The Aussie dollar is sinking, so is this a good time to put money in the forex market? We ask an expert.

Zoran Kresovic of Eightcap suggest an entry point to trade the Aussie dollar. Picture Getty

- The USD has been surging recently, pushing the AUD to below US64c

- Zoran Kresovic of Eightcap suggest an entry point to trade the AUD

- And where can Aussie do some FX trading?

Why a strong USD isn’t so good for the world

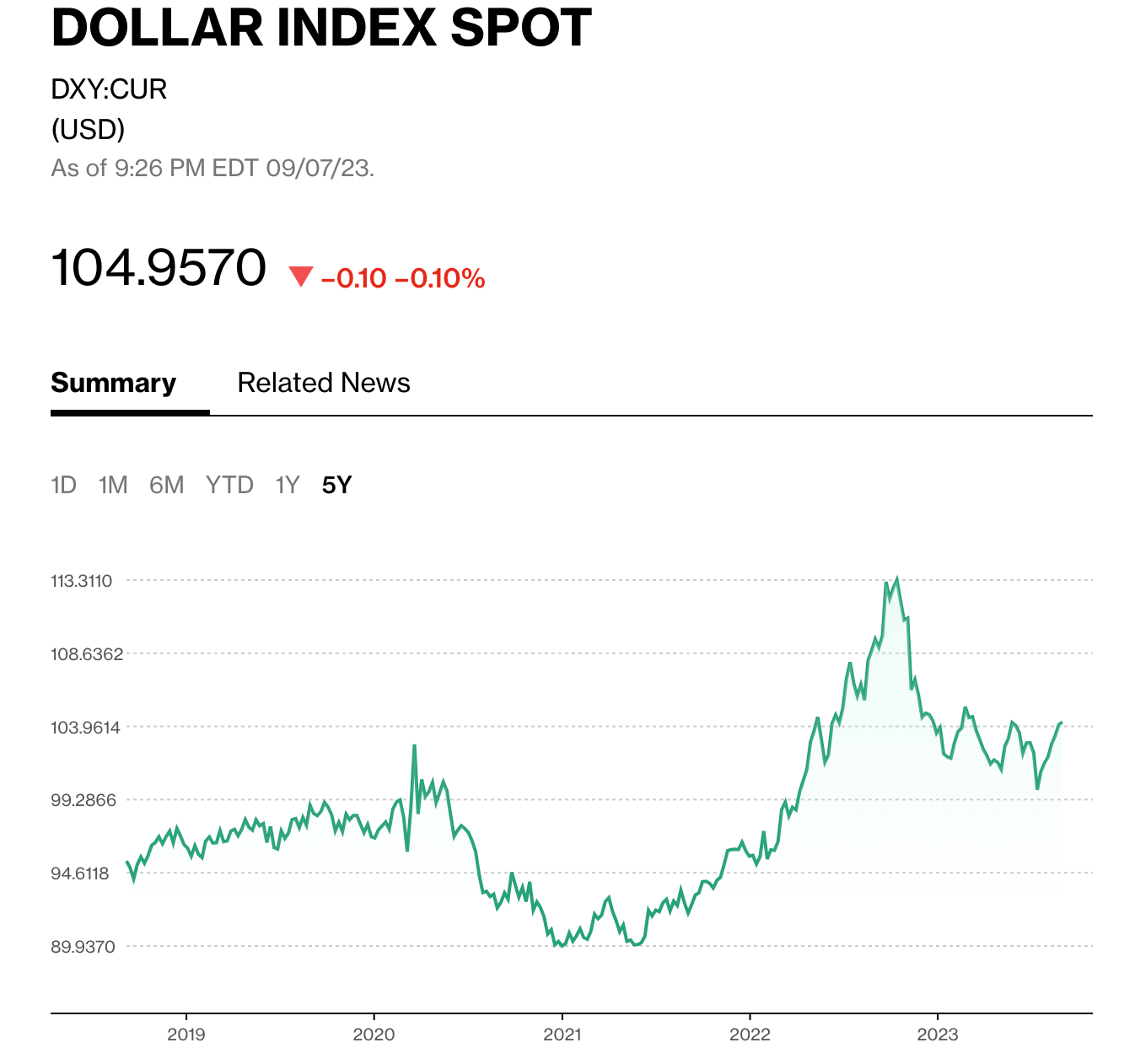

The recent US dollar rise is starting to unnerve markets around the world.

Last week, the greenback recorded its longest weekly winning streak since 2014 as the currency touched a five-month high.

It’s not so much that the US economy is doing particularly well, but more a case that it’s doing better than developed market peers.

Recently, a string of stronger-than-expected data from the US – on everything from consumer spending, residential investment, to non-farm payroll and services sector activity – are pointing to a resilient economy.

Whilst that’s good news for Americans, a strong USD is a problem for many countries.

Start with the fact that most governments and companies borrow in US dollars. And also that most things from oil, commodities and food, must be purchased using the currency.

To put it in context, the share of the US dollar as a payment currency worldwide is more than 40%, while 60% of global central banks hold their reserves in USD.

While some experts say the the greenback is already at its peak, others believe it will head higher in the coming months before weakening.

