Talk about value in bonds is getting louder. Here’s why, and how to buy them

Picture: Getty Images

Over the last couple years, interest rates have fallen, reducing opportunities for fixed income investors while significantly raising valuations in the stock markets.

Now the exact reverse is happening. Equities are falling as central banks around the world rush to unwind their pandemic-era monetary policy, causing rates to move rapidly higher.

More and more, we’re seeing asset managers rotate from growth stocks to defensive assets like government bonds. It’s a well established strategy used by investors in volatile markets, more often known as risk-on/risk-off investing.

Anthony Kirkham, Head of Investment Management at Western Asset, believes that in the current environment, the Aussie bond market presents a compelling investment opportunity.

“The situation we are in now is that Australian fixed income offers an attractive yield premium relative to other developed market bond markets,” Kirkham explained.

“Investors are getting efficient returns for risk, plus solid income generation,” he added.

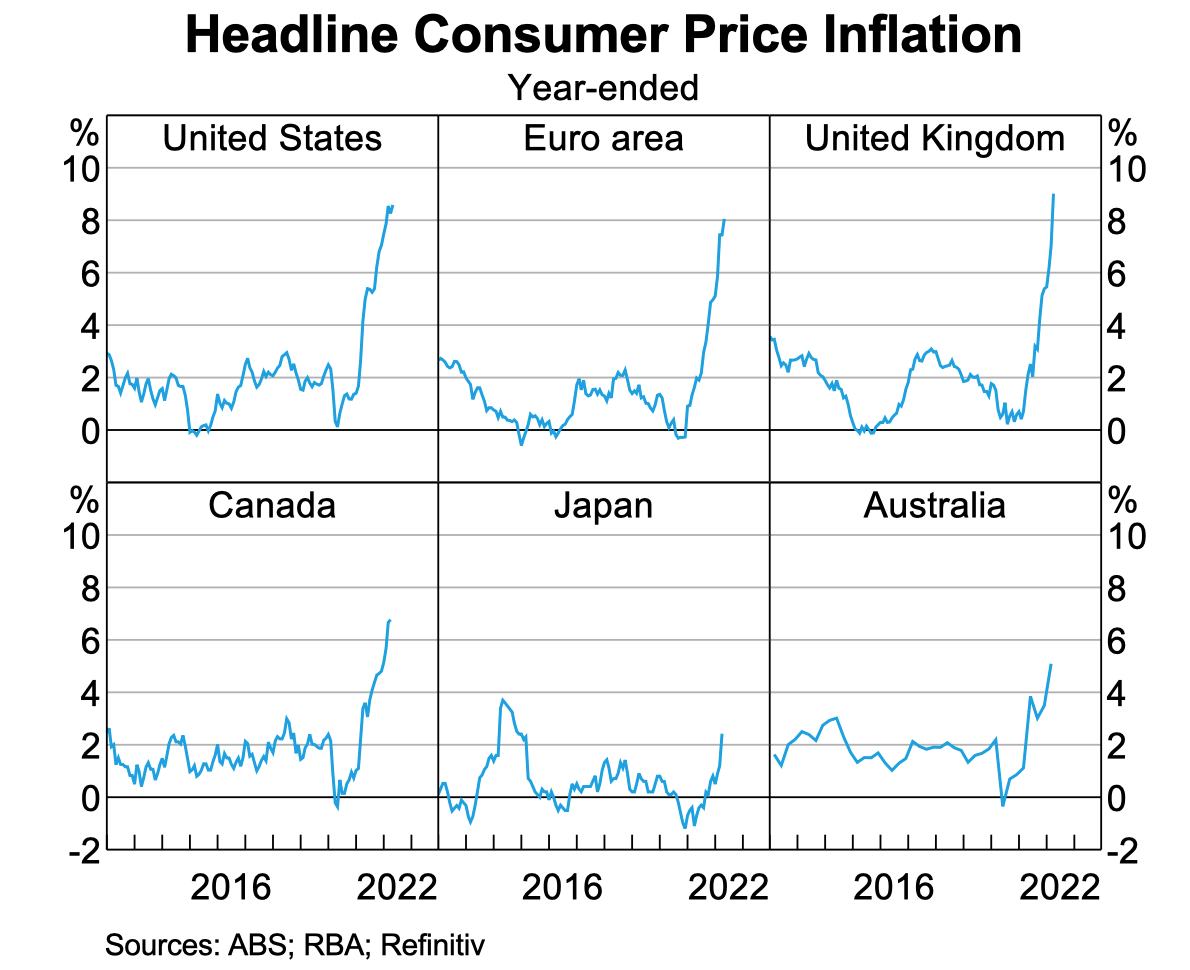

At 5.1%, Australia’s inflation is lower than most developed countries, and is currently the sixth lowest out of the 38 OECD economies.

