PETER STRACHAN: Even at current prices, this copper junior is lined up for profitable production… and soon

Picture: Getty Images

Copper markets

Recent predictions of a well-supplied copper market until 2025 rely on estimates of increasing tonnage of recycled metal coming into the market combined with lower growth for global industrial production.

Weaker economic activity in China persists as its debt heavy domestic property sector seems immune from stimulus initiatives by central government, at least in the short term.

Weaker demand growth outlook for commodities generally follows a longer period of industrial production killing higher interest rates than might have been predicted in 2022, especially in the USA.

This leaves the copper market facing a tough period through until at least late 2024.

The financial performance of miners is also being hit by rising costs for energy, logistics and labour.

However, increased use of copper in renewable energy applications and electric vehicles supports lifting copper demand and ultimately metal pricing beyond 2025.

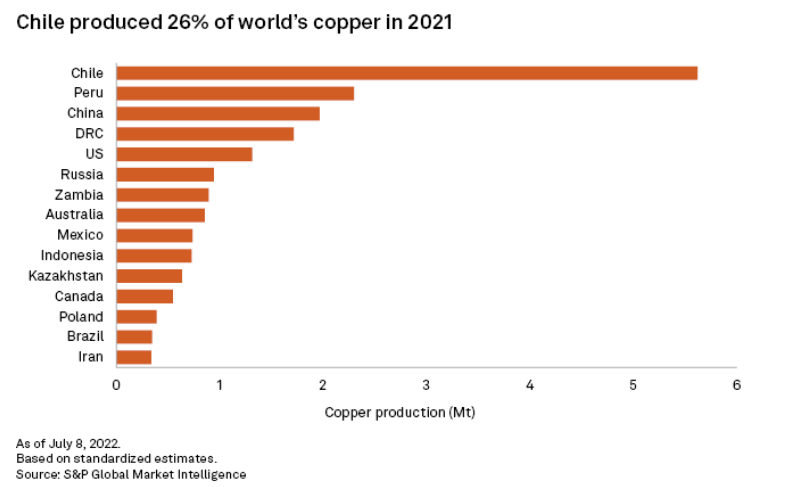

The bull-case for copper is supported by ongoing geopolitical uncertainties in mining centres like the DRC and Peru, as well as relatively low metal inventories, even as LME stockpiles have tripled since July ’23. A dearth of new copper mine supply following a lack of recent discoveries, along with the rising cost and timeframe to bring new projects online, also predicates higher copper prices over time.

A copper price of US$8,000 per tonne or US$3.63/lb, negatively impacts financial viability of the highest cost 5% of producers. Further falls to US$3.15/lb would be sufficient to eventually take significant tonnage out of the supply chain and stabilise the copper market and price.

Hillgrove Resources (ASX:HGO) is a fully funded copper mine redeveloper with a market capitalisation of $113 million and excellent leverage to the copper price via imminent production and exploration appeal. The company’s Kanmantoo underground mine and 3.6mt processing facility is scheduled to recommence processing ore in the March quarter of CY ’24 at 1.5mt pa. Estimated Measured and Indicated Ore Resources total 5.3 million tonnes grading 1.1% Cu supports an initial mine plan to produce 44 Kt of copper and 11 Koz of gold over a four-year programme.

Ore will be sourced predominantly from development of two of nine recognised underground copper-gold lodes. Underground ore production is set to ramp up to 1.5mt pa at a grade of around 1% copper, after applying a cut-off grade of 0.6% Cu. An initial 10-11Kt of copper production in concentrate is target in the first full year of operation, moving to a high of 15Kt in later years.

A well-maintained processing plant will operate on a two-week cycle of production and maintenance but could be reconfigured to boost output beyond 1.5mt pa or extend mine life if additional mineralised zones are discovered and developed.

Ore is readily processed using a course grind size of 300 micron, enabling copper recovery of up to 94% into a clean concentrate at an estimated all-in sustaining cost of $8,000 per tonne or ~US$2.30/lb.

The project is located within a 45-minute drive from Adelaide’s CBD. Unlike many others in the resources sector, Hillgrove has had little difficulty attracting quality staff who can commute from home and maintain family life.

Exploration Target

The Kanmantoo mineral field hosts several previously recognised and under-explored zones of mineralisation. Beyond the Kavanagh and Nugent lodes, that will account for planned production over the coming three years, the company has identified nine lodes that are open at depth and more than five separate targets on its mining lease, plus additional regional prospects that could add to mine life over time.

A drill intercept located 70m outside of the Resource envelope and below existing results announced in August ’23 supports this thesis with an intercept of 45m grading 1.2% Cu and 0.12g/t Au in the Kavanagh lode.

Additionally, recent drilling of 35.1m grading 1.29% Cu at the Emily Star zone and 45.4m grading 1.19% Cu at Spitfire confirms the location of ore-grade Cu-Au mineralisation proximal to the existing mine plan that holds potential to expand project life.

Importantly, the company’s geophysical survey work continues to outline potential to extend mine-life. Activity has extended zones of known mineralisation and added previously unidentified lodes beyond certified Resources, resulting in the establishment of an Exploration Target of between 60 and 100 million tonnes, capable of supporting decades of production at this site if translated into Mineral Resources.

The Kanmantoo Deeps conductivity anomaly is coincident with strong gravity and magnetic anomalism, typical of the shallower Kavanagh Cu-Au mineralisation. The centre of this conductivity zone, at 590m below surface, is approximately 400m to the north of the planned Kavanagh decline development, representing a prime target for underground drill testing as the mine progresses.

Commercial

Once in full operating mode, Hillgrove targets an all-in sustaining cost of $8,000 per tonne or ~US$2.30 per lb of copper produced, delivering a solid operating margin at current prices of around US$3.63/lb. Cash flow will be boosted by carried forward tax losses of $235 million, while potential early dividend payments would be supported by $17.6 million of franking credits.

Copper concentrate from this mine will contain no penalty elements, while its gold content will attract by-product credits. Sales will be managed out of the Port of Adelaide and into Asia by a US based commercial trading company that has a 20% shareholding in Hillgrove.

While a cut-of grade of 0.6% Cu will be applied for mining ore, the higher-grade core is surrounded by a zone of lower grade mineralisation. Any sustained lift of the copper price over time would support processing of this lower grade material as a marginal processing cost through the mill is estimated to be just $7.50 per tonne.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.