Money Talks: Why infrastructure is set to be as hot as mining once was

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to see what’s hot, their top picks and what they’re looking out for. Today, we hear from Andrew Smith, head of smaller companies & micro caps/head of research for investment firm Perennial Value Management.

What’s hot right now?

Perennial’s strategy is not to look at what’s hot right now, but to look at what is going to be hot and get in early.

The firm did this quite successfully with the mining boom and now thinks infrastructure is looking a lot like that did before it took off.

So why is infrastructure not a hot sector at the moment?

“Because in the first half, and actually more recently, a lot of the companies exposed to this sector have seen delays and weather impacts, but all that’s done has pushed the work into next financial year,” Smith told Stockhead.

“The work hasn’t gone away; the actual pipeline has got bigger. There’s unprecedented work.”

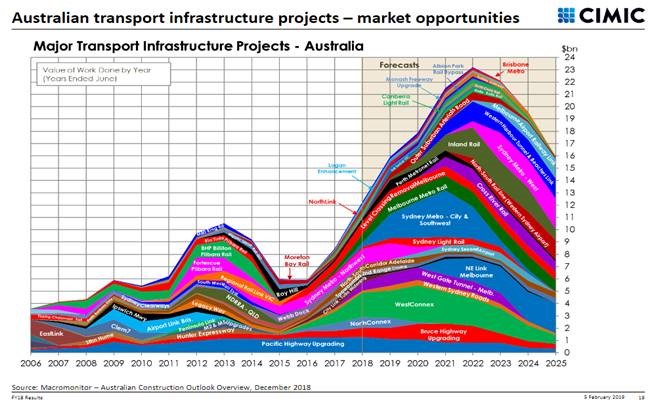

This is thanks to a government-funded East Coast infrastructure boom that is expected to run for the next four years at least.

“It feels a lot like the start of the mining boom did in 2009 and I think we’re here now in the infrastructure space,” Smith explained.

See for yourself:

Smith said Perennial made a “lot of money” from the mining boom, being sure to exit before the 2012 peak.

Top picks

Smith’s first pick is Acrow Formwork (ASX:ACF), a formwork and scaffolding business that has a market value of $51.5m at a share price of 31c.

“They just came out and said their second half earnings are going to be flat on the first half, which disappointed the market,” Smith said.

But Smith says that is because of the project deferral situation the sector has been facing, and that Acrow’s order book “has never been bigger” as it heads into the next financial year.

“It’s about 70 per cent exposed to civil and infrastructure, whereas when it listed it was quite a bit bigger residential,” he said.

“So they’ve swung out of that and gone into infrastructure. The multiple there is less than 4x earnings, because it really is an unloved part of the market.”

The multiple Smith is referring to is what is known as the P/E multiple – a comparison of a company’s market value (price) with its earnings.

A P/E of 4x means a company’s stock is trading at a multiple of four times its earnings.

Veris, according to Smith, has the added advantage of exposure to early stage involvement in projects thanks to its acquisition of Elton Consulting – a company that undertakes community engagement before building even starts.

“They’re on less than 4x earnings as well and this is in a market that’s over 15x earnings. So 4x is very, very cheap,” Smith said.

“Both [ACF and VRS] have their challenges but they don’t have a challenge with revenue looking into next year.

“We think the market has been overly pessimistic. We’re going see really strong revenue growth and that will flow through to margins for both of those companies.”

SRG is also involved in formwork through an acquisition the company did last year.

Smith said SRG has net cash on its balance sheet and a growing order book.

“They’ve had work deferred into FY20 and if you look back over the last probably month or month and a half, you’ve seen a string of news flow from new contracts coming through for them,” he said.

“So it’s started to recover as that’s happened and they’re getting a really big order book building up for FY20.

“Most importantly though it’s not an FY20 story, it’s an FY20/21 and 23 story. It probably peaks FY24/25. So you’ve got a long runway for these stocks. We think there could be a multi P/E expansion and earnings expansion for this sector.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Andrew Smith has been with Perennial in various roles since July 2008, including as lead manager on the Microcap Opportunities Fund since its inception in February 2017. Prior to joining Perennial, Smith was head of research at Linwar Securities, a boutique broker specialising in smaller company research.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.