Want to invest in small caps but not sure which stock? How about an ETF?

ETFs offer an alternative for investors to picking small cap stocks. Pic:Getty Images

- Investors have several ASX ETF options to invest in small caps in Australia and overseas

- Vanguard has the most traded small-cap ETF with over $1.6 million traded daily

- The Vanguard ETF tops small cap ETF performance returning 8.3% annually over past five years

There’s an allure of investing in smaller companies for many investors, especially with the prospect that many will grow and become bigger, rewarding those who took a punt early on. After all, BHP (ASX:BHP) and CSL (ASX:CSL) all started as small companies.

While there is no universal definition for large, medium, or small cap companies, the S&P/ASX Small Ordinaries index (XSO) represents those smaller members of the S&P/ASX300 index. It’s used as a benchmark for small cap Australian shares.

Companies in this index generally have a market cap of a few hundred million dollars to $2 billion, so it can be used as a good guide as to what constitutes a small cap on the ASX.

Stockspot senior manager investments and business initiatives Marc Jocum said smaller companies are generally younger, and less well-known than larger companies, and they tend to have more growth potential given their infancy.

However, it’s no secret small caps also can be more risky and volatile, as their businesses are often less established and their financial performance can be more unpredictable and not as strong as larger, well-established companies.

“Some investors choose to include small-cap stocks in their portfolio to potentially generate higher returns,” he said.

“Some small companies can increase 10 times or potentially 100 times their value.”

Jocum said Afterpay (ASX:APT) is a good example, listing on the ASX in 2017 with a market value of $500 million.

“In February 2021 it was worth $35 billion, representing a 70x increase or 7000% gain,” he said.

“In just four years as it transitioned from a small-cap stock to a large-cap stock.”

Research from Nobel laureates Eugene Fama and Kenneth French showed that there can be periods of history where small-cap stocks outperform large-cap stocks.

However, this is mainly due to taking on more risk, and over the last 20 years, it has been large-cap companies that did better.

“Picking the next best small-cap stock can be difficult as two-thirds of stocks underperform a market index,” Jocum said.

Picking a small cap winner

Want to invest in small caps but not sure what stocks? Well, there is an alternative – ETFs.

Stockspot has road tested the best small-cap ETFs listed on the ASX across five factors including size, costs and slippage, liquidity, returns and track record.

“We believe the best way to invest in small-caps is through an index-tracking product such as ETF,” Jocum said.

The ETFs include:

iShares S&P/ASX Small Ordinaries ETF (ASX:ISO)

SPDR S&P/ASX Small Ordinaries Fund (ASX:SSO)

Vanguard MSCI Australian Small Companies Index ETF (ASX:VSO)

VanEck Vectors Small Cap Dividend Payers ETF (MVS)

BetaShares Australian Small Companies Select Fund (Managed Fund) (ASX:SMLL)

K2 Australian Small Cap Fund (Hedge Fund) (ASX:KSM)

