ADX Energy eyes thicker target areas at Anshof-2 to significantly increase 2P reserves and oil production

Pic via Getty Images.

- Anshof-2 spudding planned for 11 November with commencement of rig-up

- ADX drilling targeting thicker mapped sands could result in a significant 300bpd increase to proven 2P reserves

- Increased interest in the well has been obtained

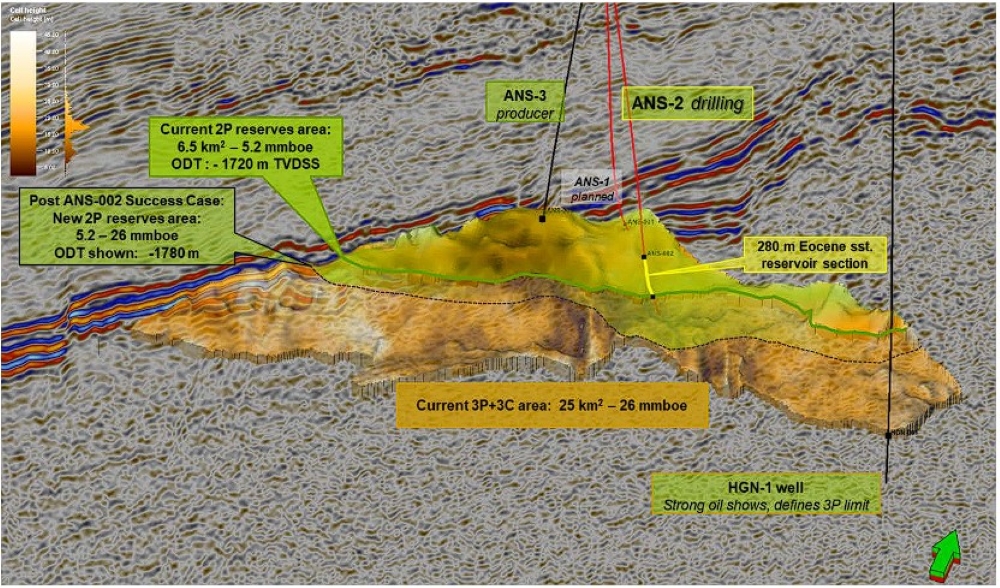

Special Report: ADX Energy is nearing the spud date of its Anshof-2 well at the Anshof field expecting to both increase proven and probable (2P) reserves and increase oil production by about 300 barrels of oil per day (bopd).

ADX Energy (ASX:ADX) has a 50% interest in the 5.2 million barrel gross equivalent (MMBOE) Anshof discovery area in an agreed farm-in deal with MND Austria, a partnership that will aid in funding, accelerate further development and complete the tie-in of the Anshof-2 and the subsequent Anshof-1 wells. The value of the deal to ADX for the 30% interest in the project is A$19 million in cash payments, project funding and success payments if the Anshof-2 well meets its production objectives.

Increased production capacity

While the Anshof-3 discovery well has produced at approximately ~120bpd since October 2022, ADX says a successful well at Anshof-2 is expected to encounter oil-filled reservoirs at the planned reservoir intersection and extend the field 2P reserves base, which currently sits at 5.2MMboe towards the large audited 3P and 3C upside potential of 26 MMBOE.

It is also expected to contribute about 300bpd to field production with well ultimate recovery of approximately 0.8 million barrels.

ADX is targeting thicker mapped sands with a high-angle well ~80m down dip of and ~1.8km southeast from the crestal Anshof-3 discovery. The drilling rig is being assembled with a plan spud date on November 11.

Meanwhile the mobilisation of the Anshof field’s permanent production facilities (PPF) will begin after the drilling of Anshof-2 and is expected to be installed in January next year and commissioned the following month.

The PPF will have a total capacity of 3,000bpd, providing ample capacity to rapidly scale up field development – including the Anshof-1 well which is planned for Q2 next year.

ADX exposure to production and reseves of the well has gotten bigger too since previous partner Xstate Resources (ASX:XST) has chosen not to participate in the Anshof-2 well, which has enabled ADX to increase its economic interest.

ADX and MND will now share XST’s share of Anshof-2 well costs on a 50:50 basis, and obtaining 60% and 40% share of production respectively – unless XST opts to buy back in, however it would have to do so at a 400% premium to well costs.

ADX executive chairman Ian Tchacos says the board is pleased with the commencement of drilling operations on the Anshof-2 well.

“The well is an important milestone for the Anshof project and provides ADX with the opportunity to establish a large reserves base as well as a potentially large increase in oil production rate,” Tchacos says.

“A successful well at Anshof-2 may provide the reserves base for a multi-well development with a potentially large build-up in production rate and cashflow.

“It is particularly pleasing for ADX shareholders that the Company’s share of well costs will be funded by the Anshof Investment Agreement with MND.

“The non-participation of XST in the Anshof-2 well allows ADX to increase its interest in the well alongside our new partner MND.”

Meanwhile, ADX said it expects to receive an environmental clearance from Austria shortly, for the Welchau Gas Prospect.

The environmental clearance is the last regulatory requirement to commence operations on the project.

Upon receipt of the environmental clearance, ADX will commence drill site construction and plans to commence Welchau-1 drilling operations during December follow the Anshof-2 well.

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.