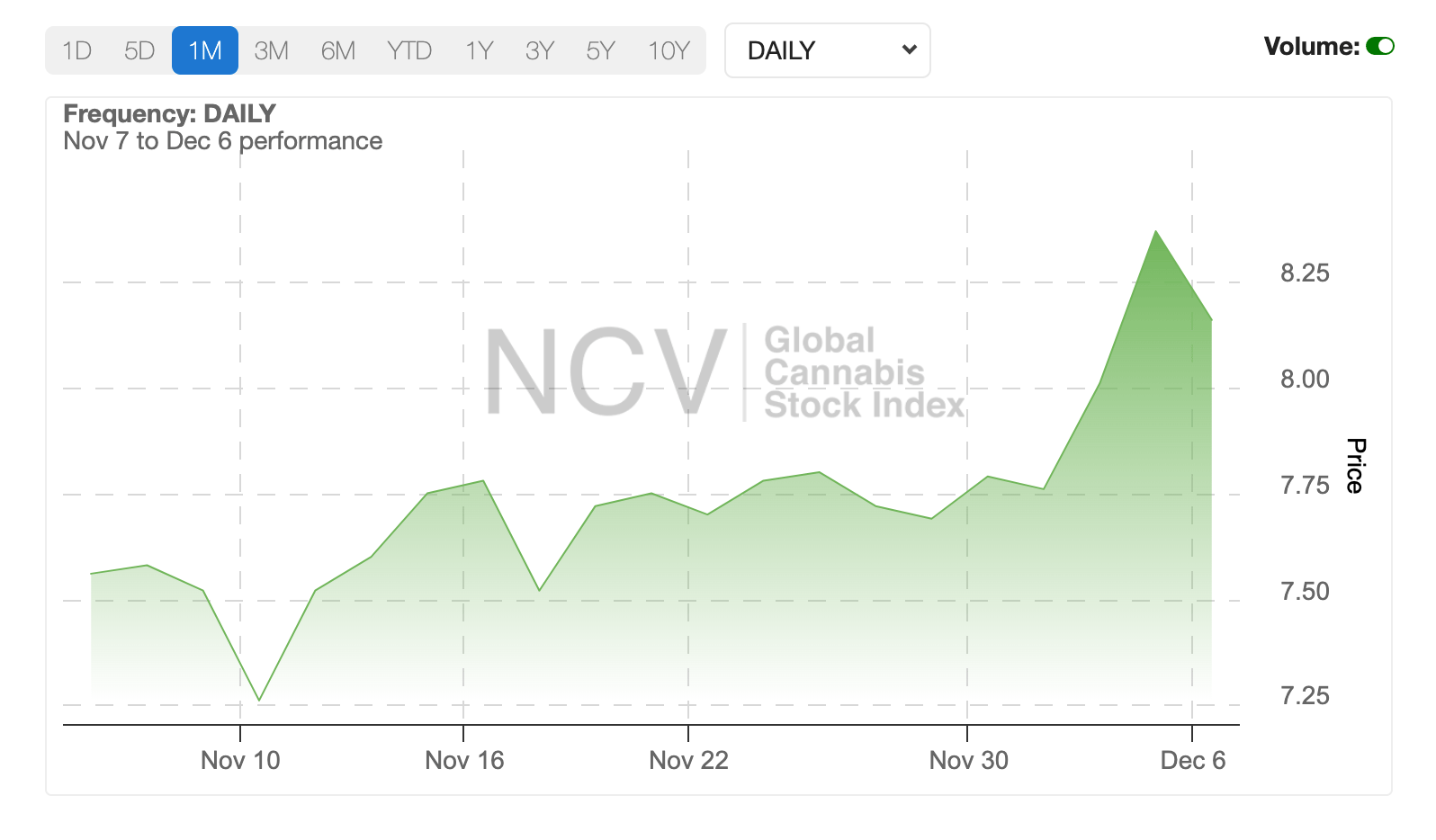

It’s been a good past fortnight for cannabis stocks, with the closely watched Global Cannabis Stock Index rising during the period.

Since the peak in February 2021, the Index has dropped 91.6% from the 92.48 points high.

But in 2023, the Index has gained some ground, particularly since August after news that the US Department of Health and Human Services had recommended to the Drug Enforcement Administration (DEA) that it move cannabis from Schedule 1 to Schedule 3.

So whilst the thrill has temporarily gone from cannabis stocks, if the DEA approves that recommendation, it could really open the floodgates to legislations and a new boom in the industry.

