Guy on Rocks: ‘Size matters’ to this cheap ASX copper-zinc explorer

Pic: Andrii Zastrozhnov, iStock / Getty Images Plus

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: China stimulus kicks copper back into gear

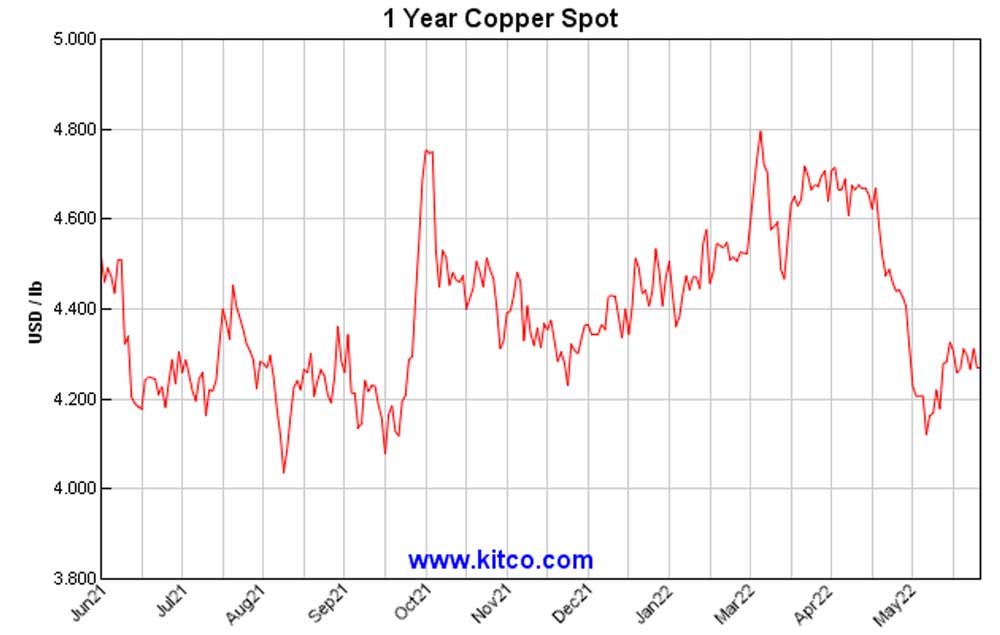

Copper finished strongly closing at US$4.47/lb up 3.7% for the week (figure 1) as China moved to ease lockdown restrictions and stimulate the economy.

In other copper news, China’s MMG also announced last week it had stood down 3,000 workers at the Las Bambas copper mine in Peru with protests now into their second month.

Mining Journal reported (3 June 2022) that around 375,000 local workers are impacted by the suspension of operations. The three-month forward market is now strongly in contango, a bullish short-to-medium sign for the red metal.

The biggest threat to metals markets appears to be the rising oil price which closed at US$120.30/bbl last week with many commentators confident that in nominal terms the previous all time high of US$150/bbl will be breached in the near term.

US oil inventories were also off 5M bbls late last week.

Natural gas prices in the US closed at US$13.50/MMbtu for a 13-year high while gasoline prices marked 24 days (from 25) of increases to close at US$4.76/gallon as the post Memorial Day driving season begins.

Last week JPMorgan Chase CEO Jamie Dimon warned investors of an impending economic “hurricane”, a view clearly shared by Elon Musk who wrote to his managers putting a freeze on global hiring.

Francisco Blanch from Bank of America questioned the ability of the global economy to continue expanding in the face of rising energy prices.

He estimates that the world can handle a total disruption of approximately 2mn BOPD of Russian oil without risking a global recession.

