THE SUNDAY ROAST: The ASX small caps that lit a fire under Stockhead’s experts this week

Picture: Getty Images

“Best not talked about” is this week’s market-watching theme, and it encompasses just about all sectors.

Holding out like a small, indomitable village in BC France, Health eked out a sickly 0.46% gain for the week against the All Ords’ -3.23% drop. The XEC was even more calamitous, down 3.50% for the week to Friday and -19.78% for the YTD 2022.

It’s not a time for risk-taking. Even Jim Cramer’s having second thoughts about that bullish crypto call he made a couple of months ago.

If there’s a theme emerging, it’s Let’s Get Back to the Energy-Sapping ‘70s. Here’s what the experts are up to.

Carl Capolingua

ThinkMarkets

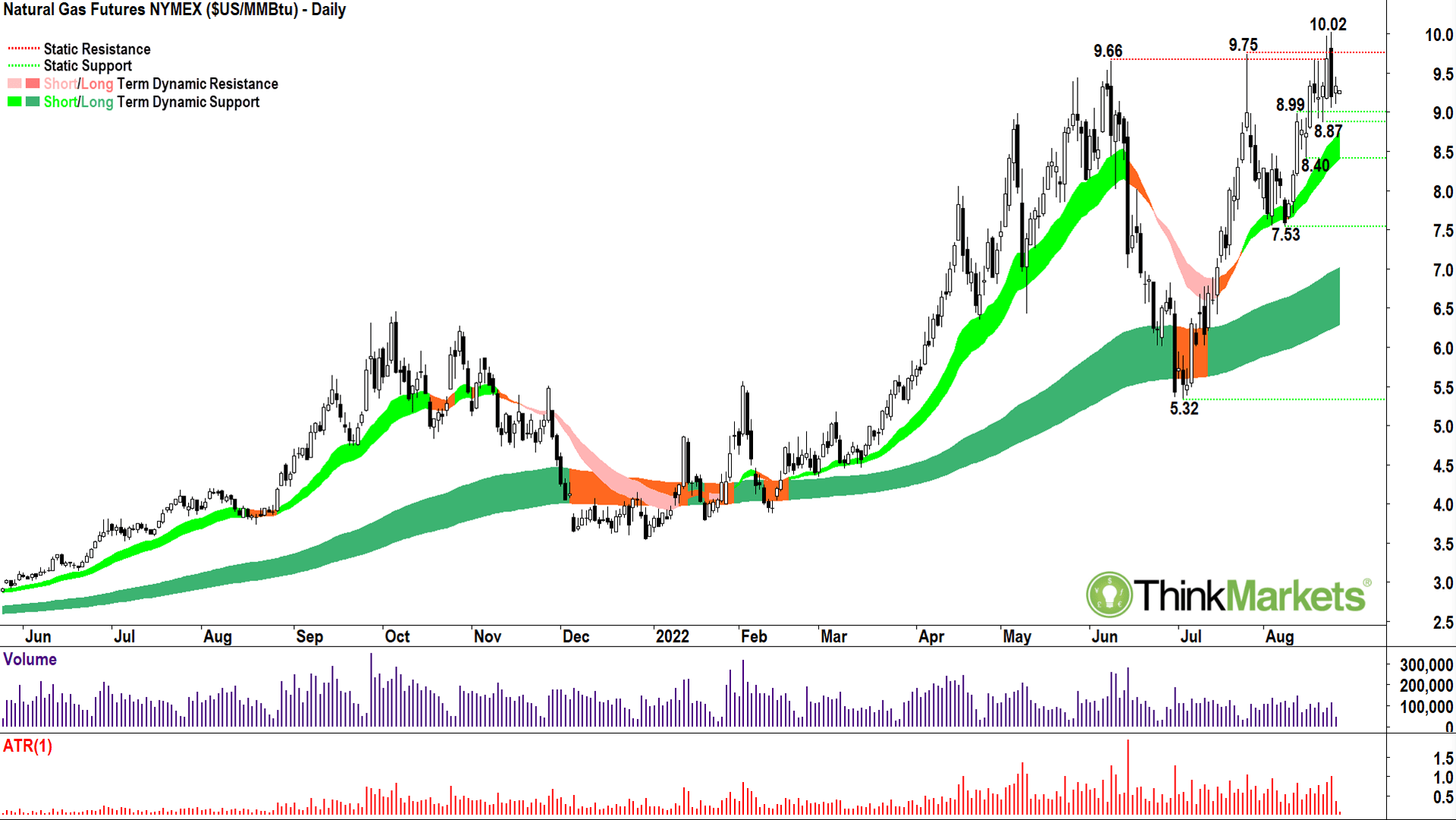

Bullish: Woodside Energy (ASX:WDS). Carl says this one is a clear beneficiary of rising Natural Gas prices as we head towards a European winter. With Putin playing gas supply god. And fossil fuel on the nose. While natural gas futures trade at 14-year highs.

Keeping warm, keeping the lights on, streaming Stranger Things, watching tik toks – all things that need gas. Carl says you might prefer to go straight to the source and trade a Contract for Difference (CFD) on the NYMEX futures contract. He can “see solid demand in the high-US$8/MMBtu region”, very little holding it back if it breaches US$10 but watch for a close below the 15 August low of US$8.40MMBtu.

And coal. Newcastle Coal Futures are in much the same league.

After a brief pullback following Russia’s invasion of Ukraine, it’s seen a steady build. But if US$488 per tonne goes, Carl says, “well, my charts don’t go back far enough to find a higher price.”

New Hope Corporation (ASX:NHC), Terracom (ASX:TER), and Whitehaven Coal (ASX:WHC) are the three go-to thermal coal plays on the ASX. Carl says stay bullish until a close below US$325 per tonne.

Guy Le Page

RM Corporate Finance

Guy Le Page’s go-to in these times of ESG-fuelled energy crisis is also Hunter Valley coal producer Whitehaven Coal (ASX: WHC) – a “standout among the listed mid-tiers”.

For not altogether different reasons than Carl Capolingua might single out, but certainly with a more controversial spin.

