ASX Health Winners April: Mesoblast leads; and why the Health sector is just built different

What sets the health sector apart from the rest? Picture Getty

- ASX Health sector was in correction territory in April

- Why is the health sector different from other sectors?

- We look at the best performing ASX health stocks for the month

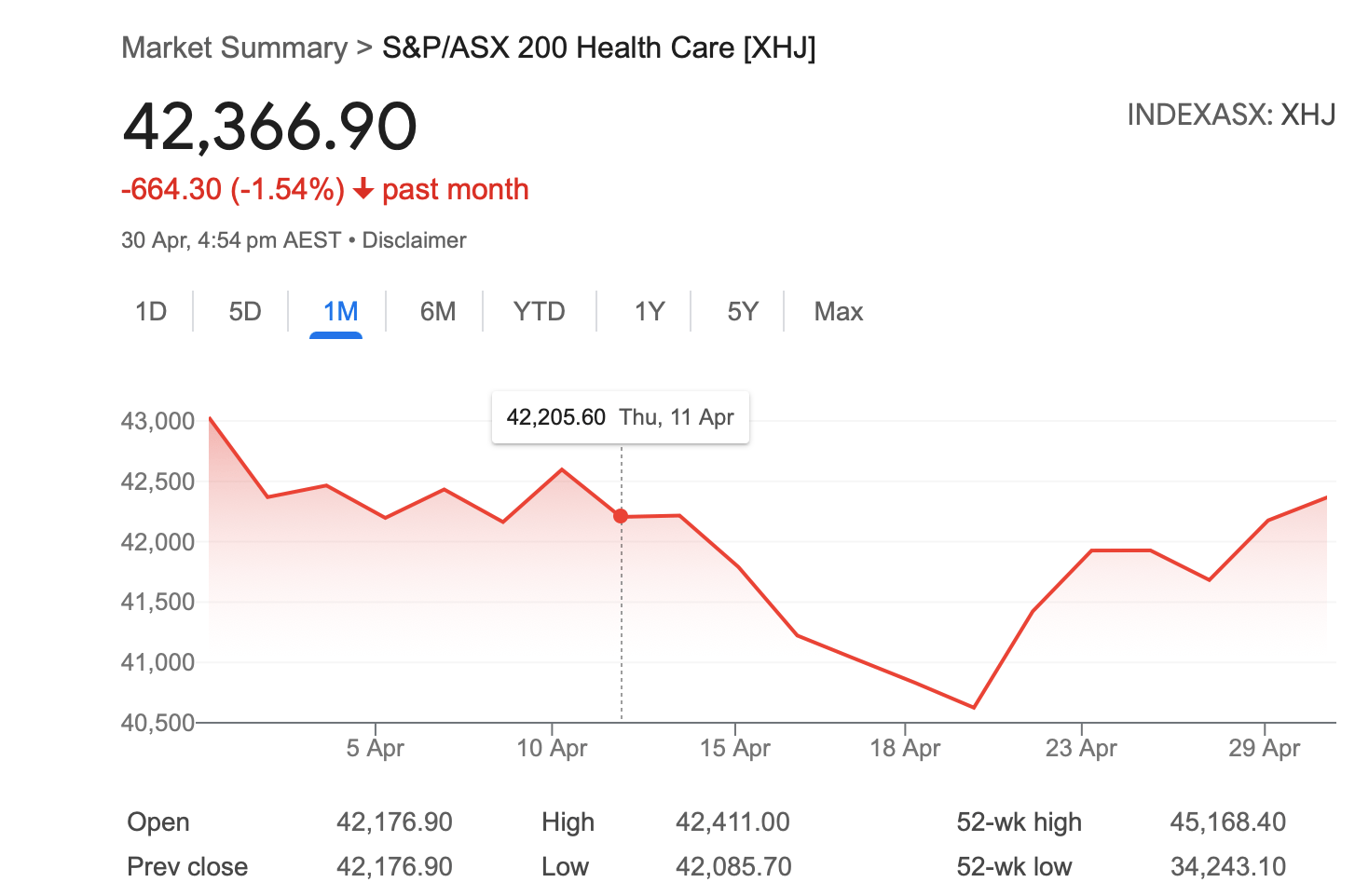

The S&P/ASX 200 Health Care [XHJ] had a soft month in April, finishing -1.54% lower. However, it still did better than the broader ASX200 index, which fell by almost -3%.

One of the things that often sets the Healthcare sector apart from the rest is the frequently wide gap between winning and losing stocks.

When some major technology stocks benefit, it seems to lift up the rest of the sector, but the environment is different for healthcare stocks.