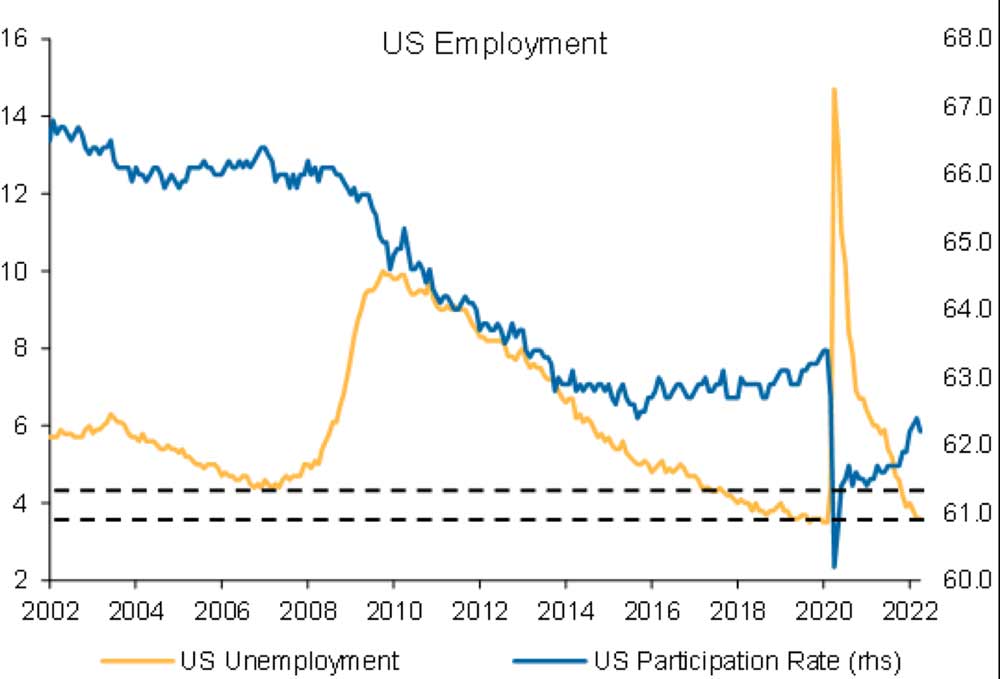

In spite of this US economic data, particularly consumer spending (up 0.70% month-on-month in April) and employment data (figure 2), continues to defy the energy markets.

While gold finished the week more or less flat at US$1,850/ounce, Neils Christensen from Kitco News (3 June 2022) pointed out that the US mint sold 147,000oz of gold in May 2022 — its best performance in 12 years with demand up 400% from its five-year average over 2015 to 2019.

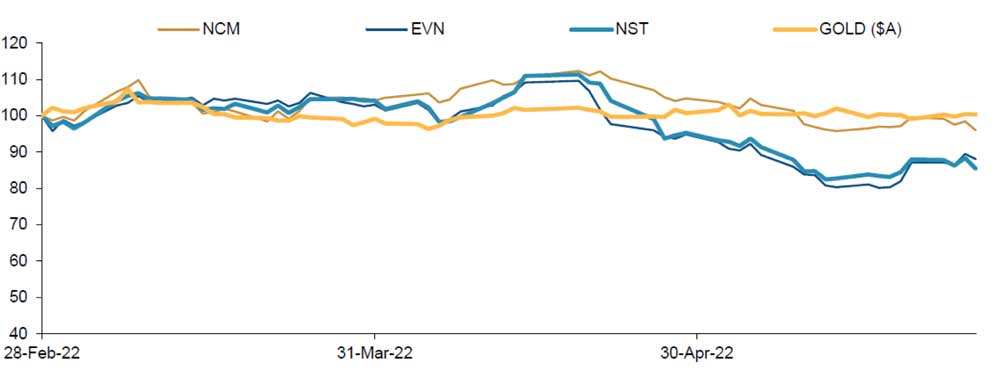

While the performance of global and domestic gold equities has been soft over recent months I think the Australian mid (figure 3) and large cap (figure 4) gold sector represents good value after a few months of declining prices.

I think the current valuations of global gold stocks will see more merger and activity in the near term in a sector that is ripe for consolidation.

The most recent tie up announced last week is the Yamana Gold proposal to merge with Gold Fields to create a US$7 billion gold miner. Executive chairman Peter Marrone also indicated it is casting the net for further acquisitions.