Because of that, Kirkham believes the Australian bond market has priced in too much of the RBA rate hike, and says that yields will have to come down (bond prices to rise).

“We believe that market pricing has moved well beyond what is justified by fundamentals,” Kirkham argues.

“Our expectation is that the RBA’s projections for inflation entail a cash rate around 1.5% – 1.75% by the end of the year – well below market expectations of around 3%,” he said.

Quick bonds refresher

Bonds do provide investors a fixed income through the payment of regular fixed coupons, but are they risky?

Well… just like equities, bond prices do fluctuate, meaning that investors will have to carry that market risk if they intend to trade it prior to maturity.

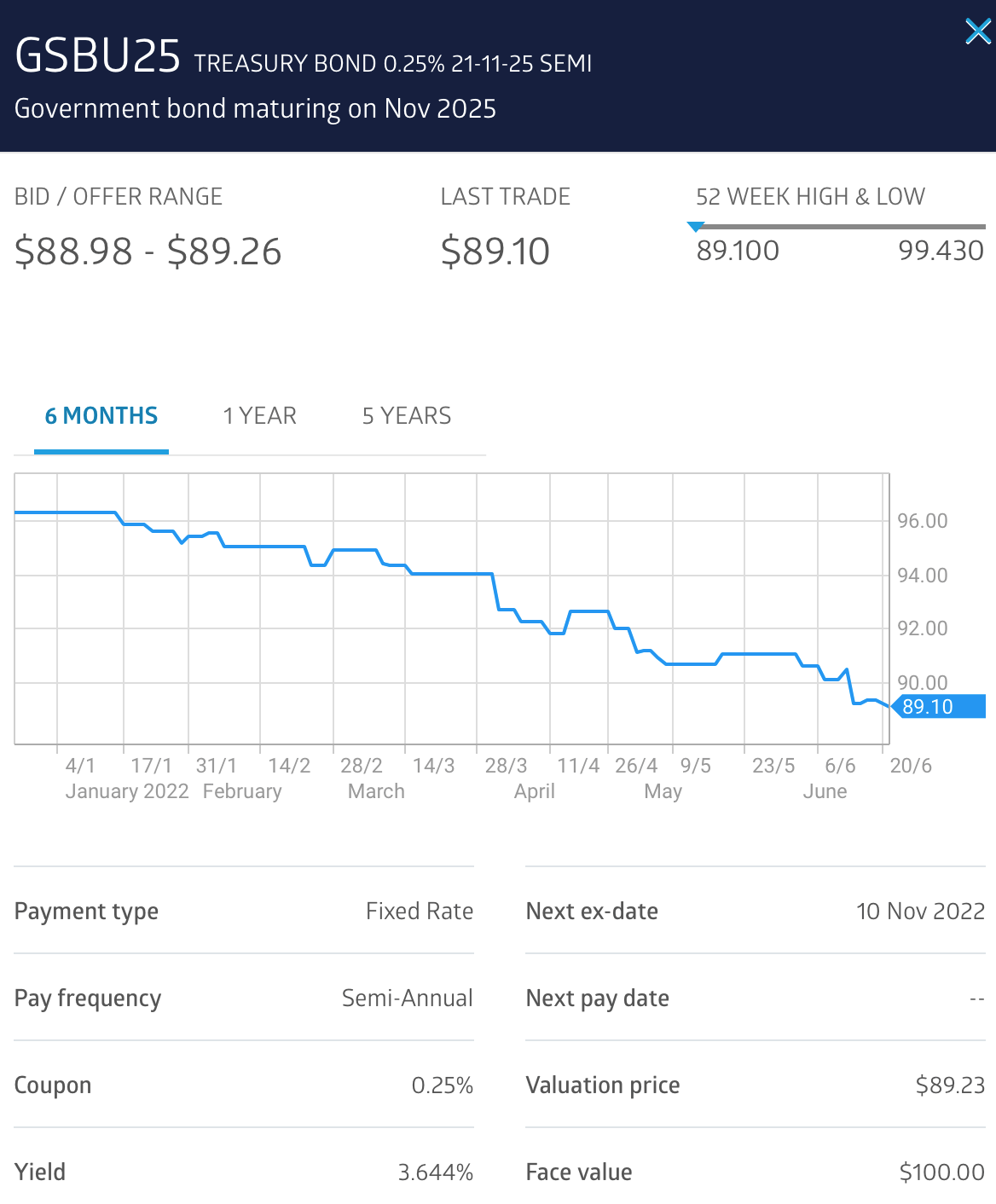

To make this point clearer, let’s use the example of an existing Aussie government bond in the market:

ASX Code: GSBU25

First issue date: 24 July 2020

Maturity date: 5 years on 21 November 2025

Issue price: $100

Coupon: 0.25% paid semi-annually every May and November

If you purchased this bond in July 2020 and held it until maturity in November 2025, there will be zero risk (apart from the risk of opportunity cost, but we won’t go into that).

This is because at maturity, you will receive your $100 principal back, plus all the semi-annual coupons that have been paid.

But if you were to instead sell that bond today, you would have suffered a big loss as the price has fallen to $89.10.

Bond price fluctuations

So why has the bond price fallen from $100 to $89.10?

Just like equities, bond valuations reflect future expectations – specifically, rates and credit expectations.

For Aussie government bonds where the credit rating is AAA, there’s almost no credit risk so we are left with just the rates component.

