World gone mad: UBS dumping on Pilbara Minerals, warms to Magellan

Pic:Getty Images

- In some good news for embattled Magellan, it’s been taken off UBS least preferred stock list

- Strongly performing lithium mining giant Pilbara Minerals is on the UBS least preferred stock list

- Seneca Investment reckons signs are good for continued long term growth of Pilbara Minerals

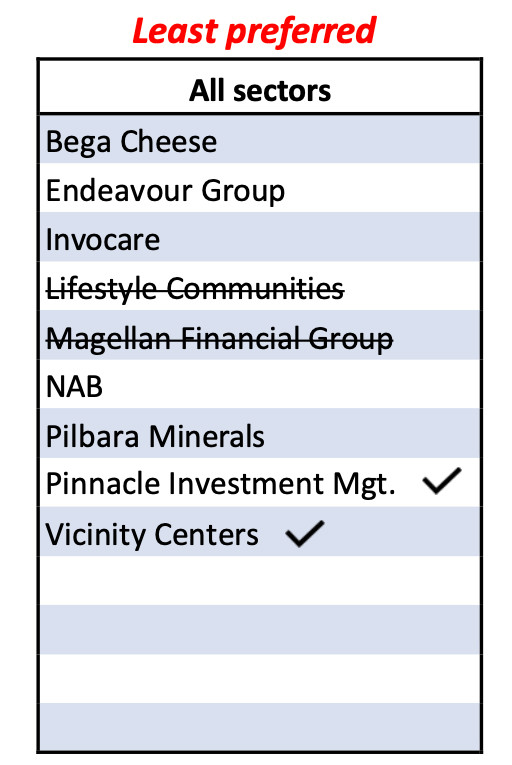

Yes, you read that right. Embattled fundie Magellan Financial Group (ASX:MFG) is no longer on the UBS Australia least preferred stock list but lithium miner Pilbara Minerals (ASX:PLS) is still in the bad books.

In the latest report from UBS equity strategist, Richard Schellbach didn’t provide much reasoning for removing MFG but also added another fund manager, Pinnacle Investment Management (ASX:PNI).

“Also on the least preferred list, we remove Magellan and add Pinnacle Investment Management, where we see a similar theme of FUM outflow and reduced performance fees playing out over coming quarters,” Shellbach wrote.

And his reasoning for PLS?

“Lower relative margins in the medium-long term creates headwinds,” Shellbach wrote.

“This is driven by higher AISC and lower price realisation.

“We see better value in other lithium names.”

Shellbach’s view on PLS comes as the company recorded a cash build of $851.1 million, or $9.25m for each of the 92 days in the December quarter, with its bank balance rising 62% to $2.26 billion.

And while on the least preferred list, the multinational investment bank isn’t completely down on PLS. As Stockhead’s Josh Chiat reported last week, UBS analysts led by Lachlan Shaw are also in the corner of ASX lithium stocks, upgrading spodumene and chemical prices by up to 50% over its forward estimates.

UBS had upgraded the stock from a Sell to Neutral with a 38% lift in price target from $3.40 to $4.70.

The PLS share price has risen 77% in the past six months and 33% in the past month, as lithium plays have recorded a solid start to 2023 and back to near all time highs.

The PLS share price today:

Magellan’s fall from market darling

Leadership turmoil and a lack of both retail and institutional investor confidence took a toll on the former market darling MFG in 2022 as funds under management (FUM) were cut in half in 2022 finishing December down to $45.3 billion.

MFG has been embroiled in controversy since the lead-up to the departure of its co-founder Hamish Douglass in March, and has not reported a period of net inflows to its FUM since FY21.

Stockhead’s Christian Edwards wrote the rundown on MFG’s fall from market darling, which has seen its market cap sink below $2 billion – a more than 80% reduction on July 2020 market cap of $10 billion.

Appointed as MFG’s chief executive in May 2022, David George has big ambitions to get the under-pressure fund back to its glory days.

And while off to a positive 2023 with ~3% rise in the past month, the MFG share price is still down 38% in the past six months.

The MFG Share price today:

From rooster to feather duster

Seneca’s investment analyst Ben Richards said MFG traded on a valuation of 30x P/E in the not too distant past.

“After a 58% fall in the share price in 2022, clients have been asking us recently if now is the time to buy MFG shares,” he said.

Richards said funds management businesses like MFG generate revenue from management and performance fees.

He said therefore, profitability is a function of assets total under management and fund performance.

“Good performance tends to encourage inflows so both types of fees increase for the fund manager, creating a positive feedback loop of profitability,” he said.

“However, in periods of poor performance the opposite is true, as outflows and lack of performance fees detract from the bottom line.

“Magellan’s unfortunate cocktail of poor performance, loss of key staff, and significant investor outflows has seen the operating leverage that was once seen as Magellan’s great strength turn into their biggest weakness.”

Richards said as their business was built on the back of Australian financial planners, these outflows are likely to continue, as many financial planners may only review client investments every 12 months.

“While some negativity appears to have been built into the share price now, funds management outflow cycles can be akin to death by a thousand cuts,” he said.

Richards said MGF’s upcycle of fund inflows lasted many years, so investors shouldn’t expect a quick recovery now that the tide has turned.

“Valuable stakes in investment bank upstart Barrenjoey and clearing house business Finclear should not be overlooked,” he said.

“However, these are tricky businesses that wouldn’t attract the same lofty multiple that the Magellan of old enjoyed.”

He said the key to moving the needle for MFG shares remains the core funds management business.

“A brand such as Magellan’s may have some strategic value, but betting on a takeover for an otherwise declining business is not a prudent strategy.”

Seneca increases position in PLS

Richards said after recently increasing its position in PLS, Seneca was pleased to see a strong December quarter production report.

“Pilbara expects to pay out a maiden dividend on the back of its FY23 results, with the company committing to pay out 20-30% of free cashflow to shareholders,” he said.

“The cashflow PLS is currently generating will be used to fund the continued expansion of their lithium operations from 330ktpa to 1Mtpa, which we think has not been factored into the share price.

“Irrespective of the short term lithium price movements, we think the longer term trend as a result of the well-documented electric vehicle demand remains supportive.”

What’s the take on Pinnacle Investment?

Cyan Investment Management director and portfolio manager Dean Fergie said the worst may be over for MFG.

“MFG has been an atrocious performer with serial fund underperformance, loss of key personnel and significant FUM outflow,” he said.

“However much of this has now been reflected in the share price and with a strong cash/investment position on the balance sheet of almost $1bn, the share price is probably reflecting most of the potential future downside.”

PNI has held up much better as a fund manager, both from a share price perspective and from its operational performance.

“With more optimistic expectations built into the share price (PNI’s market cap at $2bn is 25% greater than MFG’s) there is arguably more room for disappointment in operational performance if the company’s suite of fund managers experience further outflows or do not produce performance fees in-line with expectations,” he said.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.