Morningstar sees best value in tech, property, industrials and communication sectors on ASX in 2023

Household disposable income forecast to come under increasing pressure in 2023. Pic:Getty Images

- Morningstar sees several sectors as undervalued, including tech and real estate

- Caution urged for at least H1 CY23 with interest rate tightening cycle still a way to go

- Household disposable income to come under increasing pressure this year as mortgage repayments spike

Morningstar reckons many stocks in the tech, real estate, industrials, and communications sectors are undervalued after major share price falls in 2022 following interest rate hikes to curb rising inflation and concerns of an economic slowdown.

The best value is in the energy, real estate, financial services and telecommunications sectors, according to the Morningstar Australia and New Zealand Equity Market Outlook Q1 2023.

The ratings house said global equity markets were currently data-dependent, as inflationary forces, the labour market and wage outcomes dominate the landscape, and expectations around central bank decisions vacillate.

While volatility indexes in the US and Australia suggest investors feel comfortable and the outlook is positive, Morningstar head of equities research Peter Warnes disagrees and urges caution at least for the first half of 2023.

“The interest-rate tightening cycle has a way to go and the lag effect of eight consecutive monthly hikes in 2022 will have a meaningful impact on household consumption through 2023, starting in the post festive period,” he said.

He said markets could bottom two to three months after the central banks’ tightening cycle concludes.

However, Warnes said this doesn’t mean a v-shaped reversal as 2023 will be challenging on many fronts, not just economic but geopolitical and “Russia-Ukraine war issues are likely to persist”.

US Inverted yield curve points to recession

In the US the current two-year/10-year yield curve remains deeply inverted at 84 basis points, the widest since 1981.

“Some 41 years ago, former Fed chair Paul Volcker was also tightening into an inverted yield curve of this magnitude,” Warnes said.

“A recession closely followed the peaking of the federal-funds rate.

“Currently, the market is pricing in a peak in the federal-funds rate early in the June quarter of 2023.”