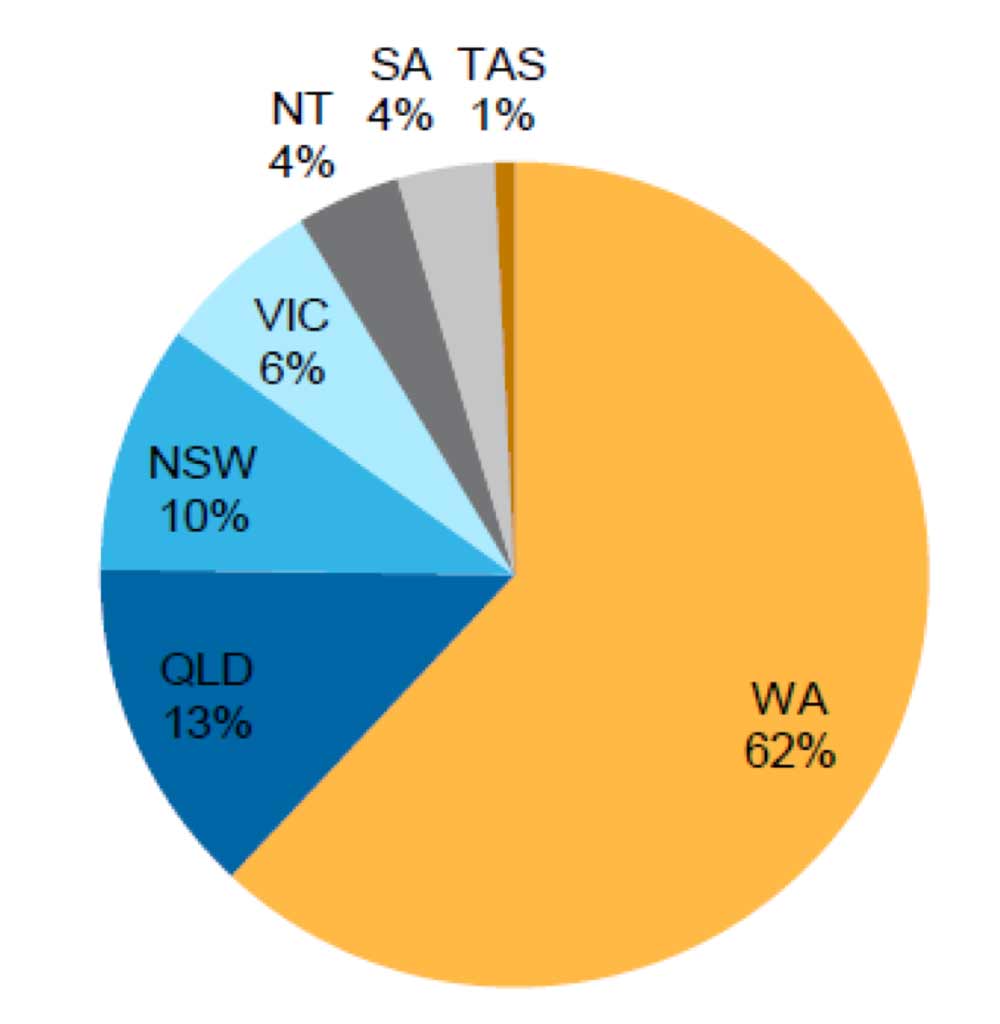

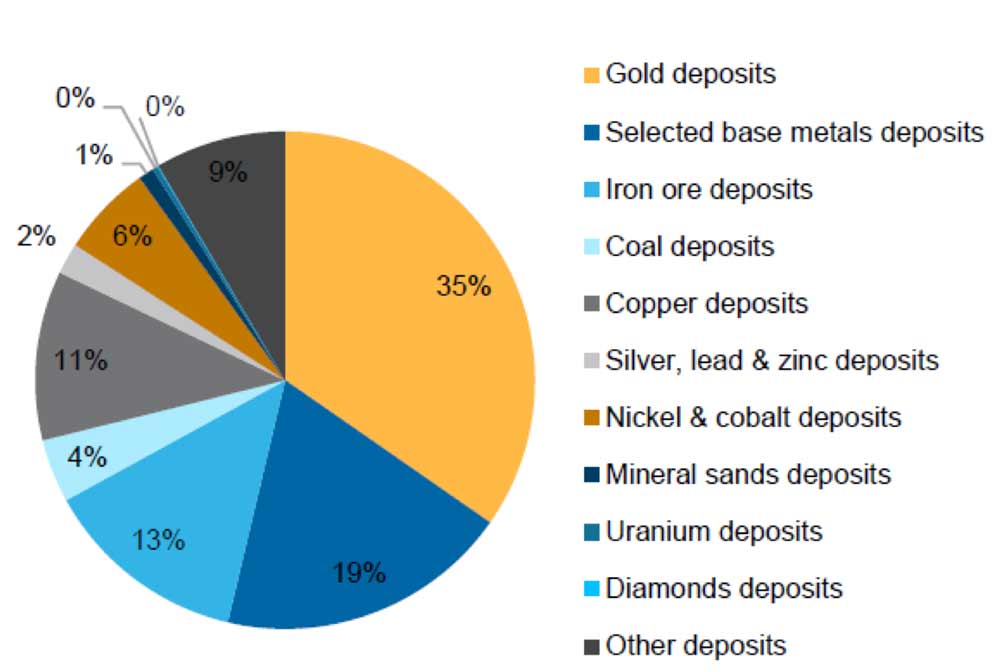

Exploration in Australia looks to be on the uptick with the ABS recently reporting 1Q22 total expenditure was up 16% year-on year with WA up 10% and QLD and NSW up 24% and 26% respectively (figure 5).

It appears much of this exploration was directed towards existing mineral deposits with gold still the dominant focus (figure 6).

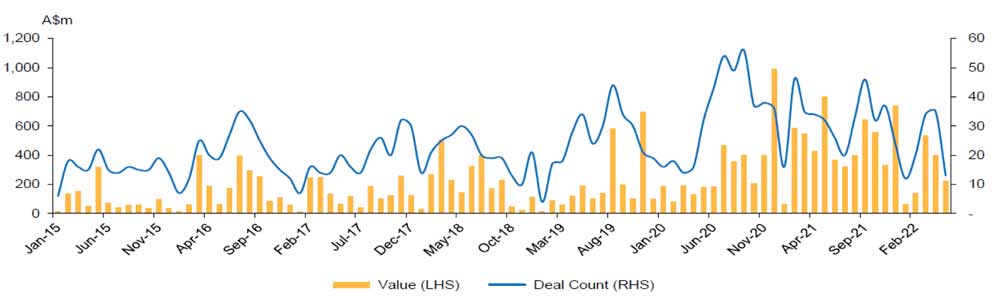

Not surprisingly, capital raisings in the recent “risk off” environment also came off the boil over April and May 2022 (figure 7) however I believe this trend is set to reverse.

New Ideas

Mining is a serious business in Brazil with exports grossing over US$41 billion in 2020.

While the country is better known as an iron ore, bauxite and gold producer, ASX listed mineral explorer Alvo Minerals Ltd (ASX:ALV) (figure 8) has recently highlighted Brazil’s base metal potential.

One of my criticisms of many explorers is the relatively small scale of their tenement holdings, with mining camps often fragmented among a number of explorers and developers. ALV however appears on track to secure a large portion of a “district scale” mining camp.

