Here’s one simple system top investors use to evaluate ASX mining stocks

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

How do disciplined investors choose which ASX mining and exploration stocks to invest in, and when to sell? Systems, that’s how.

Over the past year Simon Popple of UK-based Brookville Capital — who specialises in junior mining companies — has highlighted at least nine ASX mining and exploration stocks with growth potential.

All of them have performed well since.

Chalice Gold Mines (ASX:CHN) is one stock pick that has, so far, delivered in spades.

“In September 2019 I told you about Chalice Gold when the price was 22 cents – it’s now at $3.51,” Popple says.

That’s a massive ~1,500 per cent return, which was sparked by the unusual nickel-copper-PGE discovery at the Julimar project in March this year.

At the time of its discovery Julimar was a so-called ‘generative’ project; an early stage greenfield (unexplored) opportunity largely designed to keep Chalice’s project pipeline full.

It wasn’t intended to be a major focus.

But exploration, like investing, is an educated gamble.

Popple reckons it’s important for investors to have a system to uncover those juniors with an increased chance of success, regardless of where it comes from in their portfolio.

It’s also important to know when to sell.

“There are a lot of moving parts with any investment. Any of which could fail, causing a share price to head south,” he told Stockhead.

“We all like a good return on our investments, but it’s important you understand what you’re doing and, more importantly, what risks you’re taking and when you should sell.

“Knowing what shares to buy is not necessarily going to make you money — you don’t make any money until you sell.

“I know that’s common sense, but unfortunately, common sense is not so common.”

What am I looking for in a mining stock?

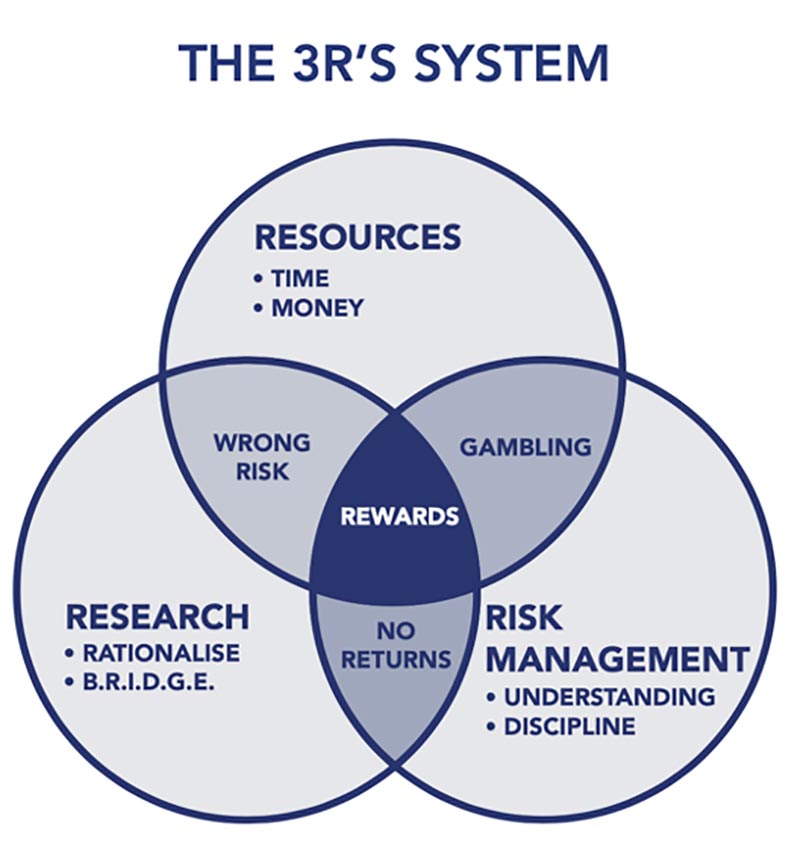

Popple uses the ‘3 Rs’ system.

First, investors need resources – time to research, and money to invest.

Secondly, they need to know what risk they are comfortable taking.

The returns can be massive, but investing in junior mining and exploration stocks is inherently high risk.

“Once you’ve read the research, you must understand the opportunity and then have the discipline to follow through with it,” Popple says.

“In this case, not selling [Chalice] when I was very tempted.

“With Chalice, there was a lot of risk, so I was looking for a high level of return. Now I’ve made more than 20 X my money, I’m going to sell some, but not all of it.

“It’s important to point out that their exploration results [at Julimar] were exceptional — there are others I would sell much earlier.”

Thirdly, investors must do the research.

Nobody has time to look at every company in a sector, so rationalisation is important, Popple says.

“Condense your universe of stocks into something you can manage and take a closer look at those,” he says.

Crossing the B.RI.D.G.E

B.R.I.D.G.E. stands for:

Balance sheet – in September last year Chalice had cash to cover their next round of exploration costs and no debt, Popple says.

Resources – Chalice had no resources, but plenty of potential.

Infrastructure – there was a reasonable infrastructure (roads, water and power) around their projects, “so if they found anything the costs of bringing it into production should be okay”.

Diversification – they had several assets, including a big gold project in Victoria, and two nickel projects in WA.So if they had good results from one (which they did), the shares could take off. Similarly, if one asset disappointed, Chalice weren’t a “one trick pony”.

Grade – their Pyramid gold project in Victoria was next to one of the highest grade gold mines in the world – Fosterville — so the omens were good.

Exploration potential – at the time they had three assets (they subsequently sold one), all with great exploration potential.

“Using this system, I was able to both carry out the research and measure the risk,” Popple says.

“The research helped me decide whether or not to buy it and the risk management guided me on the sale. I needed both.”

Over the next few years there could be some fantastic returns from this sector, Popple says.

“You may have another method. All I would say is that you should have a system, otherwise emotions and other things can lead to poor decision making,” he says.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.