India’s stock market is set to be the world’s third biggest by 2030. Here’s how to buy Indian stocks

How do I buy Indian stocks? Picture Getty Image

- India is set to be the third largest economy with the largest stock market by 2030

- Can Aussies trade in Indian stocks directly?

- Indian-themed ETFS on the ASX

India is on track to become the world’s third largest economy by 2027, surpassing Japan and Germany, and could potentially have the third largest stock market by 2030.

At the moment, the country is already the fastest-growing economy in the world, having clocked 5.5% average GDP growth over the last decade.

By 2031, India’s GDP could explode from today’s $3.5 trillion to surpass $7.5 trillion, while its sharemarket could grow by 11% per year to reach a market cap of US$10 trillion.

“India is also gaining power in the world order, and in our opinion these idiosyncratic changes imply a once-in-a-generation shift and an opportunity for investors and companies,” said Ridham Desai, Morgan Stanley’s chief equity strategist for India.

According to the Morgan Stanley’s report, there are megatrends that could drive India’s growth over the next decade.

Manufacturing will be a big one. India is poised to become the factory to the world, with the manufacturing sector expected to increase to 21% of its GDP by 2031.

Indian consumers are likely to have more disposable income, with overall spending in the country expected to double to US$4.9 trillion by the end of the decade.

The transition to renewable energy will also become a crucial and prominent sector in India’s economy.

“The rise in India’s energy consumption alongside the energy transition opens up a new segment to boost investment growth,” says Girish Achhipalia, India Utilities and Industrials analyst.

Is it India’s decade?

Morgan Stanley believes that investing in India is a long-term theme, and one that comes with its share of risks.

These include prolonged global recession, geopolitical developments, lack of skilled labor, energy shortages and volatility in commodity prices.

But sectors that played a major role in China’s success over the past few decades – such as industrials, consumer goods, and financial services – are starting to gain momentum in India.

“In the coming decade, as India’s economy transforms, we think that it will be increasingly relevant for global investors in a similar way that China is today,” says Chetan Ahya, Morgan Stanley’s chief Asia economist.

“We think that India offers the most compelling growth opportunity in Asia in the coming years.”

How do I buy India stocks then?

Most of the trading in Indian stocks takes place on its two stock exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

The BSE has been in existence since 1875, but the NSE has emerged as the leading exchange when measured by trading volume.

The Indian share market is notoriously difficult for international investors to access, and are much less accessible than Chinese stocks.

Now read: Chinese stocks are bouncing back, and here’s how you can buy them

According to Global X, everyday Australians cannot directly buy or sell NSE-listed shares, unless you have a spare $50 million lying around and can access a sub-account through an authorised institution.

These sub-accounts have to be registered with a pre-approved financial institution, which is an institution established and incorporated outside India solely for the propose of making investments in India.

In other words, it’s just too difficult for the ordinary person to access the Indian market, but there are alternatives.

Trading Indian stocks through US exchanges

Most leading Indian stocks are dual listed on US exchanges.

Tata Motors (NYSE:TTM), Infosys (NYSE:INFY), Reliance Group (NASDAQ:RELI), Sify Technologies (NASDAQ:SIFY) and Wipro (NYSE:WIT) are some of household names listed in the US.

These stocks are mainly traded in the form of American Depository Receipts (ADR) – which are basically securities that represent foreign companies that have a secondary listing in the US, similar to what a CHESS Depositary Interest (CDI) is to the ASX.

In theory, investors don’t get voting rights with most ADRs.

Investors could easily buy these securities by opening a US brokerage account with a local broker.

Also read: The pros and cons of owning US stocks, and how to go about buying them

Buying Indian shares on the ASX

The only way to get exposure to Indian stocks on the ASX is through buying one of the India-themed ETFs.

