Want to catch a BIG fixed income yield? Welcome to The IAM 6% Club

Pic: Getty Images

Income Asset Management (ASX:IAM) is a fixed income specialist and funds management incubator, which specialises in showing fixed income investors that bonds, cash, debt capital markets, treasury management, and Asset Management solutions can offer better returns than a boomerang. The goal of The IAM 6% Club endeavour is to showcase to you how to achieve a fixed income of 6%, just like it says on the tin.

- Inflation and interest rates jitters continue to hammer equity and bond markets

- Yields are up in corporate bonds for investors looking to join The 6% Club

- IAM offering corporate bonds with 6% yields from major Australian companies

As prolonged record low interest rates march higher underlying yields on investment-grade corporate bonds are also rising, now getting close to 6%.

Income Asset Management (ASX:IAM) Credit Strategist Matthew Macreadie said there is now great choices for fixed income investors wanting to join The IAM 6% Club or even achieve a higher yield depending on risk appetite.

He said for example, the forward 12-month dividend yield on the S&P ASX200 is 5.22% plus franking. Australian-REITs also offer yields in the 5-6% mark.

“However, the current 6% yield is now a chance to earn better returns without taking equity risk,” Macreadie said.

“Investors can construct diversified portfolios capable of achieving 6% for many years, of course, ensuring that they stick to investment-grade names where credit risk is very minimal.”

He said the upside of this for conservative investors is that their capital is maintained as well as allowing them to meet drawdown/income requirements at the same time.

Quick Bond 101 tutorial

Before we go into ways to earn 6% from bonds, a tutorial might be useful. Firstly, a bond is a loan by an investor to the entity issuing the bond. It could be a government bond, or a company known as a corporate bond.

The entity promises to repay the loan on a specified date, known as the maturity date, along with make interest payments at regular intervals during the term of the loan, known as a coupon.

Take as an example a bond with a value of $100, a 6% fixed coupon and term to maturity of three years.

This means the bond will pay a $6 coupon annually over the life of the bond to investors. At the maturity date, the issuer must repay the $100 principal plus the final $6 coupon to the bond holder.

The bond’s coupon rate will depend on several factors including its term to maturity, market demand and issuer’s creditworthiness.

Yields differ to coupons

Now the confusing part. A coupon rate differs from the bond’s yield, generally referred to as yield to maturity (YTM). Whereas the coupon interest rate is set, a YTM will vary through time with changes in the price and remaining term to maturity.

Back to the inverse relationship between bonds? If you buy a bond at $100 face value with a 6% coupon rate and hold it until maturity the yield is 6% ($6/$100).

However, if you wanted to sell before maturity on market, you’re unlikely to get $100 because bond prices fluctuate daily based on prevailing interest rates.

If the bond price is $90, it’s known as selling under face value or at a discount. If it is $110, it’s selling above face value or a premium.

So, if you sell at $90, the yield will be 6.67% ($6/$90). Remember the coupon rate won’t change. If you sell at $110 then the yield will be 5.45% ($6/$110).

Furthermore, you can have floating rate bonds that have a variable interest rate that doesn’t fluctuate and is tied to a benchmark.

