The White House: Going global with your portfolio using the difference between truth and fact

Experts

Experts

In this cracking series, from Lessep IM’s intrepid global equities portfolio manager James White, we mine the micro and macro perspectives to better embrace ‘The Meta’.

Sydney-based Lessep IM runs a core portfolio of 40-50 stocks that go for opportunities in productivity trends and reflect investments in both the drivers and beneficiaries of said trends. James also aims to run a long-tail of stocks that have the potential to capture a greater share of new or existing markets.

One way to think about the investment challenge is to make the distinction between fact and truth.

Not always easy to identify, but the distinction between being able to recognise fact vs truth lies at the heart of alpha* generation.

*What is alpha?

It’s the value, hopefully, with which we can measure an investment portfolio’s excess return (performance) against a particular benchmark – usually the relevant market index. It’s the degree to which a trade has surpassed the benchmark’s return over a period of time.

Fact and Truth Are Not Always the Same

On the first weekend of October, a remarkably small** number of us watched the Penrith Panthers defeat the Parramatta Eels in the National Rugby League Grand Final. According to a majority of over 160 economists polled by Reuters, this was expected.

Parramatta, lacking midfield penetration, outside strike power and genuine pace on the flanks were literally sitting ducks for a Penrith team vastly more experienced, ruthless, dynamic, brutal, relentless and sparkling with individual brilliance from 1 to 13.

The fact, that Penrith won the Grand Final, reflected the truth, they are the best team in the competition.

If Parramatta had won, the fact of their victory would have contradicted the truth that their Penrith opponents are a better team.

Fact, on occasion, can contradict truth.

**The 2022 National Rugby League (NRL) grand final gained an audience of 2.76 million domestic viewers on Australian free-to-air broadcaster (FTA) Channel Nine. This was the smallest television viewership in the game’s history.

Fact: The current broadcast deal costs Nine circa $115 million per year. Truth: It’s a dud game.

Portfolio Construction

When the Lessep portfolio is being constructed, the aim is to build a portfolio where truth and fact coincide 80% of the time, and where 20% of the time the prevailing facts (or sense of the facts), run contra to the truth. The best long-term returns will be associated with those positions where our sense of the truth runs ahead of the available facts.

An Example: Iron Ore

For a long-time, iron ore miners were one such position. The market saw peaking Chinese property sales (a fact) as a lead indicator for weaker iron ore demand. From the Lessep perspective, the more important fact, the one that led to truth, was the disconnect between property sales (high) and properties constructed (low).

The chart below highlights this.

The rapid rise in sold properties (red), began in 2016, but the increase in those under construction (grey), only accelerated in 2018/19. Only in 2020/21 did properties constructed (blue) begin to accelerate. For 24 months, the Lessep portfolio position was at odds with the facts that were important to the market. This patience was rewarded in early 2019.

Truth and Fact In Today’s Market

Today’s portfolio, however, seems to reflect a world where the sense of truth is not justified by fact.

Aside from cash, and the small position in oil tankers, there are few positions in the Lessep portfolio where the sense of truth aligns with the market’s sense of facts. In most positions, the market has arrived at the conclusion that the facts point to difficult times.

That said, it’s interesting to consider where markets are.