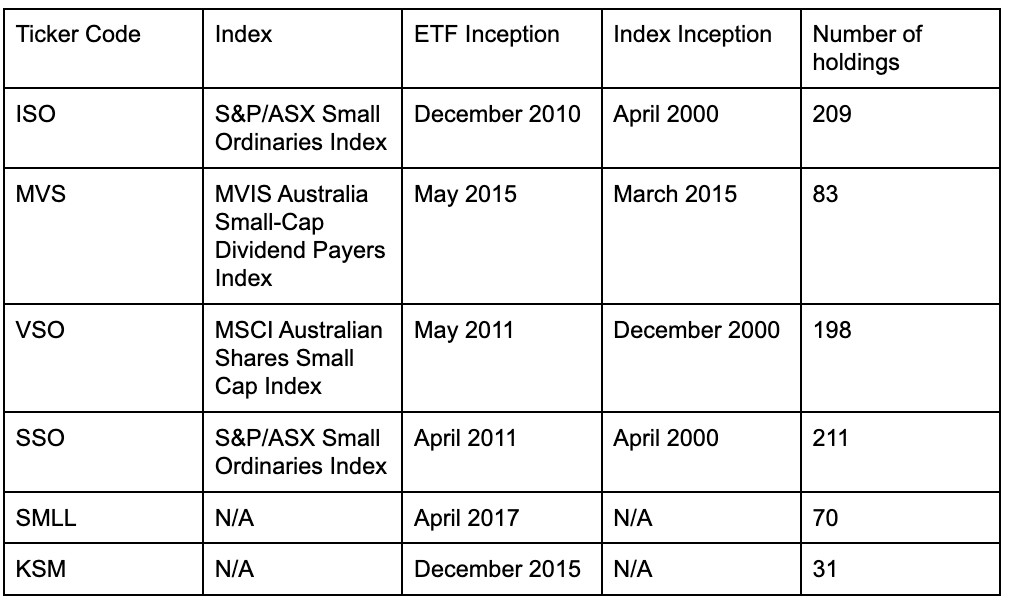

History and index

ISO was the first small-cap ETF available in Australia launching on the ASX in 2010. SSO and VSO listed the year after, followed by MVS launching in 2015.

Jocum said most of the index-based ETFs have a large number of holdings, despite MVS which is more concentrated, while the active fund managers have a smaller number of holdings.