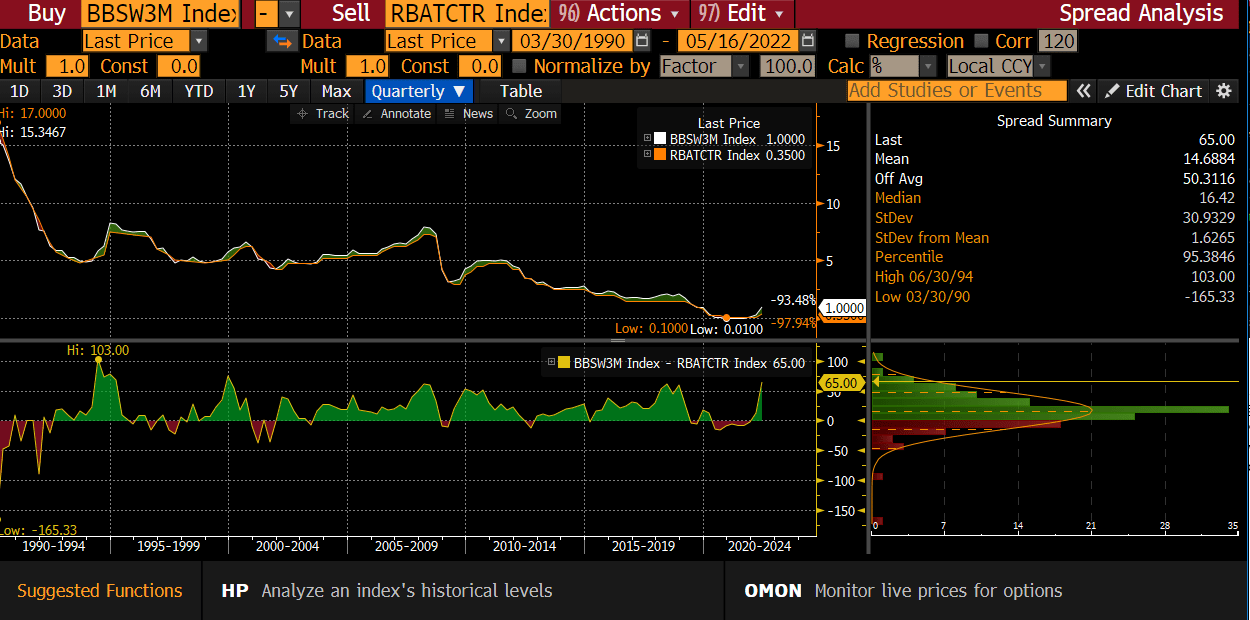

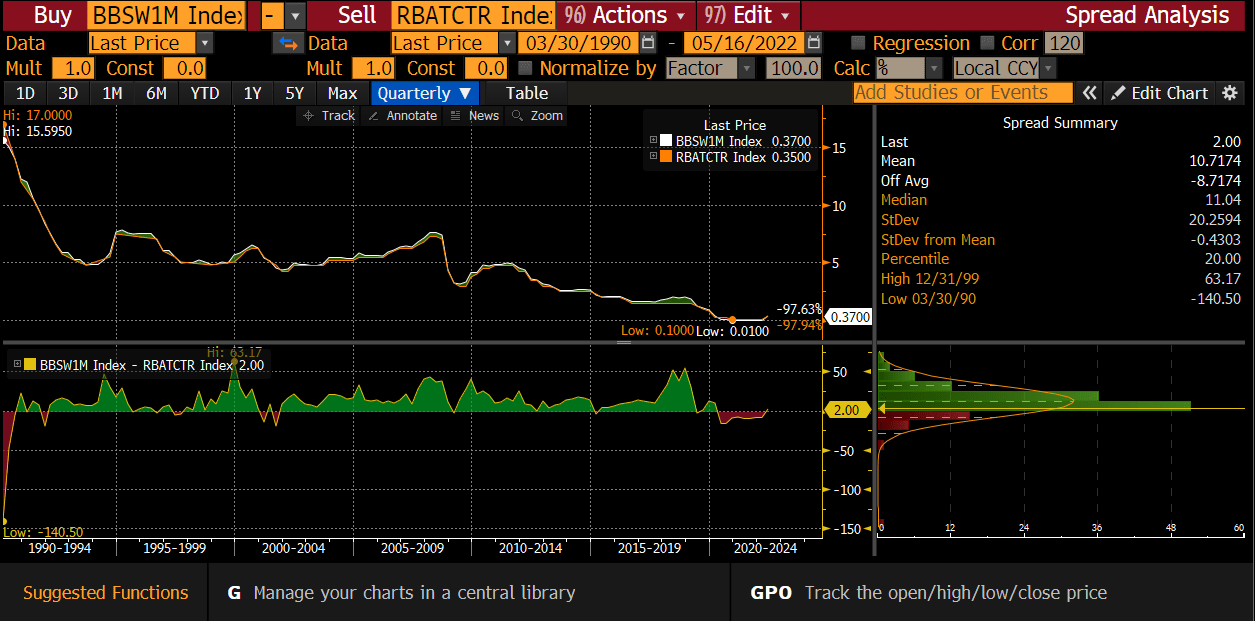

In Australia, Macreadie said that benchmark is generally the 1m or 3m Bank Bill Swap Rate (BBSW) which is well complex. But put simply and you can read more from this link, a BBSW is a short-term interest rate which is basically the mid-point rate for bank eligible securities and the rate banks lend to each other in Australia.

Historically, the cash rate and BBSW have been highly correlated and BBSW is a good indicator of the expected RBA cash rate, whether it be using the 1m or 3m BBSW respectively.

Don’t forget corporate hybrids

To finish off our Bonds 101 Tutorial a note on corporate hybrids, which are generally floating rate bonds containing elements of both debt and equity.

Corporate hybrids are issued by large non-financial corporates and can be listed or unlisted.

Macreadie said they differ to bank hybrids which are loss absorbing.

“If a bank has financial difficulties, they can convert the hybrids to bank shares but corporate hybrids are generally not convertible,” he said.

Economic condition leads to higher yields

The Australia 10 Years Government Bond used as a measuring benchmark finished April 22 with a yield above 3%.

The last time 10-year Australia 10 Years Government Bond was higher than this level was in June 2015, when the cash target rate by the RBA was 2%. Inflation was not a problem with CPI rising 1.5% through the year to the June quarter 2015.

The Australian economy now faces inflationary challenges. The cash target rate by the RBA is 0.35% with more forecasts of rate rises as CPI rose 5.1% through the year to the March quarter 2022.

Macreadie said when credit spreads (the difference in yield between bonds of a similar maturity but with differing credit quality) are added to the Australian 10-year yield, many investment-grade corporate bonds are yielding above 6%.

“This isn’t too bad a return when compared to the average dividend yield on the S&P/ASX200 index,” he said.

IAM wholesale corporate bonds

If you’re wanting to dip your toe in The IAM 6% Club here is a selection of investment-grade wholesale corporate bonds which IAM can offer in smaller sizes of $50,000.

Aurizon Holdings (ASX:AZJ) and privately owned Pacific National are two of Australia’s largest rail freight companies, while Qantas (ASX:QAN) is Australia’s national airline carrier.

“These are fixed rate issues and so do have duration risk if longer-term interest rates rise further,” Macreadie said.

“The higher yield on corporate bonds enables investors to lock away 6% or more for many years.

“Floating rate issues will protect investors from duration risk.”

He said investors can either look at corporate hybrids or over-the-counter (OTC) wholesale corporate bonds.

This story was developed in collaboration with Income Asset Management, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.