“To show your support why not go out and buy some well managed fossil fuel companies; after all, they all qualify as ‘renewable’ as new coal, oil and gas deposits are being formed as we speak,” Le Page says.

WHC’s currently trading around the $7.90 mark. Le Page reckons Macquarie’s target of $9.20/share is now looking on the conservative side…

Niv Dagan

Peak Asset Management

Niv Dagan’s literally going back to a time when inflation was at 2022-like levels, with hawkish sentiment around interest rates globally, but especially in the US. He’s focusing on three sectors during the 1970s which outperformed – Oil & Natural Gas, Energy and Commodities.

Here are his picks.

Oil & Natural Gas – Bass Oil (ASX:BAS). “At only a market cap of ~$9m Bass oil recently completed its Cooper Basin acquisition, which is expected to see daily production exceed 300 bopd,” Dagan says. “What other junior oil companies are driving more cash flows than their entire market cap?”

Uranium – T92 Uranium (ASX:T92). It’s such an under-the-radar pick, it’s not even listed yet. T92 is due to list on the ASX in the next two weeks, with Peak as the lead manager and its largest shareholder.

Cameco (NYSE:CCJ), one of the world’s largest uranium producers, reckons global power demand is expected to grow 75% by 2050. Uranium must have a large part to play in that, and last week, we again saw stocks take off.

T92 is looking for ‘elephants’ in Canada’s Athabasca – aiming for deposits >200M pounds and grades >5%. “To put things in perspective,” Dagan points out, “BHP’s Olympic Dam only has grades ~0.003%.”

James Whelan

VFS Group

After a close shave flirting with Euro luxuries for a Chinese reopening trade, Whelan’s now keeping his powder dry for a while. Although, if you think the RBA has overshot and the market’s overdone rate expectations locally, he’s got a long bonds position for you.

“For that I’m recommending AGVT (Betashares, running yield 2.24%) or VAF (Vanguard, running yield 2.8%).”

He’s also staying long agriculture on dips, with fertiliser heading towards “near impossible to find”. Indicator: “The world’s third largest river has pretty much dried up.”

Shocking pictures from China: World’s third-largest river dries up in drought 👇pic.twitter.com/1rXKa01quq

— Daniel Moser (@_dmoser) August 23, 2022

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.