How to spot the end of a bear market trough? Goldman Sachs has some thoughts

How to spot a market bottom with Goldman Sachs. Picture Getty Image

- Are we in a bear market bounce or market bottom?

- Peter Oppenheimer of Goldman Sachs explains how to spot a bottom

- We look at how interest rates are driving stock valuations right now

There’s a feeling that Wall Street, with perpetually itchy buy-button trigger fingers, is watching for signs of a stock market bottom.

While the market is still bobbing up and down, there are fresh signs that investors might be starting to dip themselves back into the game.

Last week for example, the Dow and Nasdaq notched up four consecutive days of gains, the first time they have done so in two months.

So have we reached the bottom yet?

According to Peter Oppenheimer, Goldman Sachs’ chief global equity strategist, pinpointing exactly when a market transforms from a bear to a bull is difficult because bear market rallies are common.

A bear market rally happens when there’s a lot of dip buying in the market.

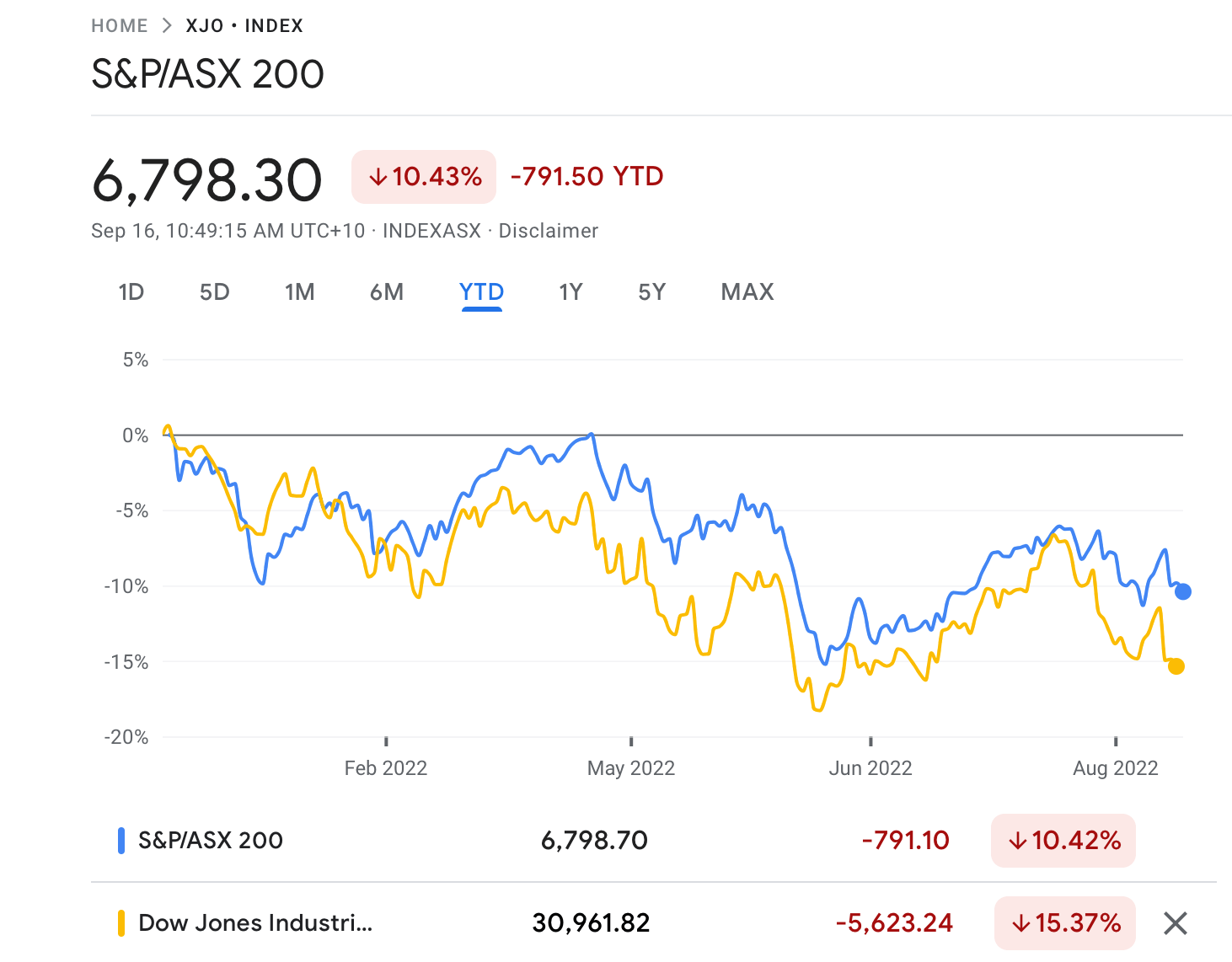

Technically speaking, a bear market rally is a short-term upturn of 5-10% that happens during a broader bear market downturn of between 10-20% – which is exactly where we’re at right now.

But Oppenheimer says you can more or less figure out when a market has hit a bottom, because there are some common characteristics of a bear market trough.

Firstly, while low valuations are a good starting point to pick out a bottom, they are not sufficient.

Instead, we need to look at other factors like earnings and profits.

“You tend to find that while equity markets do recover while economic conditions are still weak and profits depressed, it’s usually not until the rate of deterioration has slowed that investors really start to price in a recovery,” Oppenheimer explained.

He also noted that reaching a peak in inflation, interest rates, bearish sentiment and negative positioning are also important characteristics of a bear market bottom.

So….are we there yet?

According to Oppenheimer, not all of these conditions have been met yet, suggesting that markets are still in for a bumpy ride.

“There was a period of optimism in the summer focused on the Fed pivot, and the belief that we were close to a peak in inflation and interest rates,” he says.

“But what we’ve learned from Jackson Hole and since then is that was premature. Central banks have become more hawkish, yet again, both in the US and Europe.

“So, we think that there’s still some way to go to price in higher terminal rates.”

Oppenheimer cited Tuesday’s shock US headline CPI reading of 8.3% in August (vs 8.1% survey) – which did little to dissuade the expectation of another outsized Fed hike when the FOMC meets on September 21.

While most believe the Fed will hike by another 75bp, other pundits are calling a 100bp increase.

Because of that, Oppenheimer believes that markets could fall further and even expects most equity markets to fall roughly 30% from their peaks.

That means another 15% fall for the Dow Jones from here!

“Some are already close to that. In Europe, for example, we’re not too far away from that now. And it’s true across some of the emerging markets,” said Oppenheimer.

“We’ve got further to go in the US, and the US has a high valuation.

“But of course, there’s a greater probability of a softer economic landing in the US economy than there is in other markets.”

Rates driving equity valuations

Meanwhile, as we saw on Wednesday, the interest rates market is pretty much driving valuations in equities right now.

Because of that, it’s important for investors to closely watch what the Fed is saying, and how rates traders react to those comments as well as to economic data releases.

The markets are currently pricing in a hike of 75 basis points this month, with some chance of a 100 basis points increase, compared with 73 basis points before the CPI report.

While economists at Goldman Sachs still expect the Fed to hike its rate by 75 basis points at next week’s policy meeting, they have now raised expectations for a December rate increase to 50 basis points from 25 basis points – citing the inflation report.

The GS Research team now expects the Fed funds rate to rise to 4%-4.25% by December (compared with 3.75%-4% previously).

“We think the Fed is going to guide the market to a period – maybe a very long period – of holding the federal funds rate steady at an above-neutral rate following Tuesday’s CPI report,” says Goldman’s Josh Schiffrin, co-head of US interest rates.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.