“In the pharmaceutical space, all of the spoils tend to go to the winner and aren’t spread to the industry as a whole,” said Rob Hayworth at the US Bank Wealth Management.

“While drug and medical technology advancements might appear to be beneficial in raising revenues and earnings for the entire industry, the difference between the winners and losers in these situations can be striking,” he said.

That said, there is one tailwind that will always keep the sector at the forefront of the stock market – and that’s the constant emphasis placed on controlling healthcare costs for the public.

“The ageing of our population indicates a strong demand for healthcare services, but there are constraints on what can be delivered,” says Hayworth.

On that basis alone, listed healthcare companies that address the demand and lower the cost (through technology or otherwise) for healthcare products and services offer intriguing investment potential.

“Advancements in life-changing drugs and medical devices can significantly enhance our quality of life. They also create potential to generate new revenue and profits for innovative companies that deliver those products,” said Hayworth.

Here are the ASX Biotech Winners for April 2024

| Code | Name | Price | % Month Change | Market Cap |

|---|---|---|---|---|

| MSB | Mesoblast | 1.013 | 82% | $1,238,835,764 |

| CMB | Cambium Bio | 0.008 | 60% | $6,894,831 |

| RCE | Recce Pharmaceutical | 0.660 | 50% | $129,509,433 |

| EZZ | EZZ Life Science | 0.865 | 49% | $39,083,616 |

| ACR | Acrux | 0.068 | 42% | $17,733,728 |

| IDT | IDT Australia | 0.095 | 23% | $33,390,550 |

| OSX | Osteopore | 0.370 | 23% | $3,873,258 |

| CTE | Cryosite | 0.850 | 23% | $41,488,129 |

| ANR | Anatara Ls | 0.048 | 23% | $8,058,899 |

| EYE | Nova EYE Medical | 0.280 | 22% | $62,919,250 |

| FRE | Firebrickpharma | 0.059 | 18% | $10,399,791 |

| TLX | Telix Pharmaceutical | 15.145 | 17% | $5,125,286,185 |

| RHT | Resonance Health | 0.082 | 17% | $36,198,327 |

| PYC | PYC Therapeutics | 0.096 | 17% | $411,421,849 |

| EBR | EBR Systems | 0.935 | 17% | $294,226,196 |

| PSQ | Pacific Smiles Grp | 1.870 | 17% | $298,418,224 |

| RSH | Respiri | 0.032 | 14% | $37,095,412 |

| IMM | Immutep | 0.433 | 14% | $529,031,379 |

| IDX | Integral Diagnostics | 2.525 | 12% | $591,923,852 |

| AYA | Artrya | 0.330 | 12% | $24,398,238 |

| OIL | Optiscan Imaging | 0.085 | 12% | $71,003,968 |

| DXB | Dimerix | 0.335 | 12% | $186,864,813 |

| AHX | Apiam Animal Health | 0.400 | 11% | $73,482,841 |

| ATH | Alterity Therap | 0.006 | 10% | $31,470,692 |

| ACW | Actinogen Medical | 0.035 | 9% | $74,461,463 |

| FPH | Fisher & Paykel H. | 25.820 | 9% | $14,827,244,481 |

| TRP | Tissue Repair | 0.240 | 9% | $13,952,003 |

| RMD | ResMed Inc. | 32.870 | 9% | $20,226,509,777 |

| COV | Cleo Diagnostics | 0.185 | 9% | $13,708,500 |

| CYP | Cynata Therapeutics | 0.205 | 8% | $37,722,675 |

| PME | Pro Medicus | 111.920 | 8% | $11,659,038,075 |

| 1AD | Adalta | 0.029 | 7% | $14,223,980 |

| MDR | Medadvisor | 0.295 | 7% | $162,295,983 |

| ALC | Alcidion Group | 0.054 | 6% | $73,836,027 |

| NAN | Nanosonics | 2.905 | 6% | $884,698,630 |

| CUV | Clinuvel Pharmaceut. | 15.080 | 5% | $767,589,680 |

| PGC | Paragon Care | 0.325 | 5% | $227,075,181 |

| CSX | Cleanspace Holdings | 0.330 | 5% | $25,521,359 |

| GLH | Global Health | 0.120 | 4% | $6,675,697 |

| HIQ | Hitiq | 0.026 | 4% | $9,147,969 |

| SPL | Starpharma Holdings | 0.130 | 4% | $55,625,484 |

| CGS | Cogstate | 1.400 | 4% | $239,129,963 |

| ANN | Ansell | 25.450 | 4% | $3,624,971,895 |

| CHM | Chimeric Therapeutic | 0.031 | 3% | $25,553,736 |

