Peter Strachan: We need to talk about… long duration energy storage

Picture: Getty Images

- “Duck curve” increasing, leading to stress on grid and challenges for market

- LiBs can be categorised as sprinters, flow batteries are considered marathon runners

- Supply issues, rising competition for LiBs from EV manufacturers can keep cost of lithium-based batteries high

Peter Strachan is a capital markets veteran, resources analyst and lover of the oil and gas game. He completed a Bachelor of Science in Metallurgy and Geology at the University of Melbourne and worked in Zambia and PNG as a metallurgist and as a business analyst in Melbourne with CRA, now Rio Tinto.

The holy grail for integrating intermittent, renewable, or rebuildable power supply (renewable enrgy, or RE) into a 24/7 grid supply involves an ability to store low-cost power when it is generated and deliver it into a power grid when it is needed.

Australia’s Commonwealth Scientific and Industrial Research Organisation’s (CSIRO) report A roadmap for renewable energy storage in Australia, states that “Storage of renewable energy is essential to ensure access to secure, reliable and affordable energy as Australia transitions to net zero.”

In recognition of this task the CSIRO goes on to assert that “all net zero pathways will require large investments in renewable energy storage capacity”.

“Larger investment in short and medium-duration electricity storage is expected to be required to provide reliable electricity supply.”

This pathway will require Australia to “rapidly develop a pipeline of projects across a portfolio of energy storage technologies to address key technology challenges across different end-use applications and geographical locations.”

Power authorities globally are actively installing long duration energy storage (LDES) capacity to act as the critical bridge between periods of energy surplus and deficit, namely peak demand periods when renewable energy generation is absent or low.

Duck Curve Challenge – Rise of cheap yet intermittent, ‘rebuildable’ power generation

There is little debate that the future of the power grid is renewable. Rapidly expanding application of low cost, wind and PV power generation has brought forward a pressing need to time-shift surplus power, using LDES technologies.

Rising scale and ongoing technical advances for RE continue to drive power costs down, but the issue of security of delivery remains.

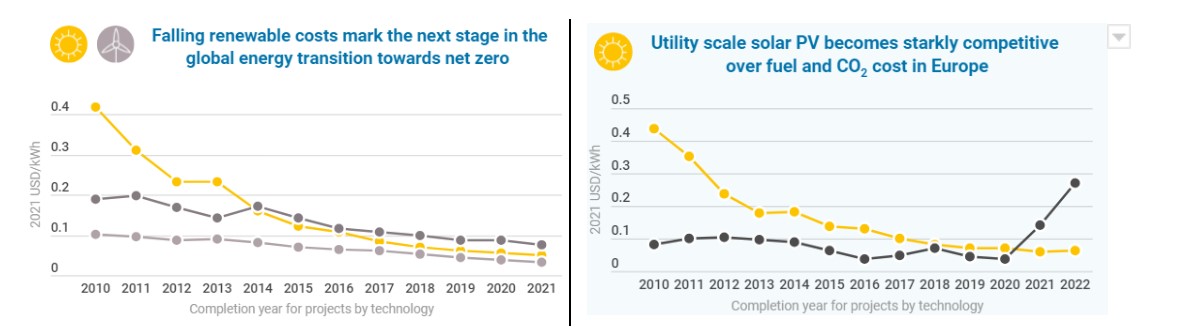

In its July 2022 report, the International Renewable Energy Agency (IRENA) states that over the 11 years to 2021, the levelised cost of energy from onshore and offshore wind turbines fell by 88% and 60% to US3.3 cents and US7.5 cents per kilowatt hour (KWh) respectively, while the cost of solar PV power fell by 68% to US4.8 cents per KWh.

Meanwhile, the cost of power from fossil fuel sources skyrocketed under the influence of rising gas and coal prices.

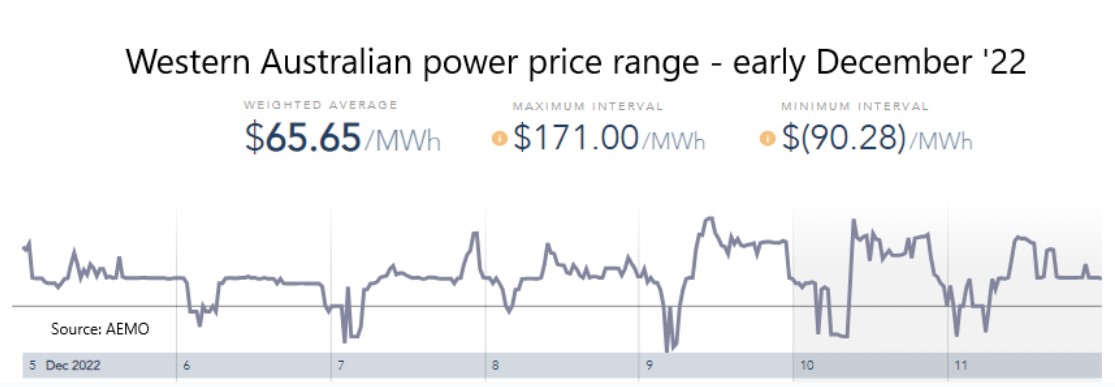

A surplus of intermittent power supply during the middle of the day, when solar PV and wind generation are at their peak, now regularly leaves power grids around the world with a zero or negative price, even in winter.

