Six things you need to know about global credit that will help you be a better investor

Pic: Getty Images

- Global credit seen as the “missing asset class” for Australian investors who favour equities

- A large and deep market, global credit is significantly larger than global share markets

- Global credit can offer higher levels of income and reduced volatility relative to equities

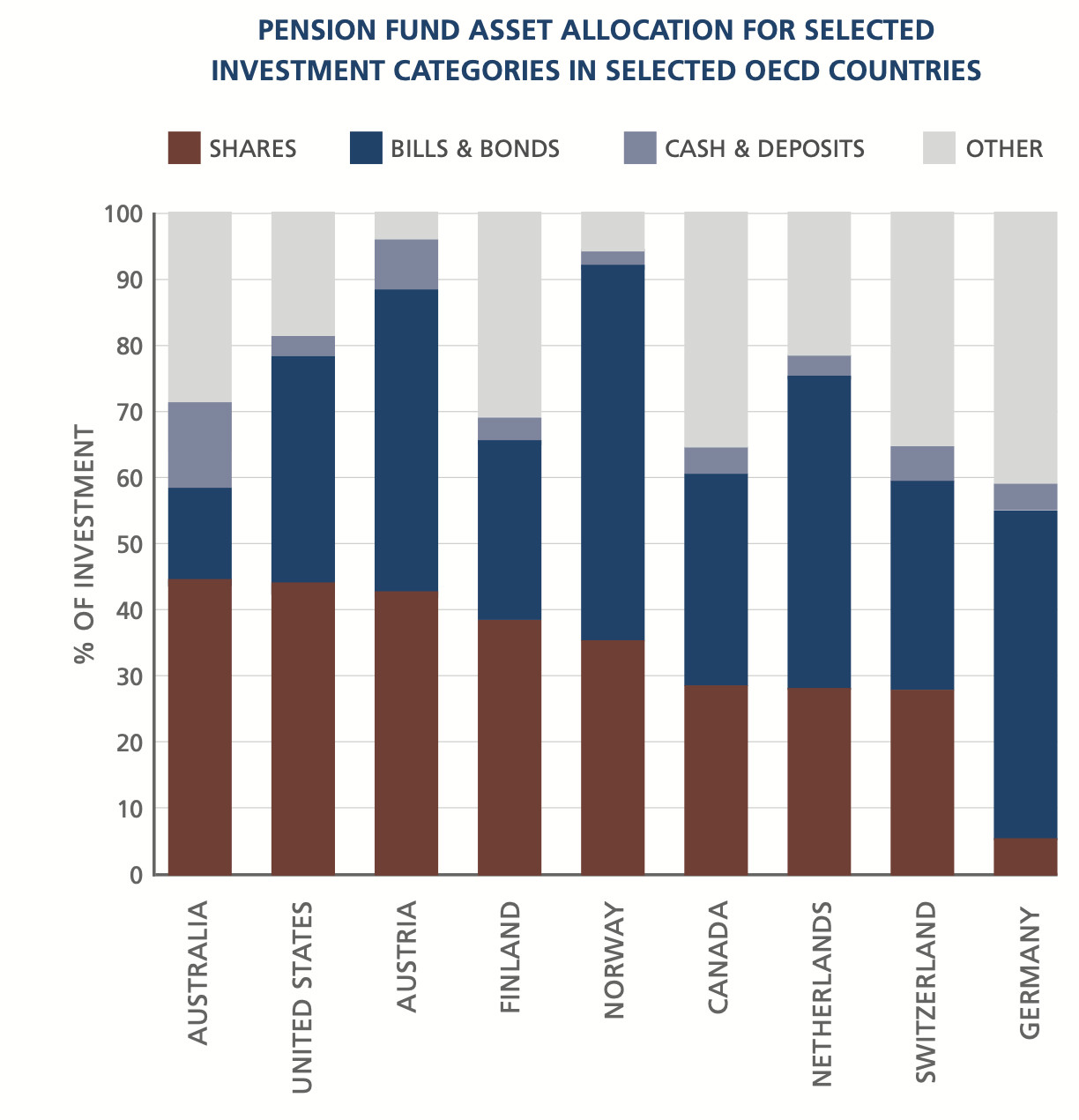

Australians love their equities and have, according to Bentham Asset Management Deputy CIO and Principal Nik Persic, notably larger allocations to equities and cash/deposits than comparable nations.

