August Health Winners: LTR Pharma, Control Bionics lead sector at the ‘cusp of an extraordinary era’

The ASX Healthcare sector has outpaced the benchmark 10x since 2006. Pic via Getty Images

- ASX health stocks down in August and trail the broader market in 2024

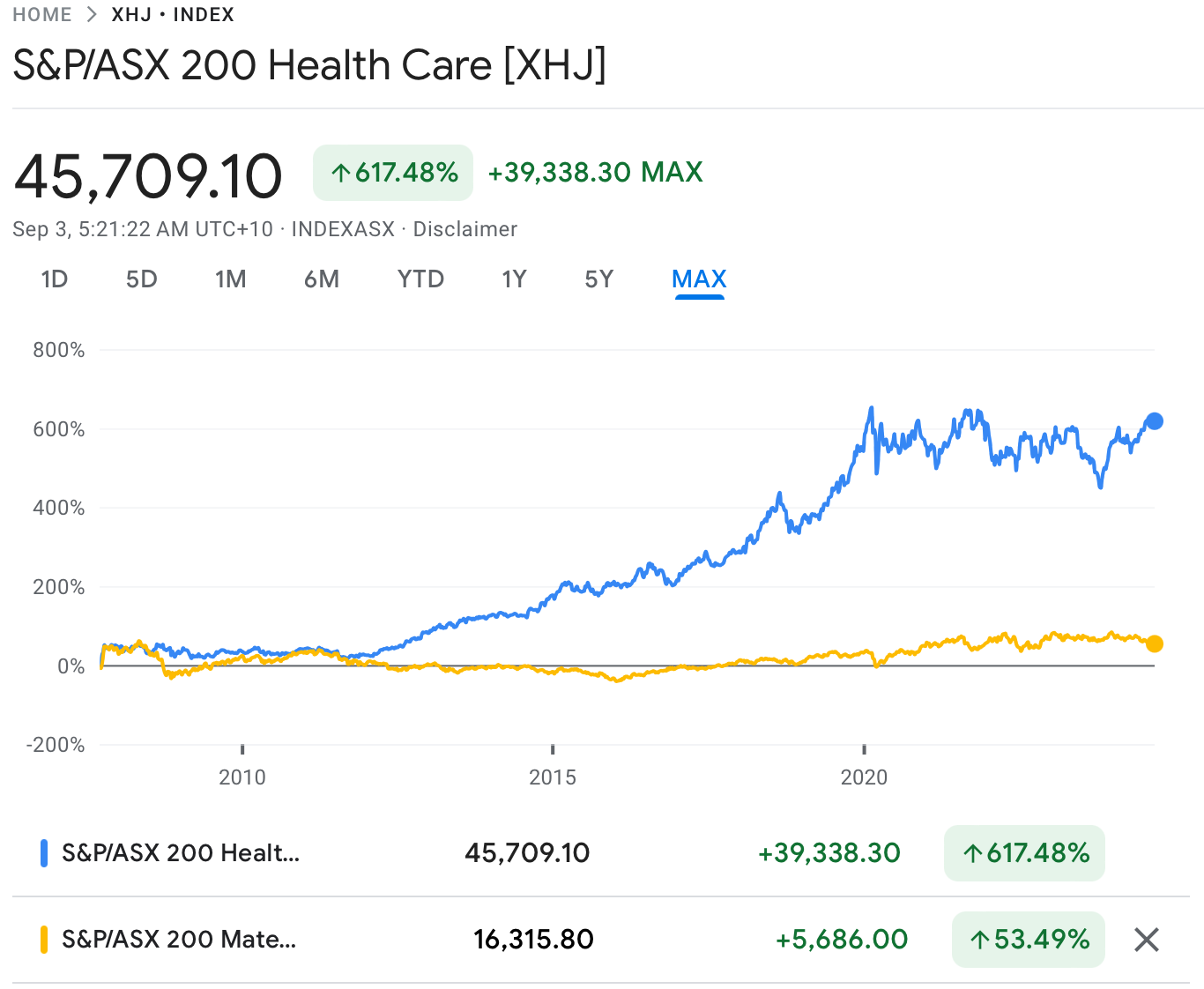

- CSL up 6,000pc since listing; sector outpaced benchmark 10x since 2006

- AI is revolutionising healthcare, boosting diagnosis and treatment

The ASX Healthcare Index (ASX:XHJ) was down by 2% in August.