| AHC | Austco Healthcare | 0.190 | 3% | $56,615,159 |

| CU6 | Clarity Pharma | 2.820 | 3% | $795,595,136 |

| NSB | Neuroscientific | 0.048 | 2% | $7,519,453 |

| M7T | Mach7 Tech | 0.730 | 2% | $173,693,554 |

| CAJ | Capitol Health | 0.245 | 2% | $255,851,400 |

| MVF | Monash IVF Group | 1.468 | 2% | $570,815,041 |

| IBX | Imagion Biosys | 0.074 | 1% | $2,415,845 |

| PEB | Pacific Edge | 0.076 | 1% | $61,656,622 |

| EBO | Ebos Group | 31.930 | 1% | $6,187,291,074 |

| SDI | SDI | 0.855 | 1% | $105,790,322 |

| VHT | Volpara Health Tech | 1.140 | 0% | $289,986,711 |

| AFP | Aft Pharmaceuticals | 2.770 | 0% | $290,479,540 |

| 1AI | Algorae Pharma | 0.010 | 0% | $18,560,868 |

| AC8 | Auscann Grp Hlgs | 0.040 | 0% | $17,621,884 |

| AHI | Advanced Health | 0.092 | 0% | $22,600,111 |

| AMT | Allegra Medical | 0.029 | 0% | $3,468,720 |

| AT1 | Atomo Diagnostics | 0.031 | 0% | $19,815,272 |

| CAN | Cann Group | 0.062 | 0% | $27,123,891 |

| EPN | Epsilon Healthcare | 0.024 | 0% | $7,208,496 |

| JTL | Jayex Technology | 0.005 | 0% | $1,406,393 |

| MDC | Medlab Clinical | 6.600 | 0% | $15,071,113 |

| NOX | Noxopharm | 0.067 | 0% | $19,287,705 |

| OCC | Orthocell | 0.390 | 0% | $79,544,191 |

| OSL | Oncosil Medical | 0.005 | 0% | $11,277,706 |

| PAB | Patrys | 0.009 | 0% | $18,517,026 |

| RGT | Argent Biopharma | 0.410 | 0% | $18,791,284 |

| TD1 | Tali Digital | 0.002 | 0% | $4,942,733 |

| VFX | Visionflex Group | 0.007 | 0% | $9,918,938 |

| SNZ | Summerset Grp Hldgs | 10.470 | 0% | $2,466,878,339 |

| PBP | Probiotec | 2.870 | -1% | $231,771,707 |

| CYC | Cyclopharm | 1.775 | -1% | $165,773,993 |

| REG | Regis Healthcare | 3.955 | -1% | $1,204,139,676 |

| IME | Imexhs | 0.570 | -2% | $25,956,033 |

| VBS | Vectus Biosystems | 0.250 | -2% | $14,632,574 |

| GSS | Genetic Signatures | 0.665 | -2% | $130,537,849 |

| SIG | Sigma Health | 1.263 | -3% | $2,121,425,976 |

| ZLD | Zelira Therapeutics | 0.680 | -3% | $8,113,216 |

| NXS | Next Science | 0.315 | -3% | $90,425,482 |

| MYX | Mayne Pharma | 7.010 | -3% | $604,878,188 |

| UCM | Uscom | 0.030 | -3% | $7,337,628 |

| COH | Cochlear | 325.790 | -3% | $21,208,952,460 |

| CMP | Compumedics | 0.260 | -4% | $46,062,366 |

| TRJ | Trajan Group Holding | 1.035 | -4% | $159,826,889 |

| CSL | CSL | 276.770 | -4% | $132,894,500,475 |

| NYR | Nyrada Inc. | 0.095 | -4% | $17,043,827 |

| BOT | Botanix Pharma | 0.215 | -4% | $346,530,204 |

| PTX | Prescient | 0.052 | -5% | $41,876,629 |

| IXC | Invex Ther | 0.080 | -6% | $6,012,308 |

| OCA | Oceania Healthc | 0.540 | -6% | $392,752,441 |

| HGV | Hygrovest | 0.046 | -6% | $9,674,288 |

| PCK | Painchek | 0.030 | -6% | $50,710,704 |

| PNV | Polynovo | 2.050 | -6% | $1,414,977,140 |

| AVR | Anteris Technologies | 21.900 | -7% | $422,819,055 |

| 4DX | 4Dmedical | 0.605 | -7% | $240,701,569 |

| ENL | Enlitic Inc. | 0.600 | -8% | $47,171,669 |

| ICR | Intelicare Holdings | 0.012 | -8% | $3,052,718 |

| RHC | Ramsay Health Care | 52.140 | -8% | $12,062,109,885 |

| PIQ | Proteomics Int Lab | 1.060 | -8% | $140,709,562 |

| HXL | Hexima | 0.011 | -8% | $1,837,436 |

| IPD | Impedimed | 0.084 | -9% | $180,055,359 |

| LTP | Ltr Pharma | 0.260 | -9% | $19,009,482 |

| SHL | Sonic Healthcare | 26.805 | -9% | $12,855,610,317 |

| ARX | Aroa Biosurgery | 0.505 | -9% | $166,940,799 |

| NC6 | Nanollose | 0.020 | -9% | $3,612,134 |

| ACL | Au Clinical Labs | 2.445 | -9% | $494,493,337 |

| ONE | Oneview Healthcare | 0.295 | -9% | $205,658,954 |

| HLS | Healius | 1.203 | -9% | $885,841,930 |

| NEU | Neuren Pharmaceut. | 19.250 | -9% | $2,458,141,763 |

| TRU | Truscreen | 0.019 | -10% | $10,499,231 |

