Keen to ride the Asia tech boom? This ASX-listed ETF might be one to look at

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

There’s no doubt the Australian tech scene is one of the fastest booming sectors, full of world-class, innovative companies that have gained global attention.

Grants in the last decade have definitely played a big part in the boom, along with investment into our NBN (national broadband network).

As a result, tech companies such as Afterpay (ASX:APT), and Appen (ASX:APX) have sprung up, not to mention the giant of them all, Atlassian, which ironically, is not listed on the ASX.

All this action has resulted in the ASX200 IT Index surging by over 40 per cent since the end of 2019, just before the pandemic began.

But the fact still remains, the sector is a relatively small fish in a big global pond in terms of both market cap and reach.

For those eager to catch bigger fish, you simply can’t ignore the emerging Asian tech market, which made up 52 per cent of global tech revenues in 2020. Due to its younger, bigger, and tech-savvy population, Asia is gradually surpassing the West in terms of technological adoption.

There is, fortunately, a way for you to ride this wave by simply trading on the ASX.

The BetaShares Asia Technology Tigers ETF (ASX:ASIA) is an ASX ETF fund that gets you exposure to the 50 largest Asian technology companies (excluding Japan).

The BetaShares Asia Technology Tigers ETF

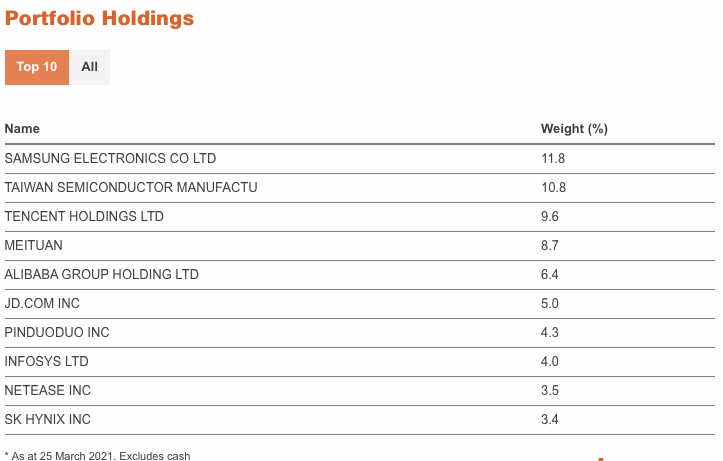

This is a $650 million fund that invests in the biggest, more well-known Asian tech stocks. The table below shows its 10 biggest positions, as of 25 March 2021.

ETFs work similarly to managed funds, and invest in various thematic financial assets including shares, bonds, infrastructure and in some cases even other ETFs.

The Asia Tech Tiger Fund’s unit price has increased by 58 per cent since the end of 2019, beating ASX200 IT Index return of 40 per cent.

Some of the stocks in the portfolio would be familiar. Samsung and Alibaba, for example, are both global behemoths in every sense of the word, with no introductions needed.

But other stocks may not be too familiar.

Taiwan Semiconductor Manufacturing Co (TSMC), is not top of mind when you think of Asian tech, but it’s the dominant chip maker globally, powering most of our computers. The company is also in pole position to take advantage of the current chips shortage due to the mass demand for EVs globally.

Chinese online retailer JD is the Amazon of China, and it raked in US$83 billion in revenues in 2019 – even more than Alibaba.

Tencent is another Chinese company behind smash-hit games like Clash of Clans, and social media chat plaform Wechat.

Infosys meanwhile, is a solid Indian company that’s been around for four decades. It was founded in 1981 with just $250, and has grown into a $13 billion-revenue outfit, operating in 123 countries. This company has clearly stood the test of time.

Each stock holding is rebalanced by Betashares every quarter, and is limited to a maximum of around 10 per cent of the whole portfolio. This clearly has the effect of reducing risk, and offers good diversification for investors.

The China factor

It’s worth noting that the fund is highly exposed to China, with around 50 per cent invested in Chinese stocks at any given point. This makes sense, given that China is home to some of the biggest tech companies in Asia. However, it presents a risk factor that investors will want to consider, due to a few reasons.

First, Chinese stocks that operate globally are vulnerable to the highly-charged geopolitical situations that arise from time to time, which may also persist over the longer term. You may recall Chinese tech company, Huawei, being investigated in the US on suspicion of spying. The company was also blocked from entering into the Australian 5G sector by the incumbent government.

Not only that, the Chinese government’s heavy involvement and sway in the private sector has given investors some concerns. One recent example was Jack Ma’s Ant Financial, whose IPO was suspended by the Chinese government at the last minute. Like all investments, the Tiger fund clearly does come with its own risks.

There are other China-themed ETFs on the ASX to consider if that’s your thing, such as the Ishares’ China ETF (ASX:IZZ) and Van Eck’s China A50 ETF (AS:CETF).

But if you’re not too keen on getting that political exposure, you could still invest in Australian-based companies that have markets in China, which Stockhead has recently compiled.

There are also Asian-themed ETFs, such as the Vanguard FTSE Asia ex-Japan (ASX:VAE), and the i-Shares 50 ETF (ASX:IAA), which will give you exposure to the broader sectors in Asia, but are not pure tech plays.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.