Despite a strong start in 2024, the Healthcare Index is trailing behind the broader market (ASX 200) by around 1% so far this year.

These recent volatilities are, however, nothing but a blip, because healthcare stocks remain some of Australia’s most reliable wealth creators.

For instance, CSL (ASX: CSL) has surged over 6,000% since its ASX listing 25 years ago.

And if you run the ruler from 2006, the XHJ index has left the broader market in the dust by a factor of more than 10x.

Fast forward to 2024, however, the focus has shifted to AI and its transformative effect on the sector.

CSIRO’s latest report shows that advances in AI technology are rapidly increasing AI use in healthcare, transforming various aspects from clinical decision support and diagnosis, to treatment and administrative tasks.

The report identified that medical research will be a significant winner from the introduction of AI algorithms.

“We’re at the cusp of an extraordinary era in medicine,” said Dr David Hansen, Research Director at CSIRO’s Australian e-Health Research Centre.

“For the first time, machines can provide efficient administrative support for clinicians and education for patients, diagnose and predict disease and inform clinical decision making,” Dr Hansen said.

The report also said that other sectors – such as aged care or disability – will also benefit substantially from AI.

“All of this shows great promise for increasing digital health impact,” said Hansen.

Now read: ‘Tide is turning for the healthcare sector’ – ASX biotechs making strong gains in 2024