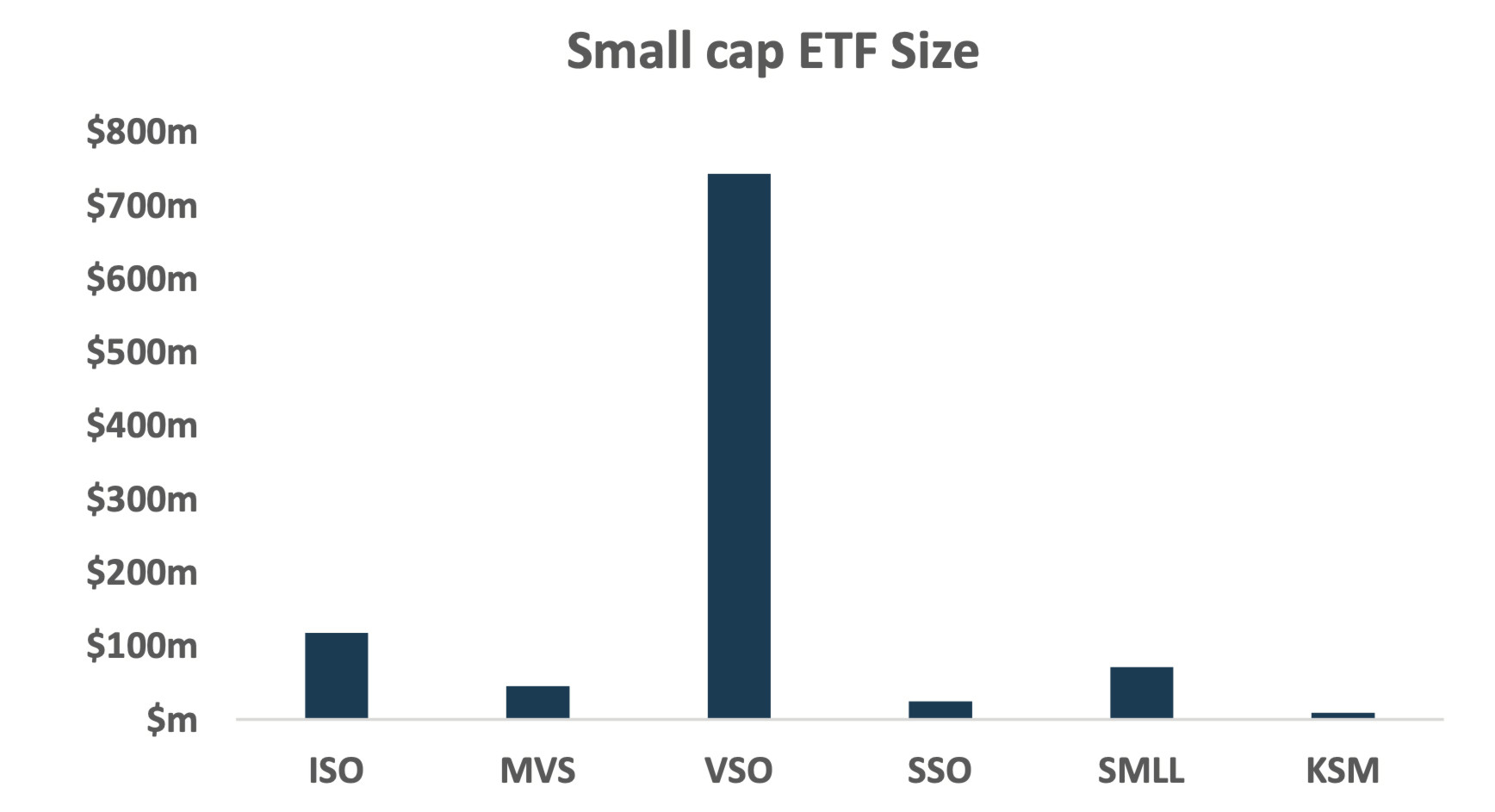

Breaking down the research – Size

VSO is the largest small-cap ETF with $744 million in assets under management, while ISO is its nearest rival managing $118 million.

Jocum said the other small-cap ETFs have struggled to gain traction with assets ranging from $9 million to $72 million between them.

Costs and slippage

According to Stockspot research, VSO is the cheapest small-cap ETF listed on the Australian share market charging 0.30% annually, while it also has the tightest spreads at 0.11%.

SMLL is the next cheapest small-cap ETF charging 0.39% but has high spreads of 0.52% given its actively managed strategy.

KSM is the most expensive small-cap ETF charging an extraordinary 2.27% in management fees per year plus having 1.13% spreads.