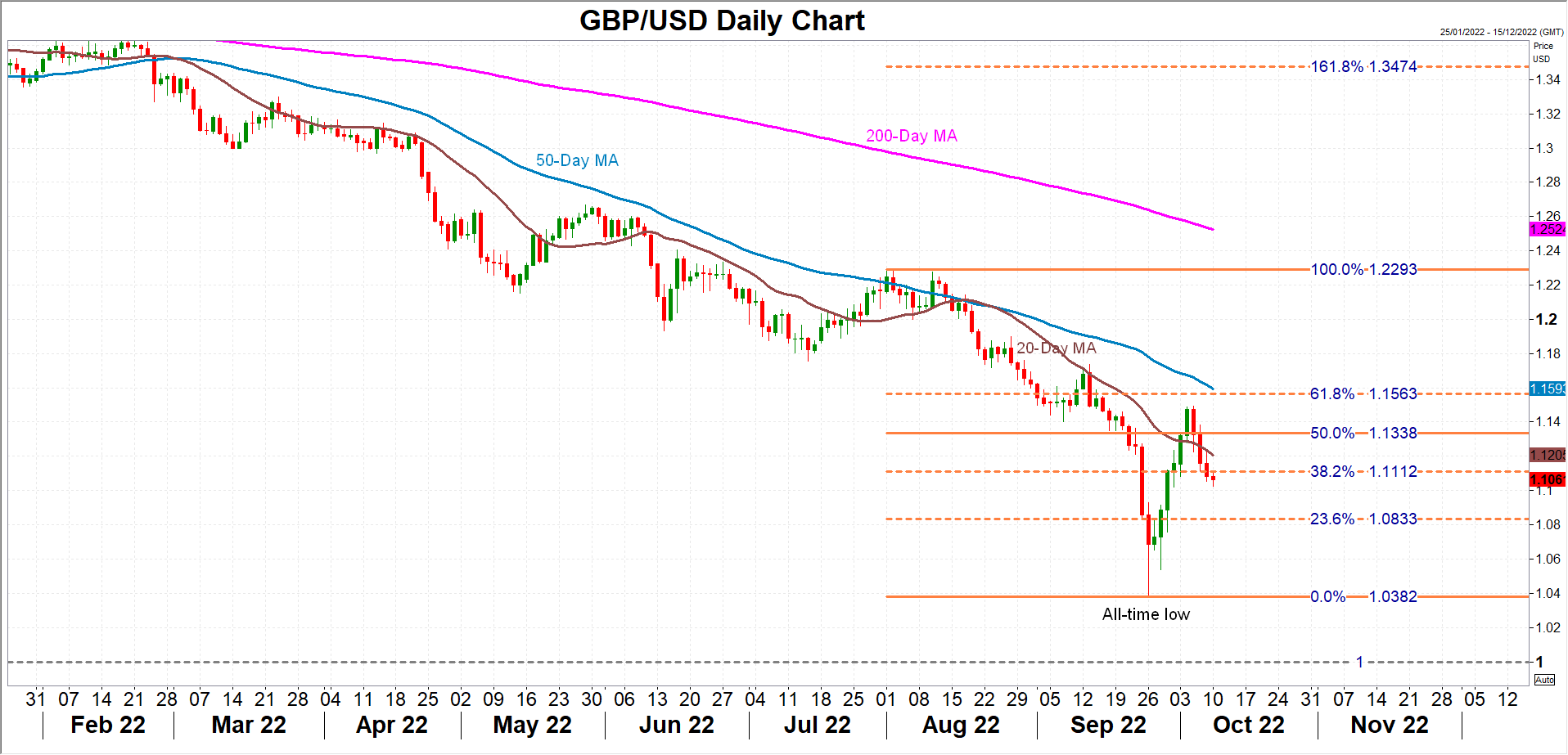

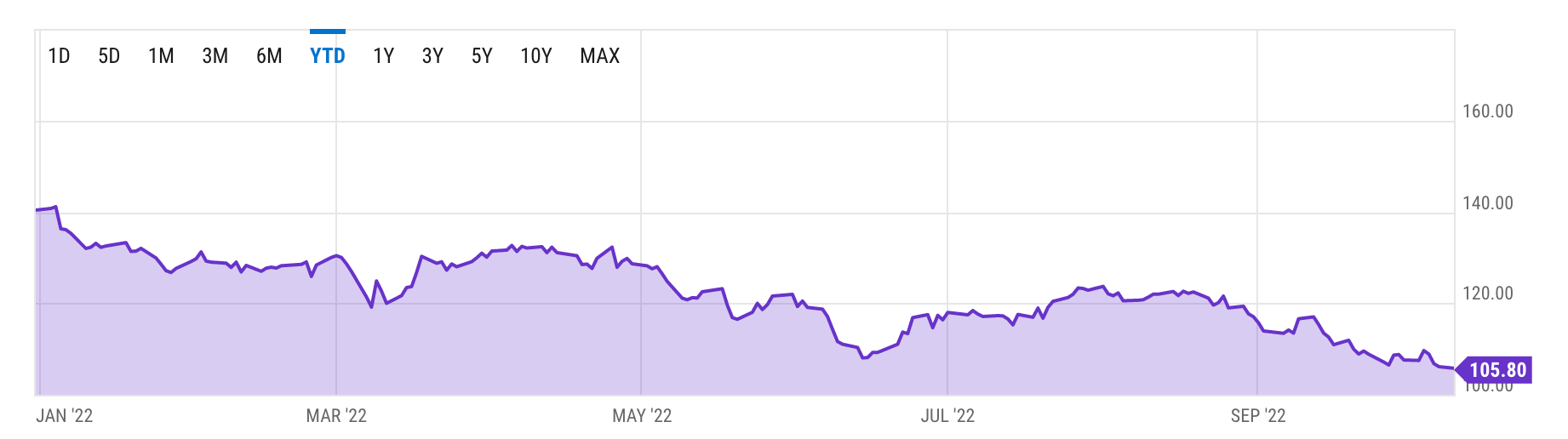

First, in practice, the best asset in this time of elevated inflation has been cash, the US dollar to be specific.

It’s been a monster:

Every other asset class has fallen.

This highlights the continual tension between theory and practice.

Second, equities are likely to be amongst the best performing asset classes at some point in this cycle. This may be because central banks, particularly the Federal Reserve, begin to ease monetary policy to reflect the slowdown in the global economy, specifically Europe.

Or it may reflect a combination of valuations reaching their new equilibrium, and companies exhibiting pricing power.

As the chart below shows, from Ed Yardeni, revenue growth in 2022 has been stronger than the market had initially expected.

Right through history, including the Weimar period most remarkably highlighted by Adam Fergusson in his cracker of a bestseller When Money Dies, (***it’s about the hyperinflation which ripped through Germany in 1923) – the ownership of hard assets, rather than cash, has been the best protection from inflation.

***ED: This book is a great read. And by great I mean as intellectually satisfying as it is emotionally traumatic. The perfect combo.

Blurb: In December 1923, with its currency all but worthless – one USD bought 4,200,000,000,000 marks – Weimar Germany was reduced to a barter economy. Artworks and jewels were exchanged for bread and flour; a cinema ticket could be purchased for a lump of coal. The Bavarian PM submitted a Bill to the Reichsrat proposing that gluttony be made a penal offence, since it might arouse discontent in view of the distressful condition of the population. When Money Dies is the classic history of these bizarre and frightening times.

It deals with the human side of inflation: why governments resort to it; the dismal, corruptive pestilence it visits on their citizens; the agonies of recovery; and the dark, long-term legacy. At a time of acute economic strain, it provides an urgent warning against the addictive dangers of printing money as a soft option for governments faced with growing unrest and unemployment.

Companies and assets, unlike cash, have the pricing power to benefit from inflation. At some point in this cycle, this truth will be seen as fact.

