MoneyTalks: IG’s Tony Sycamore on the best investment approach to a newly relaxed China

Via Getty

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from IG Markets’ Tony Sycamore.

What’s hot?

IG’s 2022 star recruit, Tony Sycamore says China’s rapid retreat from its Covid Zero strategy in recent weeks to “living with Covid” has caught many by surprise.

Chinese tech stocks are right back in the spotlight for traders as the US administration of President Joe Biden has been trying to tighten the squeeze on US-listed Chinese firms, demanding they open their opaque accounting ways or get the hell out of Dodge.

And after some months of expecting the worst, the US numbers watchdog has just revealed it’s been given all the full access it wanted to the mystical financial books of over one hundred of said Chinese companies. These are big names too – like Alibaba, Tencent and Baidu – good news for all fans of the former ‘galacticas’ of tech which have managed to stay alive on the lucrative US exchanges.

Meantime, Tony says China is also about to turn the taps on for parched domestic consumption, and moreover officials appear genuine in their renewed mission to boost growth after nixing the last years of painful zero-Covid policies.

It’s not without worry, but China looks like it could be remerging of old.

“After an initial burst of China reopening optimism, a more cautious tone is in place as evidence of a bumpy reopening emerges,” Tony told Stockhead.

And – this is Christian speaking here – everyone should brace themselves for some scary images of overpacked first tier city hospitals.

We won’t see too many 2nd tier images, but not even China’s control apparatus will be able to hide all of the hit to the population when opening the omicron floodgates.

Tony told me that even disregarding the official numbers (which show a super low case count and even smaller death toll), the simple math shows a lot of the world’s most populated country will get infected.

“Around 60% of the Chinese population is expected to contract Covid over the next three months.”

What happens now?

Putting aside the human cost, the China reopening is also receiving support from soothing regulatory and economic policies, which is expected to boost growth in 2023 significantly.

From a sluggish 2.5% (4Q/4Q) growth in China is expected to rebound above 5% in 2023. The bulk of the rebound will come during the year’s second half as the reopening gains traction following an initial hit to consumption in Q1.

The countries most leveraged to the reopening in China from a goods trade and travel perspective and from cashed-up Chinese consumers are Hong Kong, Singapore and Thailand.

The spillover into the commodity space will benefit oil-producing countries as well as Australia for its exports of iron ore, copper etc.

With this in mind, we look at the following three stocks that are well placed to benefit the China reopening.

Tony’s 3 stocks to watch

Alibaba

Alibaba is one of the world’s largest retailers and e-commerce platforms.

The share price of Alibaba has fallen dramatically in recent years from a high of $319.32 to a low of $58.01 in October, partially due to a crackdown on Chinese internet giants by regulators.

However, with supportive economic policy in place and Chinese authorities pivoting to a pro-business stance, the share price of Alibaba has an upside towards the $125.84 high of July this year.

Alibaba weekly chart

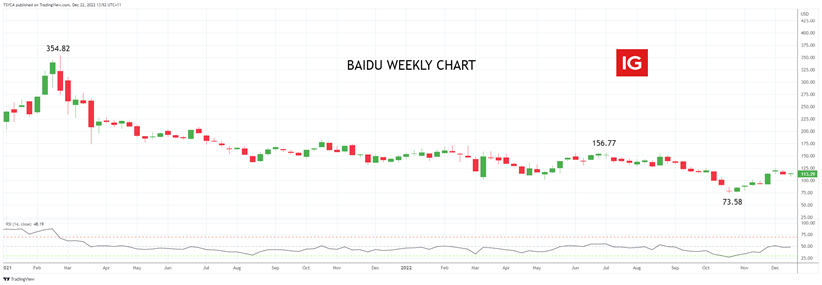

Baidu

Baidu is a massive Chinese technology company often described as the Google of China with an AI arm attached.

The share price of Baidu has suffered as part of the global rerating of tech stocks in 2022 and as sluggish Chinese growth weighed on advertising revenues.

Based on an expected pickup in China’s growth trajectory, and supported by cashed-up Chinese consumers, the share price of Baidu could rally back towards its early July 2022 high of $156.77.

Baidu weekly chart

HSBC

HSBC is the largest bank in Hong Kong by assets and is well positioned to leverage off the reopening in China, which should feed through into the bank’s revenues in 2023.

If the share price of HSBC can see a sustained break above resistance at $48.00, there is little in the way of resistance until the sequence of highs around $52.00 from the middle of this year.

HSBC weekly chart

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.