Pass the salt: Here’s how sodium-ion batteries could topple lithium demand forecasts

Pic: Via Getty

- Sodium ion is the only viable EV battery chemistry that doesn’t need lithium

- Cons: slower charging, lower energy density; Pros: cheaper, safer, longer lasting vs lithium-ion

- Sodium-ion battery buildouts now appearing at pace, with CATL, BYD and Northvolt at the forefront

- Could represent half the Chinese domestic EV market by 2030: analyst George Heppel

Electric vehicles must be made affordable for the technology to become ubiquitous.

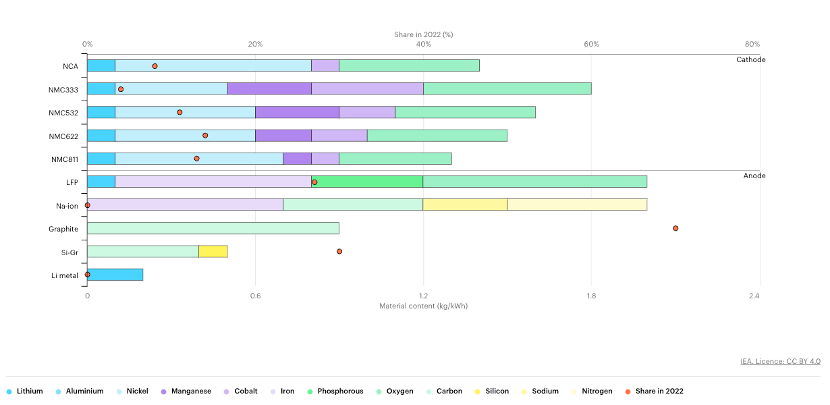

However, volatile prices for critical raw materials like lithium, cobalt, nickel, and manganese add a big layer of complexity for carmakers, which have committed to some very ambitious EV targets.

Prices have softened in 2023, but analysis generally suggests persistent and deepening shortages of these battery metals, with Benchmark Mineral Intelligence estimating ~340 new graphite, lithium, nickel, and cobalt mines will be needed in the next 12 years.

That includes 74 new lithium mines with an average size of 45,000 tonnes LCE.

Impossible numbers.

OEMs are aggressively pursuing lithium-ion alternatives but, while countless technologies have been lauded as potential disruptors, barely any make it out of the lab. Those that do still need lithium.

Lithium iron phosphate (LFP) batteries, for example, have exploded in popularity and already power a dominant chunk of EVs in China, the world’s largest market.

Tesla is also using LFP in its base Model 3s.

LFP’s cobalt and nickel free chemistries sacrifice range and power to keeps costs low but, as name suggests, lithium remains a crucial ingredient.

Even under-development solid-state batteries, which promise higher energy densities (and zero explosions) while also using no cobalt or nickel, still require a lot of lithium.

It is why analysts predict total lithium demand (in LCE) of between 2-3Mtpa in 2030, up from ~900,000tpa today.

Benchmark Mineral Intelligence even has a high case scenario of 5.3 million tonnes a year by 2030.

The giant killer

There is one real threat to lithium demand outlook; sodium ion, or Na-ion, currently the only viable chemistry that does not contain lithium.

Sodium-ion is cheaper, safer, longer lasting, and better in cold temps than lithium-ion but, like LFP, ostensibly suffers from a slower charge rate and lower energy density.

Not so good for those long trips down the coast, but ideal for a suburban run-around.

Still in its infancy, sodium-ion battery buildouts are now being announced at pace, as prophesied in January by BloombergNEF’s Top 10 Energy Storage Trends in 2023.

“An alternative to lithium-ion batteries, sodium-ion battery technology offers could alleviate battery-market pressures — and potentially push down costs — as soon as 2026,” it said.

“For 2023, we speculate that at least one major battery manufacturer will come out with a significant sodium-ion battery product roadmap announcement.”

Three months later battery behemoth CATL said its sodium-ion batteries – unveiled mid 2021 – would make their debut in Chery Auto’s EVs.

CATL, which also sells batteries to all the major Western carmakers, including Tesla, Volkswagen, Nissan, and Ford, says sodium-ion battery manufacturing “is perfectly compatible with the lithium-ion battery production equipment and processes”.

“The production lines can be rapidly switched to achieve a high-production capacity,” it says.

