Premium-grade potash stocks are growing nicely on low crop yields, strong Chinese demand

Picture: Getty Images

Australia currently relies on other countries to fulfil its potash supply requirements, but it is on the cusp of becoming a producer itself with several ASX-listed companies vying for first place.

Like in many other markets, China currently controls the supply of the higher value sulphate of potash (SOP) product, which is becoming more sought after than its muriate of potash (MOP) counterpart.

Thanks to the rise in demand for organic foods and sustainable and environmentally friendly (not to mention human-friendly) production, SOP is expected to witness higher growth than MOP in the coming years. It also fetches a much higher price on market.

SOP provides both potassium and sulphur – key elements required for the healthy growth of plants – in a soluble form.

But it also contains no chloride, making it suitable for leafy, chloride-intolerant crops that are typically high-value – such as avocados, increases their yield and minimises the amount of water required.

Salinity is also an issue for Western Australia in particular, with more than 1 million hectares of agricultural land being severely affected by salt, resulting in lost agricultural productivity of at least $519m per year.

But SOP helps solve that problem because it can be used in soils that have high salinity or where the irrigation water may have high chloride levels.

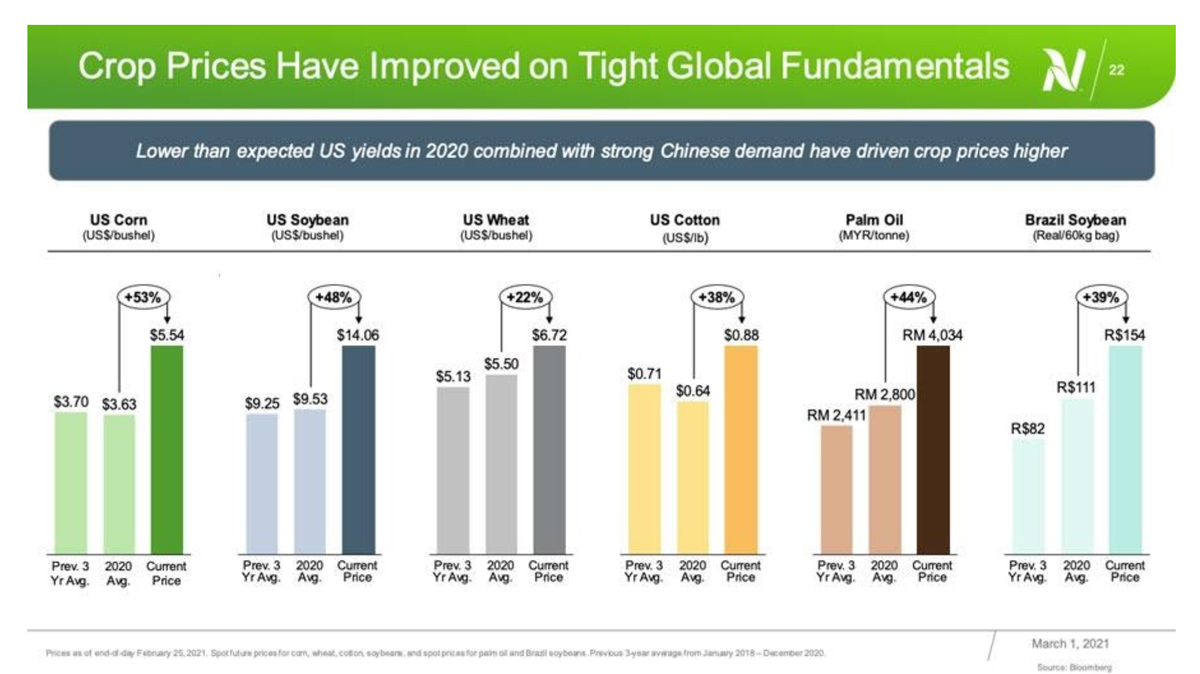

According to Canada-headquartered Nutrien, the world’s largest potash producer, the market has been driven up by higher crop prices, thanks to lower-than-expected yields in the US coupled with strong Chinese demand.