How ASX biotechs performed in the month of August

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|

| LTP | LTR Pharma | 1.880 | 141% | 596% | 0% | $159,403,414 |

| CBL | Control Bionics | 0.090 | 64% | 114% | 33% | $18,835,810 |

| EZZ | EZZ Life Science | 2.660 | 49% | 443% | 336% | $118,139,112 |

| PYC | PYC Therapeutics | 0.140 | 47% | 79% | 140% | $653,251,677 |

| BMT | Beamtree | 0.315 | 47% | 58% | 50% | $91,047,190 |

| HMD | Heramed | 0.027 | 42% | 50% | -64% | $17,097,745 |

| OPT | Opthea | 0.585 | 41% | -1% | 51% | $720,190,351 |

| ATX | Amplia Therapeutics | 0.120 | 40% | 62% | 40% | $32,975,797 |

| NOX | Noxopharm | 0.096 | 39% | 19% | 167% | $28,054,843 |

| FRE | Firebrickpharma | 0.060 | 33% | 18% | -81% | $11,718,404 |

| ECS | ECS Botanics | 0.019 | 27% | -17% | -14% | $24,482,442 |

| VFX | Visionflex | 0.005 | 25% | -32% | -39% | $14,589,123 |

| PER | Percheron | 0.087 | 24% | 0% | 36% | $78,434,412 |

| IRX | Inhalerx | 0.031 | 24% | -24% | -31% | $5,882,776 |

| MYX | Mayne Pharma | 5.250 | 23% | -23% | 11% | $441,535,555 |

| REG | Regis Healthcare | 5.130 | 22% | 42% | 104% | $1,544,309,134 |

| ACL | Au Clinical Labs | 3.000 | 22% | 26% | 1% | $587,336,984 |

| RHT | Resonance Health | 0.064 | 21% | 16% | 16% | $28,601,147 |

| BP8 | Bph Global | 0.003 | 20% | -40% | -70% | $1,189,924 |

| AVE | Avecho Biotech | 0.003 | 20% | 0% | -57% | $9,507,891 |

| IMM | Immutep | 0.405 | 17% | 12% | 46% | $588,307,977 |

| IMU | Imugene | 0.062 | 17% | -48% | -6% | $433,605,604 |

| ZLD | Zelira Therapeutics | 0.700 | 17% | -18% | -36% | $7,943,009 |

| ONE | Oneview Healthcare | 0.400 | 16% | 18% | 86% | $270,046,205 |

| OCA | Oceania Healthc | 0.800 | 16% | 48% | 17% | $579,384,824 |

| COV | Cleo Diagnostics | 0.370 | 16% | 106% | 80% | $30,192,000 |

| CSX | Cleanspace | 0.490 | 15% | 42% | 63% | $37,915,461 |

| RHY | Rhythm Biosciences | 0.062 | 15% | -35% | -85% | $15,412,999 |

| NYR | Nyrada Inc. | 0.055 | 15% | -43% | 112% | $10,021,478 |

| HLS | Healius | 1.670 | 14% | 50% | -38% | $1,165,390,409 |

| FPH | Fisher & Paykel H. | 33.010 | 14% | 44% | 60% | $19,129,378,252 |

| SNT | Syntara | 0.034 | 13% | 48% | -21% | $43,875,652 |

| CU6 | Clarity Pharma | 7.230 | 13% | 150% | 591% | $2,280,077,114 |

| RMD | ResMed Inc. | 35.720 | 13% | 34% | 40% | $22,884,287,692 |

| TRP | Tissue Repair | 0.420 | 12% | 87% | 56% | $25,395,234 |

| ANN | Ansell | 29.830 | 10% | 25% | 25% | $4,322,860,806 |

| CTE | Cryosite | 0.800 | 10% | 38% | 34% | $39,047,650 |

| PME | Pro Medicus | 150.700 | 9% | 45% | 103% | $15,375,965,645 |

| TRJ | Trajan | 1.150 | 9% | 11% | -23% | $175,048,498 |

| SOM | SomnoMed | 0.435 | 9% | 41% | -23% | $94,007,090 |

| AHX | Apiam Animal Health | 0.400 | 8% | 7% | 11% | $72,575,645 |

| IDX | Integral Diagnostics | 2.600 | 8% | 18% | -14% | $617,659,672 |

| CUV | Clinuvel Pharmaceut. | 15.690 | 8% | 15% | -21% | $771,698,590 |

| NSB | Neuroscientific | 0.043 | 8% | -10% | -52% | $6,218,009 |

| DOC | Doctor Care Anywhere | 0.073 | 7% | 3% | 52% | $26,764,884 |

| PTX | Prescient | 0.044 | 7% | -6% | -43% | $35,434,071 |

| RGT | Argent Biopharma | 0.305 | 7% | -32% | -90% | $14,763,709 |

| EMV | Emvision Medical | 2.160 | 7% | -4% | 29% | $184,517,749 |

| BOT | Botanix Pharma | 0.400 | 7% | 135% | 100% | $724,015,115 |

| NAN | Nanosonics | 3.230 | 6% | 18% | -24% | $945,353,286 |

| RAD | Radiopharm | 0.037 | 6% | -43% | -59% | $76,930,798 |

| RCE | Recce Pharmaceutical | 0.495 | 5% | 10% | -27% | $114,646,617 |

| CAN | Cann | 0.040 | 5% | -35% | -68% | $18,680,246 |

| AGH | Althea | 0.020 | 5% | -43% | -50% | $8,106,649 |

