MoneyTalks: Why Martin Currie reckons the 2020s will favour value investing, and their three picks

Martin Currie says value stocks are far cheaper today than they have been over most modern periods. Pic: Getty Images

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Martin Currie chief investment officer Reece Birtles.

What’s hot right now?

For Birtles its all about value investing, which is typically buying under-appreciated companies when others are selling them off at a discount.

Favoured by the likes of one of the world’s most successful investors Warren Buffett, at the annual Berkshire Hathaway shareholders meeting the 92-year-old conveyed his positive outlook regarding the future of value investing, saying prospects are created by the actions of others.

“What gives you opportunities is other people doing dumb things,” the Oracle of Omaha told shareholders.

Birtles says the Roaring 1920s was a decade of economic growth and widespread prosperity. He says while Covid-19 set this century’s ‘20s off to a slow start, the scene is now set for a resurgence of value style investing.

“Back in the 1990s, Eugene Fama and Kenneth French’s research highlighted the higher expected returns available over time for stocks with low market value relative to their book value of equity, small market capitalisation and higher beta,” he says.

“While value-style investing had been around for many more decades (think Benjamin Graham, Warren Buffett), Fama and French were the first to systematically test value and growth returns across a large set of stocks.”

He says their results demonstrate that value investing can be expected to produce superior long run returns relative to growth style investing.

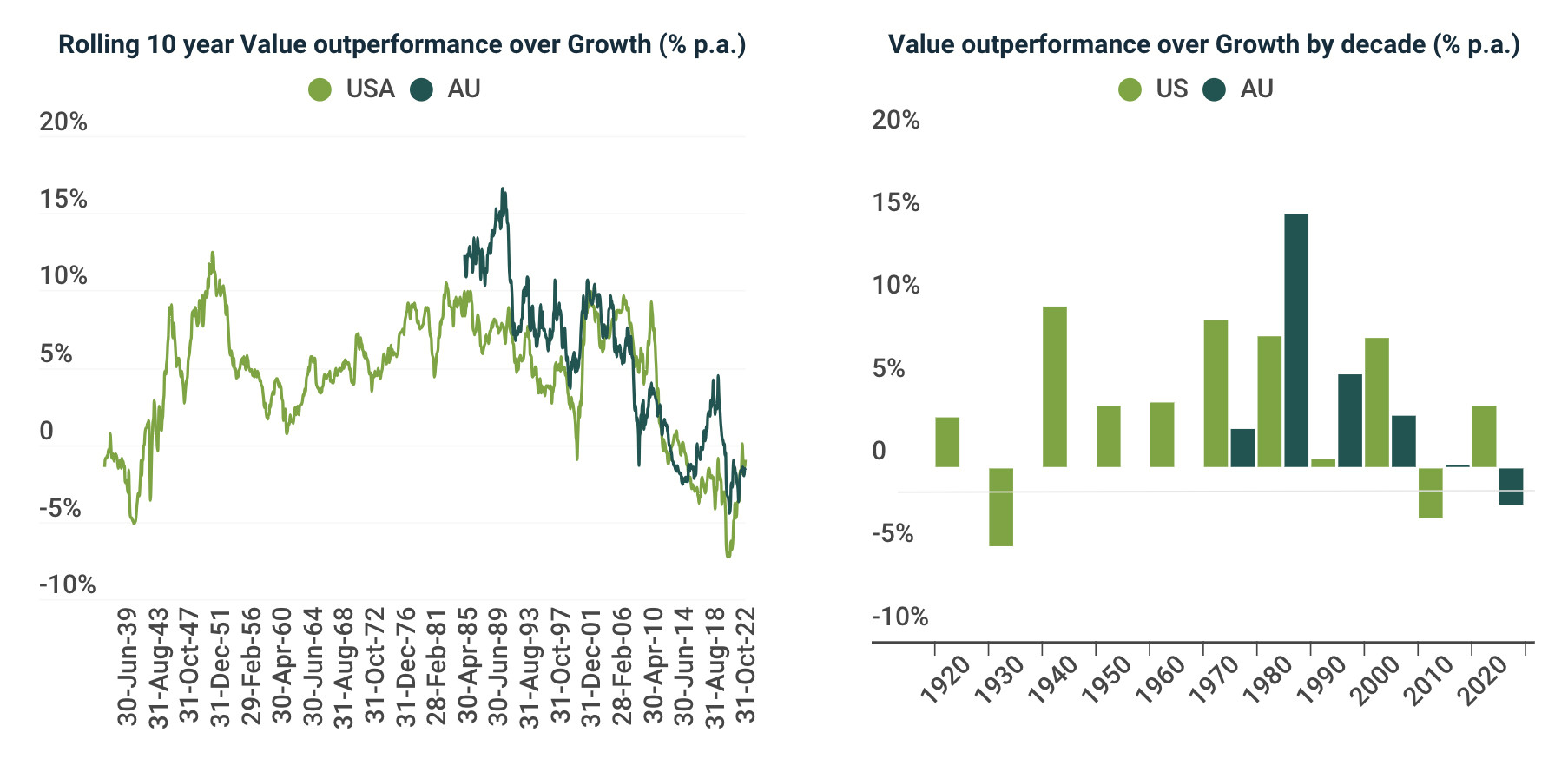

“Updated data through October 2022 demonstrates that value-style stocks have outperformed growth stocks in eight out of the last 10 decades, and in 82% of rolling 10-year average periods,” Birtles says.