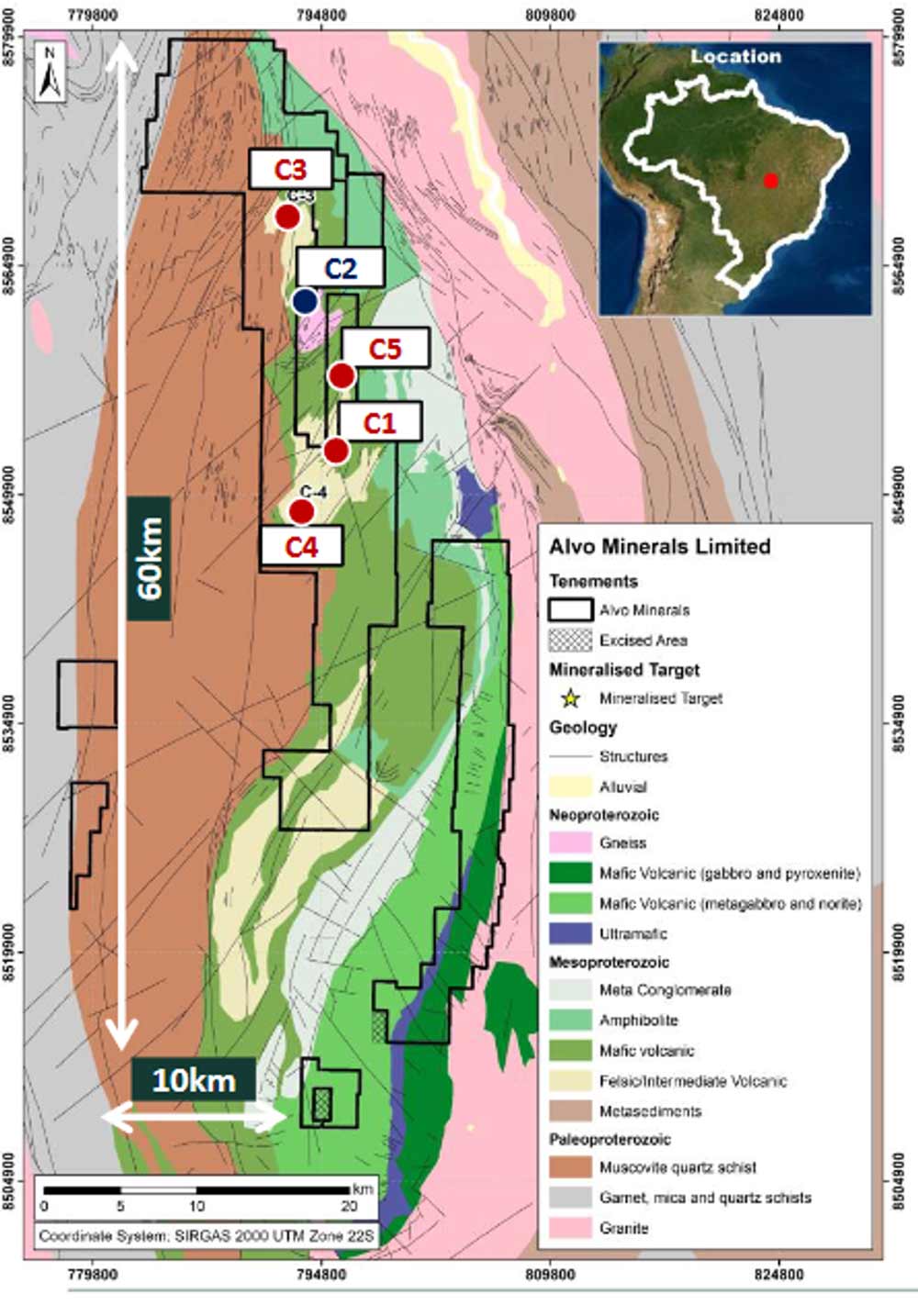

The Palma copper-zinc project (figure 9, 10) situated approximately 400km northwest of the capital Brasilia ticks a lot of boxes for me.

Size does matter in mining and ALV is consolidating more ground along a 60km strike, proximal to infrastructure, where recent exploration has continued to highlight the high-grade Cu-Zn volcanogenic massive sulphide mineralisation potential which already includes a 4.6Mt JORC Resource grading 1% Cu, 3.9% Zn, 0.4% Pb and 20g/t Ag.

The company listed in October 2021, has two diamond rigs operating and has returned a number of promising intersections, including;

▪ 7.0m @ 5.2% Cu & 8.0% Zn

▪ 7.4m @ 2.2% Cu & 23.1% Zn

▪ 36.0m @ 1.49% Cu & 8.58% Zn

▪ 10.6m @ 6.27% Cu & 14.76% Zn

Brazil is not without its risks, one of which it has been a “black hole” for male foreign mining professionals (happy to expand on this further at Cigar Social in the absence of the Stockhead fun police) (Ed: Send details to my private email and I’ll consider it. With pics.) however this district scale, high-grade base metal play in a tightly held company with an active drill program has plenty of appeal.

By the look of the beaming officials and locals it also appears their ESG strategy (whatever that means) is working.

I believe the potential to outline mining resources well in excess of +10Mt of high-grade Cu-Zn is very real here and with an enterprise value of only $10 million, there is plenty of blue sky left in the ALV share price.

And lastly, a final farewell to Perth based mining entrepreneur and car enthusiast Peter Briggs who left the building last week at the age of 83. We had a lot in common including an association with Spargos Mining NL (Bellevue Gold Mine) in the 1980s and a mutual respect for the ATO…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.