This so called “duck curve” phenomenon is increasing year by year, leading to stress on the grid and challenges for the market, whilst also challenging traditional, dispatchable energy sources by making it uneconomic for them to operate 24/7 and creating a massive price margin incentive for power storage applications to capture cheap power for resale into periods of peak power demand and price.

Storage options – the good, the bad and the ugly

A rapid improvement in performance, combined with reduction in cost for compact lithium-ion battery (LiB) technologies has seen this option dominate power supply for mobile equipment, electric vehicles (EVs) and more recently, stationary power storage.

The LiB is well suited for instantaneous high energy power supply for EVs and in support of power grid integrity but is less suited for LDES beyond about four hours. Depending on electrical configuration, a 100MWh LiB storage installation can supply 50MW over two hours or 200MW for 30 minutes, which is useful in emergencies or power system failures.

LiBs can therefore be categorised leaders in power orientated short duration battery applications. However, LiB technology is not the solution for intra-day energy storage that the grid will increasingly require. Safety considerations in use, like a propensity for thermal runaway and a storage capacity that degrades with use, also reduces the suitability of LiBs as a LDES solution.

LiBs deployed in hot regions need to use some of their stored energy to maintain lower temperatures, since battery performance begins to deteriorate above temperatures of 26 degrees Celsius, however the introduction of Na-ion and lithium-iron-phosphate (LFP) chemistries overcomes some of these safety concerns, but still does not meet the LDES holy grail.

While LiBs can be categorised as the sprinters of the battery pantheon, flow batteries are considered as marathon runners.

Flow batteries store energy in an aqueous solution and are thus not a fire risk.

A vanadium Redox battery (VRFB) changes the valance of vanadium pentoxide (V2O5) in solution as it charges and discharges, releasing some hydrogen gas through that process, while the zinc bromine flow battery (ZnBr), with at least twice the energy density per square metre of project space compared with VRFBs according to ZnBr manufacturer Redflow (ASX:RFX), deposits zinc on electrodes as it charges, with no harmful emissions.

Other LDES options include those that are still at early stages of development and not yet fully commercially deployed, including hydrogen manufacture with ceramic fuel cell coupling, compressed air, pumped hydro, or weight batteries.

These technologies respectively use surplus or low-cost power to make hydrogen, compress air, lift water or weights and then respectively, use hydrogen as fuel for a ceramic fuel call, capture kinetic energy when the air is expelled, or as gravity drives turbines when water or weights descend.

Currently, development of pumped hydro power storage in Australia is proving to be expensive and time consuming.

To meet an identified need for energy storage, mature products that are already commercially proven and cost effective in use in critical infrastructure, and with the required high market readiness, should be the natural selection.

Power can also be stored as heat in graphite or other mediums like oil and phase change substances like molten salt or silica. Stored heat can be used for industrial purposes or converted back to power through a heat exchanger and a steam cycle turbine system.

However, these complex systems are challenging to build at scale and do not yet offer viable round-trip efficiencies of storing and dispatching energy.

There are several battery technologies in development. For example, Sydney based Gelion Technologies is developing a gel-based zinc bromine battery, which aims to replicate the small size of lithium offerings that might find uses for stationary storage, once developed.

Australian company Lavo Systems has developed a complex but ingenious, hybrid LiB and hydrogen fuel cell based, 40KWh LDES battery that ideally uses surplus RE to split pure water into hydrogen and oxygen, store hydrogen under pressure in a patented, mixed metal hydride matrix, then release hydrogen to a ceramic fuel cell to generate power when needed, assisted by its companion LiB starter battery.

This complex system with many parts might have a 25-30% energy round-trip efficiency, but hydrogen could also find ancillary uses. The Lavo unit needs to be plumbed into a pure water supply and may struggle to gain regulatory approval to slap on your house, because hydrogen is involved.

Rationale for non-lithium energy storage solutions

Production of lithium chemicals and battery anode materials like graphite, used to produce LiBs, is dominated by Chinese manufacturers. In a deglobalising, post-Covid world, such a concentration of manufacturing creates market, political and logistical risks for supply, which leads governments and the renewable industry to increasingly focus on commercially proven, scalable, LDES alternatives.

The capital cost of LiB has begun to plateau following two decades of falling costs per KWh of LiB storage capacity. Even though the price of lithium chemicals has halved since November 2022, it is still about four times the price seen through 2018-21.

Supply issues and rising competition for LiBs from EV manufacturers look set to keep the cost of lithium-based batteries high, so that non-lithium alternatives for LDES are receiving very favourable attention by power utilities and other power uses that strive to reduce their carbon footprints.

Safety considerations in use are a prime concern. LiBs have a propensity for thermal runaway and a power storage capacity that degrades with use, reducing the suitability of LiBs as a LDES solution.