“This observation of superior value returns has now also been demonstrated in other markets including Australia.”

Birtles says the decade since the Global Financial Crisis (GFC) has proven to be one of the most difficult ever periods for value investing, recording the worst rolling 10-year results which extended into the start of the 2020s during Covid-19.

“It is hard to determine all the reasons as to why the 2010s were such a tough decade for value investing, but it is easy to point to one – the extraordinary monetary policies employed over the decade that drove US Bond yields to 100+ year lows,” he says.

“Value stocks have historically shown a strong outperformance correlation with upward movements in bond yields, and yields are finally on their way back up.

“The current inflationary conditions now point to a return to the ‘old normal’ for bond yields, and a tailwind for the value style.”

He says impacts of the market’s penchant for growth over the last decade has been stark on stock valuations.

“Growth stocks are far more expensive and value stocks are far cheaper today than they have been over most modern periods.”

He says the chart below shows this based on forward P/E ratios but a similar observation can be made looking at market to book, dividend yield and its proprietary Martin Currie Australia valuations.

“The exceptional monetary conditions and zero rate policies have concluded, and we are now seeing the return of inflation and central bank tightening,” Birtles says.

“Growth stocks are expensive and value stocks are cheap relative to history.

“Investors are under-allocated to value strategies as they have responded to the unusual returns of the 2010s.”

Top Picks

Birtles says energy transition is an important ongoing theme for Martin Currie’s Value equity portfolios.

Worley (ASX:WOR)

WOR offers engineering, consultancy, and project management services on a global scale.

The company boasts a diverse team of experts including consultants, engineers and data scientists, serving the energy, resources, chemicals and infrastructure industries.

“Worley is one of our long-term overweight stocks, and it was finally moved from being classified in the GICS Energy sector to the Industrials sector under Construction and Engineering,” Birtles says.

“This appeared to draw in new investors, and its recent investor day highlighted the growth and significance of sustainability and energy transition revenues.”

Shell Global Solutions International B.V. recently awarded WOR an enterprise framework agreement (EFA) for three years, with options for two one-year extensions, to provide services to its projects across the globe.

The EFA follows a previous five-year framework agreement inked in 2017. Under the EFA, Worley will provide engineering, procurement and integrated project management services for Shell’s projects covering all of its businesses.

AGL Energy (ASX:AGL)

One of Australia’s biggest energy producers, AGL this week posted an annual loss of $1.26 billion for FY23, which was down on the $860 million profit the company made a year earlier.

However, ~$700 million of the losses were attributed to write downs after AGL decided to expedite the closure of coal power plants.

AGL says the statutory loss included a negative movement in the fair value of financial instruments of ~$900 million, primarily reflecting an impact of a drop in forward prices for electricity relative to AGL’s hedging of its electricity generation position.

However, AGL’s underlying net profit after tax, which excludes the movements in the fair value of financial instruments and significant items, was $281 million for FY23, up 25%.

“AGL is a strong player as the Australian Energy Regulator passed higher retail electricity prices for Victoria recently that will see a material uplift in their EPS in FY24, the forward curve increase following the Liddell closure in April, and the Australian Energy Market Operator recently highlighting expected tightness in the market through from 2025,” Birtles says.

Aurizon Holdings (ASX:AZJ)

AZJ is Australia’s largest rail freight operator, moving a comprehensive range of commodities, including mining, agricultural, industrial and retail products for a diverse range of customers around.

According to its website this encompasses packaged retail products and food supplies transported in containers to urban and rural areas.

Aurizon handles grains, phosphate and critical minerals, as well as premium Australian coal and iron ore of exceptional quality meant for international trade.

Furthermore AUZ operates a track infrastructure spanning 5,100km, including its Tarcoola to Darwin railway, a crucial supply route for central Australia that links to the nearest Asian-facing port in the nation.

Additionally, the Central Queensland Coal Network forms part of its infrastructure, encompassing 2,100km of electrified pathways that can harness renewable energy from the Queensland grid.

“AZJ is attractive for its key attributes of inflation protection, weather related volume recovery and its moves into ‘new economy’ commodities that support the energy transition,” Birtles says.

“Aurizon’s regulated rate of return will be set over the next few months which will lead to higher regulated returns over the next regulatory period.”

AZJ is due to release its FY23 results on August 14. In its recent investor day presentation the company reported that FY23 EBITDA will be within the guidance range of $1,420 million-$1,470 million, albeit towards the lower end due to prolonged wet weather, mine production issues and some labour shortages impacting the March quarter.

The WOR, AGL & AZJ share price today:

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.