Why the Aussie dollar matters, and which ASX stocks are exposed to its movements

Why the Aussie dollar matters for investors. Picture Getty

- The Aussie dollar is making a comeback recently as the case for a super Fed hike subsides

- Why is this important for businesses and investors?

- Stockhead reaches out to OFX’s Matt Richardson

Australia’s inflation rate of 7.8% is at the highest since 1990, which could spur the RBA to raise rates once again at its February 7 meeting.

The cash rate currently stands at 3.1%, the highest level in the decade since November 2012, when it was 3.25%.

To understand how all this could impact the Australian dollar (AUD) and why it matters for investors, Stockhead turns to currency expert Matt Richardson, a senior FX dealer at OFX Group (ASX:OFX).

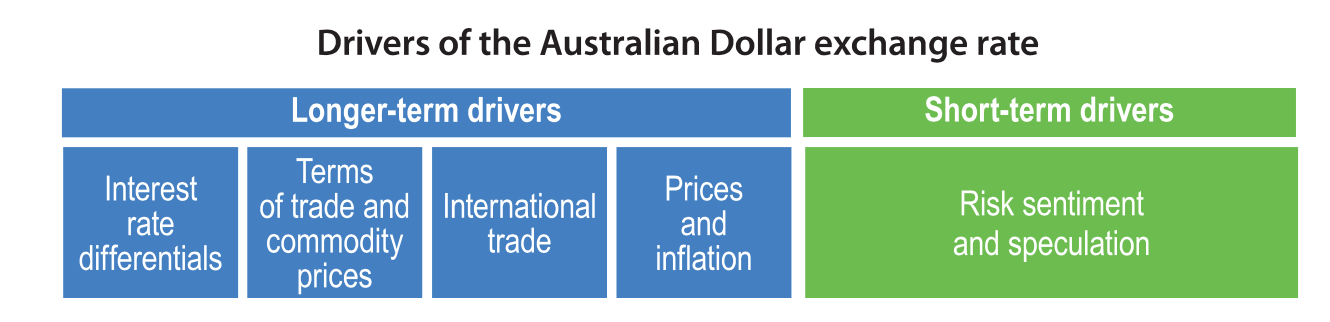

Richardson says the direction of the AUD in this early part of 2023 is likely to be shaped not only by the RBA, but also by offshore risk events such as the war in Ukraine, the US jobs market, and the pace of Fed hikes.

“The market is a little bit less confident now about the outlook around global growth, and there’s some reasonably strong signals that the US is tipping into recession,” Richardson told Stockhead.

But as inflation fears dissipate, expectations around Fed rate hikes have also started to decline, which has been a major factor weighing on the US dollar and driving the AUD recovery recently.

Over the last few weeks, the AUD has indeed enjoyed a relatively steady upward trajectory, recovering from the lows of the US61 cent range in October to US70.3 cents today.

“The reopening of China is also adding support to the Australian dollar, reviving optimism that we’ll see greater demand for key commodities,” said Richardson.

He explained further that movements in the AUD were partly driven by the differentials between the forward expectations of US and Australian rates – or essentially the difference between what the Fed and RBA are each doing.

The AUD for example could rise when the RBA is seen to be hiking at a faster pace than the Fed.

“Having said that, a fear of recession could outweigh those benefits, and the Australian dollar could decline even if the RBA does continue to raise rates and narrow that gap with the Fed,” Richardson said.

Why the AUD matters for businesses

Apart from rates differentials, long term drivers for the AUD include commodity prices and our terms of trade (the ratio of export prices to import prices).

Commodities have a large influence on the AUD because they account for a large share of Australia’s export.

To illustrate, an increase in the price of iron ore typically leads to higher export prices, which means that more Australian dollars are required to purchase the same amount of iron ore – which leads to a higher AUD.

When commodity prices rise, exporters may also decide to invest in expanding their production capacity to take advantage of higher export prices.

This investment has typically been funded from capital flowing into Australia from overseas, which supports demand for Aussie dollars even more.

Ironically, a continually appreciating AUD can also lead to lower profits for those companies that repatriate their overseas earnings back home.

Richardson says the most important thing is to have a plan to protect that currency exposure.

“Companies need to make sure they’re not leaving themselves exposed to losses simply on the back of currency movements,” he said.

“They need to create a hedging program and engage with companies like OFX to mitigate those risks.”

Why the AUD matters for investors

For ASX investors, offshore investing obviously comes with a very particular FX risk.

Now read: Four ways AUD movements directly impact your finances and how Aussies got it so wrong

But investing in local companies which have substantial operations overseas could also expose you to the same FX risk.

“If investors are looking at offshore stocks, then a lower Aussie dollar obviously makes it more expensive to buy those shares,” Richardson said.

“But local investors could also be exposed depending on whether they’re investing in companies with revenues mostly collected in US dollars.”

A fall in the AUD will likely help the iron-ore miners’ profits, whose exports are in US dollar contracts while costs are in Aussie dollars.

These include BHP (ASX: BHP), Fortescue Metals (ASX: FMG), and Rio Tinto (ASX: RIO).

In-bound tourism stocks like Qantas (ASX:QAN) and those which operate hotels like EVT Limited (ASX:EVT) could also benefit from a fall in the AUD.

On the flip side, companies that could benefit from a strong AUD are the retail companies like home furnishings Nick Scali (ASX:NCK), Adairs (ASX:ADH) and retailer Myer (ASX:MYR).

These are companies that import the bulk of their goods from overseas, and a strong AUD would make their cost of goods cheaper.

On the smaller end of town, stocks that earn most of their revenue overseas in USD and other currencies include:

Sezzle (ASX:SZL), a US-based BNPL play whose main market is the US and is eying other international markets like Canada, Brazil, Europe and India.

Doctor Care Anywhere (ASX:DOC), the GP appointment tech company whose main market is in the UK.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.