In other words, the price of GSBU25 fell from $100 to $89.10 because current and expected future interest rates have gone significantly higher since the issue date of 2020. At the time, the market did not expect the RBA would hike rates this aggressively.

Important thing to note here is : bond prices fall when rates go up, and vice versa.

It’s simple maths, but intuitively speaking, why would you want to own a bond that pays a coupon of only 0.25% when the current market pays over 3%?

Yield to maturity

If you were to buy the GSBU25 bond on the ASX today, the most important thing to look at is not the price or the coupon – it’s the yield to maturity.

Yield to maturity (YTM) is effectively the rate of return on a bond (expressed as an annual rate) if the bond was purchased at the current market price and held until the maturity date.

Again, the key point here being that you will only be guaranteed the YTM rate if you held the bond to maturity.

Taking the real life example of GSBU25, the current YTM of the bond is 3.64%. This means that you will be guaranteed a return of 3.64% if you bought the bond today at $89.10, and held it until 21 November 2025.

A side note: the yield to maturity will gravitate towards the coupon rate, and the bond price will gravitate towards $100 as we get closer to maturity (it’s called pull-to-par).

This makes sense because at maturity, the bond price will have to be $100 once again.

How do you buy bonds, and what types are there?

For Aussie investors, you can buy these bonds through a licensed broker just like you’d buy shares.

The ASX has published a comprehensive list of licensed full service and online brokers here.

Government Bonds (eTBs)

At the moment, the Australian Treasury Department is issuing coupon bonds with maturities of 1-10 years, 12, 15, 20 and 30 years.