Last week, the world’s leading EV maker BYD inked a contract for a new US$1.4bn, 30GWh sodium-ion battery plant, the largest in the world.

Sweden’s Northvolt also announced it had developed a sodium ion cell with an energy density similar to LFP cells, with plans underway to set up Europe’s first pilot plant.

If @northvolt pulls this one out. It is a world game changer. 1,000,000 times more important than COP28.

“Northvolt develops state-of-the-art sodium-ion battery validated at 160 Wh/kg”

I love tech! https://t.co/27rLB6IcKt

— Laurent Segalen (@MegaWattXinfo) November 21, 2023

Na-ion and Li-on: Complimentary or cannibalistic?

Sodium-ion represents a near term solution to those battery metal deficits, which are expected to put a substantial dent in EV forecasts.

Fastmarkets is forecasting the technology to make up 9% of global EV sales by 2033.

BloombergNEF has predicted sodium to take market share at the cheapest, lowest-range end of the car market in China, where LFP dominates.

By 2035 it could displace about 272,000 tons of lithium – about 7% of the total market that year, it says. The switch to sodium-ion could be even more if aggressive lithium shortages emerge, removing up to 37% LCE out of a global demand by 2035.

That’s equivalent to 1.4Mt LCE.

Analyst George Heppel arguably goes further, claiming sodium-ion could represent half the Chinese domestic EV market – which accounted for 60% of global sales in 2022 — by the end of the decade.

That’s huge.

The biggest EV manufacturer in the world is investing $1.4bn in a 30GWh sodium-ion gigafactory – big enough to make ~1mn sodium-ion EVs a year.

I’ve been saying it for about a year now: sodium-ion will be 50% of the Chinese EV market by 2030. https://t.co/jtupUnf68p

— George Heppel (@heppel_george) November 20, 2023

Unlike lithium-ion, there is no raw material bottleneck for sodium-ion, Heppel says.

“Sodium hydroxide is one of the biggest-traded chemicals on the planet. Sodium sulphate is so plentiful in the refinery sector that it’s getting to the point where people will literally pay you to take it away,” he tweets.

“The reality is that Na-ion is easily scalable, has good enough performance for most EVs, and is super cheap.

“Anyone betting against its success is basically betting against Chinese capacity scale-up, which is futile.

“I’ve seen these shifts a couple of times in my analyst career – shift to NCM811 in 2017-2018 and the growth of LFP – and both times, the market (myself included) has consistently underestimated the rapid pace of transition in China.

“I won’t be fooled again!”

Pump the brakes, Benchmark says

There are challenges to sodium-ion’s ramp up, says Rory McNulty PhD, senior analyst at Benchmark Mineral Intelligence.

“50% of the Chinese EV market in 2030 would represent 475 – 600 GWh of sodium-ion battery production, where current global production is in the low single GWh range,” he told Stockhead last week.

“When you look at pipeline capacity which, as of BYD’s announcement yesterday and Northvolt’s announcement today, stands at a little under 300 GWh, I can see how you might reach this figure.

“But when you look at these numbers in more detail, only ~70 GWh of this capacity has been announced by companies that have ever produced a battery cell before – this is before considering that these facilities need to ramp-up over the course of 5 – 7 years to reach their steady-state utilisation rate of <80%.”

More challenges emerge when you start diving into the details of the hard carbon supply chain, the key anode material for sodium-ion batteries.

“A total of ~110 GWh of hard carbon pipeline capacity has been announced by 2030, and of this only 12 GWh is announced by companies that have ever produced battery grade anode materials before,” McNulty says.

In short, the sodium-ion battery industry and supply chains have a long way to go to achieve mass market commercialisation, let alone secure 50% of the Chinese domestic EV market, he says.

“This is not to say that it can’t happen, but there are several technology, supply chain, and manufacturing challenges that need to be overcome to achieve mass market penetration,” he says.

“The data today indicates that we are still at the start of this journey.

“To achieve 475 – 600 GWh of production by 2030, we would need to be well into the ramp-up phase of commercialisation.”

Here’s a final word from Heppel:

One more Na-ion tweet before I get back to my day job:

Most people don’t like this prediction. But it’s usually the same people who think that China NEV sales are going to triple between now and 2030. We don’t have a supply chain for that yet either, so what’s the difference? https://t.co/4RiwkRJvmK

— George Heppel (@heppel_george) November 21, 2023

Who’s right? Only time will tell.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.