| PEB | Pacific Edge | 0.082 | 5% | 3% | -15% | $66,577,110 |

| CAJ | Capitol Health | 0.315 | 5% | 15% | 47% | $335,804,962 |

| RAC | Race Oncology | 1.700 | 5% | 100% | 109% | $289,677,282 |

| ACR | Acrux | 0.065 | 5% | 12% | 35% | $18,896,596 |

| ILA | Island Pharma | 0.069 | 5% | -7% | 0% | $8,748,020 |

| SPL | Starpharma | 0.098 | 4% | -27% | -30% | $40,902,031 |

| SDI | SDI | 0.935 | 4% | 13% | 9% | $111,139,271 |

| UBI | Universal Biosensors | 0.145 | 4% | -4% | -36% | $43,219,778 |

| DXB | Dimerix | 0.450 | 3% | 100% | 543% | $247,798,418 |

| AGN | Argenica | 0.790 | 3% | 28% | 98% | $100,434,948 |

| AFP | Aft Pharmaceuticals | 2.870 | 3% | -7% | -15% | $300,966,166 |

| MSB | Mesoblast | 1.030 | 2% | 249% | 139% | $1,084,694,908 |

| AHC | Austco Healthcare | 0.215 | 2% | 20% | 27% | $77,565,198 |

| SHL | Sonic Healthcare | 27.680 | 2% | -7% | -14% | $13,379,250,648 |

| SNZ | Summerset Grp Hldgs | 10.000 | 0% | -2% | 8% | $2,356,139,770 |

| EBO | Ebos | 32.500 | 0% | -7% | -5% | $6,282,660,427 |

| CMP | Compumedics | 0.310 | 0% | -5% | 55% | $56,968,728 |

| OCC | Orthocell | 0.380 | 0% | -11% | -6% | $79,639,191 |

| AMT | Allegra Medical | 0.029 | 0% | 0% | -52% | $3,468,720 |

| AC8 | Auscann Grp Hlgs | 0.040 | 0% | 0% | 0% | $17,621,884 |

| PAB | Patrys | 0.007 | 0% | -30% | -22% | $14,402,131 |

| TD1 | Tali Digital | 0.001 | 0% | -33% | 0% | $3,295,156 |

| RSH | Respiri | 0.029 | 0% | 26% | -6% | $37,258,299 |

| MDC | Medlab Clinical | 6.600 | 0% | 0% | 0% | $15,071,113 |

| IMC | Immuron | 0.100 | 0% | 39% | 27% | $22,799,835 |

| EPN | Epsilon Healthcare | 0.024 | 0% | 0% | 9% | $7,208,496 |

| IXC | Invex Ther | 0.070 | 0% | -16% | 41% | $5,260,769 |

| ANR | Anatara Ls | 0.048 | 0% | 92% | 83% | $9,258,899 |

| AHI | Advanced Health | 0.092 | 0% | 0% | -57% | $22,733,170 |

| CSL | CSL | 307.160 | -1% | 7% | 13% | $148,808,012,841 |

| IME | Imexhs | 0.500 | -1% | -19% | -21% | $22,768,450 |

| NTI | Neurotech Intl | 0.069 | -1% | -37% | 38% | $70,213,613 |

| SIG | Sigma Health | 1.260 | -2% | 10% | 62% | $2,031,673,338 |

| GSS | Genetic Signatures | 0.750 | -3% | 34% | 65% | $169,929,122 |

| EBR | EBR Systems | 1.120 | -3% | 37% | 32% | $345,111,371 |

| FCG | Freedomcarehold | 0.140 | -3% | -18% | 0% | $3,343,747 |

| VLS | Vita Life Sciences.. | 2.190 | -4% | 2% | 45% | $123,514,375 |

| MVP | Medical Developments | 0.405 | -4% | -50% | -55% | $45,626,621 |

| TLX | Telix Pharmaceutical | 18.610 | -4% | 50% | 69% | $6,184,155,036 |

| BDX | Bcaldiagnostics | 0.125 | -4% | 39% | 25% | $44,724,339 |

| IIQ | Inoviq | 0.560 | -4% | -18% | -20% | $62,034,953 |

| PCK | Painchek | 0.038 | -5% | 19% | 27% | $62,161,508 |

| GTG | Genetic Technologies | 0.039 | -5% | -66% | -80% | $5,671,273 |

| LGP | Little Green Pharma | 0.092 | -5% | -29% | -47% | $27,761,976 |

| HXL | Hexima | 0.018 | -5% | 38% | -22% | $3,006,713 |

| MAP | Microbalifesciences | 0.180 | -5% | 0% | -47% | $80,613,356 |

| PAR | Paradigm Bio. | 0.245 | -6% | -30% | -62% | $85,700,023 |

| PSQ | Pacific Smiles Grp | 1.770 | -6% | 26% | 24% | $282,460,030 |

| PIQ | Proteomics Int Lab | 0.825 | -6% | -21% | -4% | $108,077,242 |

| AYA | Artrya | 0.290 | -6% | -21% | -12% | $22,824,158 |

| ALC | Alcidion | 0.072 | -6% | 44% | -40% | $96,658,072 |

| LBT | LBT Innovations | 0.014 | -7% | -13% | 8% | $22,831,009 |

| CTQ | Careteq | 0.014 | -7% | -39% | -44% | $3,319,662 |

| CDX | Cardiex | 0.055 | -7% | -29% | -58% | $16,179,601 |

| PAA | Pharmaust | 0.185 | -8% | -47% | 134% | $89,950,618 |

| RHC | Ramsay Health Care | 41.550 | -8% | -24% | -20% | $10,237,859,361 |