Finally, the quality of large global equity assets has improved dramatically over the last decade.

Within the Lessep portfolio there are few sectors and companies with balance sheets that are vulnerable to higher interest rates. Of those vulnerable sectors, the airlines stand out. Of the companies, the semiconductor equipment maker KLAC, and the heavy machinery company Caterpillar are amongst the most indebted.

But elsewhere, there has been a dramatic improvement in debt to equity, and net debt to EBITDA ratios. For instance, Cleveland Cliffs Debt to Equity has fallen from 5.9x to 0.69x since 2019. The entire home builder complex has reduced debt substantially with Debt to Equity ratios of between 0.25x to 0.4x from as much as 3x in 2017. It’s not clear at this stage where balance sheet stress is likely to emerge.

2022 has been a tough year to run a long-only global equity portfolio.

sound

sound

9:58 AM ∙ Oct 4, 2022

There are steps that could have been taken to limit the extent of the damage to the portfolio. But these steps come with their own risks. The biggest is the risk of turning a temporary loss of capital, into a permanent loss of capital. The easiest way to do this is to too aggressively move to cash, or less volatile companies. These positions offer comfort in down markets but add little when trends reverse.

There are numerous global companies that exhibit relatively cheap valuations, and the ability to maintain stable earnings in the current economic environment. Nestle is such a stock.

It’s performed relatively well in 2022. But when the market does turn, the upside for the stock is limited. It remains a company that has had no top-line growth in five years.

The de-composition of stock returns through 2023 and 2024 is likely to be weighted heavily towards sales and earnings, rather than valuations. Valuations have likely found a new equilibrium as a consequence of higher interest rates. As a consequence, those companies able to grow in this environment, will be those that exhibit the best returns and increase the likelihood of ensuring 2022 remains only a temporary loss of capital.

That’s the truth Lessep is investing in. Over the next 18 months, we need the facts to validate this view.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.