| VLS | Vita Life Sciences.. | 2.170 | -10% | $122,636,378 |

| TRI | Trivarx | 0.026 | -10% | $8,800,446 |

| CBL | Control Bionics | 0.043 | -10% | $7,339,306 |

| RAC | Race Oncology | 1.270 | -11% | $216,016,984 |

| IMR | Imricor Med Sys | 0.500 | -11% | $99,250,542 |

| LGP | Little Green Pharma | 0.125 | -11% | $39,228,879 |

| ILA | Island Pharma | 0.053 | -12% | $6,372,612 |

| MAP | Microbalifesciences | 0.185 | -12% | $82,852,616 |

| AGN | Argenica | 0.590 | -12% | $66,321,583 |

| CVB | Curvebeam Ai | 0.180 | -12% | $36,065,599 |

| BDX | Bcaldiagnostics | 0.092 | -12% | $23,211,114 |

| HMD | Heramed | 0.018 | -13% | $6,181,872 |

| FCG | Freedomcaregrouphold | 0.170 | -13% | $4,299,104 |

| AGH | Althea Group | 0.027 | -13% | $12,159,973 |

| SHG | Singular Health | 0.100 | -13% | $19,339,952 |

| DVL | Dorsavi | 0.013 | -13% | $7,756,601 |

| DOC | Doctor Care Anywhere | 0.063 | -14% | $22,731,819 |

| IMC | Immuron | 0.099 | -14% | $22,799,835 |

| GTG | Genetic Technologies | 0.120 | -14% | $15,204,983 |

| RHY | Rhythm Biosciences | 0.081 | -15% | $19,924,547 |

| PER | Percheron | 0.070 | -16% | $64,911,238 |

| ECS | ECS Botanics Holding | 0.021 | -16% | $27,059,541 |

| EMV | Emvision Medical | 2.155 | -16% | $179,392,256 |

| OPT | Opthea | 0.620 | -16% | $424,197,526 |

| BMT | Beamtree Holdings | 0.180 | -16% | $50,311,541 |

| IVX | Invion | 0.005 | -17% | $32,122,661 |

| LBT | LBT Innovations | 0.020 | -17% | $28,134,044 |

| EMD | Emyria | 0.049 | -17% | $18,698,099 |

| ATX | Amplia Therapeutics | 0.062 | -17% | $11,834,390 |

| IMU | Imugene | 0.087 | -18% | $600,224,486 |

| UBI | Universal Biosensors | 0.155 | -18% | $35,867,119 |

| LDX | Lumos Diagnostics | 0.050 | -18% | $25,509,266 |

| NTI | Neurotech Intl | 0.089 | -19% | $91,564,973 |

| MVP | Medical Developments | 0.485 | -19% | $45,741,766 |

| RAD | Radiopharm | 0.045 | -20% | $20,330,803 |

| IIQ | Inoviq | 0.490 | -20% | $48,769,912 |

| ALA | Arovella Therapeutic | 0.120 | -20% | $126,018,748 |

| MEM | Memphasys | 0.008 | -20% | $12,309,680 |

| PAR | Paradigm Bio. | 0.275 | -20% | $89,197,964 |

| CTQ | Careteq | 0.014 | -22% | $3,297,662 |

| SNT | Syntara | 0.016 | -24% | $17,909,152 |

| MX1 | Micro-X | 0.090 | -25% | $52,068,189 |

| SOM | SomnoMed | 0.210 | -30% | $29,256,769 |

| AVE | Avecho Biotech | 0.004 | -30% | $12,677,188 |

| CDX | Cardiex | 0.053 | -30% | $17,356,300 |

| BIT | Biotron | 0.056 | -31% | $50,527,428 |

| VIT | Vitura Health | 0.125 | -32% | $66,225,486 |

| BP8 | Bph Global | 0.001 | -33% | $1,954,116 |

| EOF | Ecofibre | 0.060 | -33% | $23,490,182 |

| IRX | Inhalerx | 0.032 | -36% | $6,072,543 |

| VTI | Vision Tech Inc | 0.115 | -36% | $6,023,147 |

| ME1 | Melodiol Glb Health | 0.003 | -40% | $2,020,462 |

| PAA | Pharmaust | 0.225 | -40% | $96,778,349 |

| AVH | Avita Medical | 2.680 | -46% | $162,525,744 |

| ADR | Adherium | 0.022 | -48% | $7,480,880 |

Mesoblast jumped higher after announcing that the US FDA has informed the company that following additional consideration, the available clinical data from its Phase 3 study MSB-GVHD001 appears sufficient to support its submission.

Mesoblast has previously submitted to the FDA a proposed Biologics License Application (BLA) for remestemcel-L for treatment of pediatric patients with steroid-refractory acute graft versus host disease (SR-aGVHD).

Mesoblast now intends to file the resubmission during the next quarter, seeking to address all remaining product characterisation issues.

Separately, MSB announced that Joseph R. Swedish has resigned as chairman but will remain on the board until completion of his term at the Annual General Meeting later this year.