| SHG | Singular Health | 0.080 | -8% | -43% | 78% | $16,747,504 |

| DVL | Dorsavi | 0.011 | -8% | -27% | 0% | $7,367,535 |

| OSL | Oncosil Medical | 0.011 | -8% | 66% | 6% | $41,624,263 |

| ICR | Intelicare | 0.016 | -9% | -16% | 23% | $4,655,995 |

| AT1 | Atomo Diagnostics | 0.021 | -9% | -25% | -22% | $13,423,249 |

| PGC | Paragon Care | 0.410 | -9% | 100% | 95% | $678,675,209 |

| HGV | Hygrovest | 0.039 | -9% | -15% | -26% | $8,202,113 |

| PNV | Polynovo | 2.340 | -9% | 3% | 58% | $1,636,939,530 |

| OIL | Optiscan Imaging | 0.195 | -9% | 112% | 160% | $162,891,457 |

| NC6 | Nanollose | 0.019 | -10% | -21% | -67% | $3,268,121 |

| MVF | Monash IVF | 1.205 | -10% | -19% | -2% | $457,820,937 |

| VIT | Vitura Health | 0.083 | -10% | -41% | -78% | $47,797,524 |

| TRU | Truscreen | 0.017 | -11% | -15% | -24% | $9,394,049 |

| 1AI | Algorae Pharma | 0.008 | -11% | -20% | -43% | $13,499,158 |

| UCM | Uscom | 0.016 | -11% | -47% | -69% | $3,989,512 |

| HIQ | Hitiq | 0.016 | -11% | -30% | -16% | $5,629,519 |

| AVH | Avita Medical | 2.640 | -11% | -48% | -48% | $182,890,145 |

| VTI | Vision Tech Inc | 0.115 | -12% | -45% | -45% | $6,329,194 |

| ADR | Adherium | 0.015 | -12% | -63% | -77% | $11,378,699 |

| IMR | Imricor Med Sys | 0.510 | -12% | 2% | -15% | $128,715,205 |

| ALA | Arovella Therapeutic | 0.145 | -12% | -12% | 142% | $152,507,471 |

| EYE | Nova EYE Medical | 0.210 | -13% | 0% | 11% | $48,102,760 |

| CMB | Cambium Bio | 0.350 | -13% | -50% | -50% | $4,175,852 |

| ATH | Alterity Therap | 0.004 | -13% | -30% | -56% | $18,621,176 |

| COH | Cochlear | 300.370 | -13% | -14% | 10% | $19,418,725,216 |

| AVR | Anteris Technologies | 13.200 | -13% | -22% | -38% | $279,025,771 |

| CYC | Cyclopharm | 1.350 | -13% | -25% | -46% | $152,813,169 |

| LDX | Lumos Diagnostics | 0.045 | -13% | -38% | -59% | $21,658,810 |

| ARX | Aroa Biosurgery | 0.545 | -13% | -4% | -37% | $187,970,640 |

| 4DX | 4Dmedical | 0.440 | -14% | -34% | -32% | $180,633,712 |

| IVX | Invion | 0.003 | -14% | -33% | -50% | $19,913,597 |

| GLH | Global Health | 0.120 | -14% | 4% | -23% | $6,965,944 |

| IDT | IDT Australia | 0.115 | -15% | 30% | 82% | $49,402,588 |

| VBS | Vectus Biosystems | 0.080 | -16% | -68% | -80% | $4,256,842 |

| OSX | Osteopore | 0.042 | -16% | -48% | -78% | $4,853,148 |

| 1AD | Adalta | 0.021 | -16% | -9% | -5% | $12,508,094 |

| MDR | Medadvisor | 0.445 | -16% | 41% | 93% | $245,331,898 |

| M7T | Mach7 Tech | 0.530 | -17% | -20% | -30% | $127,857,755 |

| MEM | Memphasys | 0.009 | -18% | 0% | -32% | $12,444,733 |

| BIT | Biotron | 0.026 | -19% | -65% | -13% | $23,460,040 |

| CHM | Chimeric Therapeutic | 0.017 | -19% | -32% | -54% | $15,075,090 |

| CGS | Cogstate | 0.950 | -19% | -24% | -33% | $162,239,875 |

| NEU | Neuren Pharmaceut. | 15.590 | -20% | -19% | 20% | $1,944,076,432 |

| MX1 | Micro-X | 0.061 | -20% | -47% | -51% | $35,477,829 |

| NXS | Next Science | 0.210 | -21% | -33% | -68% | $61,353,649 |

| CVB | Curvebeam Ai | 0.180 | -21% | -7% | -60% | $54,970,439 |

| IPD | Impedimed | 0.048 | -21% | -42% | -73% | $97,108,508 |

| TRI | Trivarx | 0.024 | -23% | -27% | -20% | $10,968,928 |

| EMD | Emyria | 0.032 | -23% | -24% | -60% | $13,087,661 |

| CYP | Cynata Therapeutics | 0.195 | -25% | 5% | 50% | $35,207,498 |

| ENL | Enlitic Inc. | 0.092 | -29% | -86% | 0% | $7,241,918 |

| IBX | Imagion Biosys | 0.036 | -31% | -60% | -94% | $1,283,276 |

| ACW | Actinogen Medical | 0.045 | -39% | 38% | 83% | $122,030,028 |

| EOF | Ecofibre | 0.024 | -41% | -76% | -86% | $9,092,974 |

| ME1 | Melodiol Glb Health | 0.001 | -50% | -100% | -100% | $1,125,828 |