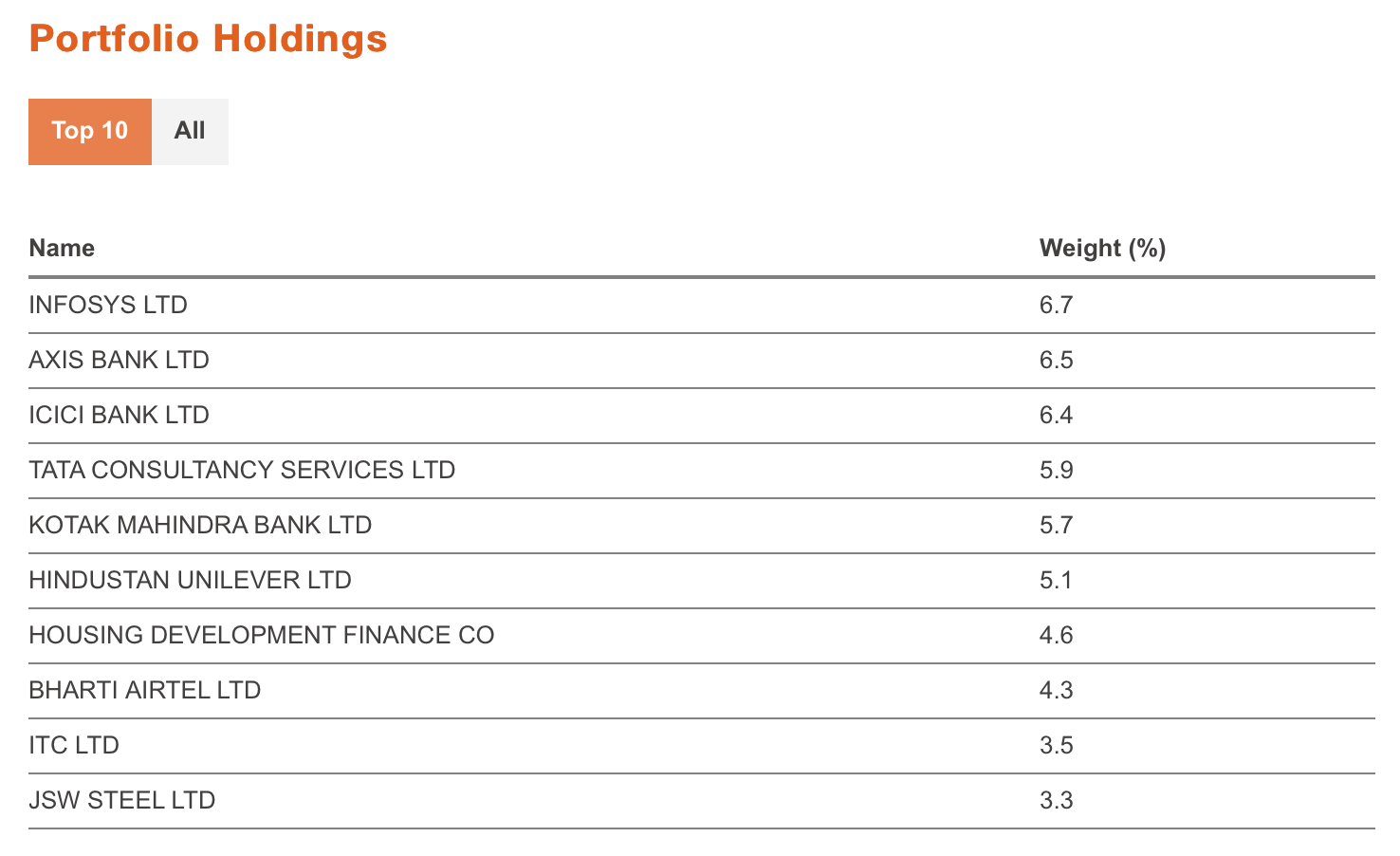

BetaShares India Quality ETF (ASX:IIND)

The IIND fund aims to track the performance of an index comprising a diversified portfolio of quality Indian companies.

The fund selects 30 Indian companies based on a combined ranking of the following key factors – high profitability, low leverage and high earnings stability.

The portfolio holds 23% of its holdings in financial companies, followed by 21% in tech, and 16% in industrials.

As of December 9, the top 10 holdings include:

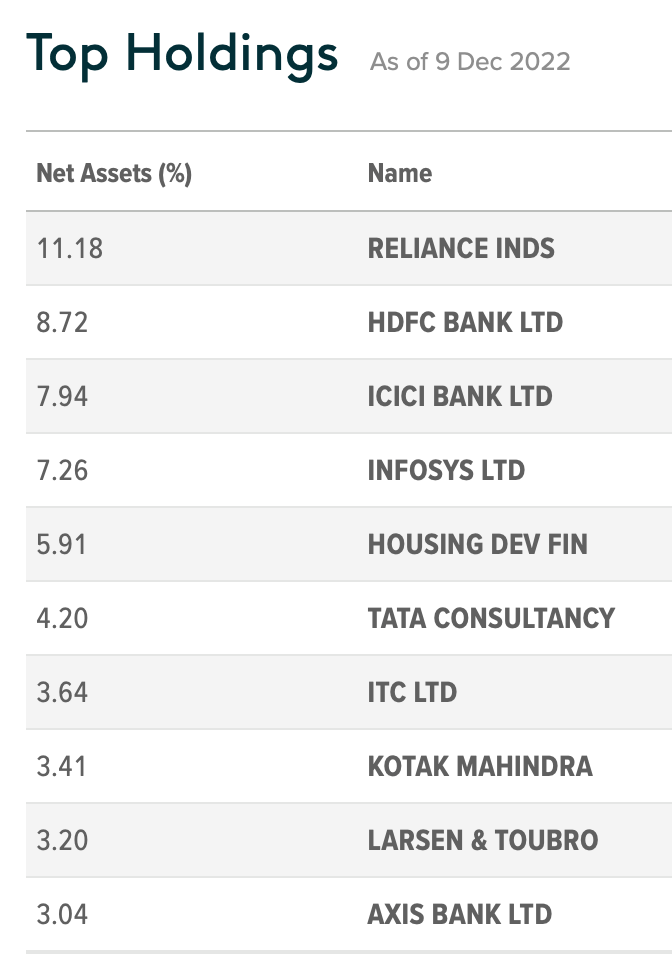

Global X India Nifty 50 ETF (ASX:NDIA)

This fund offers access to 50 of the largest and most liquid publicly traded companies in India, spanning a range of economic sectors.

It invests 37% of the funds in the financials sector, 14.5% in tech, and 13% in the Indian energy sector.

Global X warns however that emerging markets like India are influenced by currency and monetary moves from around the globe.

This played out during the first half of the 2022, as a rising US dollar put pressure on flows and forex reserves.

This is the top 10 holdings of the NDIA fund as of December 9.

ETF prices today:

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.