Persic said this is largely due to investment bias towards the Australian sharemarket. But he said there is an alternative that fits comfortably in the gap between fixed income and equities.

The asset manager has labelled global credit the “missing asset class” because many investors simply aren’t aware of it.

Persic said it offers both higher levels of income and reduced volatility relative to equities but is well suited to investors looking for predictability of income, particularly in the current economic environment.

His views come as Franklin Templeton said we could see a return to the traditional 60/40 balanced portfolio – mixing growth and defensive assets – in 2023.

Six things to know about global credit

1. Income generation

Persic said corporate bonds, loans and high-yield securities tend to pay investors regular coupons, with a higher yield than cash or fixed interest.

“A diversified portfolio of such coupon-paying instruments increases the stability of all those cashflows, which can be paid out as regular, high-yielding income,” he said.

2. Capital resilience – seniority and security

Persic said credit investors have priority of payment above equity investors for payment of coupons and repayment of principal.

“A credit investor’s ranking in the company’s capital structure is a key determinant of their recovery of investment if a company gets into trouble, and their certainty of receiving ongoing distributions,” he said.

In addition to seniority, some credit investments also provide investors with the benefit of security over specific assets of the borrower, providing further protection.

Persic said this normally takes the form of a mortgage over property and other realisable assets.

“These factors mean the capital value of credit investments has been more resilient than equities,” he said.

3. Liquid asset class

Persic said global credit is a large and deep market, significantly larger than global share markets. It has many different investor types, including asset managers, banks, insurance companies, pension funds and sovereign wealth funds.

“This diversity of investors means credit investments are traded between buyers and sellers even in difficult times,” he said.

“Global credit has been a more resilient asset class than equities, recovering far faster than equities after the GFC.

“Global credit is regarded as intermediate risk with an investment horizon of three to five years.”

4. Diversification

Credit issuers come from many industry sectors in many regions of the world, creating more credit opportunities than are available locally.

Global credit markets give active managers and investors the opportunity to achieve a high level of diversification – an important factor for credit portfolios.

Downgrades and defaults tend to be unexpected and occur in industry clusters.

Global diversification reduces overall volatility and mitigates the impact of defaults.

5. Credit types

There are many types of credit instruments, enabling an active manager with a global perspective to construct a portfolio of diversified investments. He said credit sectors include:

• Investment grade bonds

• Securitised debt

• Global syndicated loans

• Convertible bonds

• High yield bonds

• Capital securities

• Hybrid securities

• Asset backed securities

• Mortgage backed securities

• Emerging market debt

6. Managing credit risk

Persic said like all investments, there are risks to consider with the key one credit risk, where a company fails to repay coupons or principal in full and on time.

“Credit risk can be best managed and mitigated through careful investment analysis and security selection, thorough review of creditor protections in any security, a focus on rated, liquid investments, and significant diversification.

He said diversity is more important in credit portfolios than in equity portfolios but less recognised.

“A credit portfolio with 20 to 50 securities is not diversified enough to reap the full benefits of diversification.

He said diversity required to create a robust credit portfolio is simply not possible to replicate with a small portfolio.

“For context, Bentham’s credit funds typically have between 150 and 600 unique issuers in each,” he said.

Compelling case for global credit in 2023

Persic said the yields in global credit markets have changed considerably as global interest rates and credit spreads have risen in recent times. He said yields have more or less doubled over the past year.

“We’re now getting very interesting yields compared to what we have historically, and it seems compelling against other asset classes,” he said.

“For investors who have a high-income target and want more capital resilience than equities, I think many parts of global credit markets may provide a more favourable opportunity for generating income over the next few years.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.</em

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.