Now read: Growing excitement for cannabis stocks after marijuana rescheduling hopes in the US

For some experts in the space, the question surrounding cannabis legalisation and a subsequent boom isn’t a matter of if, but when.

“Legalisation of cannabis is inevitable,” Jaret Seiberg, a policy analyst at TD Cowen told CNBC.

“It’s just a question of how bumpy the next several years are going to be.”

Medicinal marijuana use is now legal in 38 US states, and more than half of Americans actually reside in states where marijuana is legal. Even more, some 70% of Americans are in favour of legalisation, according to a recent Gallup poll.

Grow six plants, carry 50g of weed

Back home, a law being introduced to NSW Parliament would allow people to give pot to their friends as long as it is not sold.

Residents of NSW will also be allowed to grow six marijuana plants for personal use, and to carry up to 50g of cannabis on the streets.

There are hopes the new law would reduce the number of Aboriginal people being arrested, as data shows that indigenous people were 10x more likely to have a marijuana-related interaction with police than non-Indigenous people.

“It is clear that cannabis prohibition is a racist law,” said Legalise Cannabis MP Jeremy Buckingham. “It’s clear it is being used to target young Aboriginal Australians.”

To ASX Weed Stocks ….

Here’s how the ASX weed stocks have performed, sorted by winners over the past month.

| Code | Company | Price | % Week | % Month | % 6-Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| EXL | Elixinol Wellness | 0.013 | 8.33 | 44.44 | -18.75 | -53.57 | $8,227,331 |

| IDT | IDT Australia | 0.105 | 5.00 | 40.00 | 54.41 | 17.98 | $36,905,344 |

| ROO | Roots Sustainable | 0.007 | 0.00 | 40.00 | 40.00 | -70.83 | $1,124,217 |

| RNO | Rhinomed | 0.040 | 17.65 | 37.93 | -44.44 | -65.22 | $11,428,788 |

| BOT | Botanix Pharma | 0.160 | 6.67 | 18.52 | 52.38 | 166.67 | $254,288,866 |

| NTI | Neurotech Intl | 0.060 | 1.69 | 7.14 | 36.36 | -29.41 | $53,178,569 |

| ECS | ECS Botanics Holding | 0.024 | 0.00 | 4.35 | 20.00 | 14.29 | $25,454,805 |

| AC8 | Auscann Grp Hlgs | 0.040 | 0.00 | 0.00 | 0.00 | 0.00 | $17,621,884 |

| BP8 | Bph Global | 0.002 | 0.00 | 0.00 | -50.00 | -88.61 | $3,231,126 |

| CGB | Cann Global | 0.021 | 0.00 | 0.00 | 0.00 | 0.00 | $5,614,845 |

| EVE | EVE Health | 0.001 | 0.00 | 0.00 | 0.00 | 0.00 | $5,274,483 |

| MDC | Medlab Clinical | 6.600 | 0.00 | 0.00 | 0.00 | -13.73 | $15,071,113 |

| RGI | Roto-Gro Intl | 0.220 | 0.00 | 0.00 | 0.00 | 0.00 | $4,333,920 |

| WNX | Wellnex Life | 0.040 | 0.00 | 0.00 | 0.00 | -27.40 | $19,513,181 |

| ALA | Arovella Therapeutic | 0.089 | 0.00 | -3.26 | 78.00 | 229.63 | $80,893,456 |

| HGV | Hygrovest | 0.051 | -1.92 | -3.77 | -5.56 | -27.14 | $10,725,841 |

| WOA | Wide Open Agricultur | 0.160 | 10.34 | -5.88 | -50.77 | -46.67 | $28,818,960 |

| ZLD | Zelira Therapeutics | 0.920 | -9.80 | -6.12 | -43.03 | -13.21 | $10,439,383 |

| EPN | Epsilon Healthcare | 0.025 | -10.71 | -7.41 | 31.58 | 0.00 | $7,508,850 |

| CAN | Cann | 0.105 | 0.00 | -8.70 | -33.85 | -54.96 | $44,380,973 |

| EMD | Emyria | 0.070 | -1.41 | -10.26 | -47.76 | -62.88 | $24,930,799 |

| LGP | Little Green Pharma | 0.125 | 4.17 | -10.71 | -28.57 | -34.21 | $37,511,655 |

