You might be interested in

News

Closing Bell: Iceni Gold skyrockets 300pc on 'spectacular discovery'; Perpetual to split up

News

Closing Bell: ASX rallies hard as RBA holds rates; Bonza drama continues with court ruling

News

Experts

The World Wrestling Entertainment Inc (popularly known as WWE) is about to form a blockbuster combat-sports merger with the UFC (Ultimate Fighting Championship).

Under the US$21 billion deal announced two weeks ago, a new publicly listed company will be formed that will bring WWE brands and Endeavor Group – the current owner of the UFC – under one umbrella.

Endeavor will take a 51% controlling interest in the new company, while existing WWE shareholders, led by the WWE icon Vince McMahon, will hold a 49% stake. The new company will be helmed by current Endeavor CEO, Ari Emanuel.

As far as the sports and entertainment industry goes, this merger ranks up there. Last year, both the UFC and WWE booked revenues north of US$1bn.

Analysts believe the merger will hold significant promise for investors seeking an opportunity in the dynamic combat sports industry.

Stockhead reached out to market expert Megan Stals, an analyst at the Australian-based international digital brokerage platform, Stake.

Stals says that while the merger is unlikely to have an immediate impact on ASX stocks, it could affect negotiations around broadcasting rights in the near future.

“Foxtel holds rights for the UFC and WWE in Australia across various parts of Foxtel, Binge and Kayo Sports, and if the merger leads to more negotiation leverage for the new company, then it could put further strain on the profit margins of broadcasters,” Stals told Stockhead.

Another area to watch is the UFC’s direct to consumer offering, UFC Fight Pass, which could be set for expansion thanks to the merger.

Both companies already have a history of crossovers between their respective sports, with notable examples including Brock Lesnar and Ronda Rousey.

Since the deal, UFC megastars like Conor McGregor and Israel Adesanya have also expressed interest in featuring in the WWE.

“This could provide the newly merged company with opportunities for combined sponsorship deals, while making it easier to attract and retain headline fighters,” said Stals.

“Given Endeavor Group’s experience in talent management, there are clear synergies with WWE that could make it easier to build 360 degree deals for the companies’ top stars.”

Investors looking to gain exposure to the merger have two options — either investing in Endeavor Group Holdings (NYSE: EDR) or buying WWE (NYSE: WWE) stock.

Endeavor is not acquiring WWE in a traditional sense, but will instead spin off the UFC by merging it with WWE (NYSE: WWE) to create a new US$21 billion combat sports venture, under the ticker ‘TKO’.

Stals said the TKO stock would be the most obvious choice for those that want pure play exposure to the merged entity.

Both the UFC and WWE have seen strong growth in the past year, reaching a record US$1.1 billion and US$1.3 billion of revenue respectively in 2022.

“With such strong brand moats, the upcoming US TV rights renewals due in 2024 and 2025, and potential for international expansion, there are clear opportunities for even stronger earnings,” said Stals.

That said, there are some risks. WWE was valued at US$9.3 billion as part of the deal, which is significantly higher than its market cap of US$7.68 billion.

When WWE stock converts to TKO, the market will determine the price, and this could result in some downside.

“While unlikely, the deal could also still become unstuck before the merger is complete due to regulatory concerns,” Stals said.

On the other hand Endeavor Group (NYSE: EDR) will become the primary shareholder in TKO.

In addition to the UFC, Endeavor generates revenue from a wide portfolio of sports and entertainment properties, including Professional Bull Riders (PBR), Euroleague, and entertainment agency WME.

“This option does offer more diversification, but Endeavor’s most successful revenue driver is still the UFC, and this should be taken into consideration before making a decision.”

According to Stals, WWE has so far been one of the few opportunities to buy into an entire sports brand, rather than gaining exposure through a specific team or holding company with multiple sports leagues.

The only other US-listed stock that has offered similar exposure is Formula 1 Group (NYSE: FWONA), which was listed in the US in 2016, following an acquisition by Liberty Media Group.

