Market Matters Masterclass: Measuring success in the fiscal reset

Via Getty

In this exclusive new series, portfolio manager at Shaw and Partners James Gerrish and his Market Matters team plot a course for opportunity through the unprecedented new fiscal reset.

There is a tide in the affairs of men, Which taken at the flood, leads on to fortune.

Omitted, all the voyage of their life is bound in shallows and in miseries.

On such a full sea are we now afloat.

And we must take the current when it serves, or lose our ventures.

Julius Caesar

— WILLIAM SHAKESPEARE

A new beginning

A mere week after its welcome burial, the first-half of calendar 2022 has most eloquently written its own special scene in the Great Theatre of Financial Tragedy.

Despite – or perhaps because of – the long-telegraphed, slow-motion train wreck nature of the sell-off, investors have spent this six months of volatility in frantic indecision, alternately sweating and selling their way to the new financial year.

Now, with much of the easy meat carved off stock markets and nearly all major global indices still on a knife’s edge, we find ourselves at the very start of fiscal ‘23 in an entirely new investing environment.

The fiscal reset

From COVID-19 and rampant growth to war and inflation, volatility in ‘23 will remain the dominant theme – only its drivers appear to have changed.

The last quarter has seen a knee-jerk hawkish reaction from central banks that many observers are saying should’ve come earlier – but, which last week has seen market expectations for longer term inflation and rate hikes generally fall over the last three weeks with some US economic indicators beginning to ease down.

For example, Wall Street’s expectation of where the Fed Funds rate will end 2022 has already started falling – from 3.7% to 3.47% in just three weeks.

At home, economist expectations for the RBA’s cash rate at year-end has fallen from 3.9% three to 3.15% in the same time frame.

Market Matters’ James Gerrish says nothing matters more for markets right now than dealing with the fiscal foot and mouth disease that is unattended inflation.

“I’m sure many think the RBA is being too heavy-handed and it’s crushing wealth but as we saw back in the 1970s if we let the inflation genie run riot these losses will continue to compound.

“Excuse the phrase but some short-term pain to get the inflation ‘genie back in the bottle’ will place equities in a position to establish a meaningful low and hopefully embark on another multi-year bull run.”

He says the full sea we are now navigating needs to be sailed calmly and a little courageously “without undue financial stress and steering far from any low-quality businesses too dependent on optimism and hope”.

And after nigh-on two years of mad optimism and bloated hope, that means repackaging portfolios from moonshot tech dreams and euphoric speculators to reliable grown-ups, with strong discipline and healthy dispositions.

In this ocean of rising inflation, AMP Capital notes higher debt levels tomorrow and falling real incomes today will see the economy slow faster than everyone expects.

Taking the tide when it serves

Led by Dr Shane Oliver, AMP now has the Aussie cash rate peaking around Christmas at 2.5%, and that’s already well below market expectations which were almost 4% halfway through last month.

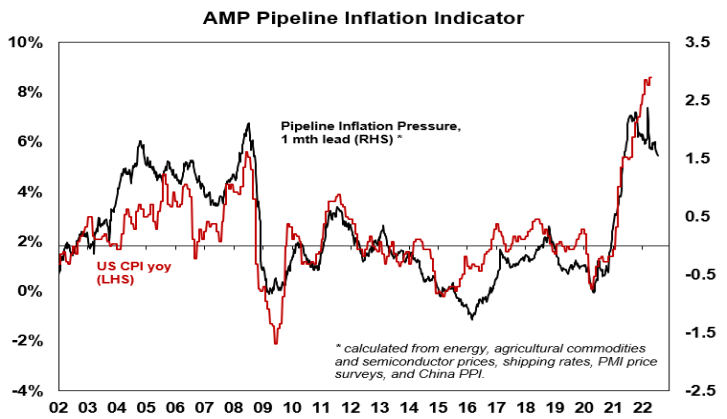

The tides are shifting fast as last week’s indicators suggest inflation pressures in the States may’ve already peaked, good news for the rest of us if AMP economists are correct that the US is six months ahead on inflation.

“The bottom line remains that with central banks still tightening and recession risk high, shares remain at high risk of further falls in the short term. This could well run out to September or October – with October having a reputation as a ‘bear market killer’,” Oliver says.

Market Matters believes volatility across equity markets likely has further to unfold with interest rate normalisation, Quantitative Tightening and the inflation boogieman probably only halfway back in the bottle.

“However, we should remember that stock markets are forward-looking beasts that generally find the bottom well before rear view mirror-looking economic data knows it’s sinking.

“They have a habit of forming bottoms when things look the worst!”

Last week was a perfect example of the very choppy market action we’re dealing with, Gerrish says.

“It began uneasily, threatened to unravel on Wednesday only to come good on the home stretch with the local index finally closing up over +2% on broad based buying which saw over 80% of the main board close higher come Friday afternoon,” he adds.

Incredibly, that was the benchmark’s best week since the Ides of March.

Market Matters: Mildly bullish the ASX 200, short-term

“St Barbara (ASX: SBM) up 9.64%, ripped after a strong 4th quarter production number. They produced 86koz of gold in the last quarter and nearly hit the midpoint of guidance.

“We like SBM as an aggressive play into weakness.”

“But Friday’s standout winner was the Tech Sector which closed up almost 7% for the week – with two standouts residing in the Market Matters Flagship Growth Portfolio – Xero (ASX:XRO) +13% and Altium (ASX:ALU) +8.3%.”

“Market Matters is looking for this ASX 200 outperformance to continue through July and potentially into August as our 6850-6900 target for the ASX200 slowly comes into sight.”

“The only constant at the moment remains the unpredictable swings of strength/weakness between the ASX sectors as investors balance their concerns between the twin economic elephants in the room.”

They are:

- Rising inflation & interest rates – when this dominates we’re experiencing tough seasons for the growth stocks with the tech stocks generally receiving the most attention from the sellers.

- Recession fears – characterised by slipping bond yields, falling commodity prices and tough days at the office for the Resources Sector.

Over the next few weeks, Mr Gerrish will be taking the wheel and steering us through the storm, with clear strategies and the names – big, small, domestic and foreign – which best represent them.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.