| ASX Code | Cost (Indirect cost ration) | Buy/Sell spreads (Slippage) |

| ISO | 0.55% | 0.31% |

| MVS | 0.49% | 0.24% |

| VSO | 0.30% | 0.10% |

| SSO | 0.50% | 0.23% |

| SMLL | 0.39% | 0.53% |

| KSM | 2.27% | 1.39% |

Source: Stockspot & ASX as of Nov 30, 2022

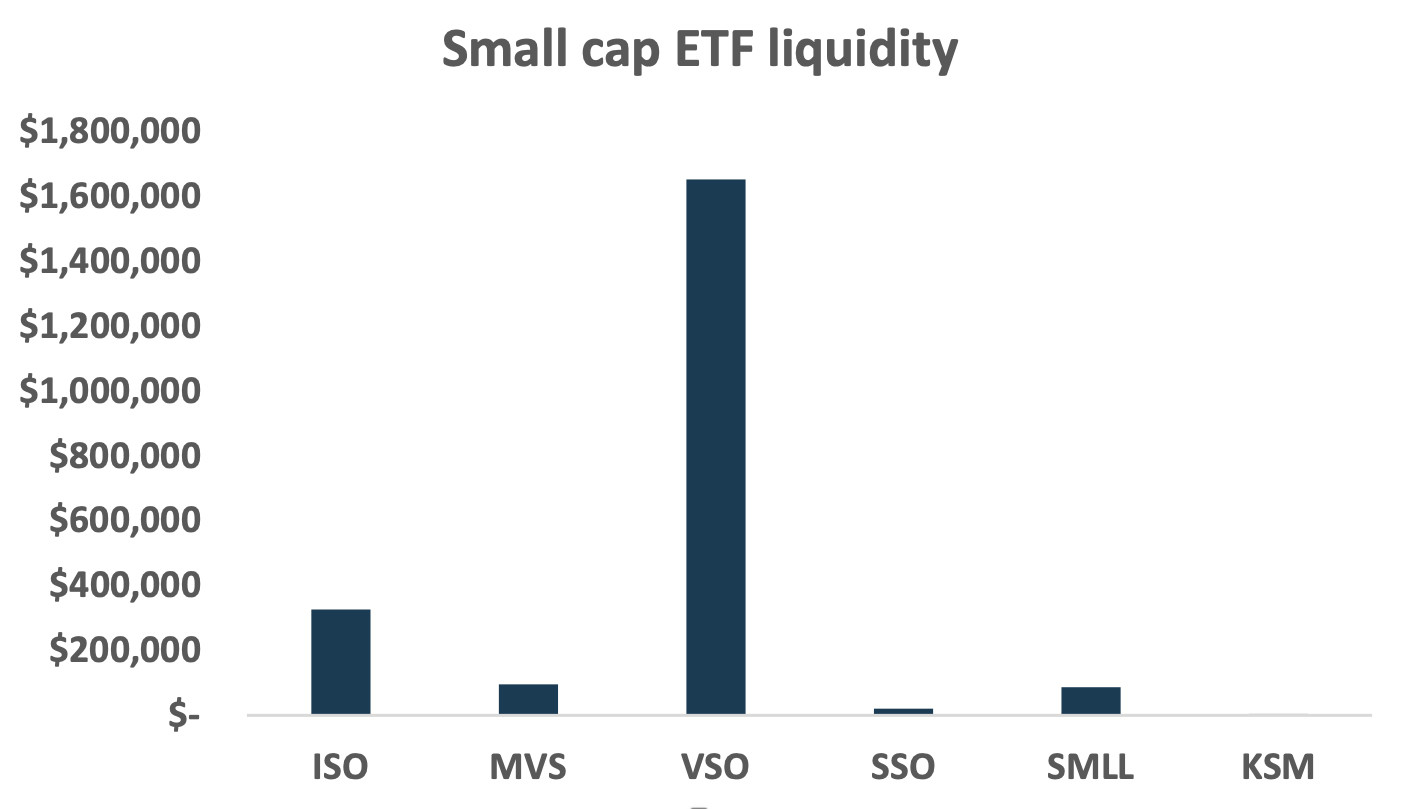

Liquidity

The Stockspot research showed VSO is the most traded small-cap ETF with over $1.6 million traded daily, providing ample liquidity.

ISO is the next most liquid small-cap ETF trading $329,000 while MVS trades $95,000 daily.

The two active ETFs, SMLL and KSM, have very limited volume given their small take-up by investors.

Who tops performance?

VSO has been the best-performing small-cap ETF returning 8.3% annually over the past five years.

“This is mainly due to having higher exposure to cyclical sectors, such as materials, which have a higher sensitivity to the domestic economy, Jocum said.

“VSO also holds slightly larger-sized companies, with a weighted-average size company of $3 billion, compared to other small-cap ETFs which have an average company size of between $1 billion and $2 billion.”

He said active fund managers like KSM have struggled to generate good returns, with a negative five-year annualised return in line with active managers underperforming a market index.

| ASX code | 1 year return | 3 year return (per annum) | 5 year return (per annum) |

| ISO | -17.9% | 1.7% | 3.2% |

| MVS | -15.8% | 0.7% | 3.0% |

| VSO | -11.2% | 7.8% | 7.4% |

| SSO | -18.0% | 1.8% | 3.3% |

| SMLL | -16.8% | 4.8% | 5.3% |

| KSM | -26.2% | -0.6% | -1.5% |

Source: Stockspot & ASX as of Dec 31, 2022

Venturing overseas

Jocum said Aussie investors can also access small-cap companies listed overseas through ETFs. There are currently three global share small-cap ETFs available on the ASX including:

- iShares S&P Small-Cap ETF (ASX:IJR)

- Vanguard MSCI International Small Companies Index ETF (ASX:VISM)

- VanEck Vectors MSCI International Small Companies Quality ETF (ASX:QSML)

“When it comes to investing in small caps the maxim can hold true that the early bird catches the worm and there are significant growth opportunities,” Jocum said.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.