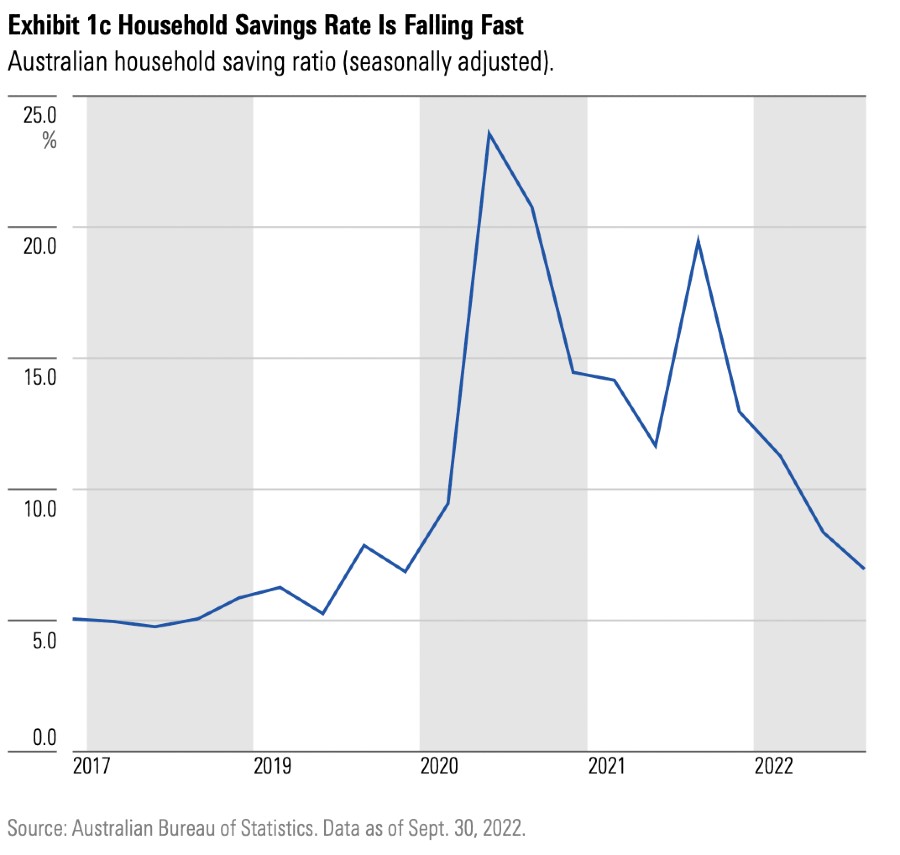

Household savings falling fast

While 2022 will finish on a relatively strong note with year-on-year GDP growth around 3%, the landscape is set to change meaningfully in 2023.

“Almost unbridled household spending, which was the main driver of GDP growth in 2022, will be restricted by the delayed impact of eight interest-rate hikes totaling 3%,” Warnes said.

And while Australia’s unemployment rate is at a 40-year low of 3.4% and we have solid wages growth, household disposable income will still come under increasing pressure as mortgage repayments spike.

“Savings buffers will continue to be depleted as the household savings/income ratio retreats to pre-coronavirus levels,” Warnes said.

“Household spending growth is expected to decline from 3% in 2022 to between 1% and 1.5% in 2023.”

The Australian economy has a substantially lower debt/GDP than larger Northern Hemisphere developed economies.

However, the interest on government debt is forecast to be the fastest-growing expense item over the next decade and budget deficits are likely to persist for many years.

While China’s stimulus policies to revive the depressed real estate sector will be beneficial to Australia’s resources sector, particularly iron ore, net exports cannot replace household consumption as the main influencer of GDP growth.

“Where household consumption and private sector expenditure goes, so will the economy,” Warnes said.

Australia & NZ Stocks still trade at a discount

Morningstar’s report shows Australia and New Zealand stocks remain modestly undervalued. As of December 9 Australian and New Zealand stocks covered by Morningstar were trading 7% below fair value on average, compared with a 15% discount at the June and October lows.

“About 44% of Australian and New Zealand stocks under Morningstar coverage are either 4 or 5-star-rated, a historically high proportion,” Warnes said.

“In comparison, the trailing 10-year average is for 22% of our coverage to be 4- or 5-star-rated.”

He said large numbers of stocks in the tech, real estate, industrials, and communications sectors are undervalued after major share price falls in 2022, triggered by sharply higher interest rates and growing fears of an economic slowdown.

“Despite rallying strongly in 2022, many stocks in the energy sector remain attractive, a testament to how cheap they were in 2021,” he said.

Gold winner as crypto winter comes

In mining coverage, Morningstar said gold miner Newcrest Mining (ASX:NCM) is the standout, trading around 30% below its fair value estimate.

“Cryptocurrency losses have also been gold’s gains with the price cracking US$1,800 per ounce in December from lows near US$1,600 in September and November 2022,” Warnes said.

“The Aussie gold price remains near record highs and we also still see value among the coal miners with upside from high prices generally not factored in.

“The rally in iron ore prices again sees those firms as notably overvalued.”

The NCM share price is up 6.47% in the past month ad 11.73% over the past six months.

Warnes said the RBA’s aggressive rate hikes are a potential catalyst for retail spending to soften near-term.

Rising cost of living pressures, such as rampant food price inflation and rent increases, are also biting.

“In this environment, Australians with increasingly limited budgets are likely to prioritise consumer staples like food and liquor over discretionary goods,” he said.

“However, given concerns about recession risk, an investor flight to safety has left defensive stocks largely overvalued.

“In their hunt for yield, investors bid up the price/earnings ratios of the most reliable income stocks in the defensive retail sector, such as supermarkets.

He said rising bond yields could prompt investors to reconsider what is a reasonable running yield from these stable but relatively mature defensive consumer staples stocks such as Coles (ASX:COL), Endeavour (ASX:EDV) and Woolworths (ASX:WOW).

“While slightly overvalued, Endeavour offers investors seeking exposure to staples retailing the most appealing value in what we believe is a strong franchise,” Warnes said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.