Watch out for multiple lithium bottoms, says Joe Lowry. And sodium-ion? It’s ‘a dog that doesn’t hunt’

Pic via Getty Images

When Joe Lowry speaks, the lithium world tends to listen. And listen it did to his keynote address on Day 2 of the Future Facing Commodities Conference in Singapore.

We listened in, too. It was customary uncompromising and astute stuff from the forthright host of The Global Lithium Podcast.

And we took note of his most striking observations about the state of play in 2024 for the prominent battery metal. Here then, are some of the key takeaways from Mr Lithium’s speech, tellingly (for a recharging market) titled: The Waiting Game.

Keep an eye out for ‘multiple bottoms’ later this year

Let’s start at the bottom. Actually, it’s not just a single bottom of the lithium market that Lowry suggests watching out for, it’s “multiple bottoms”.

What does he mean by that? To wrap the noggin around it we need to understand, he says, that there is no single “spot” lithium price.

“When you think about the lithium industry, think a little deeper than what Reuters… Bloomberg etc tells you the lithium price is,” said Lowry. “It’s a range out there.

“When you talk about the lithium price bottoming, there’s going to be multiple bottoms because there’s multiple prices.”

He’s referring to the fact that generally, “the China spot lithium price is not the lithium price”.

There are a range of lithium prices. Korea, he notes, is the second biggest market for lithium chemicals in the world. Japan is third. Both these markets didn’t see quite the fall that China’s spot price did (it dipped about 80%) by the end of 2023.

Okay, but has price bottomed?

“I’m not going to say it has for sure,” said the lithium expert, fielding his own question. “But I think it’s going to happen this year, if it hasn’t already.”

Negative sentiment ‘doesn’t make sense’

“I’ve never seen the sentiment on lithium this negative,” noted Lowry. “And it doesn’t make sense to me.”

Mr Lithium said that with even the commodity at US$15k a tonne… “that’s historically a pretty high lithium price. But the narrative here now is… well, what was $80,000?

“I never thought the lithium price would get to $40,000. And I sure never thought it would get to $80k.

“When it got to $80k, and peaked out [end of 2022], the lithium-ion battery supply chain was stuffed – from cathode to cells to packs – and what happens in China, when they start to see the price ease and come down… they stop buying. And they start living off the inventory.

“And then we saw the rundown in price. The narrative became ‘high prices fix high prices… was it oversupply because high prices fix high prices?”

Lowry believes it was more about the inventory drawdown and destocking than a case of lower-quality lepidolite (over spodumene) flooding the market.

The EV growth narrative is intact

The veteran analyst believes the narrative being pushed around the traps that demand for electric vehicles having cooled is overblown.

“The growth rate has slowed, but the Western press continues to misjudge the global EV story,” he highlighted in one of his presso slides.

“EVs are gonna do just fine. But you have to be comfortable with that because the lithium industry is now completely tied to batteries.”

What about Chinese EV titan BYD looking to infiltrate the US market and forge further global EV dominance?

“I for one would love to see BYD’s cars sell in the US, because if you really want ubiquitous EV adoption in America… if you let BYD in, people who can’t afford Teslas, could now then afford an EV. They have EVs at every price point, and we just don’t have that.”

The BYD Seagull, by the way, retails for roughly US$9k. And it is pretty highly rated in the city runabout category by car industry experts. There really isn’t a decent EV anywhere near that price point currently on sale in America, or Australia and much of the rest of the world for that matter.

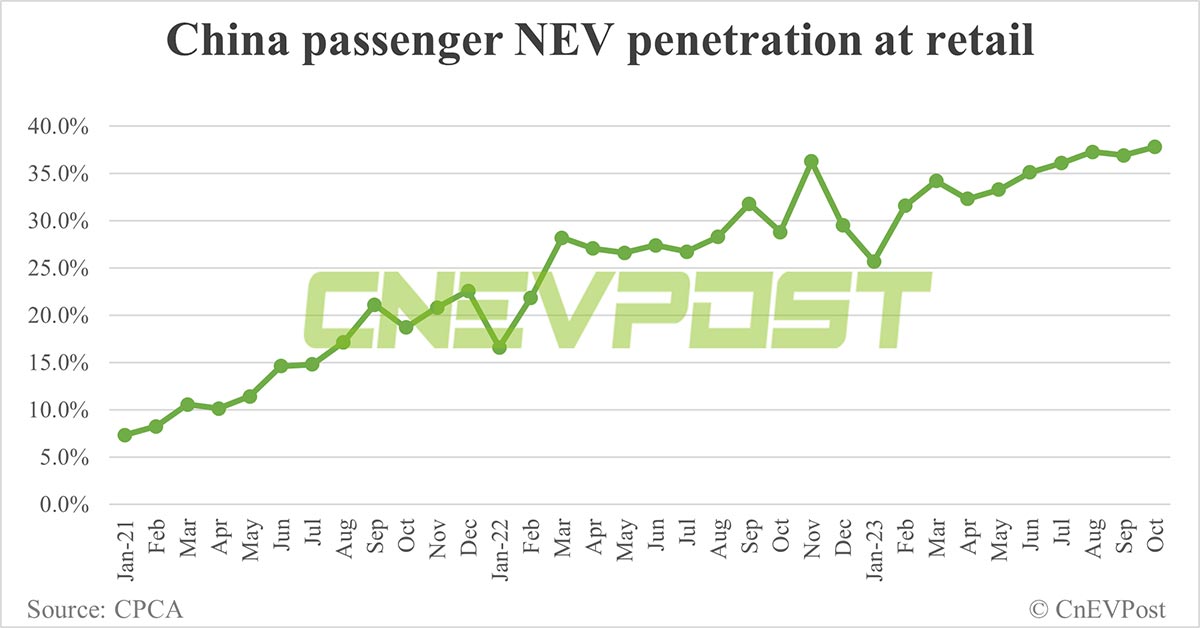

Lowry pointed to this CNEVPOST chart, highlighting the fact the trend, despite its “sawtooth” action, is going in the right direction.

“People can just stop worrying about NEV demand,” he added.

How about the sodium-ion threat to lithium?

“The great thing about the fall in price… is that we’re not really hearing a lot about sodium-ion in energy storage systems,” said Lowry.

“Because if lithium stays below $25,000 a tonne, then sodium ion is pretty much a dog that doesn’t hunt… and will have a very small niche.”

Mr Lithium’s closing thoughts

Aside from that sodium-ion dog quote above, Lowry probs saved his best/most succinct thoughts for his final slides. Key takeaways on those, were…

Did lower prices fix lower prices?

“Recent evidence suggest both chemicals and spodumene prices have bottomed. Much of the capacity that drove the 2023 oversupply is currently not economic.

“Lower prices also increased demand in the battery sector and limited substitution (sodium ion).”

How high will prices go this cycle?

“My prediction is global average carbonate pricing moves into the low to mid $20s/kg by December.”

What else?

Lithium is still a very misunderstood market, said Lowry, with banks (like Goldman, like JP Morgan) continuing to try to “force feed investors the standard commodity narrative”.

Moving ahead, Mr Lithium notes believes that excess in China capacity across the lithium-ion battery supply chain will continue to drive the volatility.

And, while China continues to dominate lithium processing, it remains dependent for raw material.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.