Flow batteries have several advantages for LDES. Like the LiB alternative, they are scalable from KWh to multi-megawatt hour applications. A small heating addition will ensure normal operations under sub-zero temperature operating conditions and unlike LiB alternatives, ZnBr flow batteries do not need external cooling under normal operations at temperatures of between 10-45 degrees Celsius, ensuring an approximate 80% roundtrip power efficiency, according to Redflow.

ZnBr batteries run a maintenance cycle after 72 hours of normal operation. Maintenance takes two hours and is usually scheduled for the end of a normal discharge cycle, prior to recharging from wind, PV or grid supply.

Flow batteries work well when they are fully cycled, unlike LiBs which need to retain some charge and would be damaged by being fully discharged.

ZnBr flow batteries can be stored indefinitely in any state of charge so seasonal power requirements can be met by hibernating some fully charged batteries that will respond instantly to an increase in power demand.

ZnBr batteries come with a 10-year/36,500KWh warranty and those that have been in operation for 10 years or more show little if any sign of operational deterioration.

In any case, ZnBr batteries are fully recyclable and can simply be refurbished.

Many alternative LDES solutions, like pumped hydro or heat storage involve multiple complex processes to re-generate power from stored energy, while a battery can deliver power directly when required.

Local heroes

ASX listed ZnBr battery pioneer, Redflow is a global leader in the rapidly accelerating LDES market. The company has established a 40MWh pa battery production facility in Thailand, and plans to expand to 80MWh pa. Redflow produces 10KWh modular units that can be combined for domestic and commercial use as well as 200KWh ‘pods’ of 20 batteries that can be combined to provide multi-megawatt storage.

Redflow has over 250 active deployments globally, including local councils, remote farming operations, the Australian Bureau of Meteorology, remote Optus telecommunications stations, as well as a 560KWh system to an off-grid ecotourist resort in South Australia, and a 2MWh system to the Anaergia Bioenergy business in California.

Redflow’s battery hibernation mode also enables energy to be stored for periods of weeks to months without any self-discharge, providing flexibility for duration and resiliency applications.

Following the signing of a 20MWh (US$12 million) project in California, the company says that it is in the final stages of closing an additional 19MWh of battery projects and is in active customer engagement over a further 273MWh of capacity, along with 2.4 GWh of active proposals it has out in the market.

Several resource companies, including Australian Vanadium (ASX:AVL), through its subsidiary VSUN Energy, have expressed interest in supplying vanadium pentoxide to vanadium redox flow batteries made in China, using an Australian patented battery invention.

The managing director of zinc bromine flow battery producer Redflow, Tim Harris, outlines three main factors influencing customers seeking roll-out of long duration energy storage systems.

Firstly, the cost profile for a storage system, including up-front capital costs and the expected levelised cost of supply over the system’s life, as well as the “cost-down profile” for future products as users duplicate and expand systems.

Secondly, the operational performance of the system, including the round-trip energy efficiency, being the amount of power available compared with the amount of power captured and stored, as well as the on-going system maintenance costs.

The final and probably the most significant factor from a user’s perspective is proof of operational performance from existing installations and evidence of operating effectiveness over time.

Harris says that ability of Redflow’s flow battery system to hibernate when power demand is low has been a significant positive in the company’s discussions for existing and prospective clients for the company’s LDES systems.

Market potential

Under its 2022 Step Change scenario for an Integrates Systems Plan (ISP), The Australian Energy Marketing Operator (AEMO) estimates that the National Electricity Market (NEM) will require 550GWh of dispatchable storage in all forms and 44GW of utility scale battery and pumped hydro capacity by 2050.

Likewise, the California Energy Storage Alliance estimates that California alone will need 45–55GWh of long duration energy storage to support California’s grid by 2045.

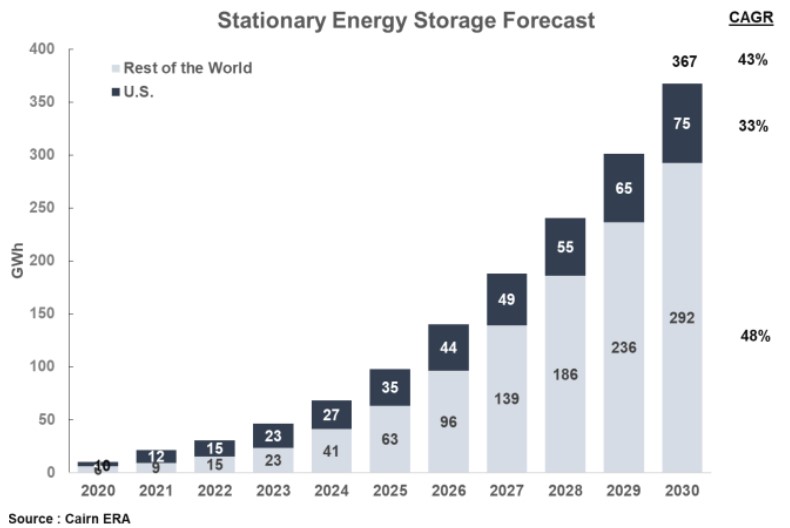

Cairn ERA estimates rapid expansion globally, rising from 21GWh in 2022 to 367GWh by 2030.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.