“This stock is a great example of what can be achieved when a sports league is managed cohesively,” said Stals.

The F1 Group handles pretty much everything apart from engineering and racing, including track design, rule setting, marketing and negotiating sponsorship agreements.

“This means it’s able to fully leverage all of its potential without being held back by competing priorities among teams,” she said.

For one, Formula 1 has made the races more competitive by limiting budgets and making it harder for the richest to dominate each year.

“In the face of eight straight Mercedes championships, we are finally seeing some alternative outcomes in the sport as Red Bull and Ferrari are starting to take over the podium.”

F1’s widely-praised Drive to Survive Netflix show also shows how sports content can be leveraged to engage a wider audience.

After four seasons, F1 has seen its average viewership grow to 70m and revenue expand to all-time highs of US$2.14 billion.

Considering that the UFC’s Ultimate Fighter, which sees up and coming fighters compete for a spot in the UFC, has also been a hit in the US, this trend suggests there’s further scope to offer more compelling entertainment packages to broadcasters in combination with WWE, says Stals.

Stals believes that one Australian small cap stock, HITIQ (ASX:HIQ), could benefit from the long term growth in combat sports.

HITIQ provides the world’s first end-to-end concussion management platform, providing mouthguards that support the identification, monitoring, and management of sport-related brain injuries.

Controversy around athlete concussions has already gained traction in the US and Australia, and while this has mainly been focused on ball sports such as rugby and American football, combat sports have some of the highest rates of brain damage across all disciplines.

The company is already gaining international traction including partnerships with New Zealand Rugby, Scottish Rugby, and the German Ice Hockey Federation.

“While HITIQ is a relatively small player, sport organisations are likely to see continued pressure to protect their athletes, which could increase demand for the company’s technology.”

Stals however says HITIQ is still unprofitable, and given current market conditions, this is a significant disadvantage.

“It also has low trading volumes when compared to its larger peers, and its share price is highly volatile,” she said.

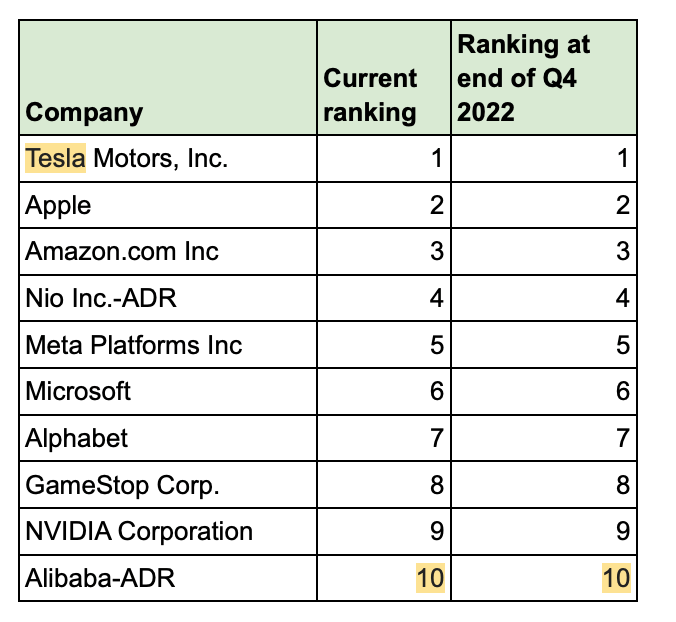

Recent data from eToro has reaffirmed once again Aussie retail investors’ love for US stocks.

According to the broker, the most widely held stocks by Aussie investors on its platform were US stocks.

Aussie investors are benefiting from their continued loyalty to big tech, with the sector staging a partial recovery in 2023.

The biggest risers among Australia’s eToro investors in Q1 this year were Microsoft, with an 11% increase in holders from Q4 2022, Coca-Cola with a 10% increase, and Alphabet, with an 8% increase.

“It’s no surprise to see big tech dominate this list,” said eToro’s market analyst, Josh Gilbert.

“Cash is king in the current environment, and big tech has that in abundance.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.