| AGH | Althea | 0.038 | 0.00 | -11.63 | -15.56 | -41.54 | $15,049,670 |

| LV1 | Live Verdure | 0.310 | -7.46 | -15.07 | 113.79 | 21.57 | $34,780,932 |

| VIT | Vitura Health | 0.300 | -3.23 | -16.67 | -21.05 | -54.89 | $167,003,399 |

| DTZ | Dotz Nano | 0.140 | -6.67 | -17.65 | -45.10 | -46.15 | $71,943,883 |

| IRX | Inhalerx | 0.034 | -8.11 | -19.05 | -15.00 | -48.48 | $6,452,077 |

| EOF | Ecofibre | 0.115 | 4.55 | -20.69 | -41.03 | -61.02 | $39,711,760 |

| AVE | Avecho Biotech | 0.003 | -25.00 | -25.00 | -40.00 | -62.50 | $9,507,891 |

| WFL | Wellfully | 0.003 | -25.00 | -25.00 | -57.14 | -78.57 | $1,478,832 |

| IHL | Incannex Healthcare | 0.041 | 0.00 | -36.92 | -64.35 | -82.55 | $65,067,485 |

| ME1 | Melodiol Glb Health | 0.002 | 0.00 | -50.00 | -80.00 | -90.91 | $9,225,840 |

| BOD | BOD Science | 0.024 | 0.00 | -57.14 | -52.00 | -85.88 | $4,256,124 |

Botanix rose after receiving feedback from FDA following its “end of review” Type A meeting request, in respect to the Sofdra new drug application (NDA) review.

The FDA confirmed that the planned content of materials proposed by Botanix would be acceptable for the planned resubmission of the Sofdra NDA package.

No additional materials have been requested by FDA as part of the resubmission. The submission of the final component required for FDA approval of Sofdra remains on target for early Q1 2024, with a likely six-month review process targeting FDA approval in mid-CY2024.

Sofdra is the trade name for Sofpironium Bromide, and is BOT’s lead product for the treatment of primary axillary hyperhidrosis.

Primary axillary hyperhidrosis is a chronic idiopathic disorder characterised by uncontrollable excessive sweating without a recognisable cause.

IDT has been rising after saying it is well placed to benefit from the rapid growth in the medicinal cannabis and psychedelic markets, given that IDT is one of the select few facilities that comply with the recently introduced GMP regulations.

During the last quarter, IDT’s potential sales pipeline also continued to grow, with the company generating 75 potential sales leads and signing confidentiality agreements with 15 potential clients.

In the quarter, the company also submitted proposals worth an additional $11.3 million, and secured sales contracts worth $1.2 million.

LGP was down over the past month despite reporting strong revenue growth for the first half, with an increase of 37% compared to the pcp.

Australian revenue was $10.8m, up 36% compared to the pcp, and European revenue was $2.0m, up 61% on the pcp.

Flower sales represented the majority of growth, with sales up 90% compared to the pcp. Newly introduced vaporiser products have continued to perform strongly since their introduction in July.

The company has cash of $6.2m with net current assets of $20.3m, and long term debt reduced down from $9.7m to $3.5m.

Neurotech International (ASX:NTI)

Neurotech’s Phase 2/3 clinical trial in autism spectrum disorder (ASD) has hit another milestone.

Neurotech said that Human Research Ethics Committee (HREC) approval to extend its Phase 2/3 clinical trial in ASD to allow patients who turn 18 to remain on treatment with its proprietary NTI164 was received.

NTI164 drug formulation is derived from a unique cannabis strain with low THC and a novel combination of cannabinoids including CBDA, CBC, CBDP, CBDB and CBN and is exclusively licenced for neurological applications globally.

The drug is being developed as a therapeutic drug product for a range of neurological disorders in children where neuro-inflammation is involved.

BOD has been the worst performing weed stock after the company appointed voluntary administrators on 29 November, with all listed securities still suspended.

BOD has been developing its Aqua Phase technology, a delivery process platform that solves solubility and bioavailability limitations with drugs that are poorly absorbed by the body through oral dose formats.

Aqua Phase has significant application within the cannabis sector, but it also holds a broader opportunity for drugs that have solubility and bioavailability limitation.

BOD however called for the Administrators after a planned $2.05m capital raising did not materialise.

On 21st November, BOD revealed Tranche One of the Placement, that it was supposed to receive from cornerstone Malaysian investor, Antah Healthcare Group, did not settle.

At Stockhead, we tell it like it is. While Neurotech International is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.