Barry FitzGerald: The IPO market for copper stocks is at its strongest for over a decade. Here are two to watch

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Investment bank Citi is a true believer in the copper super-cycle as the world gets serious about decarbonisation and electrification.

It reckons decarbonisation-led consumption growth (think solar panels, wind turbines, upgraded electricity grids, electric vehicles and so on) is set to outpace mine supply growth over the next 5-10 years.

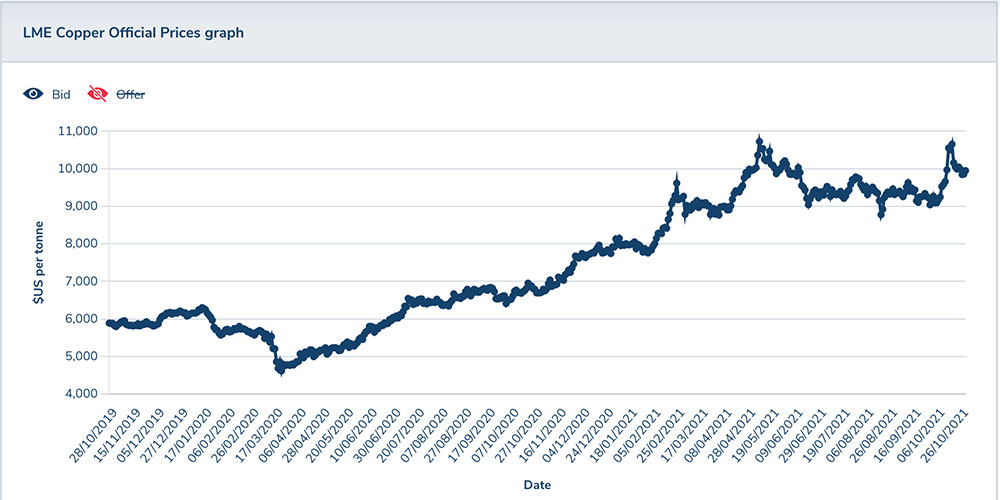

Citi’s bull case for the long-term copper price under that scenario is $US5.45/lb. That compares with the current spot price of $US4.47, and last year’s average of $US2.80/lb.

“We view the outlook for copper consumption is intrinsically linked to humanity’s chances of meeting its climate mitigation goals,’’ Citi said in its recently released “Copper Book: 2021-2030.’’

Its view is pretty much in line with that of the other investment banks, remembering that Goldman Sachs put its name to a staggering peak of $US6.80/lb copper in 2025.

So we’re all in agreement, it’s happy days for the copper producers, developers, and explorers.

Short term headwinds for copper

But today’s interest is in a trading opportunity in the copper stocks identified by Citi.

Notwithstanding its copper super-cycle belief, it has declared it is “outright bearish’’ on the red metal in the near term.

“Specifically, we see prices falling by more than 10% to $US3.72/lb over the next 3-6 months,’’ Citi said.

“Our near-term bearishness reflects curtailments in manufacturing spurred on by shortages in global power, coal and gas markets, together weakening Chinese growth, and ongoing shortages of chips and container ships,’’ Citi said.

Citi noted that a recent poll it conducted came back with 70% of respondents predicting the copper price would be below current levels by end of the year.

So selling copper stocks, particularly the producers, ahead of the predicted 3-6 slump in prices, and then buying them back at lower levels for the long haul run up in prices to Citi’s long-term pricing of $5.45/lb could prove to be profitable exercise.

Having said that, Garimpeiro reckons such a strategy is trying too hard to guess both the copper price and equity markets.

He prefers to stick with the idea that a decent copper discovery by a lightly capitalised junior is always going to deliver a leveraged response in the share price regardless of whether copper is $2.80/lb, or $6.80/lb for that matter.

Some copper IPOs to keep an eye on

Because the copper price, as it is, is incentive enough, the IPO market for copper stocks is the strongest it has been for more than a decade. It means there is now more choice out there for investors looking to play the explorers angle to the global decarbonisation and electrification thematic.

Two recent IPOs have captured Garimpeiro’s attention on the basis that, like all good IPOs should do, they have hit the ground running with exploration programs that could make a difference.

Debuted on the ASX on October 20 after raising $10m at 25c a share. Some smart Melbourne types liked the story and weren’t surprised to see it trade up to 41c on day one.

Those that missed out can take heart from the stock drifting back since to 34c.

Alvo has just started drilling at its flagship project, the Palma project in central Brazil. It is a high grade copper-zinc project of the volcangenic massive sulphide type.

Initial drilling is at the C3 prospect where the plan is to both upgrade and extend the inferred resource (2.8Mt at 1.1% copper and 4.3% zinc, with lead and silver values). It is but one of the project deposits.

The company knows its way around Brazil. Its managing director Rob Smakman is still wearing a tan from years in the Brazilian bush chasing iron ore and gold opportunities in a previous corporate life.

Debuted on the ASX on October 12 after raising $5m at 20c a share. It last traded at 15c which gives it a market cap of less than $7m.

So there’s lots of leverage to the upside from the company’s maiden drilling program at its Brandy Hill South copper-gold project in WA’s Murchison, not far from Silver Lakes’ Deflector copper-gold mine which has been kicking goals recently.

Historical drilling at Brandy Hill South recorded some nice hits, including 75m at 0.55% copper with a 23m zone returning 1.29% copper, with silver and tungsten values.

Recharge is looking to confirm some of the historical hits as well as extending mineralisation and along strike in the first drilling campaign. Later it will chase the vein-hosted mineralisation at depth.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.