What’s happening with the AUD lately?

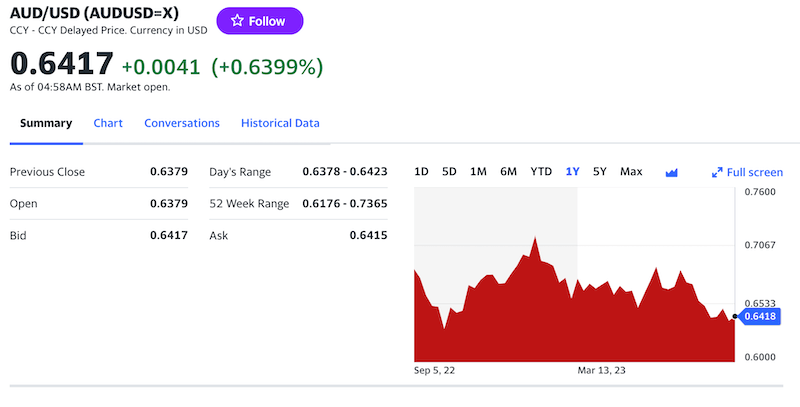

The Aussie dollar has also succumbed to the pressure of the strong greenback, falling from US73c in January to below US64c a few days ago.

“US dollar strength is currently prevailing as the USDX continues its upward surge,” says one FX market expert, Zoran Kresovic of Eightcap.

“On top of that, rising 10-year treasury yields sitting at over 4.2% in the US is another major contributing factor for AUD/USD weakness,” he told Stockhead.

Kresovic says there are other factors affecting the weakness in the AUD right now, including the weak Chinese exporting data.

“Housing concerns in China will be adding to the AUD weakness as China is Australia’s largest export destination.”

Kresovic added that last week’s RBA decision to keep rates on hold at 4.1% could make the AUD more vulnerable.

“The RBA may be done with rate rises in the foreseeable future,” he said.

While the RBA is on pause mode, a recent speech by Fed’s Jerome Powell suggested that he was willing to leave the door open for more rate hikes.

The Fed’s ultra-aggressive policy and posturing compared to its peers has in effect attracted capital inflow into the country and “one-way bets” on the US dollar.

Under that widening gap scenario, traders would be more inclined to sell AUD and buy the USD, as risk capital is always looking for higher yielding assets.

Where can Aussies trade forex?

Forex trading in Australia is governed by the financial watchdog ASIC (Australian Securities & Investment Commission).

There are several ASIC authorised brokers in Australia, including Saxo Bank, IG, CMC Markets, Forex.com, City Index, eToro and AvaTrade. Eightcap is also a regulated forex broker.

In Australia, forex trading is normally conducted on ‘margin’, which is done via Contracts For Difference (CFDs) trades.

CFD leverage or margin trading is like trading with borrowed money, ie: deposit (or ‘margin’) you give to the provider is a fraction of what your actual risk is.

Basically, you may lose all the money you invested if you can’t meet the margin call from the broker when a trade goes against you.

To understand more about CFD and margin trading, read:Stockhead’s Stronach on Stronach: An Idiot’s Guide to Degenerate Stock Market Gambling, for Dummies™

So what’s a good entry point for the Aussie dollar?

Kresovic says we could see further weakness for the AUD at current levels.

“We are potentially looking at medium term downside for AUD/USD, with a very short-term upside on the technical chart.

“But that reversal of trend does not seem to be imminent, and we do see a fair bit of weakness in AUD and any major currencies against the USD at this point in time,” he explained.

Kresovic believes the AUD/USD is bouncing off a short-term support level at 0.6370, a level that appears to be very vulnerable with further downside pressure imminent.

“The AUD/USD pair broke multi month lows after a strong sideways consolidation ranging between 0.6480 and 0.6370 since the 17th of August,” he said.

“We are likely to see further pressure from sellers as we expect AUD/USD to find major support at 0.6200c. Any potential upside rallies from 0.6383 levels are likely to hit wall of sellers.”

Another trade idea – the forex carry trade

Kresovic added that USD strength is also continuing against a basket of all major pairs.

“However, it appears there is a particular interest in carry trading, and offsetting low yielding currencies with high yielding assets such as USDJPY and USDCHF,” he said.

Carry trade is a way to extract value from rates differentials between currencies.

The idea is here is to sell a currency where the rates are lower, against buying a currency where the rates are higher.

As a simple example, if you put on a long USD/AUD forex position through a broker (buy USD and sell AUD), you would earn daily interest on your USD balance, and pay daily interest on your short AUD balance.

Since US rates are higher than Aussie rates, you will earn what’s called “positive carry”.

This daily interest will be earned on your brokerage account until you close out your position.

Roughly speaking, the daily rates (or your net carry) are calculated in this way:

Daily interest = (Rates of long currency – Rates of short currency) / 365 x Notional value of your position

It’s not a surprise that the Japanese Yen has been the poster child for carry trading for at least the last decade.

With its perpetually ultra low interest rates of almost 0%, the Yen is the perfect currency to execute the funding leg (short currency) of the carry trade.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.