This means more money in farmers’ pockets for the necessary supplies they need, including fertiliser.

The price of corn jumped the most (53 per cent), with China in particular demanding more to replenish its swine herd that was wiped out in 2018 by the African Swine Fever outbreak.

Argus Media estimates global demand will grow 12 per cent over the next decade from 6.6 million tonnes to 7.4 million tonnes.

Making cheaper potash than China

There are several potash projects in the pipeline in Western Australia that will give China a run for its money when it comes to producing lower cost SOP.

China uses the much more resource intensive, and therefore higher cost, Mannheim method, which utilises the reaction of potassium chloride with sulphuric acid at high temperatures to produce SOP.

WA, however, can make good use of its abundance of sunshine to produce SOP via the more environmentally friendly and cheaper solar evaporation of brine and salt reaction methods.

Kalium Lakes (ASX:KLL), for example, estimates it will be able to establish a low-cost, high-margin, long life operation producing SOP at an all-in sustaining cost of just $US200 ($258) a tonne, which would place the operation in the lowest quartile.

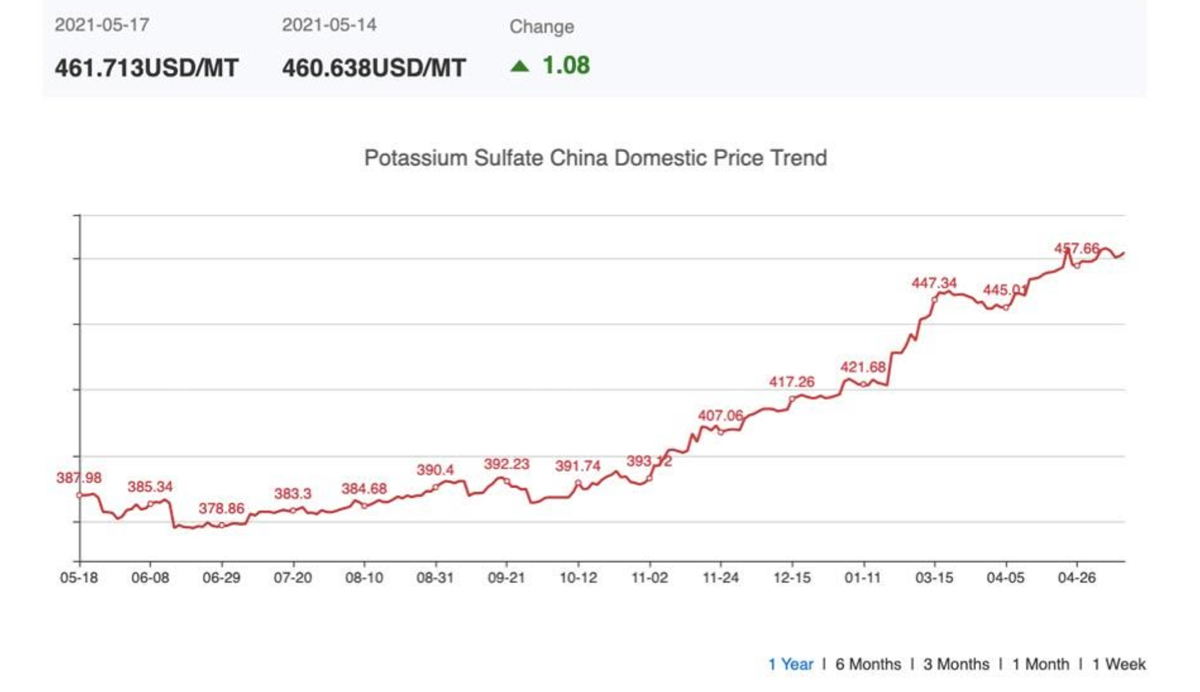

According to Hong Kong-headquartered chemical supply chain service Echemi Group, the Chinese domestic price of SOP hit nearly $US462 a tonne this week, up from $378 a tonne in mid-June last year.

