Precision Points: Dermot Woods teaches you the simplest way to value a stock

Wanna know the simplest way to understand a stock? We may just tell you. Pic: Supplied/Stockhead

In Precision Points, Precision Funds Management executive directors Dermot Woods and Andy Clayton draw on insights from two decades on the front lines of equity markets to share their expertise with Stockhead readers.

There are so many indicators used by the world’s best investors to work out whether a stock represents value for money.

Some are obvious – price to earnings for example – while others will leave you phoning Will Hunting to find out what’s going on.

But there are calculations investors can do at home, which have been used by some of the world’s most successful portfolio builders.

One is known as price to book value, and it’s something Precision Funds Management’s Dermot Woods and Andy Clayton have employed to assess whether cash-generating businesses may be under or overvalued.

“It’s probably the most old fashioned way of valuing a stock,” Woods said.

The way to do it is to take the market cap of a company and divide it by the reported net value of its assets. By logic, the market should be willing to pay at least for the book value a listed company has in its accounts.

But that’s not always the case.

“It’s even simpler than earnings because earnings is open to conjecture, because of the world we’re in in terms of underlying earnings etc, which could take out a lot of things including ongoing costs,” Woods said.

“It’s been a metric that’s worked time and again. You just have to be prepared to be patient.”

Exceptions

There are some exceptions to the rule.

Companies in areas which are vulnerable to technological changes or have perishable assets don’t fit neatly into the metric, with assets liable to depreciation or wastage.

But there are simple sectors where Woods and Clayton have used the formula to good effect.

Among them is property, where dated assessments can even mask the true value of the land they hold, and mining services, where assets are replaced on a rolling basis.

“If you’ve got something that’s trading on a discount, as long as a company’s not very badly run – i.e there’s a lot of costs getting the way of profit and the return on equity is more than their cost of equity – then price to book value should be a really good way to measure a company,” Woods said.

It can help investors peek through the looking glass in a world where outsized gains are driven by earnings momentum and passive investing flows.

“Go back to the fathers of value (investing) in the stock markets, Benjamin Graham, Warren Buffett, people like that. That was the first thing they looked at,” Woods said.

“It’s just a good old fashioned valuation measure, which got massively out of fashion because 90-something per cent of the stock market participants, even on the institutional side, just chase nothing but earnings momentum.

“Hence you get sectors like gold today and lithium three years ago where stocks that we all know are probably going to have a moment of reckoning at some point in time – because the the cash flow potential and the market cap are never going to align – can trade out of whack for years at a time.”

What to look for

So it’s easy enough to get a number, but what does it mean and when is it worth taking a look at a company?

Generally something that’s trading at 0.7, meaning its market cap is worth 70% of its net tangible assets, is a good mark, Woods says.

That would imply an upside of 43% if a firm’s market cap were to revert to 1x.

And as a firm’s valuation becomes more distorted that gain can expand. A score of 0.6x implies potential two-thirds upside, 0.5x is 100%.

“It’s not a popular measure because people love chasing low priced, low capex companies who this measure just doesn’t apply to. If you get low capex, you can get some quicker growth, but you can also get a lot of disasters, particularly when it comes to acquisitions,” Woods added.

Indeed, Woods says price to book value is ‘barely mentioned’ by research analysts despite its utility and simplicity.

Where it has worked to good effect has been with mining services stocks, which were trading at severe discounts to their book value a couple years ago.

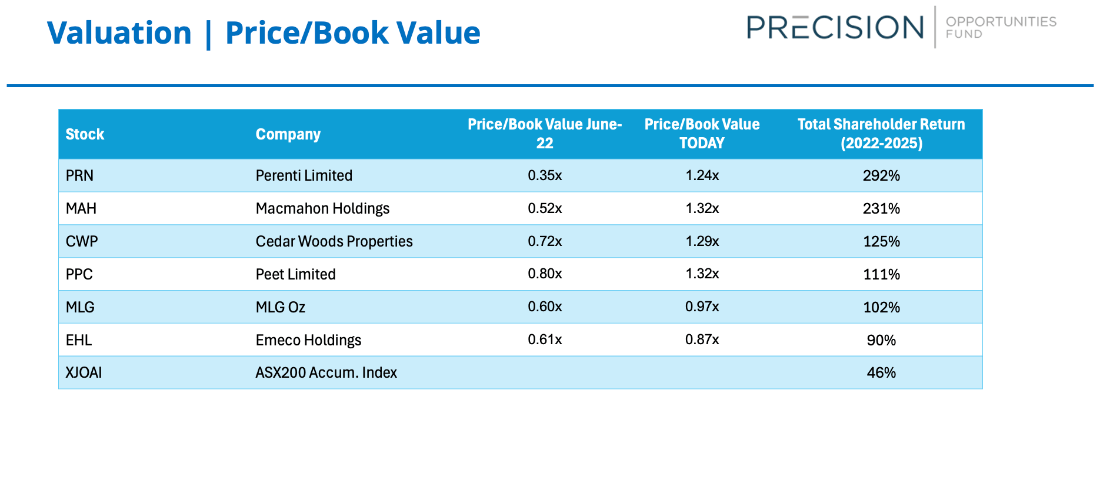

One example was Macmahon Group (ASX:MAH), which has turned from running at 0.52x book value in June 2022 to 1.32x today, delivering a 231% total shareholder return.

Perenti Global (ASX:PRN) has run from just 0.35x book value in June 2022 to 1.24x today, with a 292% total shareholder return.

Emeco Holdings (ASX:EHL) has normalised from 0.61x in June 2022 to 0.87x and it’s clear corporates view the equipment and mining services stock as cheap – US-based American Equipment Holdings is rumoured to be circling for a takeover bid.

“They’ve just got a bid and they’re still trading at a discount to book value. Book value is $1.36/sh, they were trading $1.06 before the bid and they’re trading about $1.20 now,” Woods said.

“So you still see easy upside and why you can justify paying for it, because as we’re sitting here today, theoretically they’re churning off $150 million free cash flow year. So the book value is going up as the net debt goes down.”

The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.