LTP has achieved a significant milestone with its erectile dysfunction treatment Spontan, as the first patients have started using it under the Therapeutic Goods Administration (TGA) Authorised Prescriber Scheme (APS).

This scheme allows for quicker access to the treatment, which is delivered as a nasal spray and acts within 10 minutes, offering an advantage over traditional oral tablets.

The APS enables more doctors to prescribe Spontan, making it more widely available to those who need it.

CBL said it is set to benefit significantly from a new Healthcare Common Procedure Coding System (HCPCS) code in the US that designates its NeuroNode device as reimbursable.

Starting October 1, the code will enable reimbursement of nearly US$4,300 for NeuroNode, which will enhance its accessibility and insurance coverage.

This development is expected to boost Control Bionics’ US operations and support the creation of a new wholesale distribution model.

The new code will also improve the device’s marketability and credibility, potentially increasing sales and expanding its reach within the healthcare sector.

NeuroNode is a medical device designed to assist individuals with severe speech and motor impairment.

Now read: CBL lifts on NeuroNode’s approval as reimbursable medical device in US

EZZ has reported record revenue of $66.4 million for FY24, marking a 78.9% increase from the previous year.

During the year, the company launched 21 new products and expanded its distribution channels, while maintaining a gross margin above 75%.

EZZ also saw a substantial rise in EBITDA, net profit after tax, and operating cash flow.

With a strong cash position and new strategic investments, EZZ said it was poised for further growth, including expansion into the US and Southeast Asian markets.

PYC has received approval to start human trials for its new drug, PYC-001, targeting Autosomal Dominant Optic Atrophy (ADOA), a rare eye disease.

The trials will begin this quarter in Australia, testing three different doses of PYC-001 in patients with ADOA. This follows PYC’s recent success with a drug for Retinitis Pigmentosa.

The study aims to assess safety and visual function improvements and will help design a larger study expected to start in 2026.

PYC-001 has already been granted Orphan Drug and Rare Pediatric Disease designations by the US FDA.

Additionally, the FDA has granted PYC a Rare Pediatric Disease designation for PYC-001.

Amplia jumped after providing an update on its ACCENT trial for advanced pancreatic cancer on August 21.

The trial, which tests a drug called narmafotinib combined with standard chemotherapy, has hit a major milestone.

Recently, a fifth patient in the trial showed a confirmed partial response, meaning their tumour size decreased by at least 30% and remained stable over two months, with no new tumours appearing.

The trial started with 26 patients, and the goal was to see at least six of them achieve this level of tumour reduction before expanding to a second group of 24 patients.

With five patients now meeting this target, only one more confirmed response is needed to proceed with the next phase of recruitment.

So far, the trial has observed a 38% response rate among the patients who were evaluated at the four-month mark.

Narmafotinib, Amplia’s leading drug, is a targeted therapy designed to inhibit a protein called FAK, which is often over-expressed in pancreatic cancer.

At Stockhead we tell it like it is. While LTR Pharma, Control Bionics and EZZ Life Science are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.