Kalium last week announced it had completed the commissioning of the power station for its Beyondie SOP project in WA, with plant commissioning due to start in the next few weeks.

The project has more than 30 years of reserves and is on track to start commercial production in September this year. The company expects to initially produce around 100,000 tonnes per annum of SOP by mid-2022 before scaling up to 120,000 tonnes per annum.

Kalium’s stage one production is already tied up in a 10-year offtake deal with German fertiliser heavyweight K+S, which currently supplies more than 60 per cent of the Australian and New Zealand SOP markets.

“As a primary producer of SOP, Kalium will become a lowest quartile SOP producer and through their offtake agreement with K+S, focus on distributing the largest portion of their production in the Australian and New Zealand markets, supporting the local agricultural industry,” CEO Rudolph van Niekerk told Stockhead.

“Kalium has a significant resource base outside of its initial production areas and is strategically working on maximising production over the next few years as a second stage of their Byondie SOP Project.”

Salt Lake Potash (ASX:SO4), meanwhile, is the closest to production having started the commissioning of the process plant at its Lake Way project in WA.

First SOP production is slated to begin during the June quarter. The company is targeting a staged ramp up to 245,000 tonnes per annum by the fourth quarter of fiscal 2022.

Indicating the high demand for long-term SOP supply, Salt Lake has secured binding five-year and 10-year offtake deals for 224,000 tonnes each year with big fertiliser suppliers in the Americas, Europe, Middle East, Africa and Asia.

Investors getting behind potash plays

In the past year, the share prices of SOP players have been climbing. Kalium Lakes is up over 70 per cent since June last year and is trading around 21.5c.

But Macquarie analysts see plenty more upside, placing a 12-month share price target of 43c – an 8 per cent hike on their previous target – and an “outperform” rating on the company.

“Continuing to deliver Beyondie to schedule and budget is key to realising the long-term value we believe the project has to offer,” analysts Andrew Bowler, Hayden Bairstow and Jon Scholtz said in a March research report.

“Unlocking further capacity beyond 100ktpa could provide upside to our base case.”

Australian Potash (ASX:APC), which is advancing its Lake Wells potash project in WA, is also on the march, rising nearly 244 per cent from a 52-week low of 4.8c in June last year.

Prominent WA mining personality Mark Creasy recently increased his stake to nearly 8 per cent, making him the largest backer of the company. (When Creasy goes all in you know it’s going to be good!)

All of Australian Potash’s proposed 150,000 tonnes per annum of production is locked up in agreements for distribution across Europe, Asia, Australia, New Zealand and the US.

During the March quarter, the company received European organic certification for its K-Brite SOP products.

Australian Potash said having organic certification opened up premium markets across the globe that demanded environmentally friendly inputs.

The European Union wants 25 per cent of its agricultural area to be organic farmland by 2030, up from 7.7 per cent currently.

BCI Minerals (ASX:BCI) is also well off its bottom of 14c – reached in mid-May last year. The share price has surged 218 per cent to 44.5c as the company moves its Mardie salt and potash mine towards production.

BCI envisages Mardie will produce 5.35 million tonnes of salt and 140,000 tonnes of SOP each year when it’s operational.

Around $60m worth of work to provide key infrastructure to accelerate the Mardie development is underway. Mardie has been assigned “Major Project Status” from the Australian government and is so far the project to have received the largest sum of Northern Australia Infrastructure Facility funding of $450m.

BCI has negotiated two non-binding memoranda of understandings covering 80 per cent of the first three years of SOP production from Mardie. The company is also in talks with several other end-users to secure further offtake deals for future production.

Agrimin (ASX:AMN) shares have climbed from their 52-week low of 32c to 53c, notching a gain of nearly 66 per cent.

The company last week awarded the front-end engineering design contract for the process plant at its Mackay potash project in WA to Primero Group.

Agrimin says the project will be the world’s lowest cost producer of SOP with a forecast total cash cost of $US159 per tonne.

The company is targeting 450,000 tonnes per annum of production from the Mackay project, which has an initial mine life of 40 years.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.