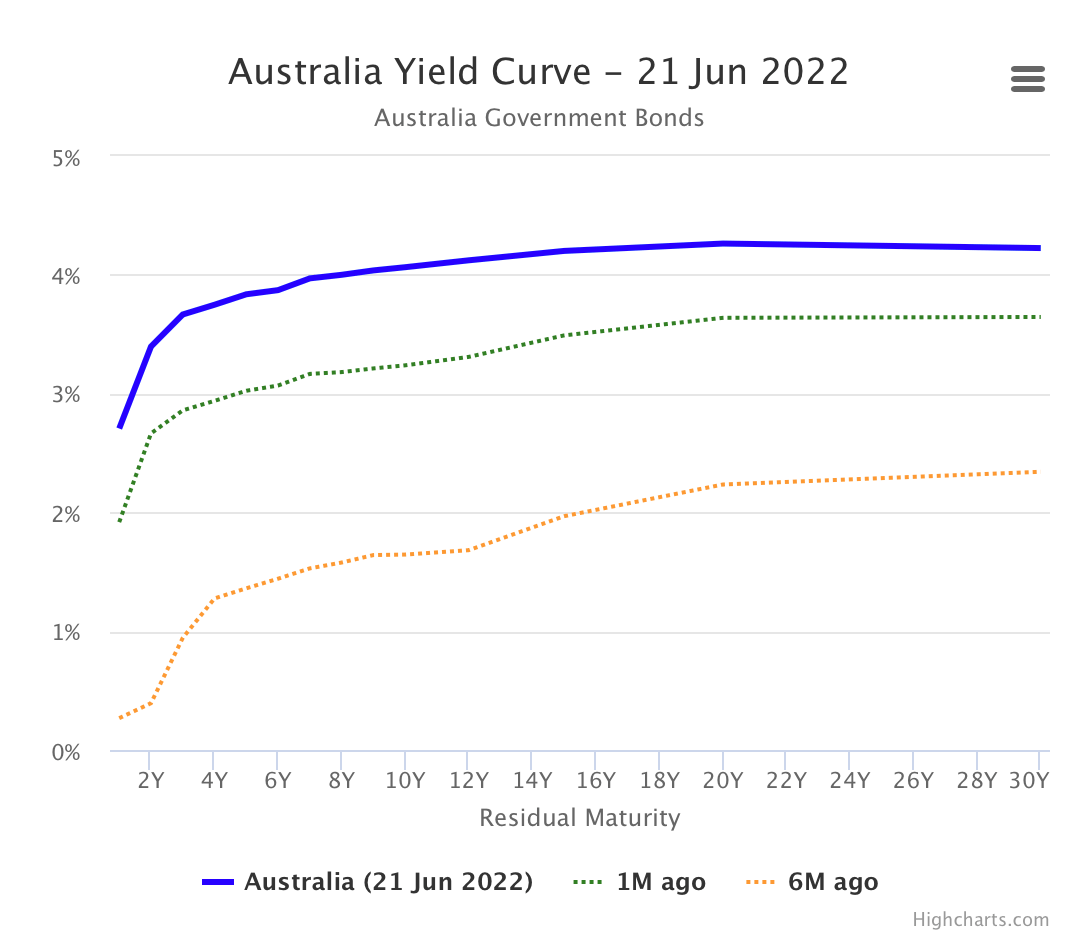

And because the current yield curve is positively sloped, you can expect to earn higher yields/coupons with the longer dated bonds.

As an example, the current coupon rates for a 2-year Aussie govvie is around 3.5% per annum, the 10-year at 4.15%, while the 30-year bond is paying around 4.3%.

Apart from fixed rate bonds, the Treasury Department is also issuing floating rate and inflation linked bonds. But these are very thinly traded, and should really be left to the professionals.

Corporate Bonds (XTBs)

These are bonds issued by individual companies on the ASX, and you can also trade them as you would shares and government bonds.

Corporate bonds have higher coupon rates than government bonds, reflecting their higher credit risk.

The corporate bond market on the ASX is far less liquid than government bonds, and a list of what corporate bonds are available is here.

Although you won’t get the capital upside of a stock holding, corporate bonds sit higher on the credit totem pole.

This means that bondholders would get their money back before shareholders would in a corporate insolvency situation.

Bond-themed ETFs

There is also a handful of bond-themed exchange traded funds (ETF) on the ASX.

Some of the popular funds include:

– iShares Core Composite Bond ETF (IAF)

– iShares Government Inflation ETF (ILB)

– Ishares Core Corporate Bond ETF (ICOR)

– Ishares Global High Yield Bond (AUD Hedged) ETF (IHHY)

– BetaShares Australian Government Bond ETF (AGVT)

– Betashares Australian Composite Bond ETF (OZBD)

– SPDR S&P/ASX Australian Bond Fund (BOND)

– Vanguard Australian Fixed Interest Index ETF (VAF)

– VanEck Australian Corporate Bond Plus ETF (PLUS)

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.