The board has unanimously appointed Jane Bell AM to the role of non-executive chair effective 30 April.

Recce has been rising after announcing that an independent Safety Committee has unanimously cleared an increase of Recce327 (R327) to 4000mg (IV) over a fast infusion of 30 minutes.

The approval came after the company has previously tested dosing at 3000mg at multiple infusion times; 15 mins, 20 mins, 30 mins, 45 mins, and 1 hour.

Recce has now identified 30 minutes as the potential optimum infusion time for 4000mg, as the company investigates R327’s high concentration potential.

R327 is one of Recce’s anti-infective pipelines used as an intravenous and topical therapy being developed for the treatment of serious and potentially life-threatening infections.

The drug is currently being studied in the ongoing Phase I/II study of the IV formulation in healthy volunteers and in patients with uncomplicated or recurrent urinary tract infections (UTIs).

In a parallel clinical program, R327 applied topically against diabetic foot ulcer infections recently demonstrated its efficacious potential against a broad range of antibiotic-resistant infections.

The potential of R327 via IV administration will now be made available at the completion of this human clinical trial in line with study protocol.

The genomic life science company has reported receipts from customers of $23.6m for Q3 FY24, up 111% on the prior corresponding period, as it launches four new EZZ health and wellness products.

The company’s operating cash flows remained positive at $2.04m, representing a 372% increase from the last quarter.

EZZ also recorded a 15% increase in cash balance over the previous quarter to $14.5m at March 31, 2024, with no debt.

Acrux jumped massively after announcing the launch of its generic of Dapsone 5% Gel in the United States.

Dapsone 5% Gel is a prescription medicine used on the skin (topical) to treat acne vulgaris. It helps decrease the number and severity of acne pimples, and helps pimples that do develop to heal more quickly.

Dapsone is an antibiotic. According to data from IQVIA, annual market sales for Dapsone 5% Gel products exceed US$15 million.

A generic of topical acne treatment, Aczone, it was approved by the FDA in June 2023.

IDT rose after reporting continued strong growth across all its three business pillars in Q3 – namely Advanced Therapies, Specialty Orals, and API Manufacturing.

IDT’s Advanced Therapies segment focuses on Messenger RNA (or mRNA) research, where it has a partnership with Sanofi Australia.

The Specialty Orals division specialises in the solid dose oral forms as well as liquid dose oral forms of drugs – providing comprehensive support for pre-clinical and clinical studies ranging from Phase I to Phase III, as well as commercial supply.

The API (active pharmaceutical ingredients) Manufacturing segment meanwhile is an Australian leader in synthesising APIs and their intermediates, to supply finished-dose medicines for both local and global markets.

Total unaudited revenue for the quarter was $3.2m, up 48% on the pcp.

Unaudited group revenue in the first three quarters of FY24 has now reached $8.9m, exceeding the full revenue in FY23 by 27%, with a quarter remaining.

IDT also says sales growth and positive momentum is expected to continue.

Total unaudited revenue for the quarter was $3.2m, up 48% on the pcp.

Unaudited group revenue in the first three quarters of FY24 has now reached $8.9m, exceeding the full revenue in FY23 by 27%, with a quarter remaining.

IDT also says sales growth and positive momentum is expected to continue.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.